- NLI Research Institute >

- Real estate >

- Japanese Property Market Quarterly Review,Second Quarter 2016-While Housing Starts Robust, Office and Retail Rents Peak Out-

Japanese Property Market Quarterly Review,Second Quarter 2016-While Housing Starts Robust, Office and Retail Rents Peak Out-

Kazumasa Takeuchi

Font size

- S

- M

- L

6.J-REIT and Property Investment Markets

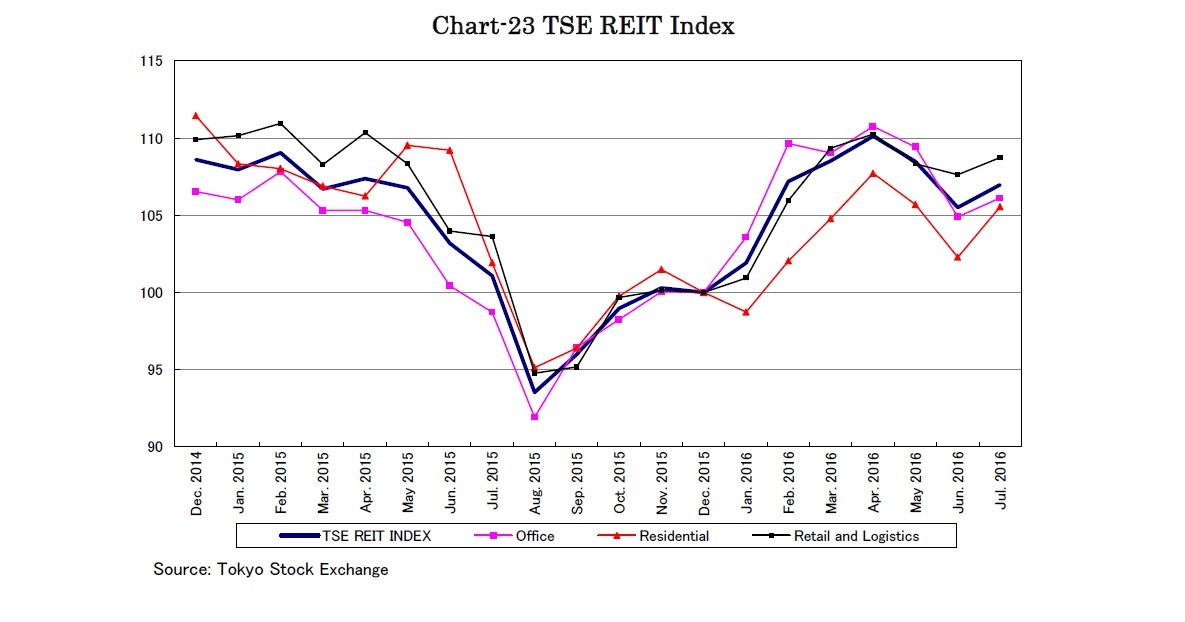

At the end of June, the J-REIT market value was JPY 11.6 trillion, while the price to NAV ratio was 1.3 times and the dividend yield was 3.4% with a 3.6% yield spread on ten year Japanese government bonds.

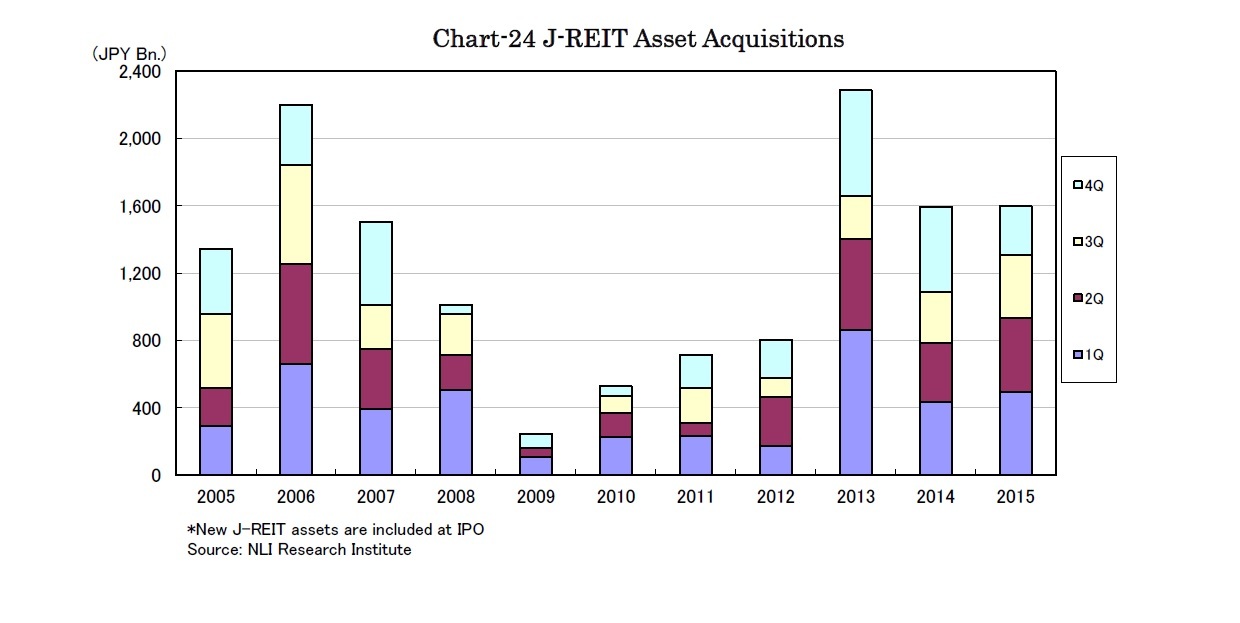

Star Asia REIT with 18 assets valued at JPY 685 billion was listed in April 20, raising the number of J-REITs to 54. Two new REITs are scheduled to be listed and two existing REITs will be delisted as results of mergers in the third quarter.

The negative interest rate policy pushed bond yields down by 0.4% and can lead to incremental values of the J-REIT portfolios. The average CAP rate of the J-REIT portfolios is 4.5% and the total NAV is JPY 8.8 trillion. Supposing that CAP rates can shrink by 0.4% accordingly, the value of the portfolios and the total NAV will increase by 9% and 16% to JPY 16.3 trillion and JPY 10.2 trillion, respectively.

However, the investor survey conducted by Japan Real Estate Institute shows that many investors consider CAP rates will remain unchanged from the time before the negative interest rate policy was introduced. As CAP rates have been already very low, property incomes now have to grow for sustainable value enhancement.

Kazumasa Takeuchi

Research field