- NLI Research Institute >

- Real estate >

- Asian Insurers, Increasingly Influential Property Investors-Mainland Chinese Insurers Follow Taiwanese and Koreans-

Asian Insurers, Increasingly Influential Property Investors-Mainland Chinese Insurers Follow Taiwanese and Koreans-

mamoru masumiya

Font size

- S

- M

- L

3―Property Investments by Asian Insurers

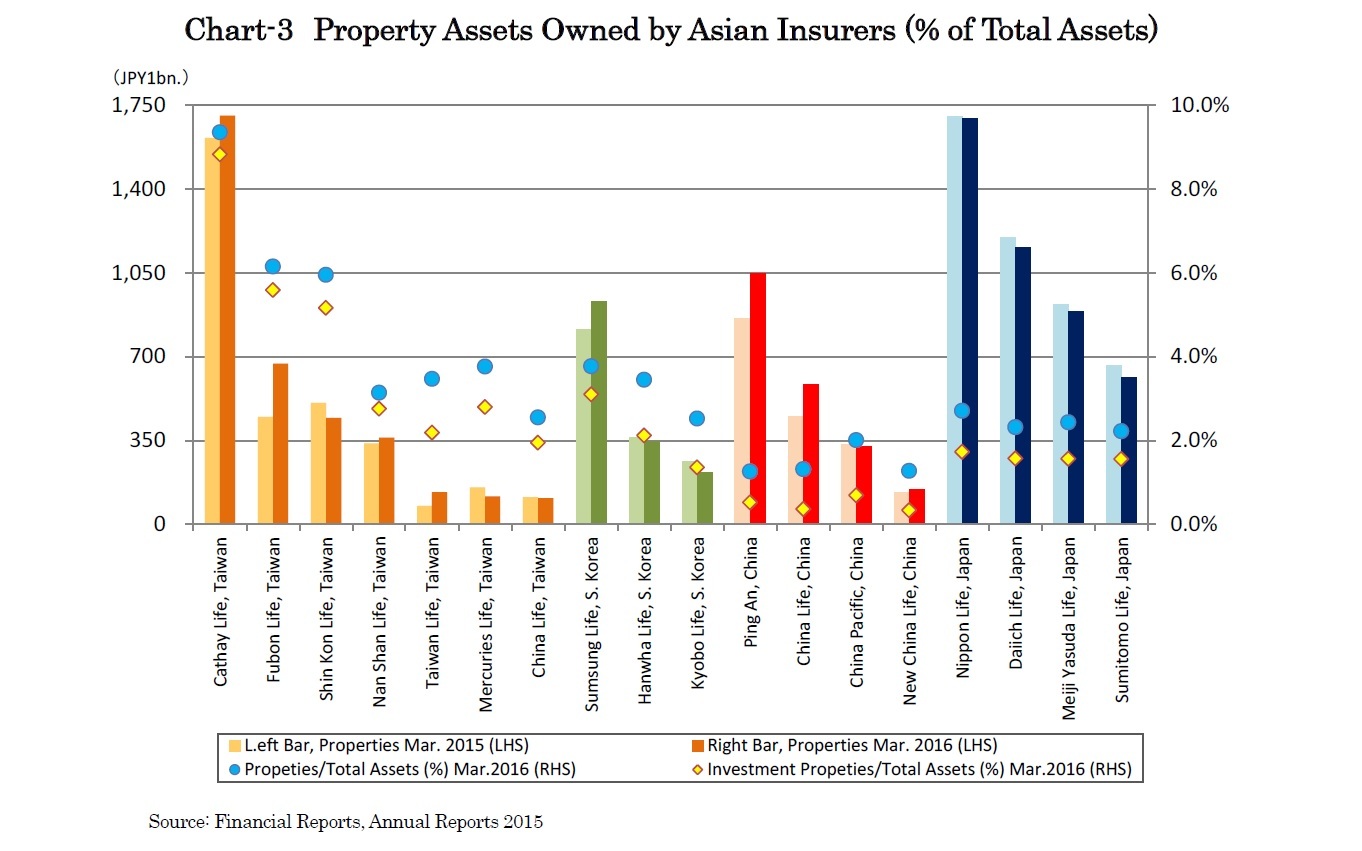

In Taiwan where insurers are quite aggressive in property investment, the leading insurer, Cathay Life Insurance, increased its property investments in 2015 and has become the largest property investor among Asian insurers, even exceeding Nippon Life Insurance which is much larger in total assets. Other than Cathay Life, multiple Taiwanese insurers, such as Fubon Life Insurance and Taiwan Life Insurance, have noticeably increased property investments.

Outside of Taiwan, mainland Chinese insurers drew even more attention, as both major Ping An Insurance and China Life Insurance have significantly increased property investments. As mainland Chinese insurers have only recently started property investment, their ratios of properties to total assets are relatively low. However, since they have massive amounts of total assets and thus their property assets have already exceeded those of Korean major insurers.

4―Growing Asian Insurance Markets

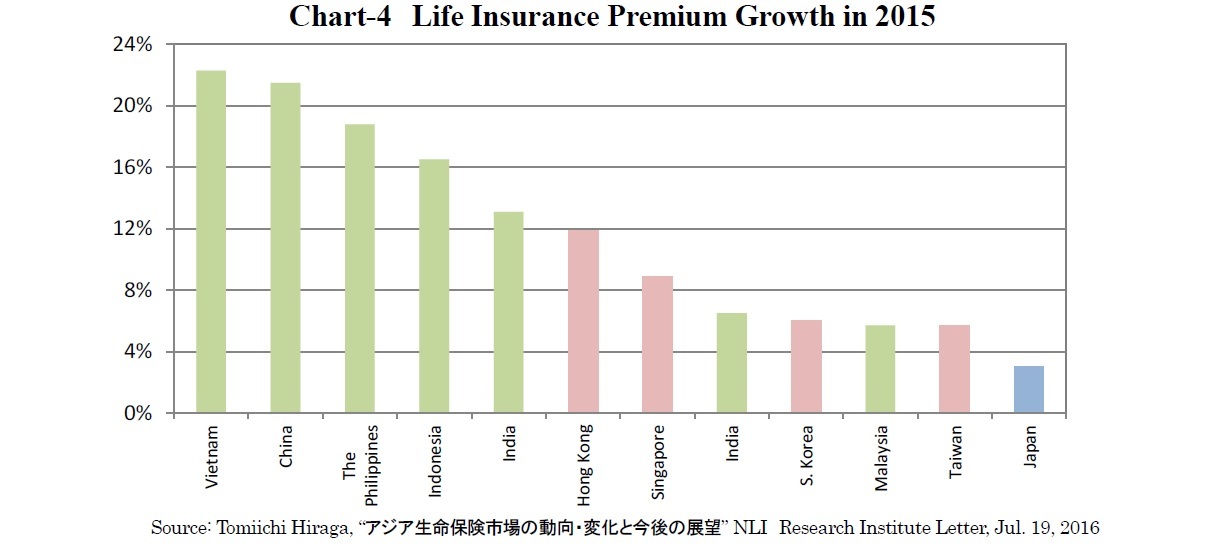

Moreover, even in the four newly industrialized economies (NIEs) of Hong Kong, Singapore, South Korea and Taiwan, where life insurance penetration is as high as that in advanced western countries, life insurance premiums grew strongly in 2015. In the aging four NIEs, demand for pension or medical care insurance products has been increasing, and saving or investment products have also become popular backed by increasing household incomes.

mamoru masumiya

Research field

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング