- NLI Research Institute >

- Real estate >

- Japanese Property Market Quarterly Review, First Quarter 2016 -Office Rents Rise Again, Foreign Visitor Arrivals Boost Hotels and Land Prices-

Japanese Property Market Quarterly Review, First Quarter 2016 -Office Rents Rise Again, Foreign Visitor Arrivals Boost Hotels and Land Prices-

Eriko Kato

Font size

- S

- M

- L

1.Economy and Housing Market

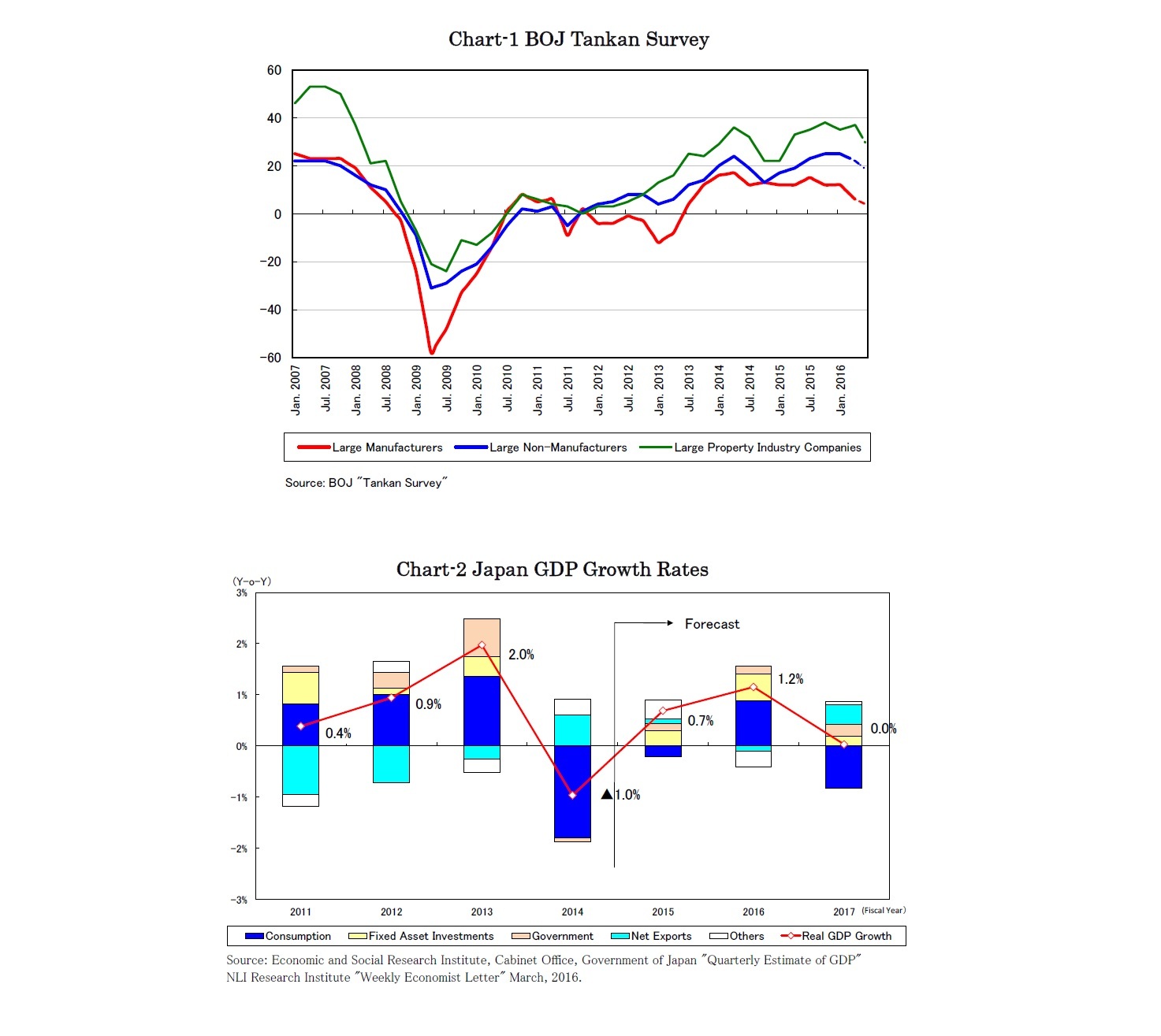

In the BOJ Tankan Survey, the current business confidence D.I. of large manufacturers and non-manufacturers deteriorated while that of the property industry improved a little, as it was expected to benefit from the negative interest rates. However, the three-month outlook declined noticeably in all categories (Chart-1).

NLI Research Institute forecasted Japan’s real GDP growth rates on March 8 at +0.7%, +1.2% and 0.0% for 2015, 2016 and 2017 respectively (Chart-2). These forecasts are based on the consumption tax rate hike scheduled in April 2017, and it is possible the numbers can be inflated in the case of postponement of the tax rate hike.

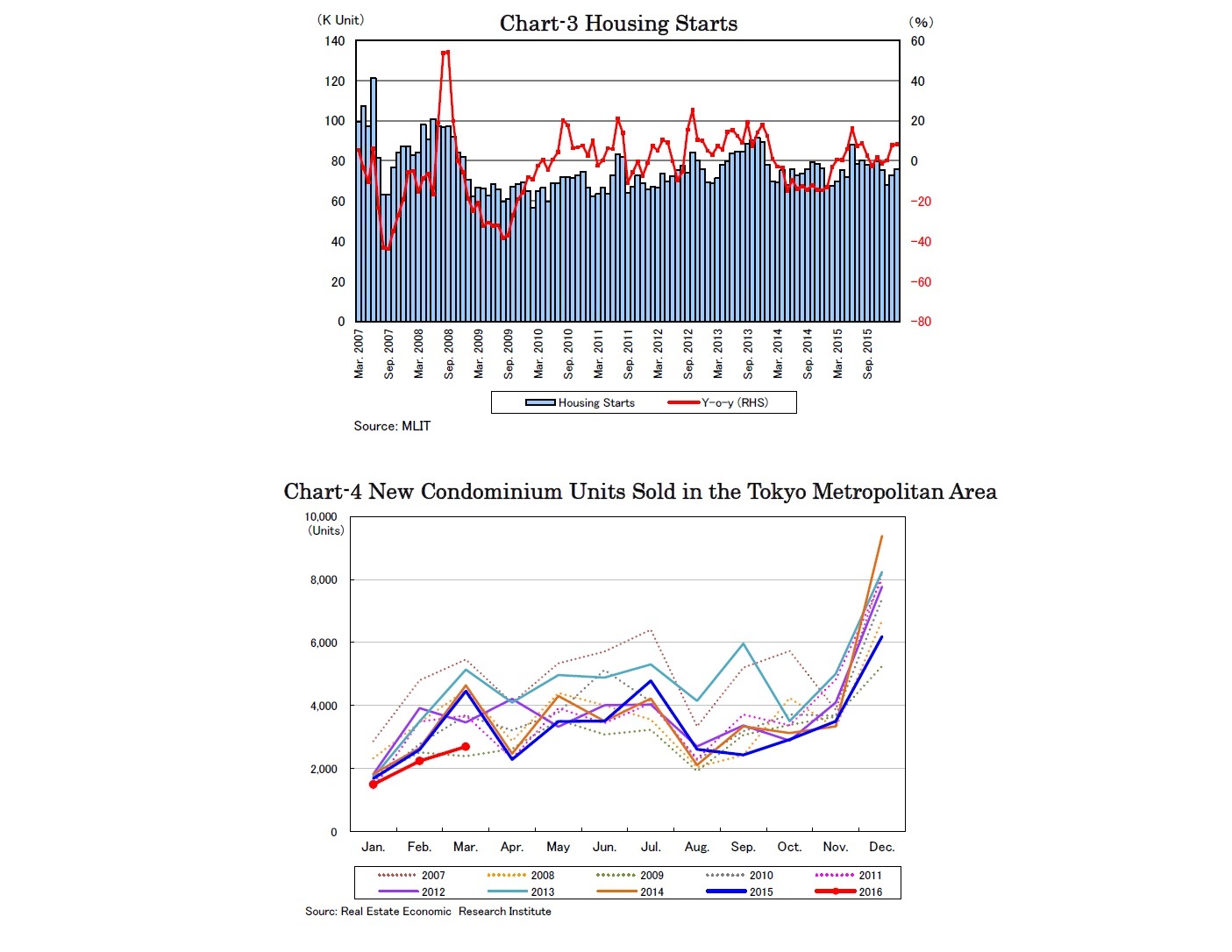

The number of new condominium units sold in the Tokyo metropolitan area shrank significantly in the first quarter to figures as small as those in 2009 just after the global financial crisis (Chart-4), and the fiscal year number for 2015 declined by 14.4% y-o-y. On the other hand, both average unit price and average price per tsubo appreciated y-o-y for the fourth consecutive fiscal year, led by luxury units in the center of Tokyo.

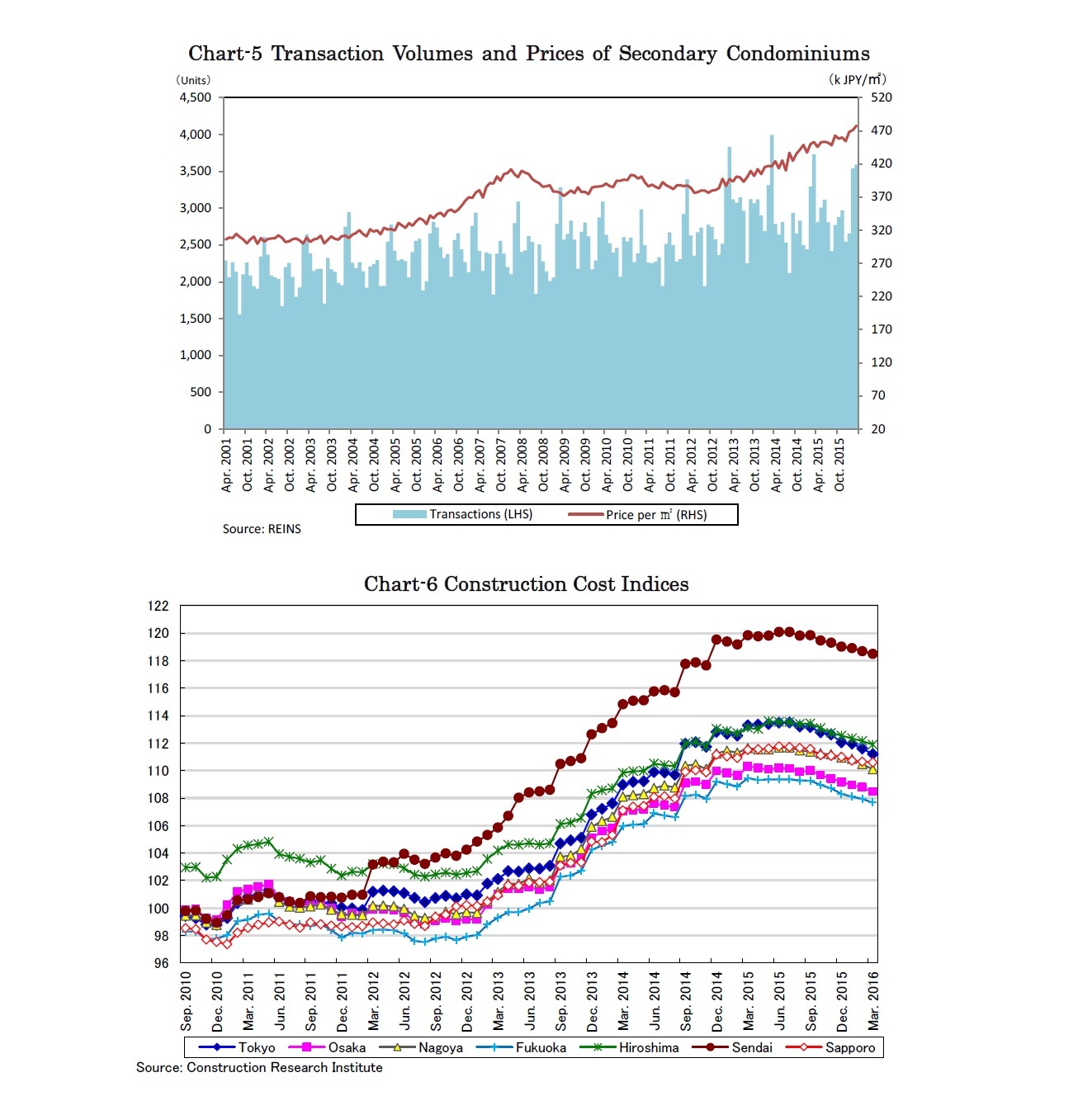

While new condominiums have been no longer affordable for most ordinary people, secondary condominiums have become increasingly popular. According to Real Estate Information Network Systems, the transaction volume in the secondary condominium market in the Tokyo metropolitan area increased by 3.4% y-o-y to 9,784 units in the first quarter, and the average price per square meter appreciated by 5.5% y-o-y to 477.8 k JPY (Chart-5).

Construction costs have still remained high, despite having peaked out in the first half of 2015 (Chart-6). Although the prices for secondary condominiums should not be directly affected by construction costs, they have still appreciated significantly and are no longer considered reasonable.

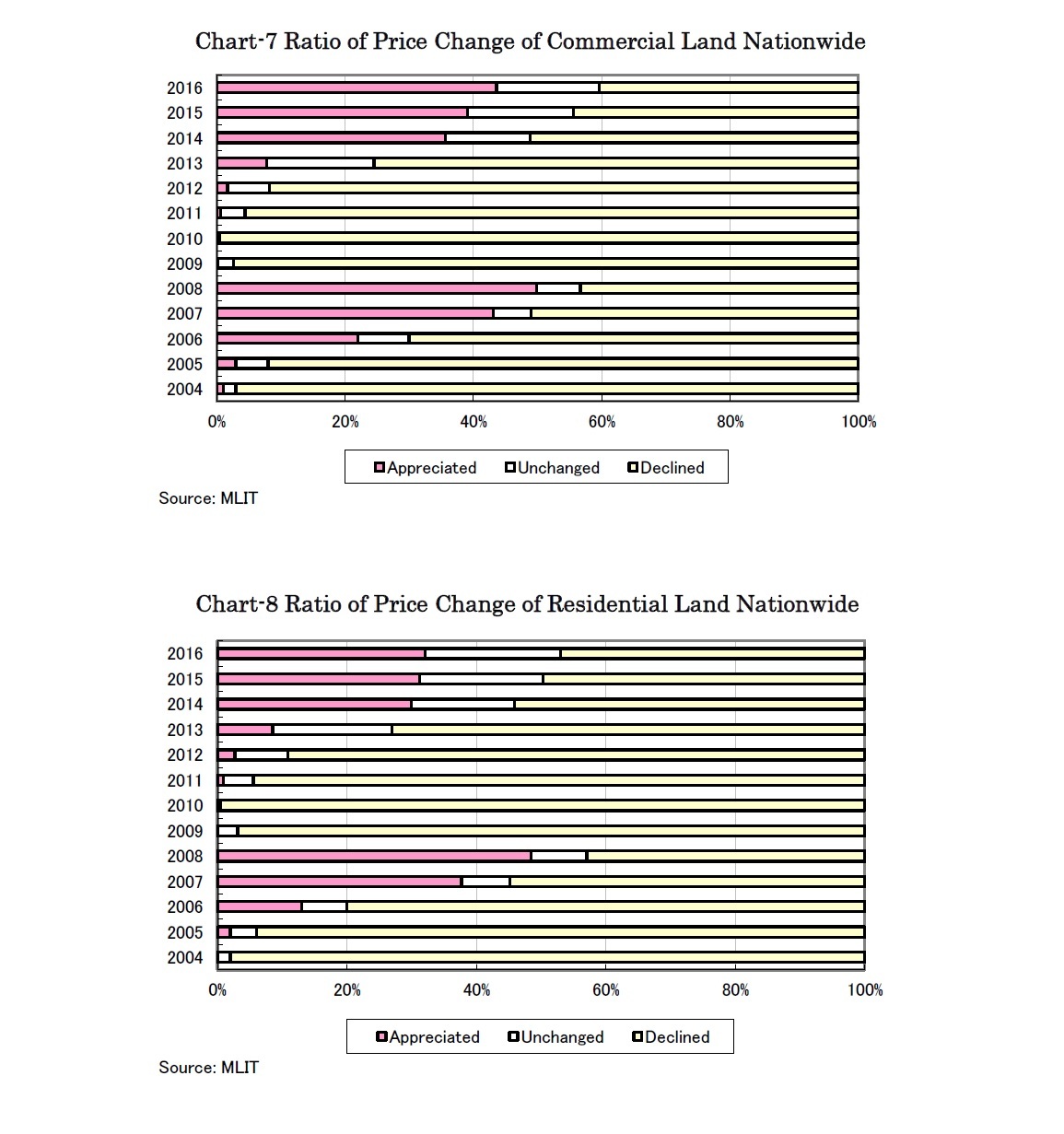

2.Land Prices

Commercial land prices in Osaka performed outstandingly, benefitting from inbound demand for retail stores, as Shinsaibashi and Dotonbori performed the best and the second best in Japan, appreciating by 45.1% and 40.1% y-o-y respectively.

Residential land prices in areas popular among foreigners also performed well. Niseko in Hokkaido, a popular resort among Australians and Chinese, performed the best among residential land in Japan appreciating by 19.7% y-o-y.

Eriko Kato

Research field