- NLI Research Institute >

- Economics >

- Japan’s Economic Outlook for Fiscal 2021 to 2023 (February 2022)

16/02/2022

Japan’s Economic Outlook for Fiscal 2021 to 2023 (February 2022)

Economic Research Department Executive Research Fellow Taro Saito

Font size

- S

- M

- L

1. Annualized growth of 5.4% in the October–December quarter of 2021

In the October–December quarter of 2021, real GDP posted a growth of 1.3% (annual rate of 5.4%), the first increase in two quarters. The main reason for the rapid growth was a 2.7% increase in private consumption, mainly for face-to-face services such as dining out and lodging, following the lifting of the state of emergency due to COVID-19. Exports increased by 1.0% from the previous quarter due to easing supply constraints such as semiconductor shortages, and the contribution of external demand increased by 0.2% (annual rate of 0.8%) from the previous quarter. In contrast, public demand declined for the first time in two quarters as government consumption decreased by 0.3% compared to the previous quarter, reflecting the slowdown of vaccinations, public investment decreased by 3.3%.

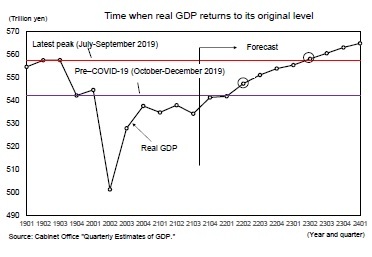

For calendar year 2021, real GDP grew 1.7%. It was the first positive growth in 3 years, but the pace of recovery was slow after the sharp negative growth (−4.5%) in 2020. Despite strong growth in the October–December quarter of 2021, real GDP is 0.2% lower than its pre–COVID-19 level in the October–December quarter of 2019. By demand item, government consumption greatly exceeded the pre-pandemic level, reflecting the cost of vaccination and the establishment of the medical care provision system. Private consumption also recovered to its pre–COVID-19 level due to the high growth in the October–December quarter of 2021, but housing investment, capital investment, and public investment were significantly lower than their pre–COVID-19 levels. In addition, although exports of goods have increased on the back of the recovery of overseas economies, exports of goods and services have remained almost unchanged compared to its pre–COVID-19 level because exports of services have been much lower than the pre-pandemic level, mainly due to border restrictions causing a lack of inbound travelers’ demand.

The real GDP annualized growth rate was −10.6% in the October–December quarter of 2019 due to the effect of the consumption tax rate hike. The level of economic activity in Japan had already fallen sharply before the effects of COVID-19 became apparent. Compared to the latest peak in July–September 2019, real GDP in the October–December quarter of 2021 was down 2.9% and private consumption was down 3.5%.

For calendar year 2021, real GDP grew 1.7%. It was the first positive growth in 3 years, but the pace of recovery was slow after the sharp negative growth (−4.5%) in 2020. Despite strong growth in the October–December quarter of 2021, real GDP is 0.2% lower than its pre–COVID-19 level in the October–December quarter of 2019. By demand item, government consumption greatly exceeded the pre-pandemic level, reflecting the cost of vaccination and the establishment of the medical care provision system. Private consumption also recovered to its pre–COVID-19 level due to the high growth in the October–December quarter of 2021, but housing investment, capital investment, and public investment were significantly lower than their pre–COVID-19 levels. In addition, although exports of goods have increased on the back of the recovery of overseas economies, exports of goods and services have remained almost unchanged compared to its pre–COVID-19 level because exports of services have been much lower than the pre-pandemic level, mainly due to border restrictions causing a lack of inbound travelers’ demand.

The real GDP annualized growth rate was −10.6% in the October–December quarter of 2019 due to the effect of the consumption tax rate hike. The level of economic activity in Japan had already fallen sharply before the effects of COVID-19 became apparent. Compared to the latest peak in July–September 2019, real GDP in the October–December quarter of 2021 was down 2.9% and private consumption was down 3.5%.

(Increasing outflow of income overseas due to deterioration in terms of trade)

As economic activity around the world continues to normalize, the import price index has been growing at a 40-year high of about 40% year-on-year due to soaring prices of crude oil and other resources caused by concerns about tight supply. Reflecting the recovery of the world economy, export prices have increased by 10% from the previous year, but fall short compared to the import price index. As a result, the terms of trade index (export price index divided by import price index) has fallen sharply.

As economic activity around the world continues to normalize, the import price index has been growing at a 40-year high of about 40% year-on-year due to soaring prices of crude oil and other resources caused by concerns about tight supply. Reflecting the recovery of the world economy, export prices have increased by 10% from the previous year, but fall short compared to the import price index. As a result, the terms of trade index (export price index divided by import price index) has fallen sharply.

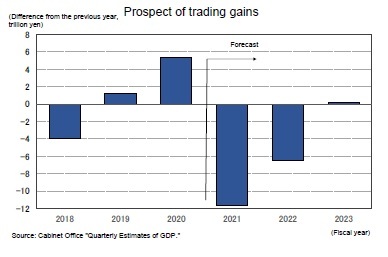

Deterioration in terms of trade means that income is flowing out of Japan. In the GDP statistics, "trading gains" is published as an index to grasp the change in real income (purchasing power) with the change in terms of trade (relative prices of imports and exports), and there is a relationship where "real gross domestic income (GDI) = Real GDP + trading gains".

Deterioration in terms of trade means that income is flowing out of Japan. In the GDP statistics, "trading gains" is published as an index to grasp the change in real income (purchasing power) with the change in terms of trade (relative prices of imports and exports), and there is a relationship where "real gross domestic income (GDI) = Real GDP + trading gains".Trade gains declined throughout 2021 as import deflator growth continued to outpace export deflator growth. As crude oil prices continue to rise in 2022, the decline in trading gains is likely to widen. Trade gains in FY 2021 were down 11.7 trillion yen from the previous year, and according to the current GDP statistics (from FY 1994 onwards), it is expected to be the largest deterioration in history, exceeding the 6.3 trillion yen decrease in FY 2011.

2. Real GDP growth rate is expected to be 2.5% in FY 2021, 2.5% in FY 2022, and 1.7% in FY 2023

(Service consumption soars toward the end of 2021 after the lifting of the state of emergency)

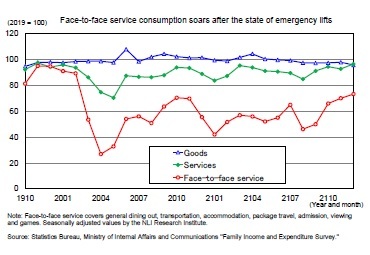

Following the lifting of the state of emergency at the end of September 2021, consumption of face-to face services such as dining out, lodging and entertainment, which had been sluggish until then, recovered sharply toward the end of the year.

Following the lifting of the state of emergency at the end of September 2021, consumption of face-to face services such as dining out, lodging and entertainment, which had been sluggish until then, recovered sharply toward the end of the year.

According to a Statistics Bureau, Ministry of Internal Affairs and Communications' Family Income and Expenditure Survey, consumer spending on face-to-face services (general dining, transportation, accommodation fees, package tour fees, admissions, viewing, and game fees) fell by around 50% in January 2021 following the reissuance of the state of emergency, but rebounded sharply in October 2021 to 32.0% compared to the previous month, followed by strong growth in November (6.2%) and December (4.7%). Service consumption in the Bank of Japan's Consumption Activity Index grew about 10% in the 3 months from October 2021. Consumption of face-to-face services reported by both the Family Income and Expenditure Survey and the Consumption Activity Index recovered at the end of 2021 to levels surpassing those seen around the fall of 2020, when Go To Travel was implemented.

According to a Statistics Bureau, Ministry of Internal Affairs and Communications' Family Income and Expenditure Survey, consumer spending on face-to-face services (general dining, transportation, accommodation fees, package tour fees, admissions, viewing, and game fees) fell by around 50% in January 2021 following the reissuance of the state of emergency, but rebounded sharply in October 2021 to 32.0% compared to the previous month, followed by strong growth in November (6.2%) and December (4.7%). Service consumption in the Bank of Japan's Consumption Activity Index grew about 10% in the 3 months from October 2021. Consumption of face-to-face services reported by both the Family Income and Expenditure Survey and the Consumption Activity Index recovered at the end of 2021 to levels surpassing those seen around the fall of 2020, when Go To Travel was implemented.

(The accelerating pace of inflation will depress real income)

The employees’ income environment remains difficult, but the worst is over. The ratio of job openings to job seekers, which reflects the supply–demand relationship in the labor market, fell from 1.64 in January 2019 to 1.04 in October 2020, and then rose to 1.16 in December 2021. The unemployment rate rose from 2.2% in December 2019 to 3.1% in October 2020, but has remained in the upper 2% range since the beginning of 2021.

The employees’ income environment remains difficult, but the worst is over. The ratio of job openings to job seekers, which reflects the supply–demand relationship in the labor market, fell from 1.64 in January 2019 to 1.04 in October 2020, and then rose to 1.16 in December 2021. The unemployment rate rose from 2.2% in December 2019 to 3.1% in October 2020, but has remained in the upper 2% range since the beginning of 2021.

Per capita wages have been increasing since the beginning of FY 2021 after falling sharply in FY 2020 due to the effects of the pandemic, but have generally remained at a low increase level of 0%. As consumer prices have started to rise, the real wage growth has been negative since September 2021.

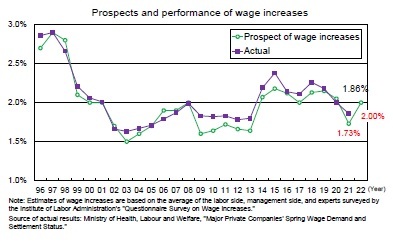

Per capita wages have been increasing since the beginning of FY 2021 after falling sharply in FY 2020 due to the effects of the pandemic, but have generally remained at a low increase level of 0%. As consumer prices have started to rise, the real wage growth has been negative since September 2021.According to a survey (of approximately 500 experts in labor and economic fields) on wage increases released by the Labor Administration Research Institute on February 2nd, 2022, the average wage increase forecast for 2022 is 2.00%, up 0.27 percentage points from the previous year. The spring wage increase rate (labor’s demand and settlement rate of spring wage increase by major private companies) calculated by the Ministry of Health, Labour and Welfare was 1.86% in 2021, falling below 2% for the first time in 8 years. It is likely to return to over 2% in 2022; however, excluding regular pay increases of approximately 1.7–1.8%, the increase is only about 0.2–0.3%. Since consumer prices are expected to continue to increase at the 1% level in FY 2022, it is highly likely that real wage growth (per capita) will remain in the negative range.

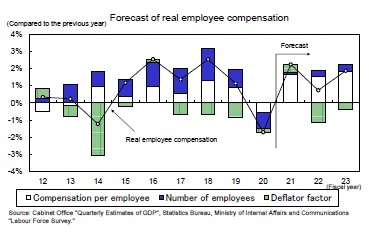

Nominal compensation for employees decreased by 1.5% in FY 2020, the first decrease in 8 years, and is expected to increase by 1.8% in FY 2021. In FY 2022, as the number of employees continues to increase against the backdrop of a strong sense of corporate manpower shortage, nominal compensation for employees will slightly increase by 1.9% from the previous year. This reflects the fact that the wage increase rate in the spring labor negotiation is higher than the previous year for the first time in 3 years, with higher growth in scheduled cash earnings and an increase in special cash earnings (bonus), which is highly linked to corporate profits. At the same time, however, as the pace of price increases accelerates, real employee compensation is expected to decline sharply from 2.2% year-on-year in FY 2021 to 0.7% year-on-year in FY 2022. As the pace of inflation will slow in fiscal 2023, real employee compensation will increase by 1.9%.

Nominal compensation for employees decreased by 1.5% in FY 2020, the first decrease in 8 years, and is expected to increase by 1.8% in FY 2021. In FY 2022, as the number of employees continues to increase against the backdrop of a strong sense of corporate manpower shortage, nominal compensation for employees will slightly increase by 1.9% from the previous year. This reflects the fact that the wage increase rate in the spring labor negotiation is higher than the previous year for the first time in 3 years, with higher growth in scheduled cash earnings and an increase in special cash earnings (bonus), which is highly linked to corporate profits. At the same time, however, as the pace of price increases accelerates, real employee compensation is expected to decline sharply from 2.2% year-on-year in FY 2021 to 0.7% year-on-year in FY 2022. As the pace of inflation will slow in fiscal 2023, real employee compensation will increase by 1.9%.

(Real GDP will exceed its most recent peak in FY 2023)

In the October–December quarter of 2021, the economy grew at a high annual rate of 5.4% compared to the previous quarter, mainly due to high growth in private consumption, but the situation has changed drastically since the beginning of 2022. In response to the spread of the COVID-19, mainly caused by the Omicron strain, priority preventative measures were applied to Hiroshima, Yamaguchi and Okinawa Prefectures on January 9, 2022, and as of February 16, 2022, the number of prefectures has expanded to 36. Total GDP of the prefectures affected by priority preventative measures accounts for 91% of Japan's total GDP.

In the October–December quarter of 2021, the economy grew at a high annual rate of 5.4% compared to the previous quarter, mainly due to high growth in private consumption, but the situation has changed drastically since the beginning of 2022. In response to the spread of the COVID-19, mainly caused by the Omicron strain, priority preventative measures were applied to Hiroshima, Yamaguchi and Okinawa Prefectures on January 9, 2022, and as of February 16, 2022, the number of prefectures has expanded to 36. Total GDP of the prefectures affected by priority preventative measures accounts for 91% of Japan's total GDP.

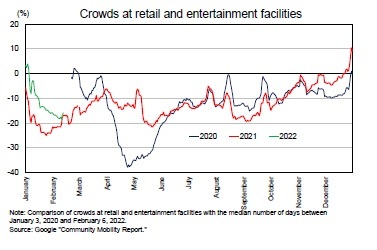

Following the state of emergency's lifting at the end of September 2021, the number of people patronizing retail and entertainment venues picked up and by the end of the year had recovered to surpass pre–COVID-19 levels. However, the sharp increase in the number of infected people and the accompanying effect of priority preventative measures have negatively affected the number of people visiting retail and entertainment venues in 2022. In February, this number approached the level in 2021, when the state of emergency was issued. Consumption of face-to-face services, such as dining out and accommodation, is likely to decline in the January–March quarter of 2022.

Following the state of emergency's lifting at the end of September 2021, the number of people patronizing retail and entertainment venues picked up and by the end of the year had recovered to surpass pre–COVID-19 levels. However, the sharp increase in the number of infected people and the accompanying effect of priority preventative measures have negatively affected the number of people visiting retail and entertainment venues in 2022. In February, this number approached the level in 2021, when the state of emergency was issued. Consumption of face-to-face services, such as dining out and accommodation, is likely to decline in the January–March quarter of 2022.In the January–March quarter of 2022, real GDP's private consumption is expected to decrease by 0.4% from the previous quarter. However, the total real GDP is expected to show a slight positive growth of 0.4% per annum from the previous quarter, due to an increase in capital investment reflecting higher corporate profits, an increase in exports on the back of recovery in overseas economies, and higher growth in government consumption reflecting progress in the COVID-19 vaccination campaign. If stricter restrictions on activities are imposed, consumption will fall further, increasing the risk of negative growth.

From the April–June quarter of 2022 onwards, growth is expected to continue to exceed the potential growth rate in the mid 0% range, given that the COVID-19 infection rate has subsided and measures such as the state of emergency and priority preventative measures will likely not been taken. If restrictions on economic activities are removed, it can be expected that consumption of face-to-face services, such as dining out and travel, will increase significantly by increasing the propensity to consume. However, there is a great deal of uncertainty regarding the trend of infection and measures to deal with it.

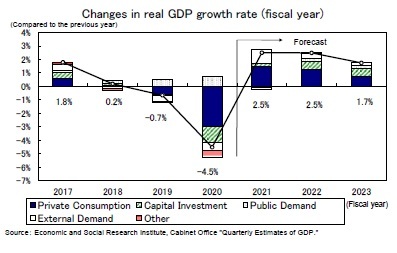

Real GDP’s growth rate is expected to be 2.5% in FY 2021, 2.5% in FY 2022 and 1.7% in FY 2023. Even if restrictions on economic activity are lifted, it will take time for consumption to recover in earnest because a certain level of concern about infectious diseases will curb consumption of face-to-face services. Private consumption is expected to increase 2.7% in FY 2021, 2.4% in FY 2022, and 1.3% in FY 2023, which are relatively sluggish given the sharp decline of 5.4% in FY 2020. The level of private consumption on a fiscal year basis will not exceed the latest peak (FY 2018) until FY 2024.

Real GDP’s growth rate is expected to be 2.5% in FY 2021, 2.5% in FY 2022 and 1.7% in FY 2023. Even if restrictions on economic activity are lifted, it will take time for consumption to recover in earnest because a certain level of concern about infectious diseases will curb consumption of face-to-face services. Private consumption is expected to increase 2.7% in FY 2021, 2.4% in FY 2022, and 1.3% in FY 2023, which are relatively sluggish given the sharp decline of 5.4% in FY 2020. The level of private consumption on a fiscal year basis will not exceed the latest peak (FY 2018) until FY 2024.However, as corporate profits continue to improve, capital investment is expected to increase from −7.5% in FY 2020 to 1.4% in FY 2021, and to maintain a high growth rate of 3.8% in FY 2022 and 3.7% in FY 2023. According to the Bank of Japan’s Tankan survey conducted in December 2021, the capital investment plan (total scale and industry, including software investment, excluding land investment) for FY 2021 increased 9.6% from the previous year’s level, far exceeding the 3.2% decrease in the same period of the previous year’s survey (the FY 2020 plan in the December 2020 survey). A breakdown of capital investment shows that software investment to cope with labor shortages and to expand telework is the main driver.

Looking ahead, investment in the face-to-face service industry, which faces a very difficult earnings environment, is expected to continue to be a negative factor, but an overall increasing trend is expected to continue, particularly in machinery investment and digital-related investment in the manufacturing industry.

Exports weakened in the second half of 2021 due to supply constraints such as a shortage of semiconductors and difficulty in procuring parts from Southeast Asia, but have been on a recovery trend. As for the future, the upward trend will become clearer on the back of the recovery of overseas economies as the effects of supply constraints ease. In FY 2020, exports were down 10.5% from the previous year in FY 2021, but after growing 12.6% in FY 2021, exports will remain strong at 4.5% in FY 2022 and 3.9% in FY 2023, which will boost the growth rate.

Real GDP recovered to a level of 0.2% below its 2019 pre–COVID-19 level in the October–December quarter of 2021, but growth in January–March 2022 will be only 0.1% compared to the previous quarter (0.4% per annum), so it will not surpass its pre-pandemic level until April–June 2022.

Real GDP recovered to a level of 0.2% below its 2019 pre–COVID-19 level in the October–December quarter of 2021, but growth in January–March 2022 will be only 0.1% compared to the previous quarter (0.4% per annum), so it will not surpass its pre-pandemic level until April–June 2022.In Japan, the level of economic activity had fallen sharply before the COVID-19 pandemic because of the consumption tax rate hike, so simply returning to the level before the pandemic would not be considered normalization of the economy. Real GDP is not expected to recover to the level of its most recent peak during July–September 2019 until the April–June quarter of 2023.

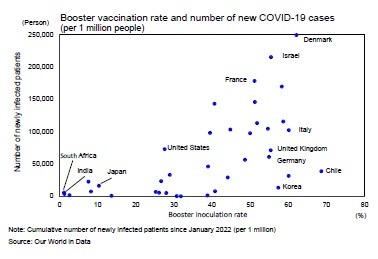

The Japanese economy will continue to be affected by the COVID-19 outbreak and its countermeasures. At first, Japan’s delayed vaccination campaign in comparison to other countries was thought to be the main culprit of the slow economic recovery. By the autumn of 2021, however, even though the rate of vaccination (two doses) had risen to a level of or above those in other major developed countries, the emergence and spread of the Omicron strain had led to a renewed tightening of restrictions on activities.

Currently, the government is actively promoting the third booster inoculation, but the spread of COVID-19 is not necessarily controlled in countries where the booster inoculation has been widely administered. Even after the surge in infection brought about by the Omicron strain has passed, it is quite possible that the number of infected people will increase again with the emergence of new variants. If the government tightens restrictions as it has in the past, economic activity, particularly consumer spending, will stagnate again. On the other hand, if a flexible system for providing medical care tailored to the characteristics of the variant (e.g., infectivity, toxicity, etc.) is established, the need to restrict economic activities may be reduced even if the number of infected patients increases, and the economy may be greatly boosted.

Currently, the government is actively promoting the third booster inoculation, but the spread of COVID-19 is not necessarily controlled in countries where the booster inoculation has been widely administered. Even after the surge in infection brought about by the Omicron strain has passed, it is quite possible that the number of infected people will increase again with the emergence of new variants. If the government tightens restrictions as it has in the past, economic activity, particularly consumer spending, will stagnate again. On the other hand, if a flexible system for providing medical care tailored to the characteristics of the variant (e.g., infectivity, toxicity, etc.) is established, the need to restrict economic activities may be reduced even if the number of infected patients increases, and the economy may be greatly boosted.

03-3512-1836

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング