- NLI Research Institute >

- Real estate >

- Cross Border Capital Flows into Japanese Properties in 2015-Risk-Off Sentiment Restrains Property Transactions-

Cross Border Capital Flows into Japanese Properties in 2015-Risk-Off Sentiment Restrains Property Transactions-

mamoru masumiya

Font size

- S

- M

- L

4.Concentration on Tokyo

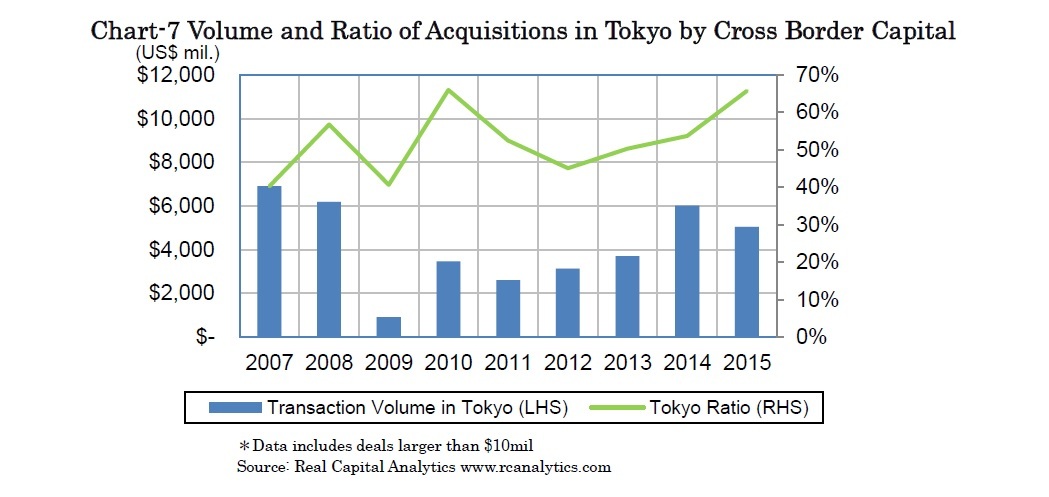

Incidentally, investment property stock in Japan has been diversified with growing sectors such as logistics and healthcare facilities, which are primarily located outside of Tokyo. Even with this diversification the ratio of acquisitions in Tokyo has been higher, suggesting the trend toward Tokyo cannot be ignored.

It looks like foreign investors are concerned about the nationwide stagnation of the Japanese economy due to demographic declination. On the other hand, Tokyo can expect to improve its infrastructure in preparation for the 2020 Tokyo Olympic Games. However, even in Tokyo, quite a few investors will appear to consider only short term investments until the Olympic Games. It is imminent thus to maintain and reinforce the competitiveness of Tokyo as one of the prime Asian cities from a long-term perspective.

5.Capital Inflows from the U.S. and Asia

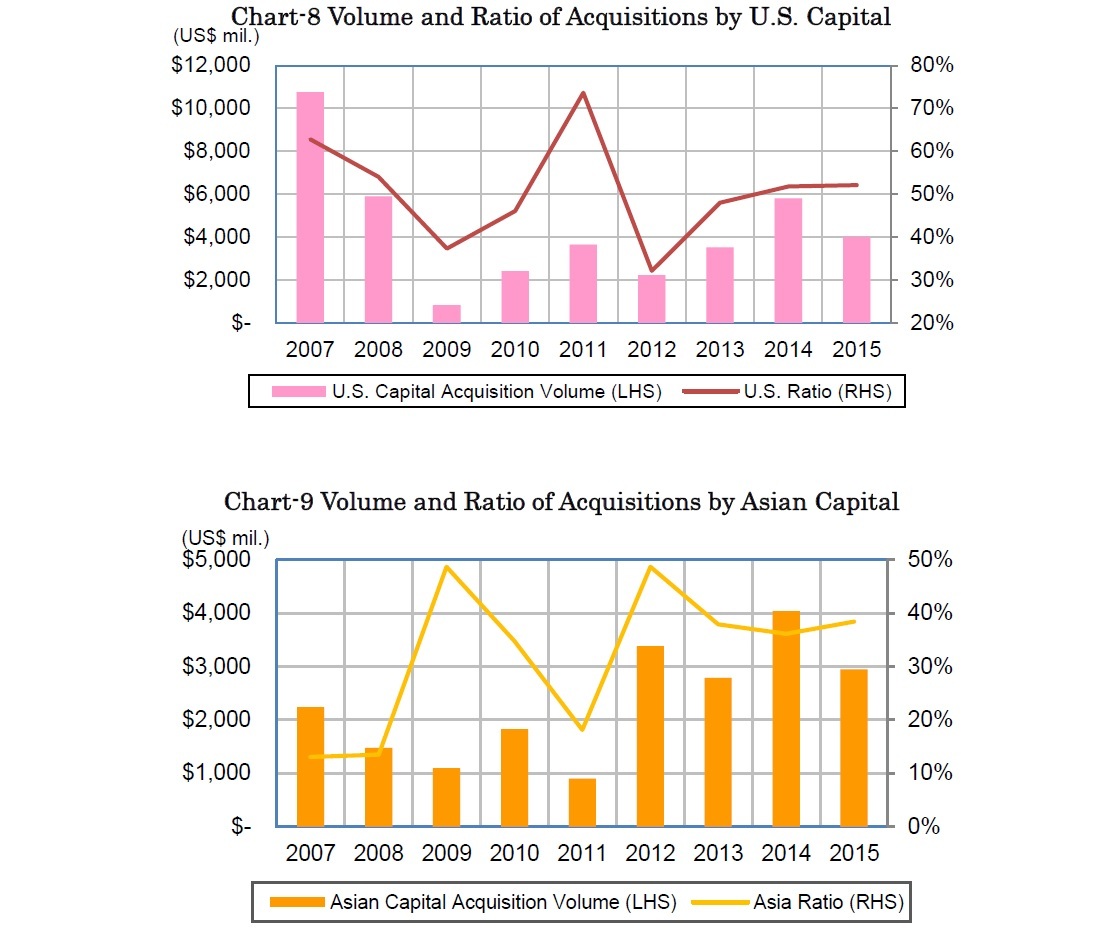

While during the global financial crisis in 2009, U.S. capital drastically lost momentum as Asian capital maintained its pace, both declined to a similar degree in 2015 with U.S. capital holding steady and Asian capital suffering the effects of concerns over the Chinese economy.

6.Final Note

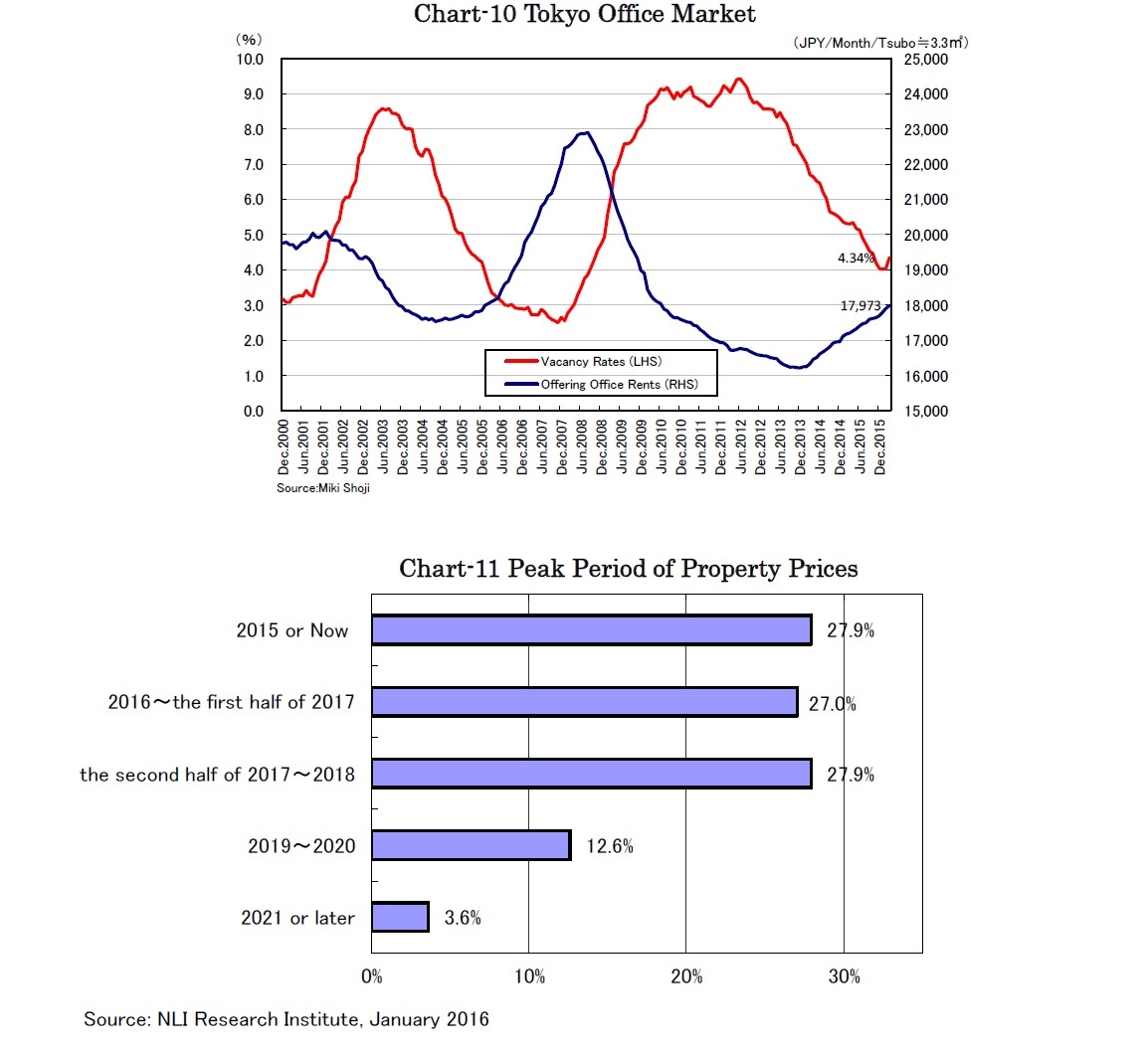

However, different from the equity market where stock prices are available every day, the movement of property prices is difficult to grasp with limited transaction data. Therefore, transaction volume is considered as important data to understand the property investment sentiment, however, as seen above, the transaction volume declined in 2015, and, in particular, acquisitions by cross border capital declined noticeably.

Although the trend of increased cross border capital acquisitions of Japanese properties ended in 2015, acquisitions of Japanese hotels by Asian capital still increased. As seen in the hotel case, properties with a growth driver, or positioned to benefit from the improved infrastructure of Tokyo will continue to attract cross border capital.

1 Mamoru Masumiya “Outlook Reverses, Divergence in Forecasts of Property Price Peak from 2015 to 2018~The Twelfth Japanese Property Market Survey~” Real Estate Analysis Report, February 2, 2016

mamoru masumiya

Research field

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング