- NLI Research Institute >

- Real estate >

- Asian Insurers, Increasingly Influential Property Investors-Mainland Chinese Insurers Follow Taiwanese and Koreans-

Asian Insurers, Increasingly Influential Property Investors-Mainland Chinese Insurers Follow Taiwanese and Koreans-

mamoru masumiya

Font size

- S

- M

- L

Asian insurers have noticeably increased property investments in recent years. Following active Taiwanese and Korean insurers, mainland Chinese insurers have started property investments since the deregulation in 2010. However, financial markets have become volatile since the latter half of 2015. It is interesting to check how active Asian insurers have invested into properties under these risk sensitive market conditions.

■Contents

1―Introduction

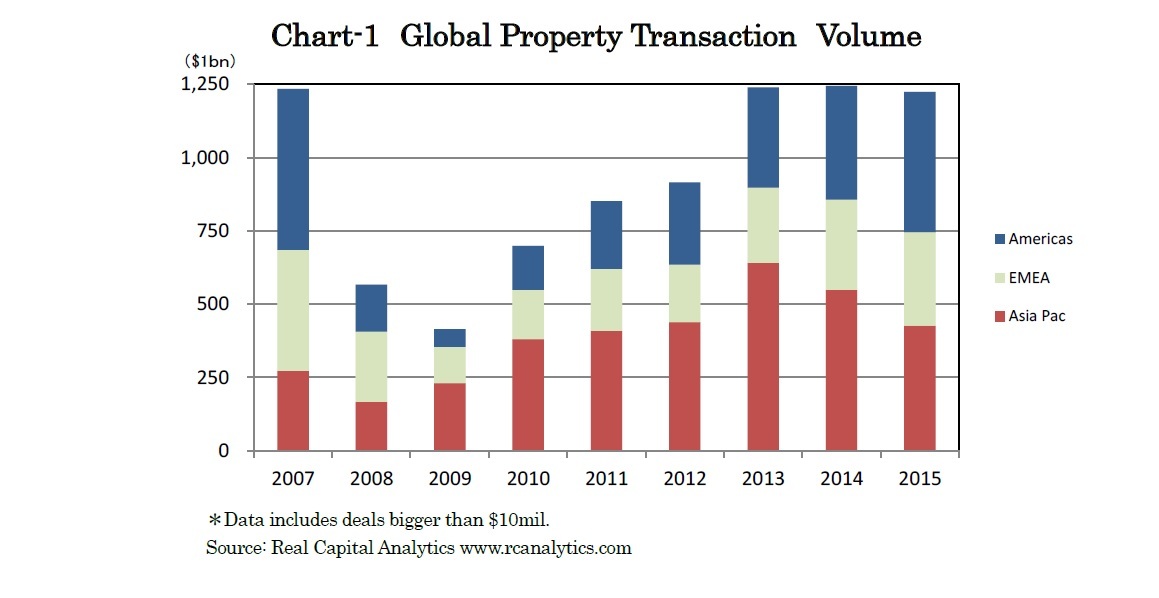

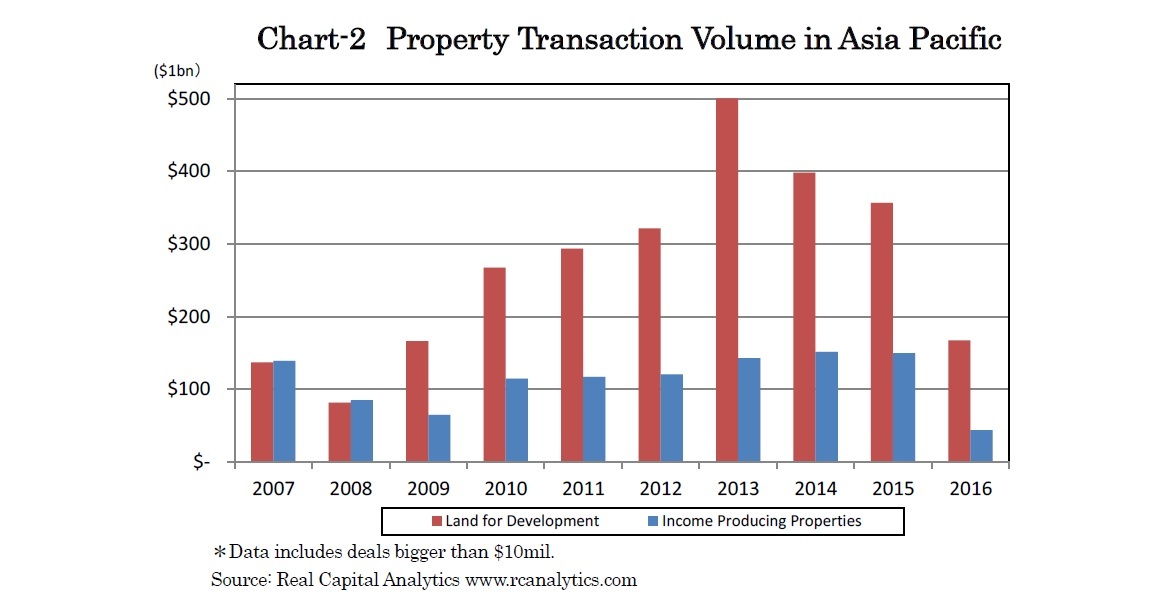

2―Peak-out of Property Transaction Volume

3―Property Investments by Asian Insurers

4―Growing Asian Insurance Markets

5―Acceleration to Invest into Properties

6―Final Note

1―Itroductionn

2―Peak-out of Property Transaction Volume

Checking the trend of investor activities, the transaction volume of income-producing properties also already peaked out in 2014 and declined significantly in the first half of 2016. It looks like investors have become risk-sensitive and are no longer as aggressive about property investment as before due to Chinese economic uncertainty and declining local currencies.

mamoru masumiya

Research field

Social media account

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング