- NLI Research Institute >

- Real estate >

- Japanese Property Market Quarterly Review, Fourth Quarter 2015-J-REITs Decline for First Time in Four Years, Foreign Visitor Arrivals Increase 47%-

04/02/2016

Japanese Property Market Quarterly Review, Fourth Quarter 2015-J-REITs Decline for First Time in Four Years, Foreign Visitor Arrivals Increase 47%-

Financial Research Department Economic Research Department Researcher Hiroto Iwasa

Font size

- S

- M

- L

Summary

- After recovering to a positive number in the third quarter, the real GDP growth rate turned negative again due to weak private consumption in the fourth quarter. Housing starts increased again in 2015 and land prices continued to appreciate based on a strong demand for hotels and retail stores benefitting from an increase in inbound visitors. While a decreasing number of new condominium units have been sold in the Tokyo metropolitan area for two years, the transaction volume in the secondary condominium market increased.

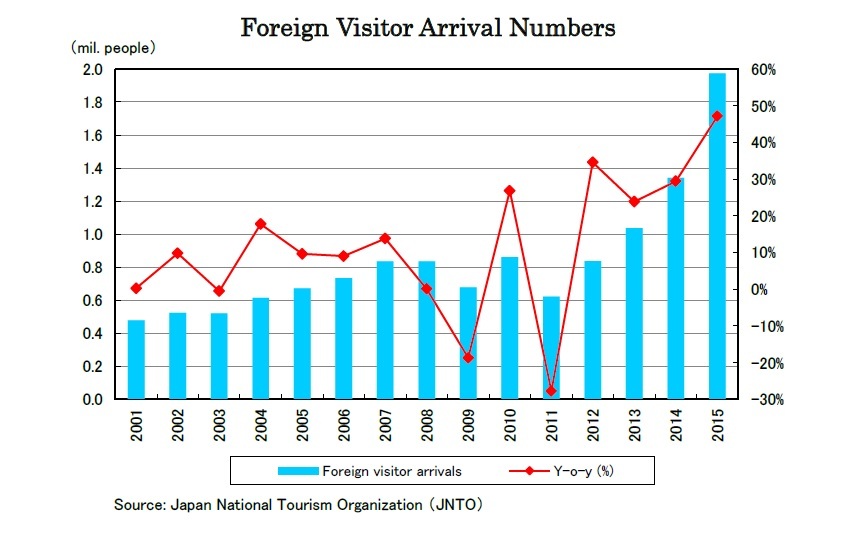

- The office vacancy rates in Tokyo have further improved and office rents continued to rise for the fifteenth consecutive quarter. However office rents declined q-o-q in the fourth quarter. Residential rents in Tokyo have been rising. Foreign visitor arrivals increased by 47% to 19.73 million in 2015. Hotel room occupancy rates have remained at a record high. Logistics vacancy rates rose due to the largest ever new supply.

- The TSE REIT Index declined by 7.9% in 2015 for the first time in four years. J-REITs acquired property assets valued at 1.6 trillion JPY in 2015 and the total asset value expanded to 14 trillion JPY with 52 J-REITs listed. The property transaction volume declined in 2015 and the NLI Research Institute investment survey suggested the market has peaked.

03-3512-1858

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング