- NLI Research Institute >

- Economics >

- Japan’s Economic Outlook for Fiscal Years 2024-2026 (November 2024)

18/11/2024

Japan’s Economic Outlook for Fiscal Years 2024-2026 (November 2024)

Economic Research Department Executive Research Fellow Taro Saito

Font size

- S

- M

- L

■Summary

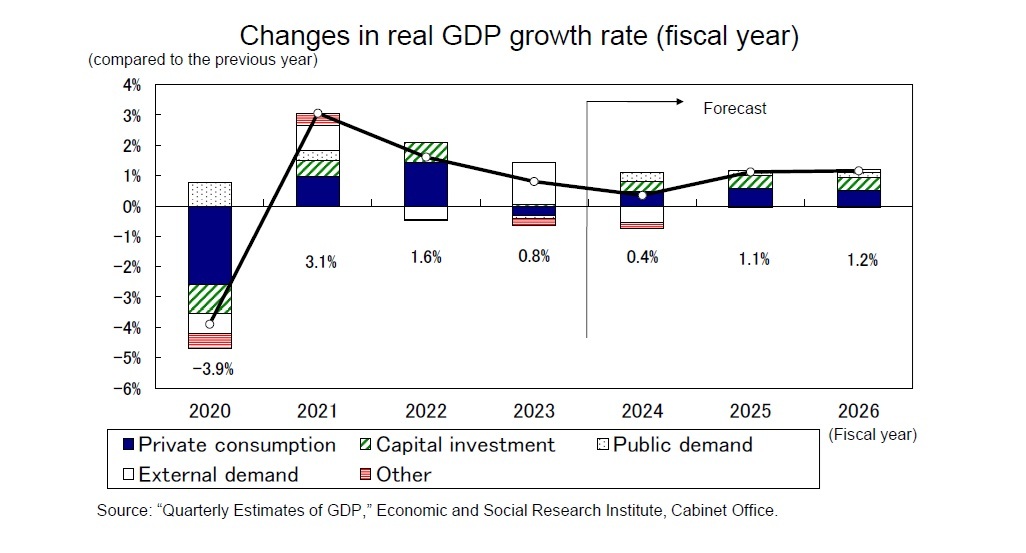

<Real Growth Rate: Forecasted at 0.4% for FY2024, 1.1% for FY2025, and 1.2% for FY2026>

- In the July–September quarter of 2024, Japan’s real GDP grew by 0.9% on an annualized basis from the previous quarter, marking the second consecutive quarter of positive growth. The primary driver was strong private consumption growth supported by income and resident tax cuts.

- Looking ahead, although the effects of the tax cuts are expected to diminish, an increase in real disposable income driven by recovery in real wages will likely support consumption. While capital investment remains in a state of fluctuation, the recovery trend is expected to persist, underpinned by high corporate earnings.

- Real GDP growth is forecasted to be 0.4% in FY2024, 1.1% in FY2025, and 1.2% in FY2026. Although exports are unlikely to act as a key driver of economic growth in the near term, firm domestic demand is expected to maintain the recovery trend. Potential downside risks include a sharp slowdown in the global economy triggered by the economic policies of President-elect Trump and a decline in consumption caused primarily by a slump in real incomes due to rising prices.

- The consumer price index (excluding fresh food) is forecasted to increase by 2.6% in FY2024, 2.0% in FY2025, and 1.7% in FY2026. While the pace of price increases is expected to accelerate toward the end of FY2024 as inflation mitigation measures are scaled back, this acceleration is anticipated to moderate after the effects of these measures subside. During the second half of FY2025, the upward pressure on service prices from wage increases will likely be offset by a slowdown in goods price growth driven by yen appreciation, causing the inflation rate to fall below the Bank of Japan’s 2% target.

■Index

1.The July–September Quarter of 2024 Achieved 0.9% Positive Growth on an Annualized Basis

・Exports Continue a Modest Upward Trend

・Summer Bonuses Significantly Boosted Wages

・The Rate of Increase in Spring Wages in 2025 is Expected to Remain in the 5% Range for the Second Consecutive Year

2.The Real Growth Rate is Forecasted at 0.4% in FY2024, 1.1% in FY2025, and 1.2% in FY2026

・Growth Rate Expected to Remain Around 1% Annually

・Personal Consumption Dependent on Disposable Income

・Labor Shortages Restrain the Pace of Capital Investment Recovery

・Outlook for Prices

1.The July–September Quarter of 2024 Achieved 0.9% Positive Growth on an Annualized Basis

・Exports Continue a Modest Upward Trend

・Summer Bonuses Significantly Boosted Wages

・The Rate of Increase in Spring Wages in 2025 is Expected to Remain in the 5% Range for the Second Consecutive Year

2.The Real Growth Rate is Forecasted at 0.4% in FY2024, 1.1% in FY2025, and 1.2% in FY2026

・Growth Rate Expected to Remain Around 1% Annually

・Personal Consumption Dependent on Disposable Income

・Labor Shortages Restrain the Pace of Capital Investment Recovery

・Outlook for Prices

03-3512-1836

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング