- NLI Research Institute >

- Economics >

- Japan's Economic Outlook for Fiscal Years 2024 and 2025 (May 2024)

17/05/2024

Japan's Economic Outlook for Fiscal Years 2024 and 2025 (May 2024)

Economic Research Department Executive Research Fellow Taro Saito

Font size

- S

- M

- L

1.Negative growth of -2.0% on an annualized basis from the previous quarter in the January–March quarter of 2024

Real GDP in the January–March quarter of 2024 was -0.5% from the previous quarter (-2.0% on an annualized basis from the previous quarter), marking the first negative growth in two quarters.

Despite an increase in public demand, private consumption declined for the fourth consecutive quarter (-0.7% from the previous quarter) due to a sharp drop in automobile sales, following the suspension of production and shipments in the wake of the fraud scandal and amid continued downward pressure from inflation. Capital investment also declined for the first time in two quarters (-0.8% from the previous quarter) due to the Noto Peninsula earthquake and the automobile fraud scandal. Exports fell -5.0% from the previous quarter, exceeding the decline in imports (-3.4% from the previous quarter). Net exports pushed down the growth rate, contributing -0.3% from the previous quarter (-1.4% on an annualized basis). The negative impact of the auto cheating scandal was widespread, affecting private consumption, capital investment, and exports.

In FY 2023, real GDP growth was 1.2% compared to the previous year (1.6% in FY2022), and nominal GDP growth was 5.3% compared to the previous year (2.4% in FY 2022). Both marked positive growth for the third consecutive year. The nominal GDP growth rate was the highest in 32 years since FY1991 (5.3%).1

Real GDP grew for the third consecutive year in FY 2023, but the intra-year growth rate (the growth rate from the January–March quarter of 2023 to the January–March quarter of 2024) was -0.4%. The Japanese economy is judged to have remained stagnant throughout FY2023.

1 Based on a simplified retrospective GDP series on the 2015 base expenditure side.

Despite an increase in public demand, private consumption declined for the fourth consecutive quarter (-0.7% from the previous quarter) due to a sharp drop in automobile sales, following the suspension of production and shipments in the wake of the fraud scandal and amid continued downward pressure from inflation. Capital investment also declined for the first time in two quarters (-0.8% from the previous quarter) due to the Noto Peninsula earthquake and the automobile fraud scandal. Exports fell -5.0% from the previous quarter, exceeding the decline in imports (-3.4% from the previous quarter). Net exports pushed down the growth rate, contributing -0.3% from the previous quarter (-1.4% on an annualized basis). The negative impact of the auto cheating scandal was widespread, affecting private consumption, capital investment, and exports.

In FY 2023, real GDP growth was 1.2% compared to the previous year (1.6% in FY2022), and nominal GDP growth was 5.3% compared to the previous year (2.4% in FY 2022). Both marked positive growth for the third consecutive year. The nominal GDP growth rate was the highest in 32 years since FY1991 (5.3%).1

Real GDP grew for the third consecutive year in FY 2023, but the intra-year growth rate (the growth rate from the January–March quarter of 2023 to the January–March quarter of 2024) was -0.4%. The Japanese economy is judged to have remained stagnant throughout FY2023.

1 Based on a simplified retrospective GDP series on the 2015 base expenditure side.

(Exports to pick up moderately)

Exports have remained sluggish but with signs of bottoming out. World trade volume has continued to decline compared to the previous year since the October–December quarter of 2022, but the pace of decline has recently slowed.

Exports have remained sluggish but with signs of bottoming out. World trade volume has continued to decline compared to the previous year since the October–December quarter of 2022, but the pace of decline has recently slowed.

Considering the outlook for overseas economies, which will affect the outlook for exports, real GDP growth in the US is expected to continue to slow to 2.5% in 2023 from 1.9% in 2022, 2.3% in 2024, and 1.6% in 2025, partly due to the cumulative effects of monetary tightening. In the euro area, which grew only 0.4% in 2023 compared to the previous year, growth is not expected to recover strongly, although it will gradually pick up due to calming inflation and other factors. Additionally, China’s real GDP growth in 2023 accelerated to 5.2% from 3.0% in 2022 due to the end of the zero-COVID-19 policy.However, it is expected to continue to decelerate to 4.8% in 2024 and 4.3% in 2025 due to the impact of the real estate market slump. Overall, the forecast assumes that overseas economies will recover moderately in 2024 and through FY2025, the period of this forecast, but that growth will remain low.

Considering the outlook for overseas economies, which will affect the outlook for exports, real GDP growth in the US is expected to continue to slow to 2.5% in 2023 from 1.9% in 2022, 2.3% in 2024, and 1.6% in 2025, partly due to the cumulative effects of monetary tightening. In the euro area, which grew only 0.4% in 2023 compared to the previous year, growth is not expected to recover strongly, although it will gradually pick up due to calming inflation and other factors. Additionally, China’s real GDP growth in 2023 accelerated to 5.2% from 3.0% in 2022 due to the end of the zero-COVID-19 policy.However, it is expected to continue to decelerate to 4.8% in 2024 and 4.3% in 2025 due to the impact of the real estate market slump. Overall, the forecast assumes that overseas economies will recover moderately in 2024 and through FY2025, the period of this forecast, but that growth will remain low.

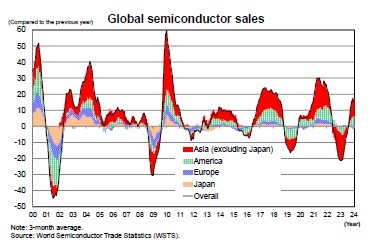

On the other hand, the fact that the adjustment in global information technology goods has reached a point of no return is an encouraging sign. Global semiconductor sales had been declining year-on-year since the summer of 2019, but after bottoming out around spring 2023, they are currently showing double-digit growth compared to the previous year. Although export growth is not expected to accelerate significantly due to continued low growth overseas, the pick-up is expected to continue, especially for information technology goods. Exports of goods and services in the GDP statistics are expected to continue to grow moderately at 3.4% compared to the previous year in FY2024 and 3.3% in FY2025.

(The impact of the re-accelerating weak yen and persistently high oil prices)

Since 2022, when the US began raising policy rates to cope with high inflation, the yen has continued to weaken against the dollar on the back of the widening Japan–US interest rate differential. The yen stopped weakening in the second half of 2023 when the US stopped raising interest rates but has been weakening again since April 2024 because the US interest rate cut is no longer expected due to the high inflation rate and other factors.

Since 2022, when the US began raising policy rates to cope with high inflation, the yen has continued to weaken against the dollar on the back of the widening Japan–US interest rate differential. The yen stopped weakening in the second half of 2023 when the US stopped raising interest rates but has been weakening again since April 2024 because the US interest rate cut is no longer expected due to the high inflation rate and other factors.

A weaker yen will improve corporate earnings, especially in the manufacturing sector, through higher exports. Additionally, the rise in import prices associated with a weaker yen will initially have a negative impact on households through a decline in real income associated with a rise in consumer prices. However, later, the improvement in corporate earnings will spill over to employment and wages, and households will generally benefit as well.

On the other hand, crude oil prices (WTI) have been calm recently, hovering around $80 per barrel, but remain high compared to pre-COVID-19 levels (2019 average in the low $50s per barrel). Rising oil prices will depress corporate earnings and reduce the real purchasing power of households through the outflow of income overseas due to worsening terms of trade.

During the current phase of price hikes, companies have been able to fully pass on the increased costs associated with higher import prices to their prices, thus mitigating the negative impact of the weaker yen and higher oil prices. Corporate ordinary income for the most recent period (October–December quarter, 2023) is 28.4% higher than the pre-COVID-19 period (2019 average). Although the labor cost factor has slightly pushed down earnings, reflecting the higher wage rate, they have been significantly boosted by a substantial increase in sales, which had previously fallen due to the COVID-19 disaster. This increase has been due to the higher value of exports from the weaker yen and the transfer of prices to the domestic market (sales factor). Additionally, although variable costs have increased due to the weak yen and high crude oil prices, companies’ earnings have benefited from lower ratio of variable costs to sales due to sufficient price transfers (variable cost factor).

On the other hand, crude oil prices (WTI) have been calm recently, hovering around $80 per barrel, but remain high compared to pre-COVID-19 levels (2019 average in the low $50s per barrel). Rising oil prices will depress corporate earnings and reduce the real purchasing power of households through the outflow of income overseas due to worsening terms of trade.

During the current phase of price hikes, companies have been able to fully pass on the increased costs associated with higher import prices to their prices, thus mitigating the negative impact of the weaker yen and higher oil prices. Corporate ordinary income for the most recent period (October–December quarter, 2023) is 28.4% higher than the pre-COVID-19 period (2019 average). Although the labor cost factor has slightly pushed down earnings, reflecting the higher wage rate, they have been significantly boosted by a substantial increase in sales, which had previously fallen due to the COVID-19 disaster. This increase has been due to the higher value of exports from the weaker yen and the transfer of prices to the domestic market (sales factor). Additionally, although variable costs have increased due to the weak yen and high crude oil prices, companies’ earnings have benefited from lower ratio of variable costs to sales due to sufficient price transfers (variable cost factor).

On the other hand, in the household sector, nominal employment compensation in the January–March quarter of 2024 increased by 6.1% from the pre-COVID-19 period (2019 average), but real employment compensation decreased by -4.3% because the household consumption deflator increased by 10.4% during that period. For the corporate sector, the benefits of a weaker yen outweighed the disadvantages of a weaker yen and higher oil prices, whereas, for the household sector, the disadvantages of a weaker yen and higher oil prices outweighed the benefits of a weaker yen.

(The rate of increase in wages in the 2024 spring wage negotiations will reach 5% for the first time in 33 years)

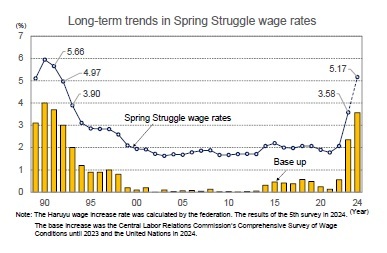

According to the Results of the Fifth Round of Responses to the Spring 2024 Life Struggle released by RENGO on May 8, the average wage increase for 2024 was 5.17%, and the “portion of wage increase” corresponding to base increases was 3.57%. Because small and medium-sized enterprises, which have relatively low wage increases, will be late in concluding their contracts, the overall level is expected to be slightly lower in the final tally scheduled for July. However, if the final tally remains above 5%, it will be the highest level in 33 years since 1991 (5.66%).

According to the Results of the Fifth Round of Responses to the Spring 2024 Life Struggle released by RENGO on May 8, the average wage increase for 2024 was 5.17%, and the “portion of wage increase” corresponding to base increases was 3.57%. Because small and medium-sized enterprises, which have relatively low wage increases, will be late in concluding their contracts, the overall level is expected to be slightly lower in the final tally scheduled for July. However, if the final tally remains above 5%, it will be the highest level in 33 years since 1991 (5.66%).

The real wage growth rate, which is nominal wages discounted by consumer prices, has been negative compared to the previous year for 24 consecutive months from April 2022 to March 2024. This has been due to the persistently high rate of consumer price inflation and the continued sluggish growth of nominal wages.

The real wage growth rate, which is nominal wages discounted by consumer prices, has been negative compared to the previous year for 24 consecutive months from April 2022 to March 2024. This has been due to the persistently high rate of consumer price inflation and the continued sluggish growth of nominal wages.Nominal wages are expected to increase to 3% compared to the previous year, the same level as the base salary increase, by the summer of 2024 when the results of the 2024 Spring Struggle are reflected. Meanwhile, consumer prices (excluding fresh food) are expected to continue growing in the upper 2% range for the time being but will decline to the lower 2% range in the second half of FY2024, mainly due to a slowdown in the rate of increase in goods prices. Consequently, real wage growth is expected to turn positive in the October–December quarter of 2024.

03-3512-1836

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング