- NLI Research Institute >

- Real estate >

- Outlook Reverses, Divergence in Forecasts of Property Price Peak from 2015 to 2018~The Twelfth Japanese Property Market Survey~

Outlook Reverses, Divergence in Forecasts of Property Price Peak from 2015 to 2018~The Twelfth Japanese Property Market Survey~

mamoru masumiya

Font size

- S

- M

- L

Introduction

1 The Japan-based property professionals are those engaged in various work such as development, construction, banking, insurance, brokerage, property management, fund management, advisory, consulting, research and publishing.

Results

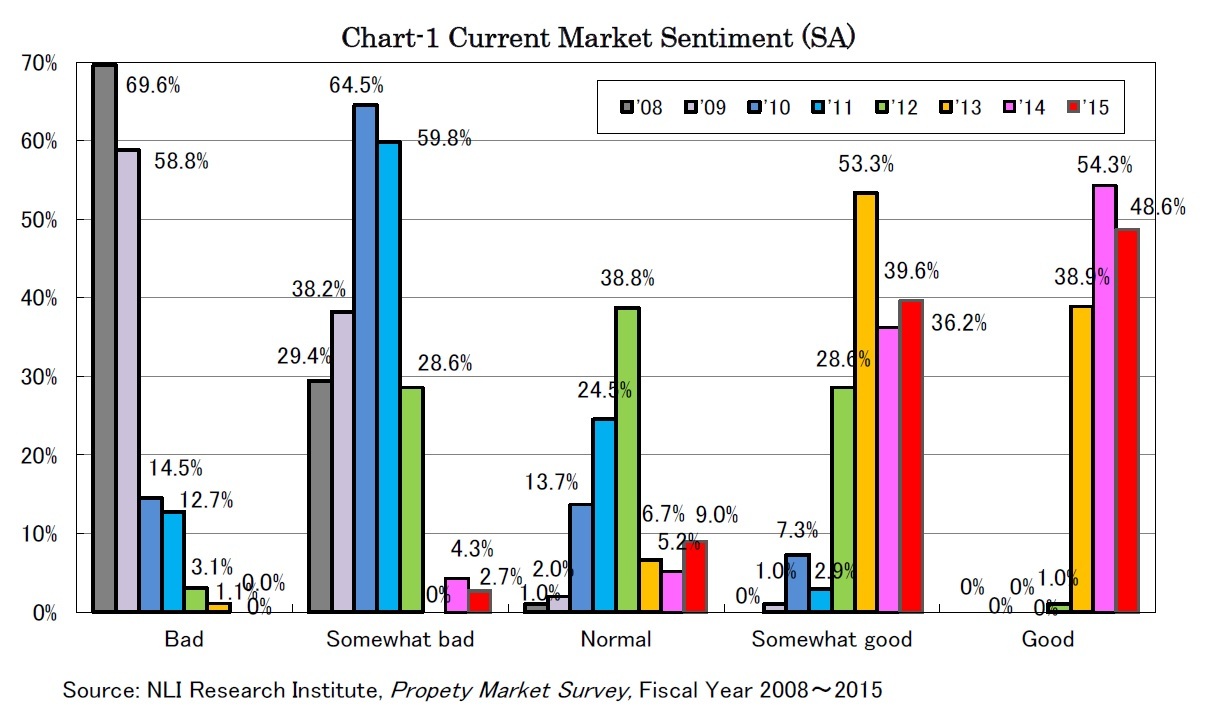

Regarding the current sentiment in the property investment market, “Good” or “Somewhat good” responses accounted for nearly 90% of responses for three consecutive years (Chart-1). The sentiment looks totally opposite of that during the global financial crisis in 2008 and 2009 when “Bad” responses accounted for more than half of the responses.

Regarding the six-month property investment market outlook, “No change” responses ranked first chosen by 54.5% of respondents (Chart-2).

“Somewhat better” or “Better” responses predicting higher prices or more transactions accounted for more than half of the responses until last fiscal year. However, this time “Worse” or “Somewhat worse” responses outnumbered the sum of the optimistic responses, which was the first time since 2008 (Chart-3) as the six-month outlook had already improved even in 2009 when the sentiment was at the bottom.

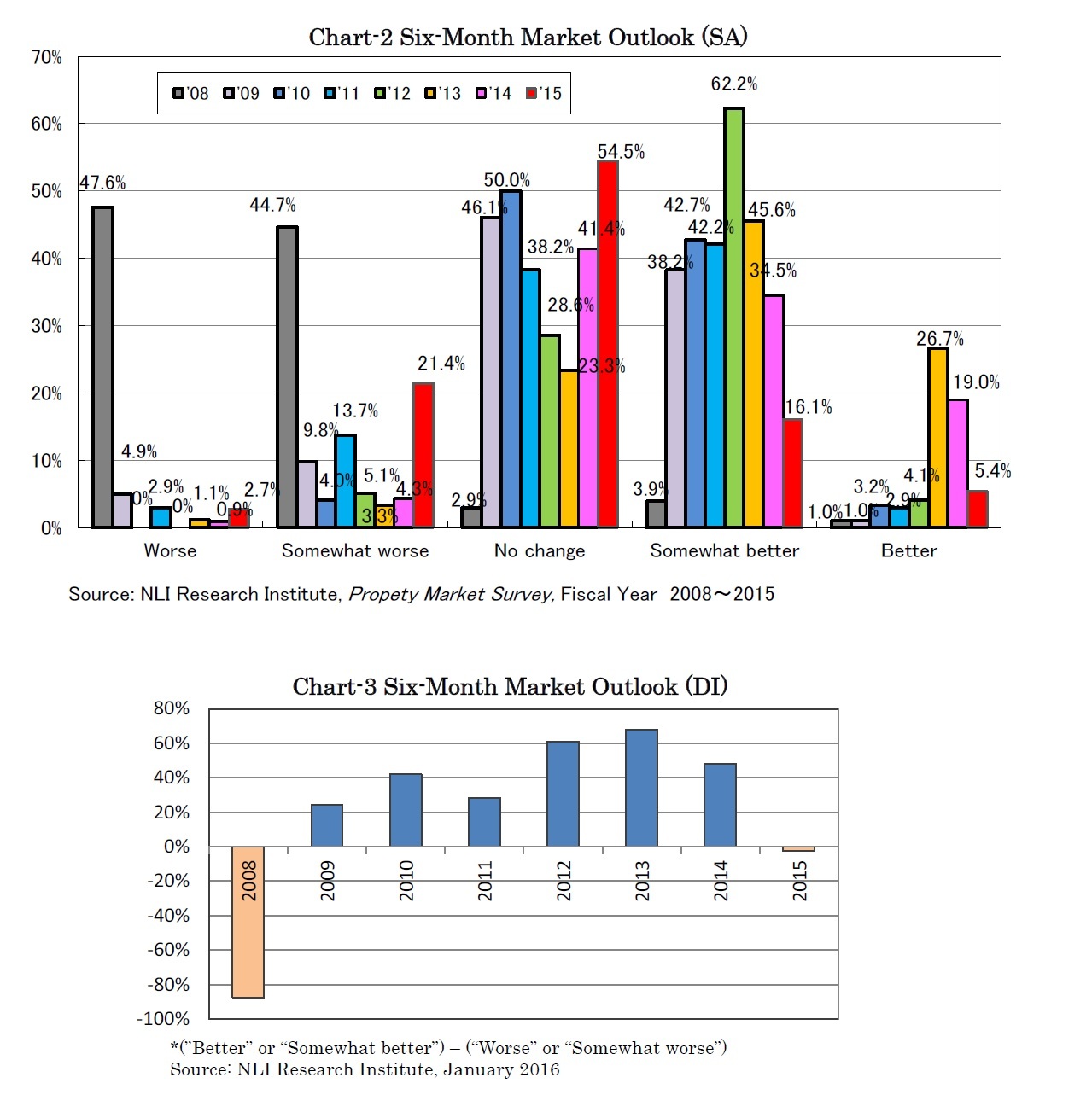

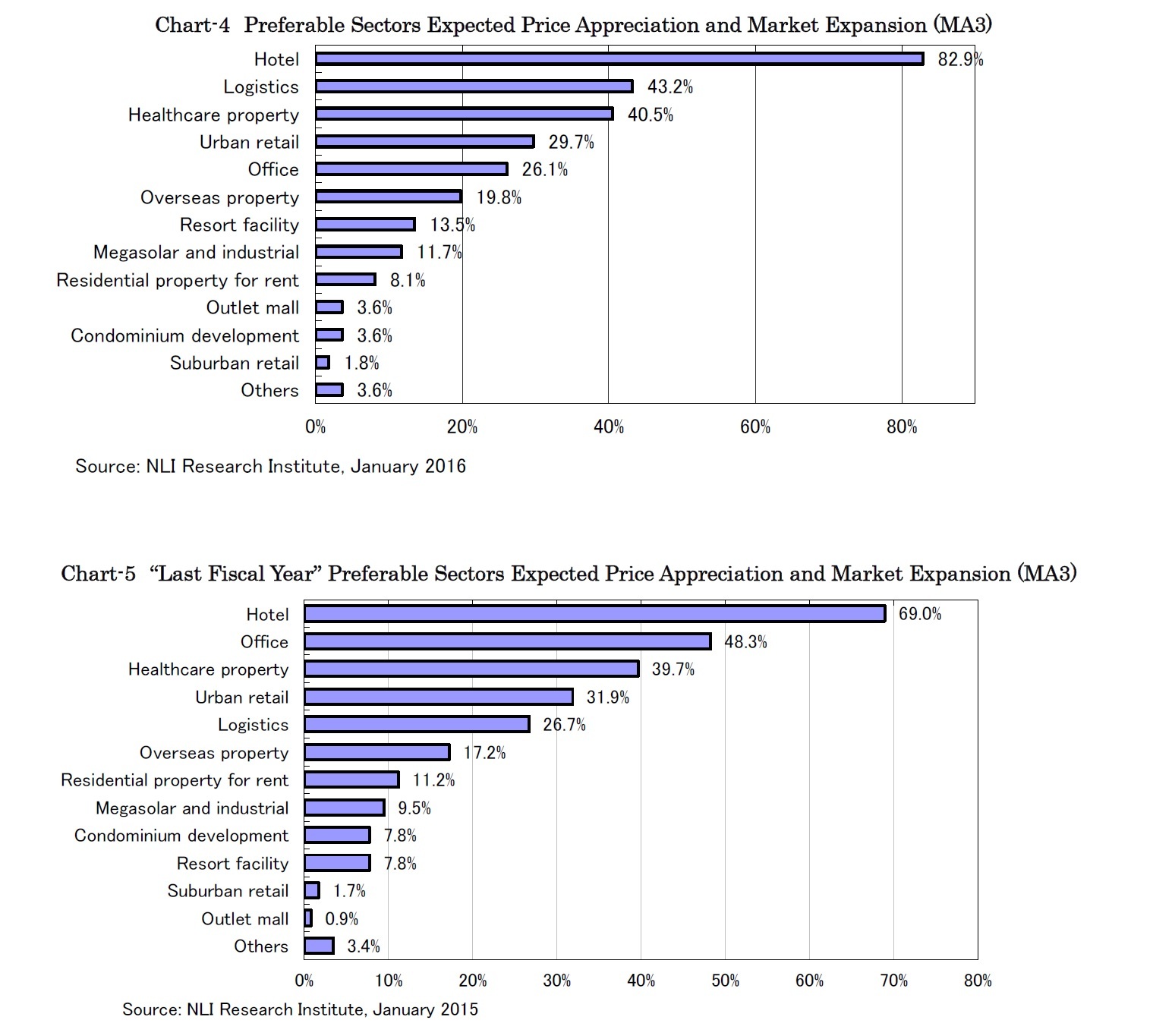

When asked which property sectors were the top three preferable investment targets in terms of price appreciation and market growth, a dominating 82.9% of the respondents chose “Hotel” (Chart-4). As the foreign visitor arrival number grew faster than expected by 47% y-o-y to 19.7 million already in 2015 with the government target of 20 million by 2020, hotel occupancy rates have remained at an all-time high. “Hotel” had been regarded as a niche sector for specialists; however, many companies have newly established or strengthened their hotel investment teams recently. In addition to “Hotel,” the number of respondents who chose “Resort facility” almost doubled to 13.5%.

The number of respondents who chose “Logistics facility” also increased significantly following a temporal decline last year (Chart-5). As volumes of logistics facilities were supplied in the fourth quarter of 2015 and are scheduled to continue, vacancy rates are anticipated to increase for a while. However, it is expected that the larger stock and more liquidity will enhance the attraction of the logistics investment market.

On the other hand, “Office,” which had steadily ranked as one of the top main investment targets, declined significantly to 26.1% this time. Even with improving vacancy rates and rising office rents, the demand growth has recently shown some weakness2. As the office market best shows a classic price cycle among the sectors, some respondents apparently anticipated the cycle to peak out and shifted to other growing sectors.

The number of respondents who chose “Condominium development” also declined noticeably. In addition to structural concerns based on the shrinking population, the recent sales slowdown with high prices and the fabrication of structural piling data presumably affected.

2 Mamoru Masumiya, “Japanese Property Market Quarterly Review, Third Quarter 2015-Markets Steady but Some Weaknesses Creeping In-” Real Estate Analysis Report, NLI Research Institute, November 16, 2015.

mamoru masumiya

Research field

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング