- NLI Research Institute >

- Real estate >

- Overseas Property Investments by Asian Insurers-Chinese Insurers Emerge as Global Main Players-

Overseas Property Investments by Asian Insurers-Chinese Insurers Emerge as Global Main Players-

mamoru masumiya

Font size

- S

- M

- L

1|Introduction

1 Mamoru Masumiya “Asian Insurers, Increasingly Influential Property Investors-Mainland Chinese Insurers Follow Taiwanese and Koreans-” Real Estate Analysis Report, August 30, 2016

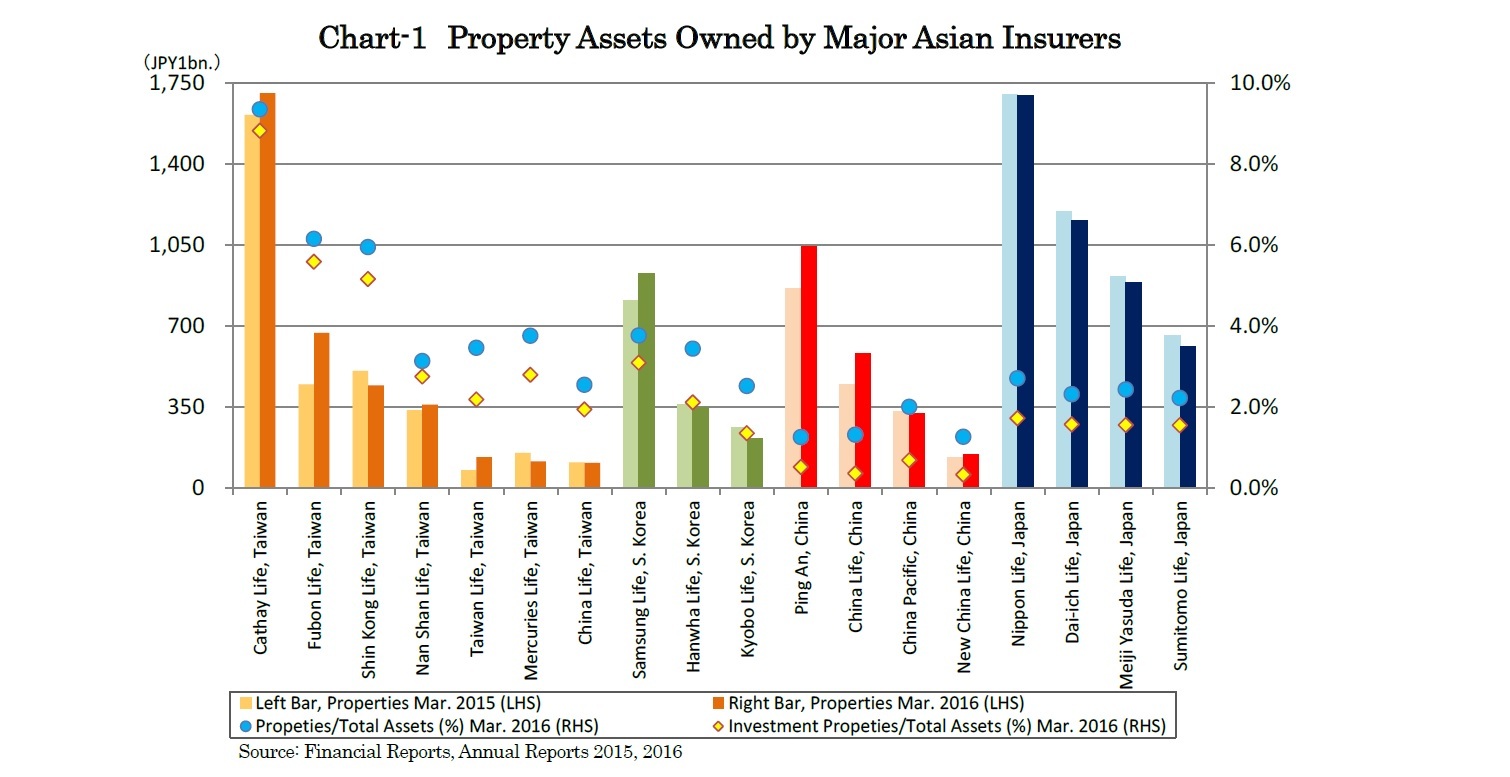

2|Property Investment Increase by Asian Insurers

3|Overseas Property Investments by Japanese, Taiwanese and South Korean Insurers

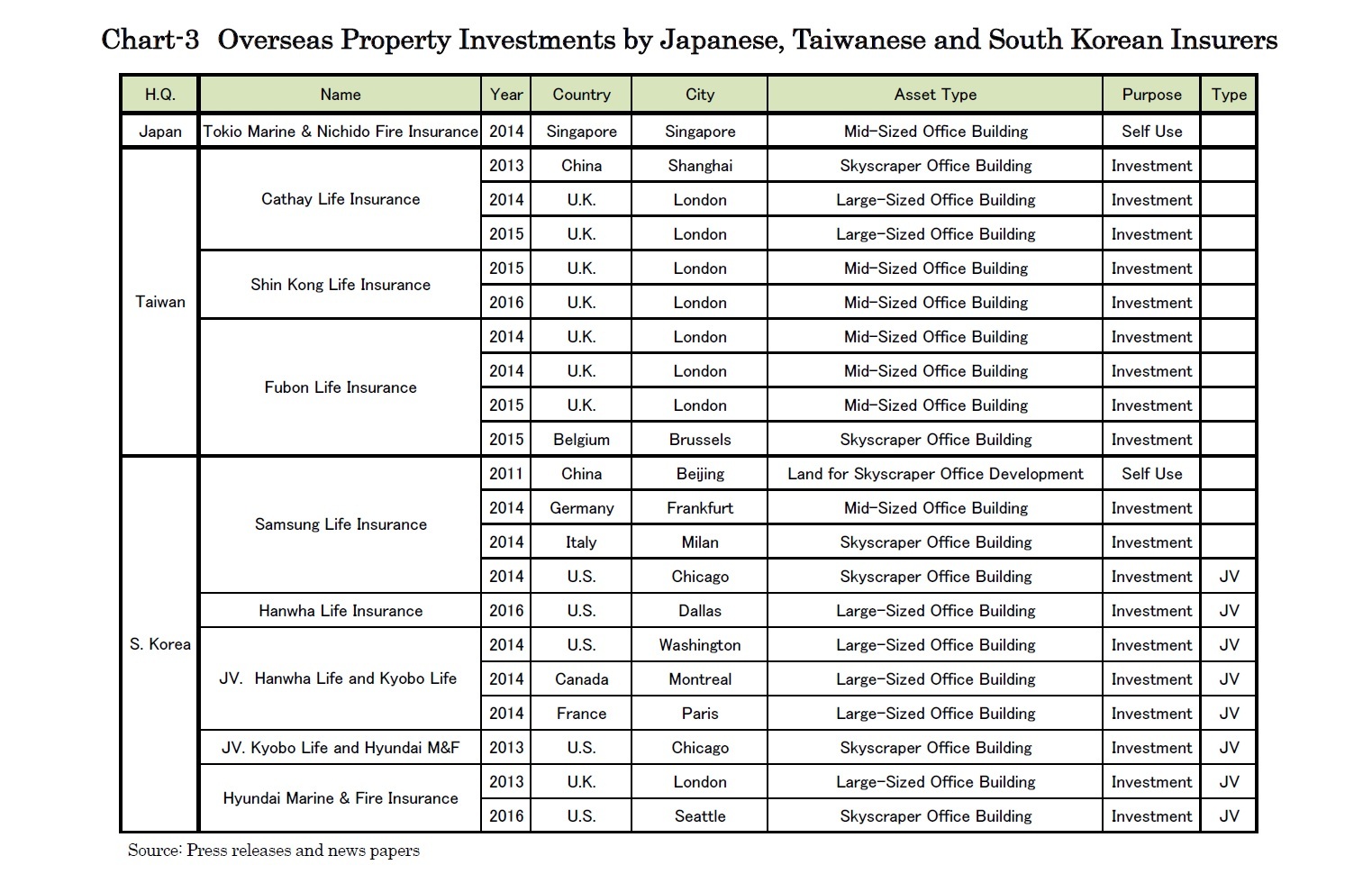

As actual cases show (Chart-3), the stance of Taiwanese and South Korean insurers regarding overseas property investment is categorically different from that of Japanese insurers. Although Tokio Marine & Nichido Fire Insurance acquired a self-occupied office building in Singapore, no other acquisitions by Japanese insurers have been seen recently2. On the contrary, Taiwanese and South Korean insurers have continuously acquired properties overseas for the purpose of investment.

Taiwanese insurers have invested in the traditional way, investing in office buildings in Europe, particularly in London, excluding an exceptional case in Shanghai. These insurers prefer to invest independently and do not acquire large buildings beyond their capacity. Meanwhile, Cathay Life Insurance, the exceptional leading player, has acquired very large buildings.

On the other hand, South Korean insurers have proactively invested not only in London but also in North America and Southern Europe. They often establish joint ventures with other investors to share the risk of individual cases, which makes it possible for them to invest mainly in skyscrapers and large-sized buildings. Life insurers even sometimes establish a joint venture with a competitor in the same industry.

2 Excluding investment in indirect property investment products such as global property investment funds

mamoru masumiya

Research field

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング