- NLI Research Institute >

- Economics >

- Japan’s Economic Outlook for Fiscal Years 2024-2026 (November 2024)

18/11/2024

Japan’s Economic Outlook for Fiscal Years 2024-2026 (November 2024)

Economic Research Department Executive Research Fellow Taro Saito

Font size

- S

- M

- L

1.The July–September Quarter of 2024 Achieved 0.9% Positive Growth on an Annualized Basis

In the July–September quarter of 2024, Japan’s real GDP grew by 0.2% from the previous quarter (0.9% on an annualized basis), marking the second consecutive quarter of positive growth. While private residential investment (-0.1% from the previous quarter) and capital investment (-0.2% from the previous quarter) showed slight declines, private consumption increased by a strong 0.9%, supported by an increase in disposable income resulting from income and resident tax cuts. With the downward pressure from rising prices, summer consumption faced further constraints from temporary train suspensions, travel cancellations, and factory shutdowns caused by typhoon activity and the Nankai Trough Earthquake Advisory. However, the income and resident tax cuts implemented since June have significantly boosted household disposable income, supporting consumption.

Exports grew by only 0.4% from the previous quarter, falling short of the 2.1% growth in imports. As a result, net external demand contributed negatively to growth (-0.4%). Nevertheless, increases in both private demand and public demand led to a positive contribution from domestic demand (+0.6%), outweighing the drag from external demand.

Exports grew by only 0.4% from the previous quarter, falling short of the 2.1% growth in imports. As a result, net external demand contributed negatively to growth (-0.4%). Nevertheless, increases in both private demand and public demand led to a positive contribution from domestic demand (+0.6%), outweighing the drag from external demand.

(Exports Continue a Modest Upward Trend.)

The global trade volume turned positive year-on-year after entering 2024 and has gradually gained momentum, while Japan’s exports have remained flat.

Looking ahead at overseas economies, which will influence the outlook for Japanese exports, the real GDP growth rate of the U.S. is expected to slow from 2.9% in 2023 to 2.7% in 2024, but still well above the potential growth rate. However, cumulative monetary tightening, along with President-elect Trump’s pledged tariff hikes and inflationary pressures from the deportation of illegal immigrants, is expected to slow U.S. growth to 1.8% in 2025 and 1.4% in 2026. In the euro area, which recorded a low growth of 0.4% in 2023, inflation stabilization is anticipated to lead to a gradual recovery, with growth improving to 0.8% in 2024 and 1.4% in both 2025 and 2026. However, growth is expected to remain moderate compared to the sharp contraction during the COVID-19 crisis. In China, real GDP growth accelerated from 3.0% in 2022 to 5.2% in 2023 following the end of the zero-COVID-19 policy. However, growth is forecasted to decelerate to 4.7% in 2024, 4.2% in 2025, and 4.0% in 2026, reflecting a sluggish real estate market and slow improvements in employment and income conditions. Overall, while the global economy is expected to recover modestly through 2026, growth is likely to remain subdued.

The global trade volume turned positive year-on-year after entering 2024 and has gradually gained momentum, while Japan’s exports have remained flat.

Looking ahead at overseas economies, which will influence the outlook for Japanese exports, the real GDP growth rate of the U.S. is expected to slow from 2.9% in 2023 to 2.7% in 2024, but still well above the potential growth rate. However, cumulative monetary tightening, along with President-elect Trump’s pledged tariff hikes and inflationary pressures from the deportation of illegal immigrants, is expected to slow U.S. growth to 1.8% in 2025 and 1.4% in 2026. In the euro area, which recorded a low growth of 0.4% in 2023, inflation stabilization is anticipated to lead to a gradual recovery, with growth improving to 0.8% in 2024 and 1.4% in both 2025 and 2026. However, growth is expected to remain moderate compared to the sharp contraction during the COVID-19 crisis. In China, real GDP growth accelerated from 3.0% in 2022 to 5.2% in 2023 following the end of the zero-COVID-19 policy. However, growth is forecasted to decelerate to 4.7% in 2024, 4.2% in 2025, and 4.0% in 2026, reflecting a sluggish real estate market and slow improvements in employment and income conditions. Overall, while the global economy is expected to recover modestly through 2026, growth is likely to remain subdued.

On a brighter note, the global recovery in demand for IT-related goods continues. Global semiconductor sales, which had been declining year-on-year since the summer of 2019 and bottomed out in the spring of 2023, have recently achieved growth of over 20% year-on-year.

Although low global economic growth limits the potential for a sharp acceleration in export growth, Japan’s exports are expected to show a gradual recovery, particularly exports of IT-related goods. In GDP statistics, exports of goods and services are forecasted to grow moderately by 1.5% year-on-year in FY2024 and by 2.9% in both FY2025 and FY2026.

Although low global economic growth limits the potential for a sharp acceleration in export growth, Japan’s exports are expected to show a gradual recovery, particularly exports of IT-related goods. In GDP statistics, exports of goods and services are forecasted to grow moderately by 1.5% year-on-year in FY2024 and by 2.9% in both FY2025 and FY2026.

(Summer Bonuses Significantly Boosted Wages.)

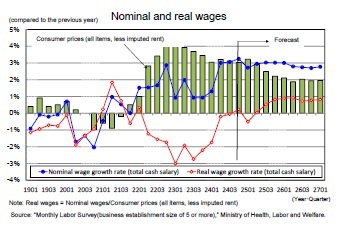

Total cash earnings (per capita) grew by a robust 3.1% year-on-year in the July–September quarter of 2024, following a 3.0% increase in the April–June quarter. This reflects the results of the 2024 spring labor negotiations, which saw the highest wage increases in 33 years, as well as a significant rise in summer bonuses, boosting total cash earnings.

According to the Ministry of Health, Labour, and Welfare’s November 7th announcement, summer bonuses in 2024 increased by 2.3% year-on-year, marking the third consecutive year of growth. However, this figure represents the average for workers at establishments that paid bonuses. When all establishments are included, the average bonus per worker grew by a substantial 5.7% year-on-year. This was due to an increase in the percentage of establishments paying bonuses, from 65.9% in 2023 to 73.0% in 2024, as well as a rise in the proportion of workers employed at such establishments from 80.0% to 84.3%. Many small- and medium-sized enterprises likely decided to pay bonuses amid improved corporate earnings and severe labor shortages.

Total cash earnings (per capita) grew by a robust 3.1% year-on-year in the July–September quarter of 2024, following a 3.0% increase in the April–June quarter. This reflects the results of the 2024 spring labor negotiations, which saw the highest wage increases in 33 years, as well as a significant rise in summer bonuses, boosting total cash earnings.

According to the Ministry of Health, Labour, and Welfare’s November 7th announcement, summer bonuses in 2024 increased by 2.3% year-on-year, marking the third consecutive year of growth. However, this figure represents the average for workers at establishments that paid bonuses. When all establishments are included, the average bonus per worker grew by a substantial 5.7% year-on-year. This was due to an increase in the percentage of establishments paying bonuses, from 65.9% in 2023 to 73.0% in 2024, as well as a rise in the proportion of workers employed at such establishments from 80.0% to 84.3%. Many small- and medium-sized enterprises likely decided to pay bonuses amid improved corporate earnings and severe labor shortages.

The real wage growth rate, calculated by adjusting nominal wages for consumer price inflation, turned positive for the first time in two years and three months in June 2024 (+1.1% year-on-year), followed by a 0.3% increase in July. However, these positive results were mainly driven by significant increases in special cash earnings (bonuses). In August (-0.8% year-on-year) and September (-0.1%), when fewer bonuses were paid, real wages turned negative again. Real wage growth is expected to turn positive again in October, primarily due to a slowdown in electricity and city gas price inflation under the “Emergency Assistance for Overcoming Severe Summer Heat” program, and in December, driven by strong year-end bonuses. However, after the program ends, inflation is likely to rise again, delaying sustained and stable real wage growth until after the start of FY2025.

(The Rate of Increase in Spring Wages in 2025 is Expected to Remain in the 5% Range for the Second Consecutive Year.)

The rate of wage increase in the 2024 spring labor negotiations was 5.33% (Ministry of Health, Labour and Welfare, “Spring Wage Demands and Compensation of Major Private Corporations”), the highest in 33 years. In 2025, the labor market is expected to remain tight, with the effective job openings-to-applicants ratio staying well above 1.0 and the unemployment rate hovering at the mid-2% range. In addition, ordinary income (seasonally adjusted) in the Financial Statements Statistics of Corporations by Industry continues to set new records, while consumer price inflation remains elevated.

The rate of wage increase in the 2024 spring labor negotiations was 5.33% (Ministry of Health, Labour and Welfare, “Spring Wage Demands and Compensation of Major Private Corporations”), the highest in 33 years. In 2025, the labor market is expected to remain tight, with the effective job openings-to-applicants ratio staying well above 1.0 and the unemployment rate hovering at the mid-2% range. In addition, ordinary income (seasonally adjusted) in the Financial Statements Statistics of Corporations by Industry continues to set new records, while consumer price inflation remains elevated.

In its basic policy announced on October 18, RENGO stated that it would again demand wage increases of 5% or more (including regular salary increases) in 2025, and that small- and medium-sized labor unions would actively seek additional increases to address wage disparities. Based on this context, the current forecast assumes that the rate of spring wage increase for 2025 would be 5.20%, maintaining a high level in the 5% range for the second consecutive year.

Nominal wages are forecasted to grow by approximately 3% year-on-year. However, given the volatility of consumer prices due to policy changes, real wages are expected to alternate between positive and negative growth in the short term. Sustained and stable positive real wage growth is not anticipated until the July–September quarter of 2025, when consumer price inflation (excluding imputed rent of owner-occupied houses), currently around 3%, is expected to decelerate to the mid-2% range.

Nominal wages are forecasted to grow by approximately 3% year-on-year. However, given the volatility of consumer prices due to policy changes, real wages are expected to alternate between positive and negative growth in the short term. Sustained and stable positive real wage growth is not anticipated until the July–September quarter of 2025, when consumer price inflation (excluding imputed rent of owner-occupied houses), currently around 3%, is expected to decelerate to the mid-2% range.

03-3512-1836

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング