- NLI Research Institute >

- Asset management・Asset building >

- Investors Trading Trends in Japanese Stock Market: An Analysis for March 2025

Column

08/04/2025

Investors Trading Trends in Japanese Stock Market: An Analysis for March 2025

Financial Research Department Chizuru Morishita

Font size

- S

- M

- L

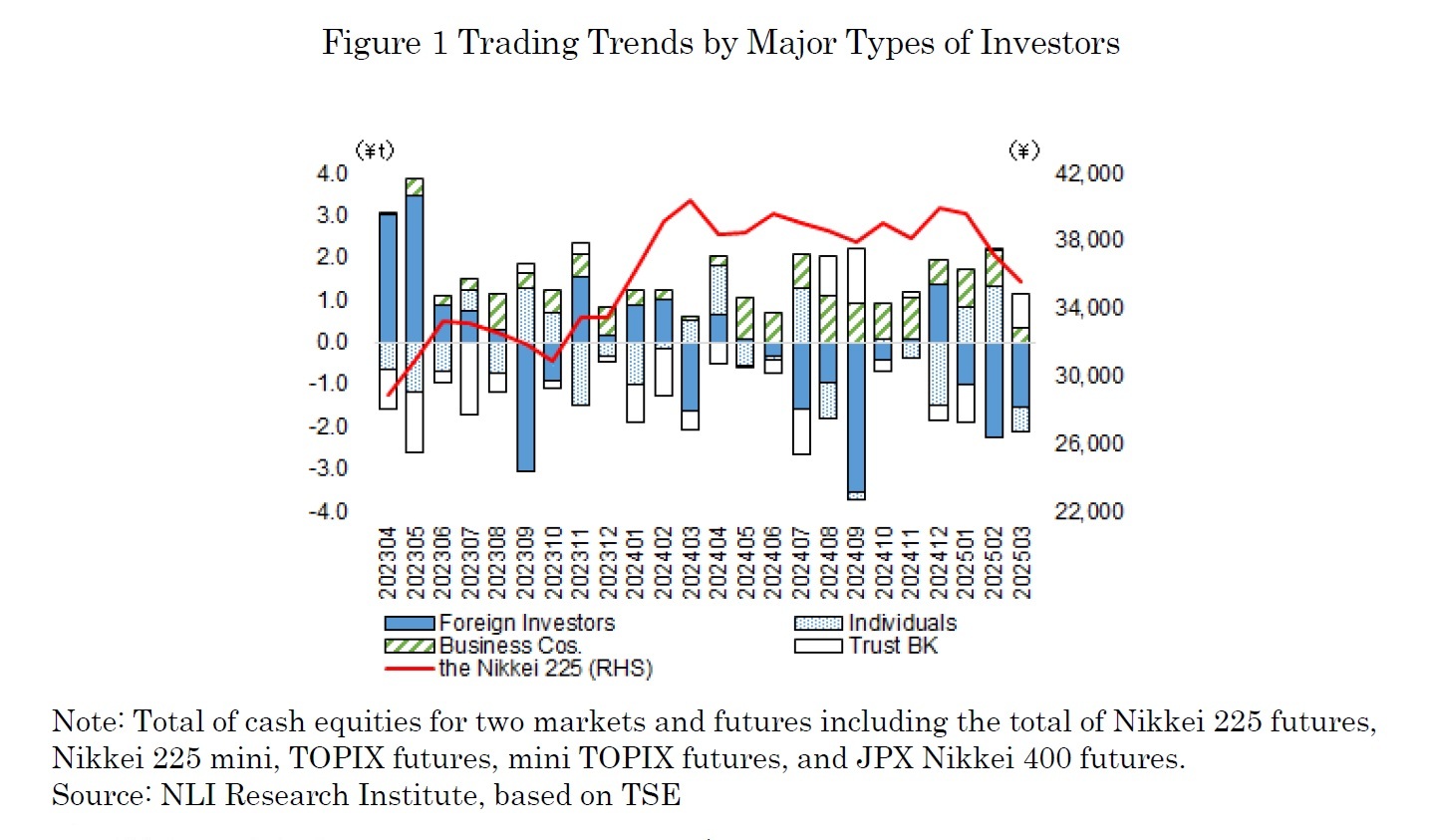

In March 2025, the Nikkei 225 began the month on a soft note, declining from the previous month’s close of 37,155, following the enforcement of additional U.S. tariffs. However, market fears temporarily eased after the announcement on the night of March 5 of a grace period for Mexico and Canada, leading the Nikkei to rebound to 37,704 on March 6. Subsequently, the market moved sideways, weighed down by weakness in U.S. tech stocks, speculation over an additional BOJ rate hike, and a stronger yen. In mid-March and beyond, rising U.S. stocks and a weakening yen supported the market, with the Nikkei climbing to a monthly closing high of 38,027 on March 26. However, later that night, U.S. President Donald Trump announced the imposition of auto tariffs, reigniting fears of a global economic slowdown. Selling spread across economically sensitive stocks, and on the final trading day of the fiscal year, March 31, the Nikkei dropped by over 1,500 yen, closing at 35,617. By investor type, trust banks and business corporations were net buyers, while foreign investors and individuals were net sellers (as shown in Figure 1).

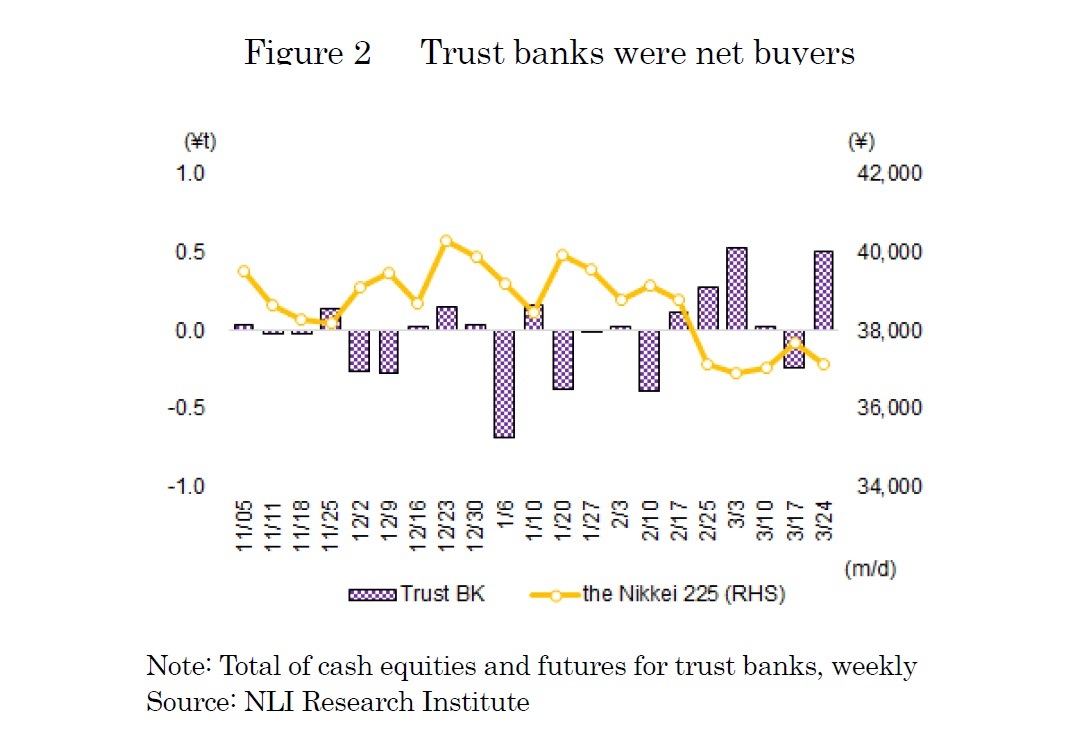

The trading by type of investors in March 2025 (March 3 to 28) shows that trust banks were the largest net buyers, with a total net purchase of 815.4 billion yen in cash equities and futures. On a weekly basis, trust banks recorded significant net buying of 524.7 billion yen in the first week (March 3 to 7) and 502.5 billion yen in the fourth week (March 24 to 28). Historically, there tends to be strong buying demand toward the fiscal year-end due to dividend reinvestments, and this year followed the same pattern, with buying activity dominating(as shown in Figure 2).

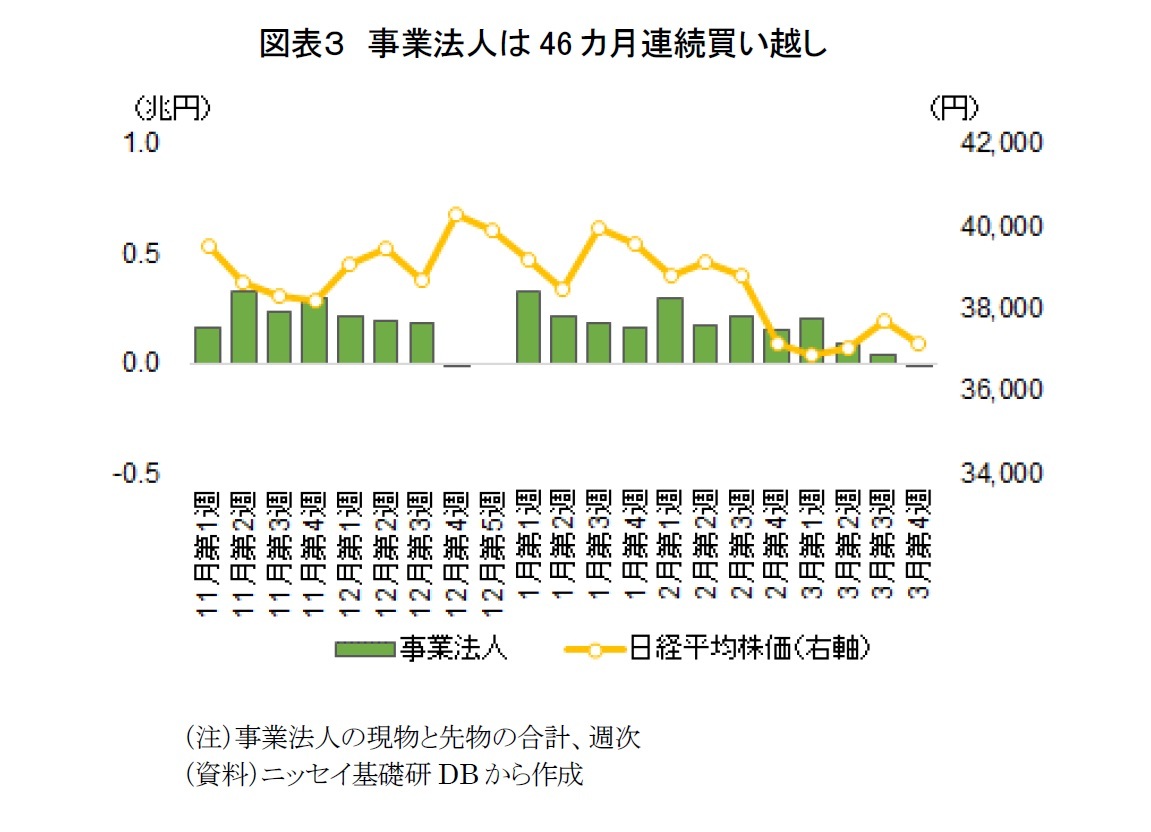

During the first week (March 3 to 7), they recorded a net purchase of 203.4 billion yen. Net buying continued through the second and third weeks (March 10 to 21), though the amounts remained modest, each below 100 billion yen. However, in the fourth week (March 24 to 28), as the fiscal year-end approached, business corporations turned to a slight net sale of 7.5 billion yen, reflecting the typical tendency to refrain from share buybacks at the end of the fiscal year.

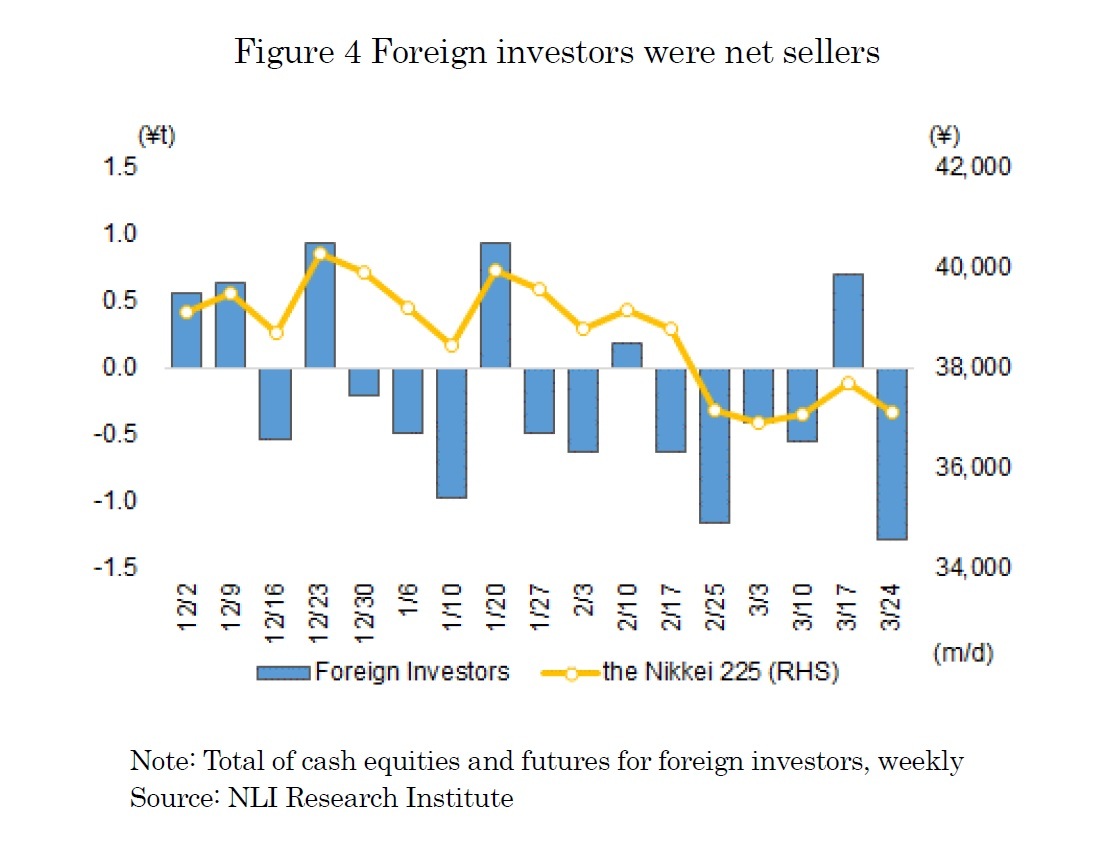

On the other hand, foreign investors were the largest net sellers in March 2025, with a total net sale of 1.54 trillion yen in cash equities and futures. On a weekly basis, they recorded net sales of 413.9 billion yen in the first week (March 3 to 7) and 546.7 billion yen in the second week (March 10 to 14), as risk-off sentiment grew amid concerns over U.S. tariff policies and a potential economic slowdown. In contrast, the third week (March 17 to 21) saw a temporary shift, with foreign investors becoming net buyers of 698.1 billion yen. However, following President Trump’s announcement on the night of March 26 regarding the implementation of auto tariffs, risk aversion returned to the market, and in the fourth week (March 24 to 28), foreign investors turned to a large-scale net sale of 1.28 trillion yen. While there were instances of short-term buying during the market rebound, strong selling pressure—especially toward the month-end—ultimately weighed on the Nikkei (as shown in Figure 4).

On the other hand, foreign investors were the largest net sellers in March 2025, with a total net sale of 1.54 trillion yen in cash equities and futures. On a weekly basis, they recorded net sales of 413.9 billion yen in the first week (March 3 to 7) and 546.7 billion yen in the second week (March 10 to 14), as risk-off sentiment grew amid concerns over U.S. tariff policies and a potential economic slowdown. In contrast, the third week (March 17 to 21) saw a temporary shift, with foreign investors becoming net buyers of 698.1 billion yen. However, following President Trump’s announcement on the night of March 26 regarding the implementation of auto tariffs, risk aversion returned to the market, and in the fourth week (March 24 to 28), foreign investors turned to a large-scale net sale of 1.28 trillion yen. While there were instances of short-term buying during the market rebound, strong selling pressure—especially toward the month-end—ultimately weighed on the Nikkei (as shown in Figure 4).

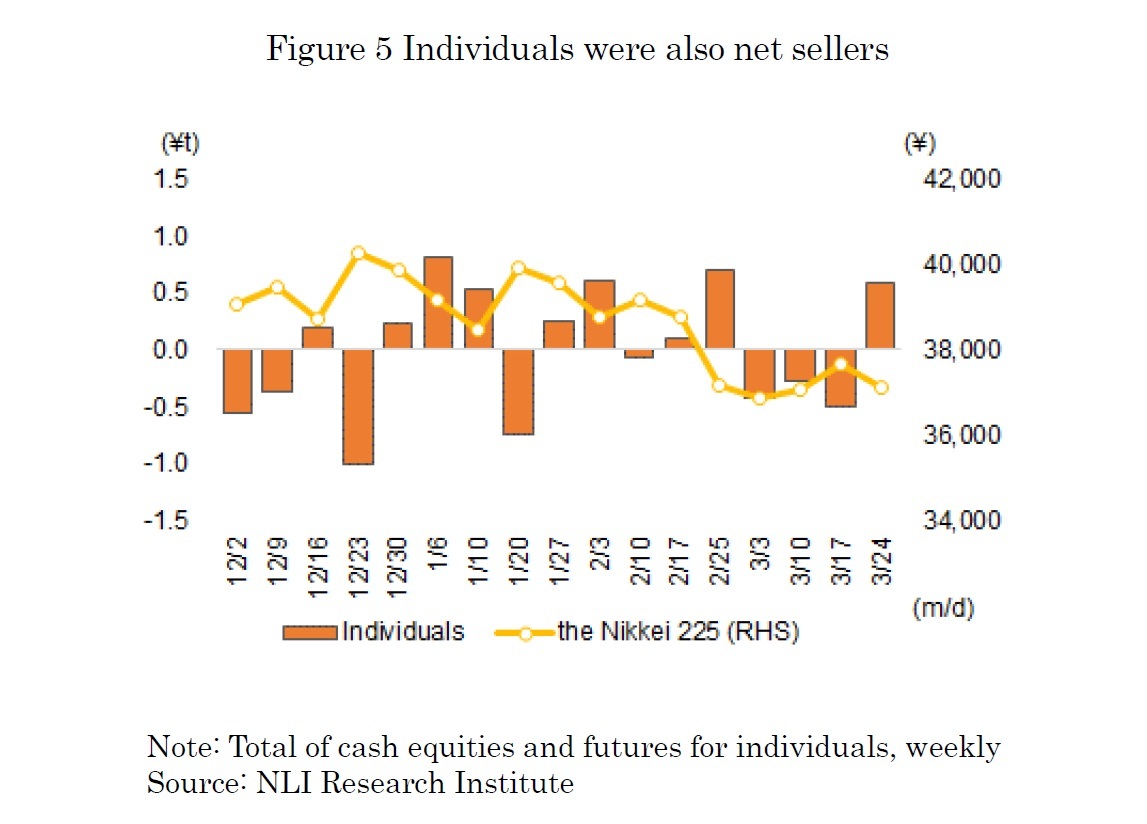

In March 2025, individuals were also net sellers, with a total net sale of 608.2 billion yen in cash equities and futures. From the first to the third week (March 3 to 21), individuals consistently sold, with particularly notable net selling of 498.2 billion yen in the third week (March 17 to 21).However, in the fourth week (March 24 to 28), individuals shifted to net buying of 588.0 billion yen, suggesting that bargain-hunting emerged amid the sharp market decline toward month-end(as shown in Figure 5).

This report includes data from various sources and NLI Research Institute does not guarantee the accuracy and reliability. In addition, this report is intended only for providing information, and the opinions and forecasts are not intended to make or break any contracts.

03-3512-1855

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング