- NLI Research Institute >

- Economics >

- Japan's Economic Outlook for Fiscal Years 2023 to 2025 (November 2023)

16/11/2023

Japan's Economic Outlook for Fiscal Years 2023 to 2025 (November 2023)

Economic Research Department Executive Research Fellow Taro Saito

Font size

- S

- M

- L

2.Projection of Real GDP Growth

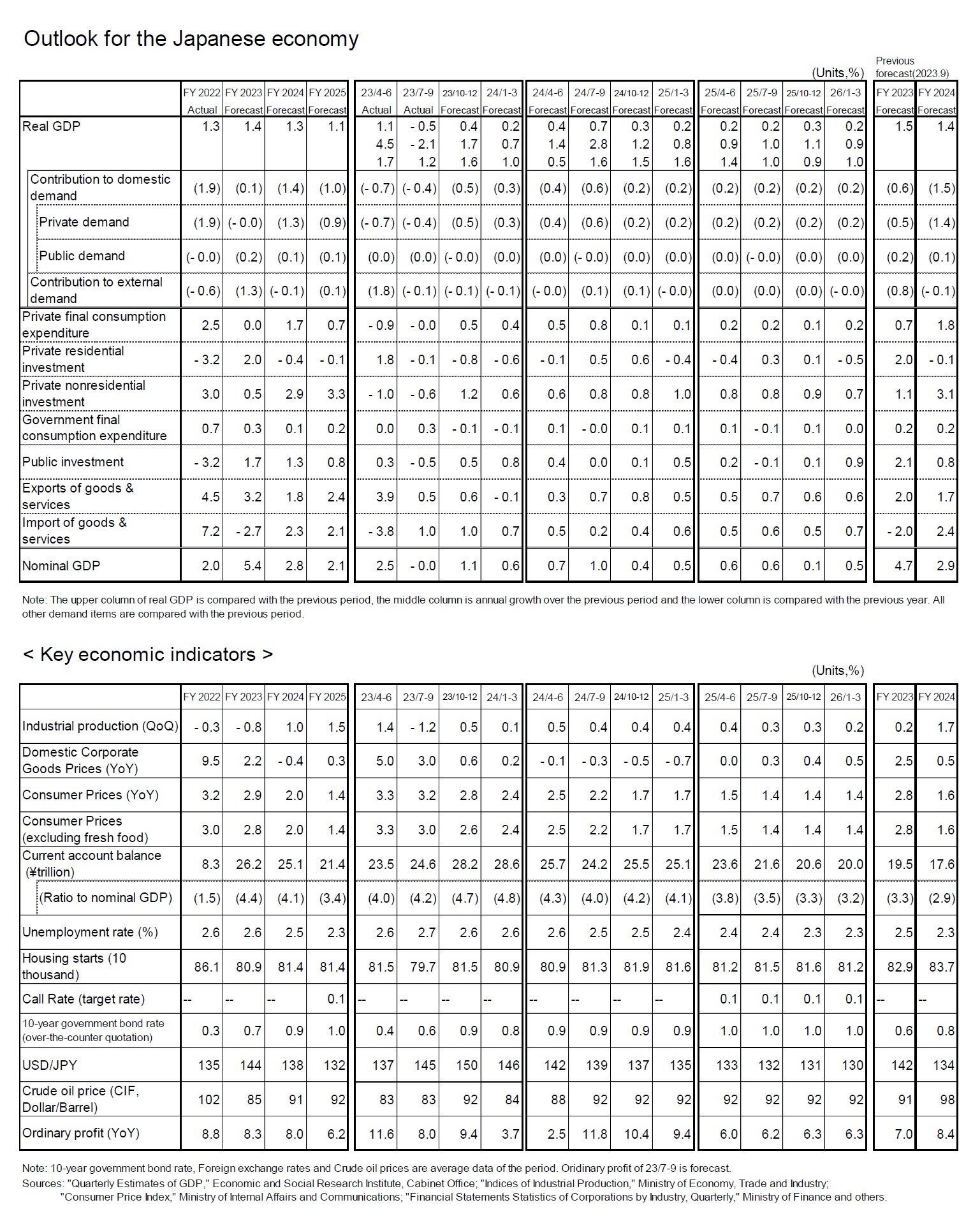

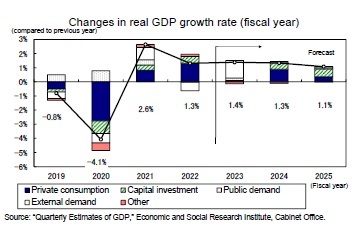

The anticipated real growth rates stand at 1.4% for FY 2023, 1.3% for FY 2024, and 1.1% for FY 2025.

Continued Emphasis on Domestic Demand

The July–September quarter of FY 2023 exhibited sluggishness in domestic and foreign demand, leading to negative growth (−2.1% on an annualized basis from the previous quarter) for the first time in three quarters. In the latter half of FY 2023, services exports are expected to rise, driven primarily by inbound-tourist demand; goods exports might remain sluggish due to the global economic slowdown. However, it is not anticipated that exports will be the primary engine of economic growth in the foreseeable future.

Meanwhile, private non-residential investment is expected to maintain its upward trajectory, supported by robust fixed investment by businesses. Additionally, a recovery in private consumption, especially in face-to-face services, is expected with the improvement in the employment and income environment, consistent with the normalization of socioeconomic activities. The growth of the Japanese economy is forecast to remain centered on domestic demand.

The July–September quarter of FY 2023 exhibited sluggishness in domestic and foreign demand, leading to negative growth (−2.1% on an annualized basis from the previous quarter) for the first time in three quarters. In the latter half of FY 2023, services exports are expected to rise, driven primarily by inbound-tourist demand; goods exports might remain sluggish due to the global economic slowdown. However, it is not anticipated that exports will be the primary engine of economic growth in the foreseeable future.

Meanwhile, private non-residential investment is expected to maintain its upward trajectory, supported by robust fixed investment by businesses. Additionally, a recovery in private consumption, especially in face-to-face services, is expected with the improvement in the employment and income environment, consistent with the normalization of socioeconomic activities. The growth of the Japanese economy is forecast to remain centered on domestic demand.

Future Growth Patterns

Real GDP is predicted to return to positive growth, reaching 1.7% in the October–December quarter of 2023 (on an annualized basis from the previous quarter). However, this growth is anticipated to slow, hovering around the zero range at 0.7% in the January–March quarter of 2024, primarily due to weakened exports.

Real GDP is predicted to return to positive growth, reaching 1.7% in the October–December quarter of 2023 (on an annualized basis from the previous quarter). However, this growth is anticipated to slow, hovering around the zero range at 0.7% in the January–March quarter of 2024, primarily due to weakened exports.

The scheduled tax cut included in the ongoing economic stimulus package is set to be implemented in June 2024, propelling a high rate of growth in private consumption of 2.8% on an annualized basis from the previous quarter in the July–September quarter of 2024. The effect of this tax cut is, however, expected to be temporary, with growth maintaining a steady pace of around 1% on an annualized basis from the October–December quarter of 2024 onwards.

The scheduled tax cut included in the ongoing economic stimulus package is set to be implemented in June 2024, propelling a high rate of growth in private consumption of 2.8% on an annualized basis from the previous quarter in the July–September quarter of 2024. The effect of this tax cut is, however, expected to be temporary, with growth maintaining a steady pace of around 1% on an annualized basis from the October–December quarter of 2024 onwards.Projections indicate that real GDP growth will persist at 1.4% in FY 2023, 1.3% in FY 2024, and 1.1% in FY 2025.

Shifts in Demand and Inbound Tourism

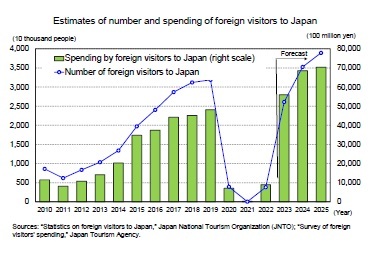

Inbound tourist demand, previously diminished due to the COVID-19 pandemic, has experienced rapid recovery following the phased relaxation and eventual elimination of border measures by April 2023. In October 2023, inbound visitors to Japan reached 2,516,500, surpassing 2019 levels for the same month and demonstrating a rebound in demand.

The share of visitors from China remains low, at 35.1% in October 2023 compared to the same month in 2019 and constituting about 30% of the total before the pandemic. However, an expected improvement in Japan–China relations could accelerate the overall growth in foreign visitors to Japan.

Inbound tourist demand, previously diminished due to the COVID-19 pandemic, has experienced rapid recovery following the phased relaxation and eventual elimination of border measures by April 2023. In October 2023, inbound visitors to Japan reached 2,516,500, surpassing 2019 levels for the same month and demonstrating a rebound in demand.

The share of visitors from China remains low, at 35.1% in October 2023 compared to the same month in 2019 and constituting about 30% of the total before the pandemic. However, an expected improvement in Japan–China relations could accelerate the overall growth in foreign visitors to Japan.

More notably, spending by foreign visitors surged: In the July–September quarter of 2023, their spending totaled 1.39 trillion yen, marking a 17.7% increase from the same period in 2019 and significantly surpassing pre-pandemic levels. This surge is attributed to factors such as a weaker yen and increased stays by business and other visitors.

More notably, spending by foreign visitors surged: In the July–September quarter of 2023, their spending totaled 1.39 trillion yen, marking a 17.7% increase from the same period in 2019 and significantly surpassing pre-pandemic levels. This surge is attributed to factors such as a weaker yen and increased stays by business and other visitors.The number of foreign visitors to Japan is expected to surpass 2019 levels by 2024 and exceed 31.88 million. Due to an increase in per capita spending attributed to the weak yen, inbound foreign travel consumption is expected to exceed the government target of 5 trillion yen by 2023 and expand to 7 trillion yen by 2025.

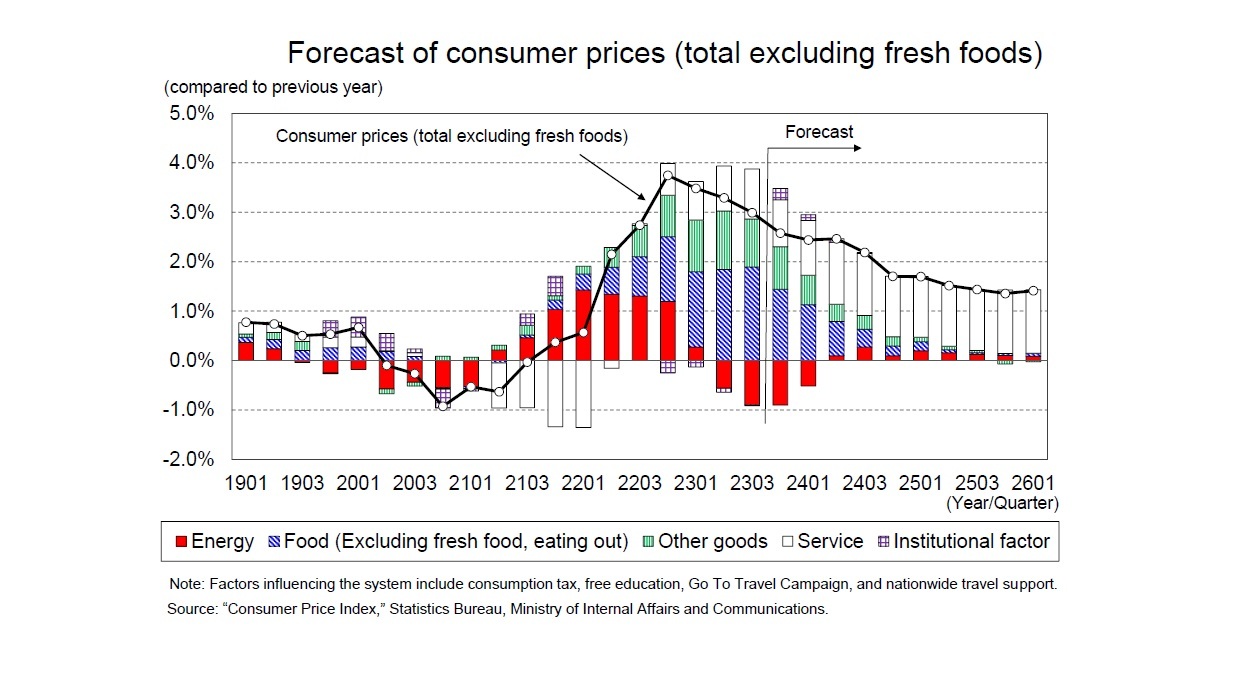

Price Outlook and Consumer Inflation

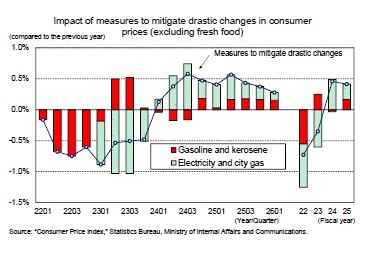

The core CPI rose to 4.2% in January 2023, the highest level in 41 years, but settled in the low 3% range from February onwards due to government measures to alleviate the pressure of electricity and city gas bills. In September, the CPI dipped to 2.8% year-on-year while the core CPI, excluding energy and fresh food, maintained a high level in the upper 4% range for six consecutive months, indicating persistent upward price pressure.

The core CPI rose to 4.2% in January 2023, the highest level in 41 years, but settled in the low 3% range from February onwards due to government measures to alleviate the pressure of electricity and city gas bills. In September, the CPI dipped to 2.8% year-on-year while the core CPI, excluding energy and fresh food, maintained a high level in the upper 4% range for six consecutive months, indicating persistent upward price pressure.

Measures to mitigate the effect of increases in fuel oil prices were extended due to yen depreciation and renewed increases in crude oil prices. These measures are expected to impact the core CPI, depressing its rate of increase until the October–December quarter of 2023 but boosting it from the January–March quarter of 2024 onwards.

Measures to mitigate the effect of increases in fuel oil prices were extended due to yen depreciation and renewed increases in crude oil prices. These measures are expected to impact the core CPI, depressing its rate of increase until the October–December quarter of 2023 but boosting it from the January–March quarter of 2024 onwards.

Please note: The data contained in this report has been obtained and processed from various sources, and its accuracy or safety cannot be guaranteed. The purpose of this publication is to provide information, and the opinions and forecasts contained herein do not solicit the conclusion or termination of any contract.

03-3512-1836