- NLI Research Institute >

- Real estate >

- Asian Insurers, Increasingly Influential Property Investors-Mainland Chinese Insurers Follow Taiwanese and Koreans-

Asian Insurers, Increasingly Influential Property Investors-Mainland Chinese Insurers Follow Taiwanese and Koreans-

mamoru masumiya

Font size

- S

- M

- L

5―Acceleration to Invest into Properties

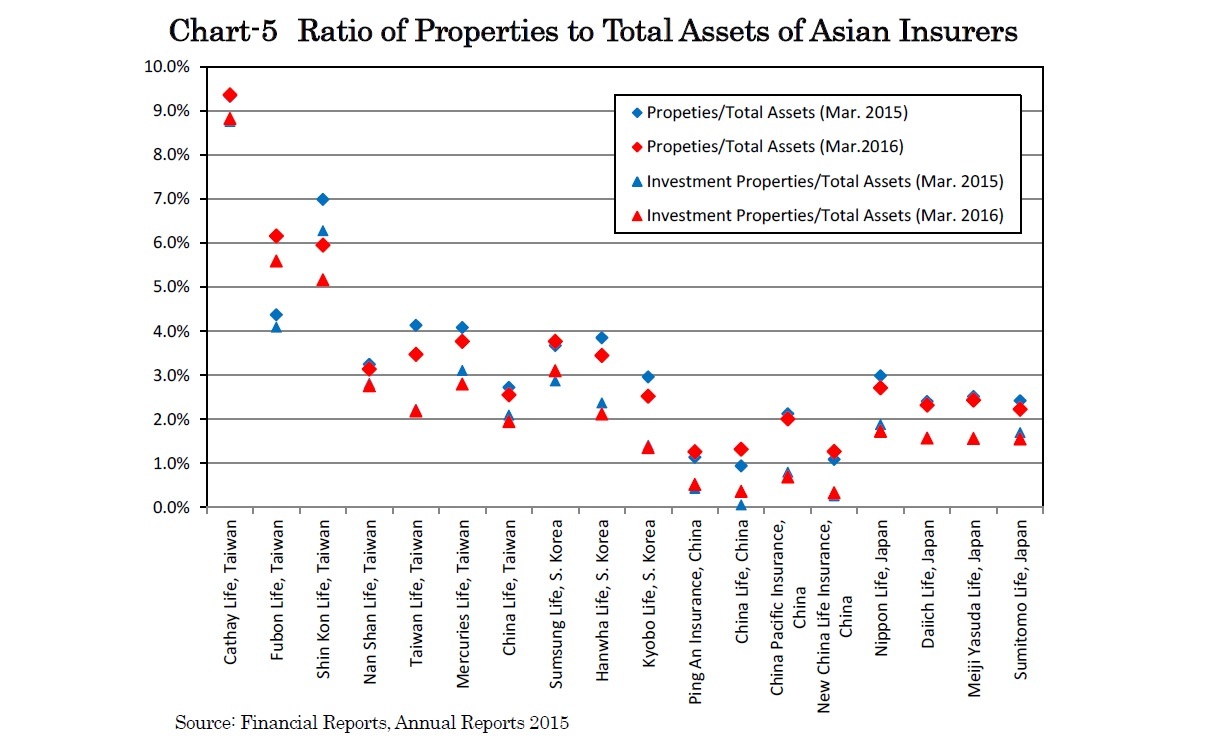

However, mainland Chinese insurers who have low ratios of properties to total assets continued to lift the ratios even after the peak-out of regional property transaction volume. In addition, some Taiwanese and Korean insurers, such as Fubon Life Insurance, also accelerated property investments which lifted the property ratio significantly.

Some Asian insurers have become aggressive about property investments even in the U.S. and Europe. Property investment has been increasingly important for insurers who demand stable income-producing assets under the current low interest rate conditions.

6―Final Note

The regional property transaction volume can shrink further affected by global risks including the Chinese economic hard landing. However, it is likely that Asian insurers will continue to grow and increase property investments, and thus, will become more influential in property investment markets. It is possible that Asian insurers will become considerable property investors in Japan where they have never made sizable property investments.

mamoru masumiya

Research field

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング