- NLI Research Institute >

- Economics >

- Will Consumer Prices in Japan Continue to Rise?-Future Prospects for Consumer Prices

26/05/2022

Will Consumer Prices in Japan Continue to Rise?-Future Prospects for Consumer Prices

Font size

- S

- M

- L

I. Introduction

Consumer prices in Japan are rising. The consumer price index (CPI, all items less fresh food) has increased for the past 11 consecutive months; in April 2022, the rate of increase exceeded 2 percent and many economic forecasters predict that prices will continue to rise by more than 2 percent during the remainder of 2022. However, is the structural environment of Japan’s inflation changing to one where the CPI increase is sustained in the medium to long run through a widening range of items that undergo price increases? We would like to consider this question in light of past trends and characteristics of prices in Japan, focusing on factors such as business cycles and expected inflation rate.

II. Recent Price Developments

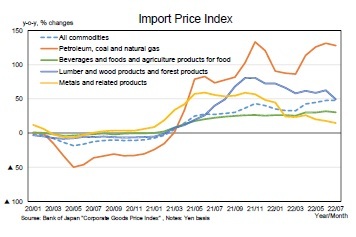

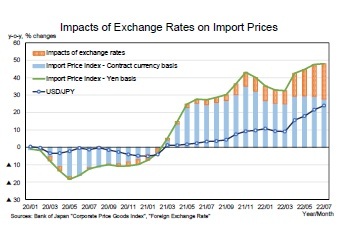

In 2021, prices of commodities such as crude oil and natural gas began to soar due to the increase in demand associated with the global economic recovery. This sharp rise in commodity prices has led to an increase in import prices for Japan, a country that relies on imports for most of these commodities. Import prices have continued to rise year-on-year since March 2021, and since September 2021, the year-on-year rate of increase has exceeded 30 percent. Looking at the breakdown of the import prices, “Petroleum, coal, and natural gas” have risen approximately 100 percent; lumber, metals, and food products have also risen significantly.

In 2021, prices of commodities such as crude oil and natural gas began to soar due to the increase in demand associated with the global economic recovery. This sharp rise in commodity prices has led to an increase in import prices for Japan, a country that relies on imports for most of these commodities. Import prices have continued to rise year-on-year since March 2021, and since September 2021, the year-on-year rate of increase has exceeded 30 percent. Looking at the breakdown of the import prices, “Petroleum, coal, and natural gas” have risen approximately 100 percent; lumber, metals, and food products have also risen significantly.

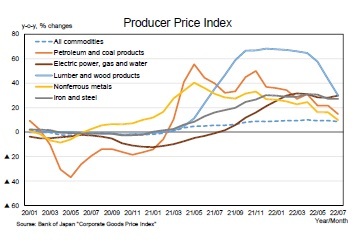

This has led to an increase in production costs for goods produced using imported commodities. In response to the rise in import prices, domestic corporate goods prices have similarly risen on a year-on-year basis since March 2021, rising 10.0 percent on a year-on-year basis in April 2022, the highest rate since December 1980 (10.4 percent).

This has led to an increase in production costs for goods produced using imported commodities. In response to the rise in import prices, domestic corporate goods prices have similarly risen on a year-on-year basis since March 2021, rising 10.0 percent on a year-on-year basis in April 2022, the highest rate since December 1980 (10.4 percent).

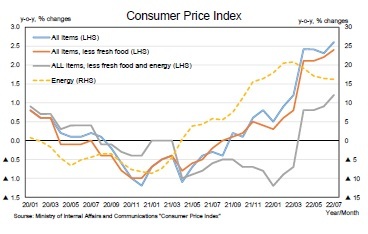

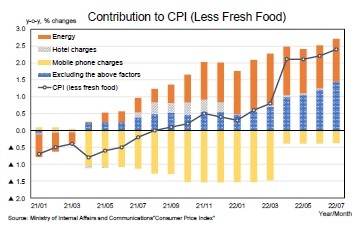

Consumer prices also began to rise in 2021, accompanied by an increase in energy prices. CPI (all items less fresh food) has risen every month since September 2021, and has continued to rise above 2 percent year-on-year since April 2022. Note that the rate of increase rose sharply in April 2022; however, from April 2021 until March 2022, the year-on-year rate of increase included the temporal impact of a substantial reduction in mobile phone charges which were urged by the Japanese government.

Consumer prices also began to rise in 2021, accompanied by an increase in energy prices. CPI (all items less fresh food) has risen every month since September 2021, and has continued to rise above 2 percent year-on-year since April 2022. Note that the rate of increase rose sharply in April 2022; however, from April 2021 until March 2022, the year-on-year rate of increase included the temporal impact of a substantial reduction in mobile phone charges which were urged by the Japanese government.

Russia's invasion of Ukraine has further pushed up commodity prices. In addition, the yen is depreciating due to factors such as the U.S.’ tightening of its monetary policy and a widening interest rate differential; this will cause yen-denominated import prices to rise further.

Russia's invasion of Ukraine has further pushed up commodity prices. In addition, the yen is depreciating due to factors such as the U.S.’ tightening of its monetary policy and a widening interest rate differential; this will cause yen-denominated import prices to rise further.While it is projected that import prices and domestic producer prices will continue to rise, will the rise in consumer prices expand to a wider range of items besides energy, resulting in sustained price increases?

III. Will higher energy prices lead to higher general prices?

In general, the inflation rate is determined by business cycle factors (GDP gap, unemployment rate, etc.) and the expected inflation rate. Import price increases also have an impact.

When an economy is booming, the tightening of supply–demand conditions caused by increased demand will likely exert upward pressure on prices. In addition, if future price increases are anticipated, current prices will be affected through wage- and price-setting which take into account such anticipated increases. Rising import prices due to surging commodity prices and a weakening yen will directly increase domestic prices if the imported goods are final goods. If the imported goods are raw materials or intermediate goods, the effect on domestic prices depends on whether companies pass through the increased production costs to domestic prices. When imported goods have a direct relationship with domestic prices—e.g., the relationship between crude oil prices and energy prices such as petroleum products, electricity charges, and manufactured and piped gas charges—a price increase in imported goods leads to higher domestic prices.

When an economy is booming, the tightening of supply–demand conditions caused by increased demand will likely exert upward pressure on prices. In addition, if future price increases are anticipated, current prices will be affected through wage- and price-setting which take into account such anticipated increases. Rising import prices due to surging commodity prices and a weakening yen will directly increase domestic prices if the imported goods are final goods. If the imported goods are raw materials or intermediate goods, the effect on domestic prices depends on whether companies pass through the increased production costs to domestic prices. When imported goods have a direct relationship with domestic prices—e.g., the relationship between crude oil prices and energy prices such as petroleum products, electricity charges, and manufactured and piped gas charges—a price increase in imported goods leads to higher domestic prices.

A. Business Cycle

A. Business CycleIn the process of recovering from the substantial economic fallout due to the COVID-19 pandemic, it is expected that the improved supply–demand conditions caused by increased demand will put upward pressure on consumer prices.

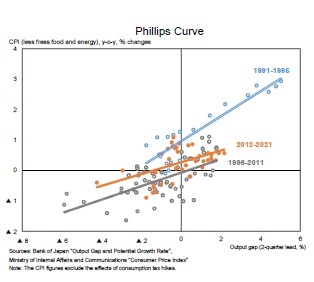

However, the degree of influence of business cycle factors on prices is said to have weakened since the late 1990s.

In addition, supply-side constraints, such as shortages of semiconductors and components, will also cause supply–demand conditions to tighten. However, it has been pointed out that Japanese firms have a strong tendency not to raise prices but to ask customers to endure delivery delays when facing supply-side constraints (Kuroda, 2021); as long as this trend continues, the upward pressure on prices due to tighter supply–demand conditions will not become significant.

B. Commodity Prices, Weaker Yen

B. Commodity Prices, Weaker YenThe current rise in consumer prices stems from higher import prices due to soaring commodity prices. In addition, the recent depreciation of the yen has greatly increased the impact of commodity prices on domestic energy prices. However, unless the commodity price hikes and the yen's depreciation continue significantly over a long period of time, their impact on consumer prices will only be temporary.

C. Expected Inflation Rate

Will the increased production costs due to higher energy prices be passed on to prices of final consumer goods and services, resulting in higher consumer prices for a wide range of items? The key factors in determining this are the expected inflation rate, firm price-setting behaviors, and consumer attitudes toward higher prices.

Will the increased production costs due to higher energy prices be passed on to prices of final consumer goods and services, resulting in higher consumer prices for a wide range of items? The key factors in determining this are the expected inflation rate, firm price-setting behaviors, and consumer attitudes toward higher prices.

1. Expected Inflation Rate

1. Expected Inflation RateIn general, firms faced with increased costs of production would like to raise prices if possible. Moreover, if general prices are expected to rise in the future, or at least if a firm’s competitors are expected to raise their prices, the firm will be more likely to raise its prices. Furthermore, if consumers also expect prices to rise, the upward pressure on wages will make it easier for them to accept price increases. Thus, the expected inflation rate is important.

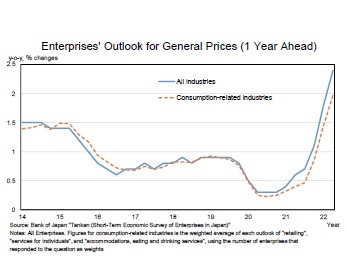

Currently, many of the relevant economic indicators show inflation expectations are clearly rising. Looking at survey-based indicators, the "Enterprises’ outlook for general prices" in the Bank of Japan's (BOJ’s) Tankan (Short-Term Economic Survey of Enterprises in Japan) has turned upward significantly since around 2021; in the June 2022 Tankan, the average outlook for one-year ahead general prices for all enterprises in all industries was 2.4 percent. Note that when narrowed down to private consumption-related industries, it is lower than that of all industries.

Currently, many of the relevant economic indicators show inflation expectations are clearly rising. Looking at survey-based indicators, the "Enterprises’ outlook for general prices" in the Bank of Japan's (BOJ’s) Tankan (Short-Term Economic Survey of Enterprises in Japan) has turned upward significantly since around 2021; in the June 2022 Tankan, the average outlook for one-year ahead general prices for all enterprises in all industries was 2.4 percent. Note that when narrowed down to private consumption-related industries, it is lower than that of all industries.

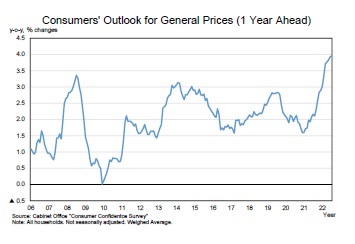

The expected inflation rate for consumers has also reached nearly 4 percent, estimated from household expectations of prices a year ahead in the Cabinet Office's Consumer Confidence Survey.

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング