- NLI Research Institute >

- Asset management・Asset building >

- Investors Trading Trends in Japanese Stock Market: An Analysis for December 2023 and the Full Year

Column

12/01/2024

Investors Trading Trends in Japanese Stock Market: An Analysis for December 2023 and the Full Year

Financial Research Department Chizuru Morishita

Font size

- S

- M

- L

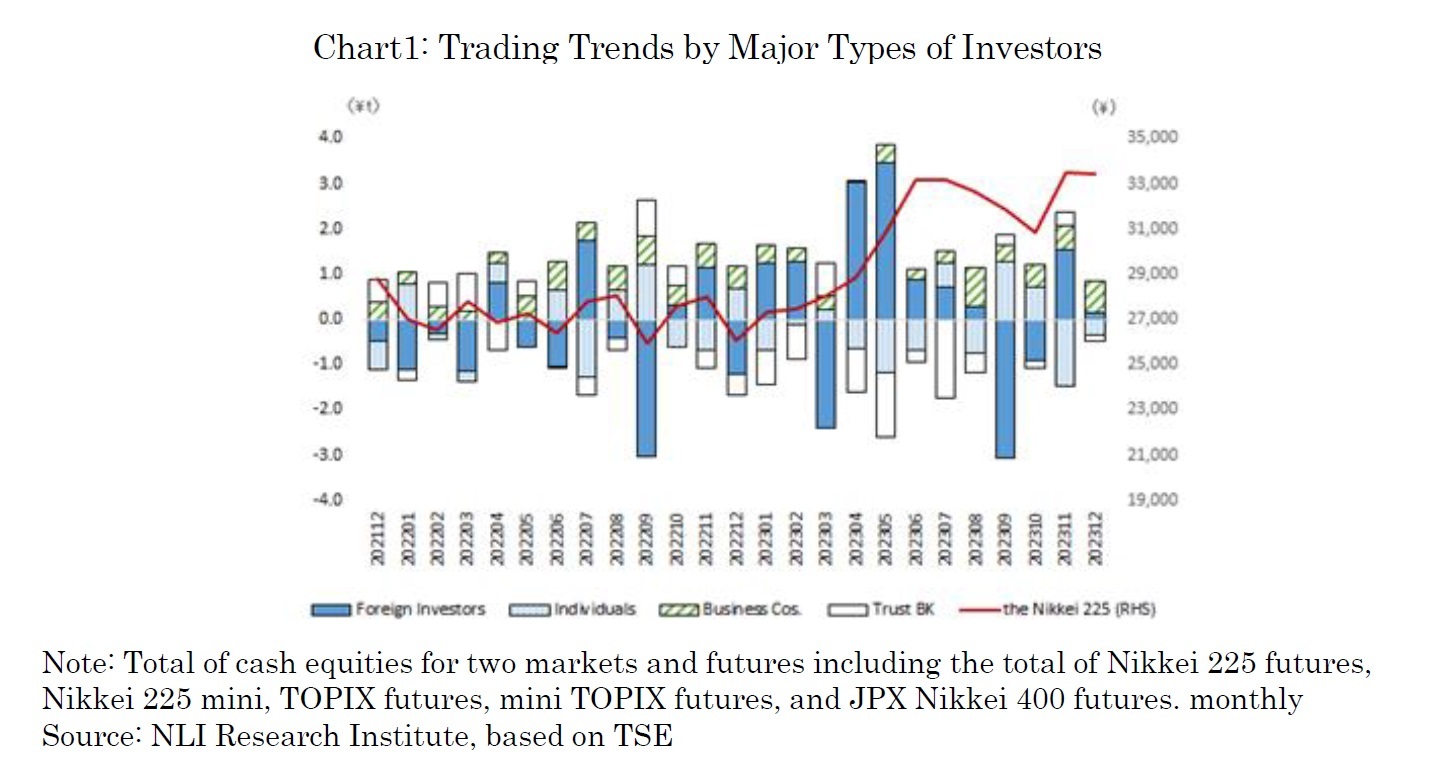

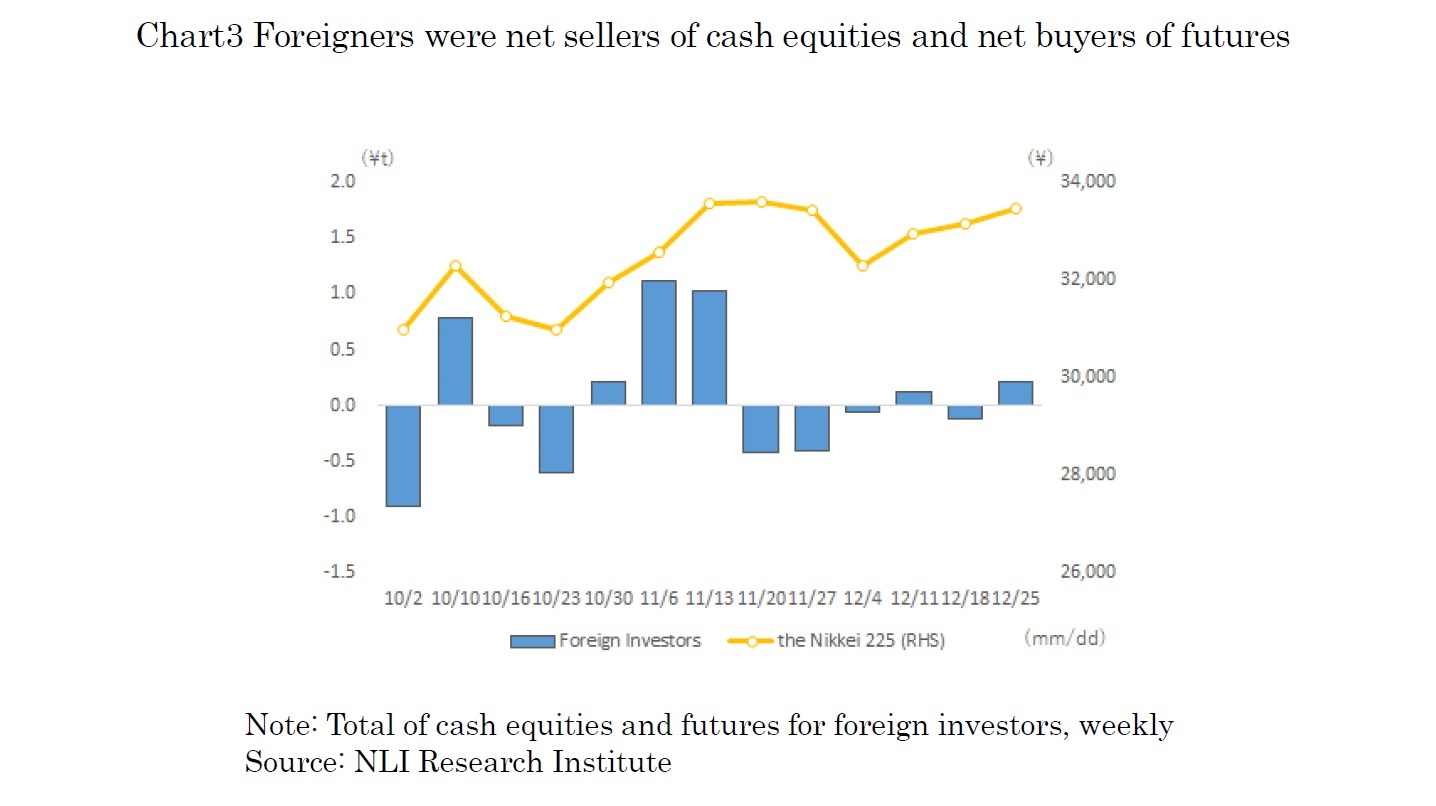

In December 2023, the Nikkei Stock Average experienced notable fluctuations, primarily influenced by the monetary policy outlook in Japan and the United States, as well as movements in the foreign exchange market. The month began with a downturn in the Nikkei 225, which fell to 32,775 on the 5th. This decline was largely attributed to a decrease in U.S. interest rates, sparked by growing concerns over the U.S. economic outlook. Concurrently, the yen appreciated to \146/$ level, its strongest position in approximately three months, adding further pressure to the market. Furthermore, on the 7th, the Bank of Japan Governor's comments raised expectations of an early revision of monetary policy, and the Nikkei 225 fell to 32,307 on the 8th. However, the mood in the market shifted following the Bank of Japan's monetary policy meeting on the 19th. The decision to maintain the current policies brought a sense of stability and optimism, propelling the index to a high of 33,675 on the 20th. In the latter half of the month, concerns over the yen's ongoing appreciation restrained the index's upward movement, and it closed at 33,464 at the end of the month. Foreign investors and business corporations were net buyers, while individual investors and trust banks were net sellers.

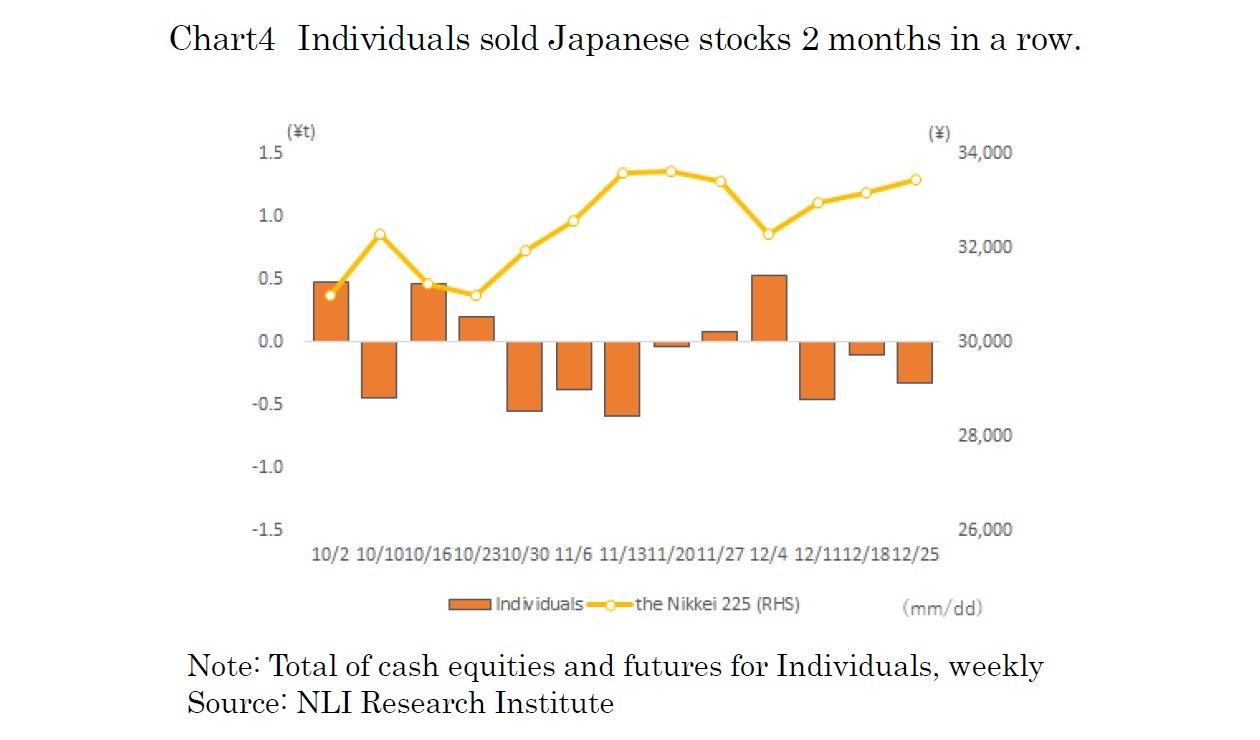

On the other hand, individuals were the largest net sellers, with a total of 357.5 billion yen in cash equities and futures. On a weekly basis, individuals purchased 537.1 billion yen in the first week of the month (Dec. 4-8) when the Nikkei 225 declined, but then they turned to sell 894.7 billion yen in the second to fourth weeks (Dec. 11-29). Trust banks also sold a total of 125.2 billion yen in cash equities and futures.

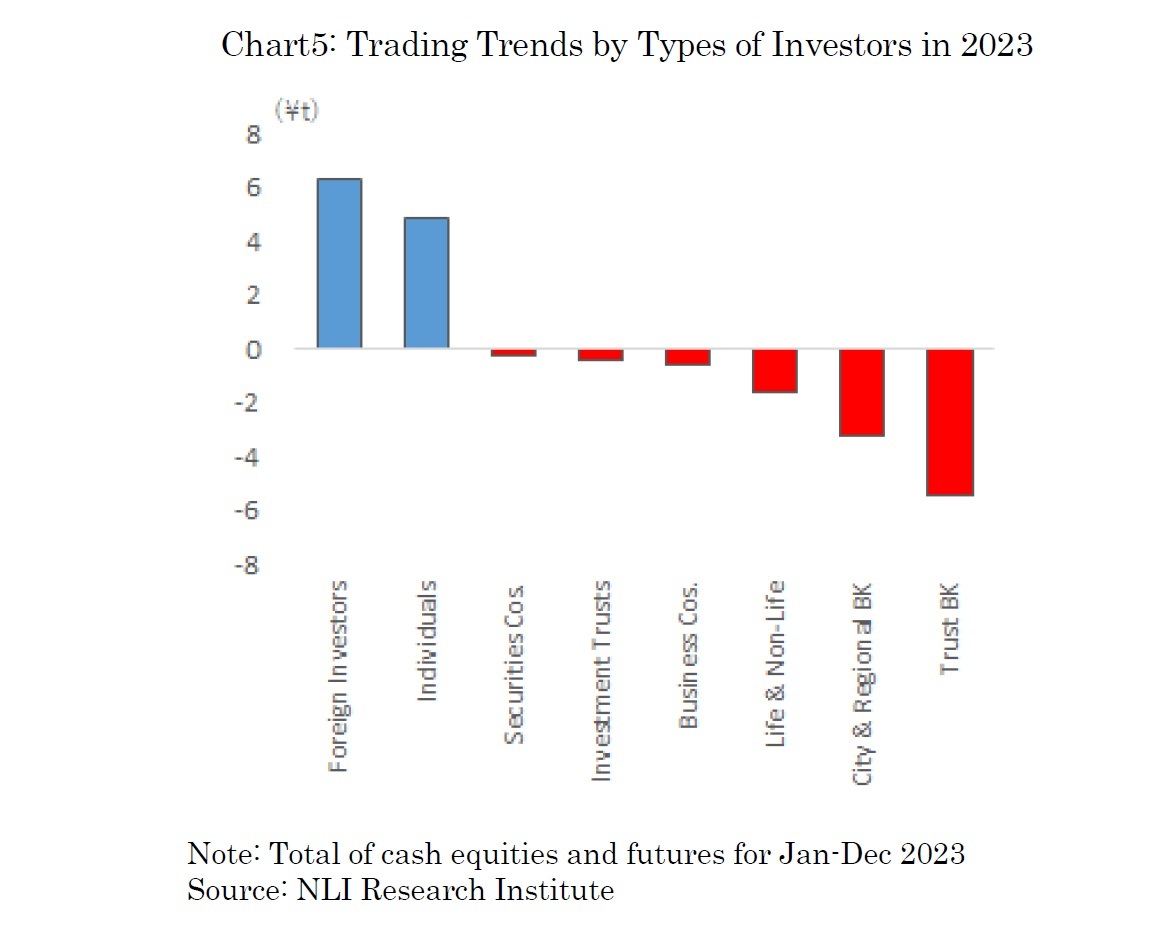

In reviewing the trading trends of various types of investors in the Japanese stock market throughout 2023, distinct patterns emerge. As illustrated in Chart 5, which spans from January to December 2023, there are clear differences in investment behaviors across investors’ types. Notably, foreign investors and business corporations emerged as the primary net buyers in the market. Foreign investors led the buying trend with a total of 6.29 trillion yen, followed by business corporations with 4.88 trillion yen. Conversely, trust banks and individual investors were the main sellers, offloading 5.41 trillion yen and 3.21 trillion yen, respectively.

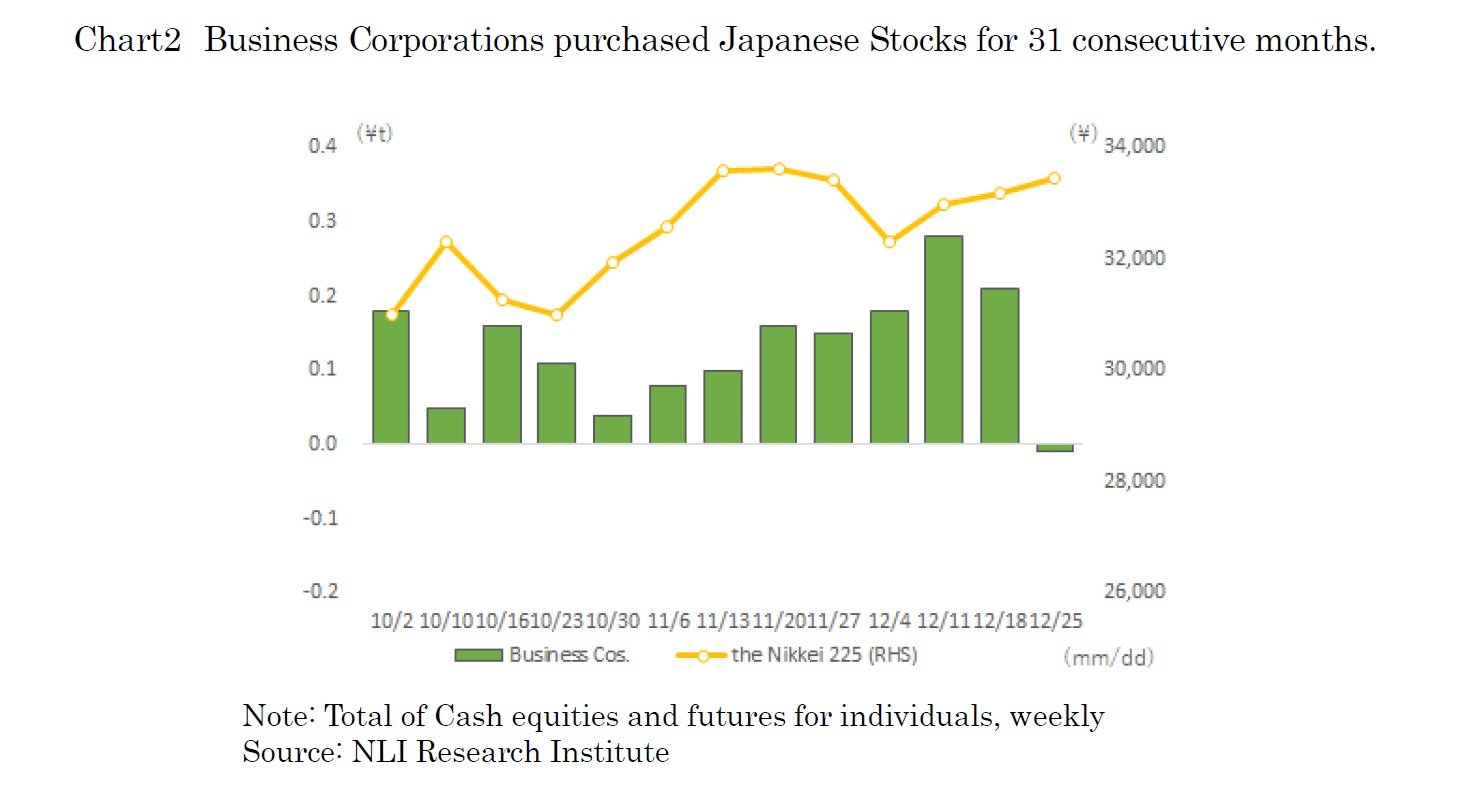

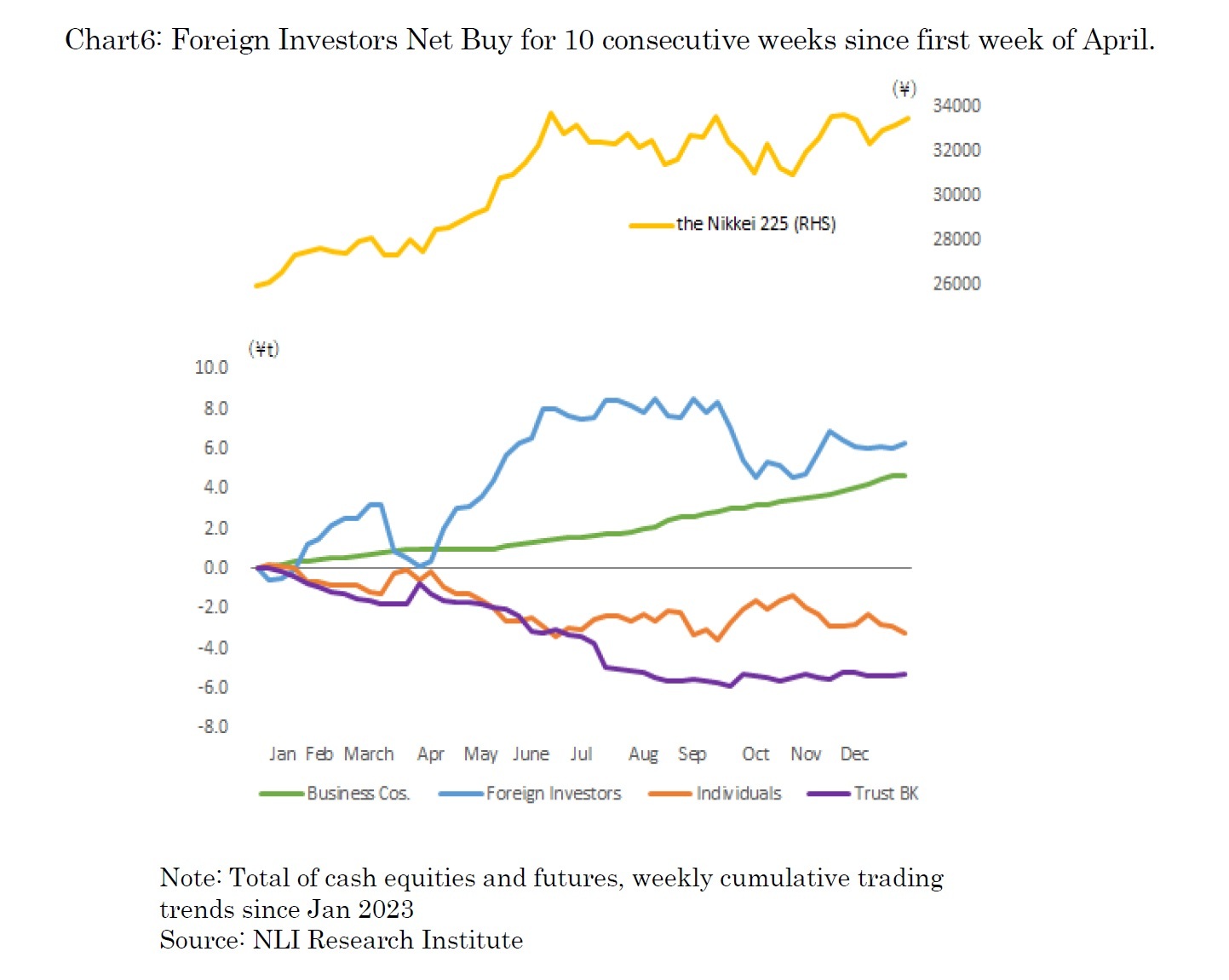

One of the standout observations is the consistent overbuying by foreign investors for ten consecutive weeks starting from the first week of April. This sustained buying spree was largely driven by several factors: expectations for corporate reforms mandated by the Tokyo Stock Exchange (TSE), a bullish sentiment towards Japanese stocks among prominent U.S. investors, and a favorable financial environment. During this period, the Nikkei Stock Average experienced a significant rise, approximately 4,000 yen. Simultaneously, business corporations actively participated in the market, primarily influenced by corporate share buybacks. In 2023, the amount set aside for share buybacks by listed companies, which are components of the TOPIX index, reached an impressive 9.4 trillion yen. This trend of corporate overbuying, closely linked to the implementation of share buybacks, is anticipated to persist in the future. In contrast, trust banks and individual investors predominantly engaged in selling, primarily aiming to lock in profits amid the rising index. This profit-taking behavior was a notable counterpoint to the buying trends observed among foreign investors and business corporations.

Please note: The data contained in this report has been obtained and processed from various sources, and its accuracy or safety cannot be guaranteed. The purpose of this publication is to provide information, and the opinions and forecasts contained herein do not solicit the conclusion or termination of any contract.

03-3512-1855

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング