- NLI Research Institute >

- Asset management・Asset building >

- Investors Trading Trends in Japanese Stock Market:An Analysis for November 2024

Column

10/12/2024

Investors Trading Trends in Japanese Stock Market:An Analysis for November 2024

Financial Research Department Chizuru Morishita

Font size

- S

- M

- L

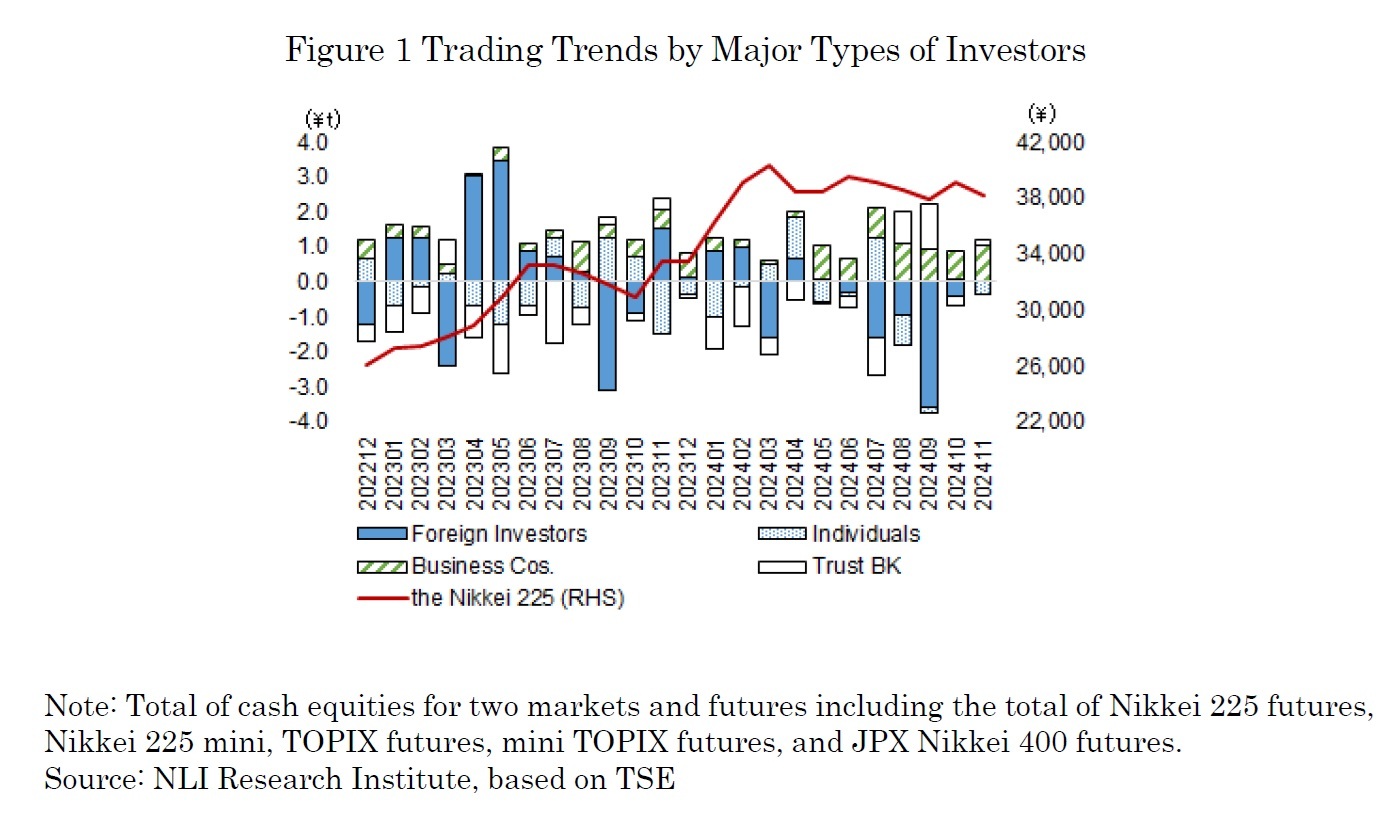

In November, the Nikkei Stock Average initially plummeted to 38,053 at the start of the month due to the decline in U.S. high-tech stocks and speculation of an additional rate hike by the Bank of Japan. However, following Mr. Trump’s victory in the U.S. presidential election, the market rebounded on expectations of economic stimulus measures, reaching 39,533 on the 11th. In mid-November, concerns over the protectionist trade policies of the incoming Trump administration and the fact that many major domestic companies’ earnings fell short of forecasts weighed on the index. As a result, the market softened and fell to 38,026 on the 21st.Towards the end of the month, export-related stocks were sold off amid President-elect Trump’s indication of strengthening tariffs and the yen’s appreciation against the dollar. On the other hand, financial stocks remained firm due to favorable market reactions to rising domestic long-term interest rates, leaving the Nikkei hovering in the low 38,000 range. The index finished the month at 38,208. Amid these fluctuations, business corporations, trust banks, and foreign investors were net buyers, while individuals were net sellers (as shown in Figure 1).

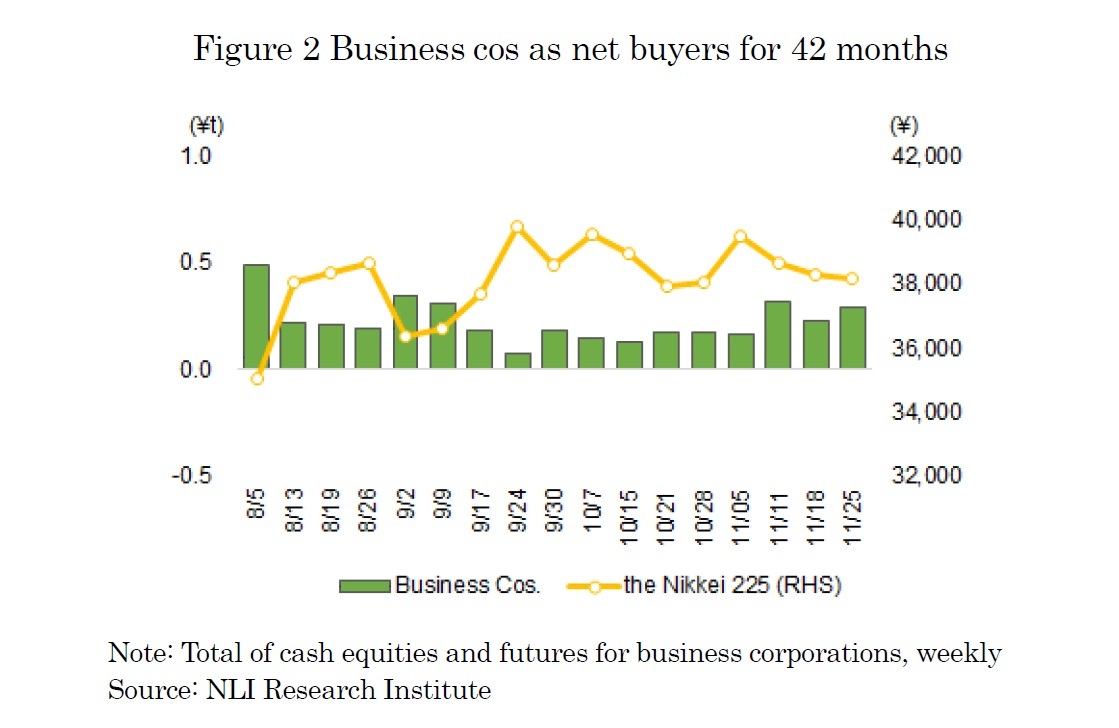

The trading by type of investors on November 2024, spanning from November 5 to November 29, show that business corporations were the largest net buyers, with a total of 1.01 trillion yen in cash equities and futures(as shown in Figure 2). From January to November 2024, the total amount of share buybacks announced by TOPIX-listed companies reached 15.8 trillion yen—approximately 1.7 times the figure recorded during the same period in 2023. Business corporations have been net buyers for 42 consecutive months, a trend likely driven by the Tokyo Stock Exchange’s calls for corporate management to become more conscious of capital costs and share prices, prompting active share buybacks.

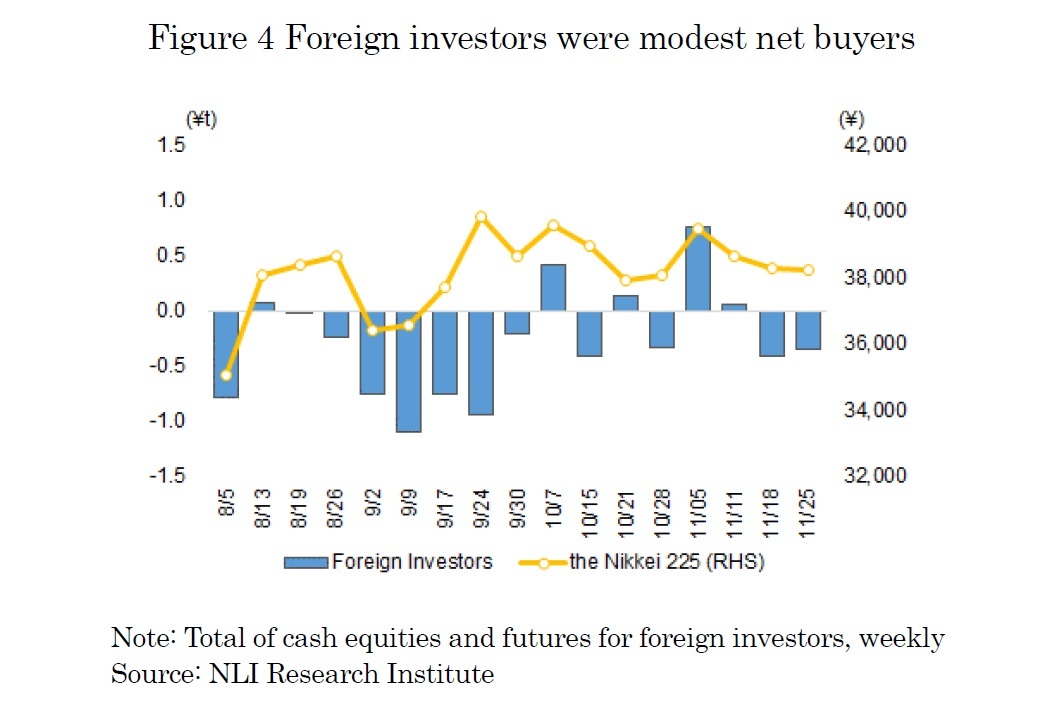

Foreign investors were net buyers as well, albeit modestly, with total net purchases amounting to 56.0 billion yen in cash equities and futures (as shown in Figure 4). During the first week of November (November 5 to 8), the so-called “Trump trade” emerged as foreign investors bought equities on expectations of economic stimulus following Mr. Trump’s election victory. However, from mid-November onward, the market faced growing uncertainties over potential tariff hikes and other protectionist measures, which appears to have prompted a shift toward net selling by foreign investors.

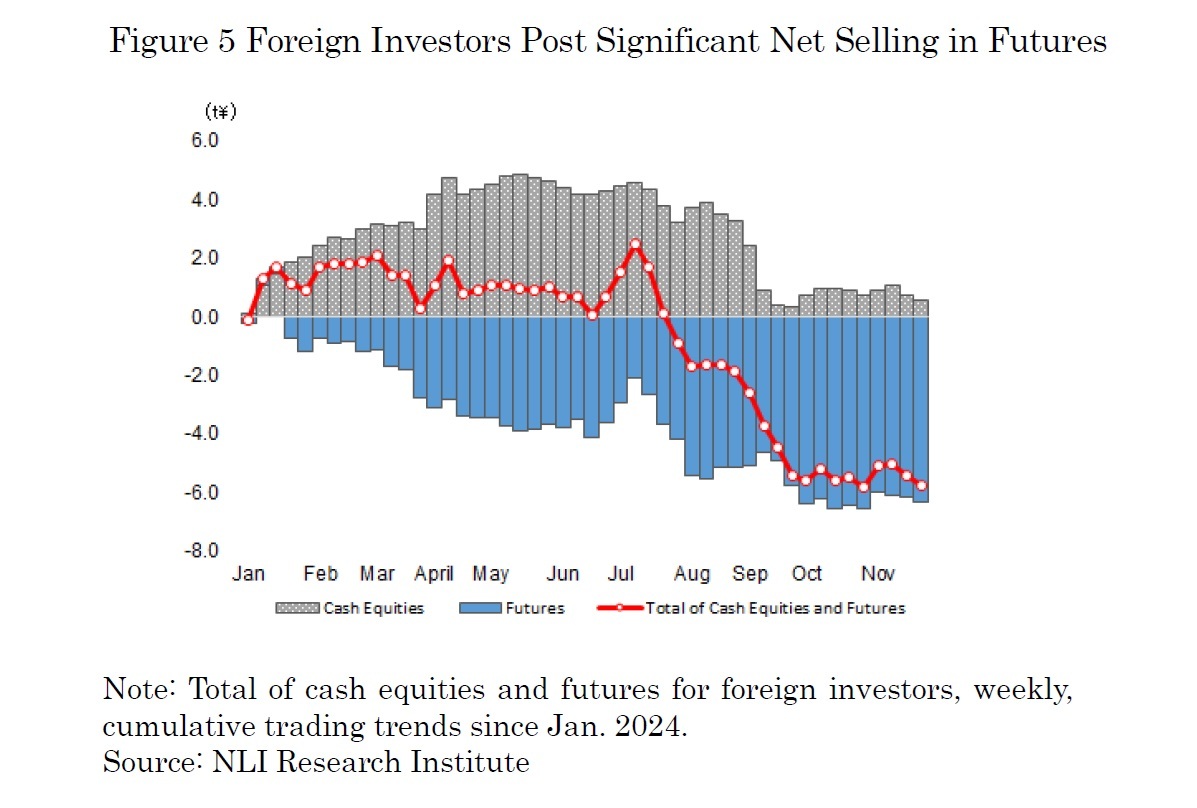

Examining foreign investors’ trading from January through November 2024 reveals that they have been net sellers of a combined total of 5.7 trillion yen in cash equities and futures. This comprises a net purchase of 0.6 trillion yen in cash equities, offset by a notable net sale of 6.3 trillion yen in futures, highlighting the predominance of futures selling (as shown in Figure 5). Attention will focus on whether, at some point, overseas investors begin to cover their futures positions.

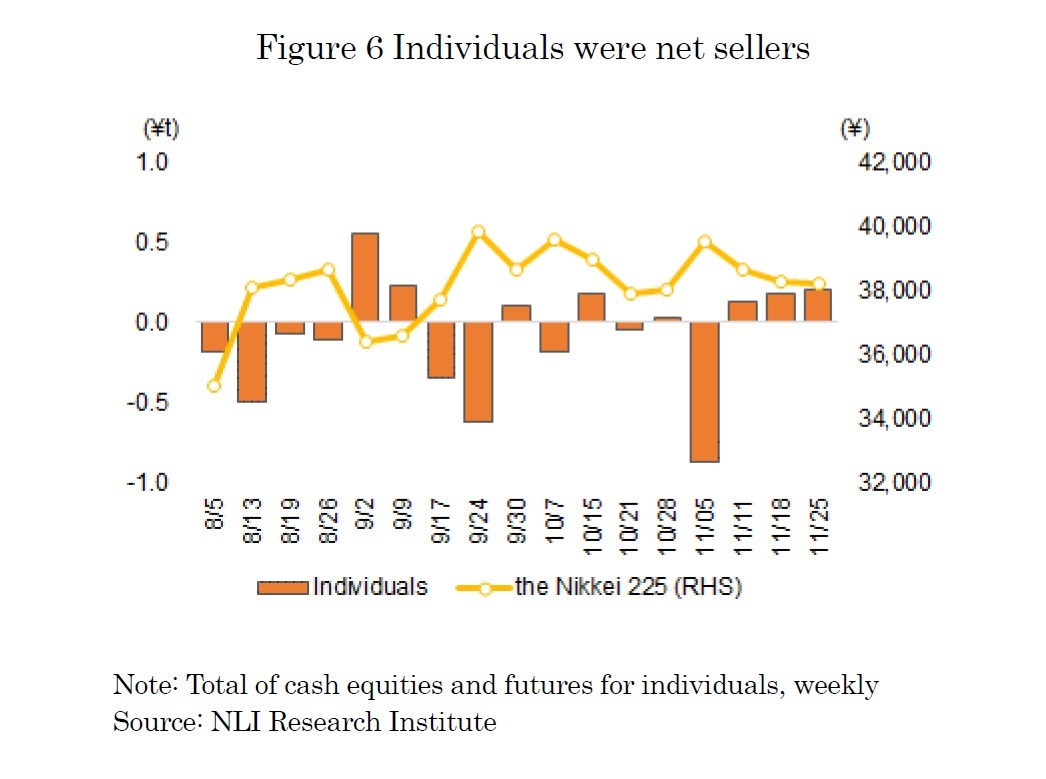

On the other hand, individuals were the largest net sellers in November, with total net sales of 363.3 billion yen in cash equities and futures (as shown in Figure 6). In the first week of November (November 5 to 8), individuals recorded net sales of 870.7 billion yen combined in cash equities and futures. From the second to the fourth week of November (November 11 to 29), they shifted to a small net buying position. This pattern suggests that individuals continued their contrarian behavior in November—selling when the index rose and buying when it declined.

Please note: The data contained in this report has been obtained and processed from various sources, and its accuracy or safety cannot be guaranteed. The purpose of this publication is to provide information, and the opinions and forecasts contained herein do not solicit the conclusion or termination of any contract.

03-3512-1855