- NLI Research Institute >

- Real estate >

- Japanese Property Market Quarterly Review, Third Quarter 2016-Inbound Demand Peaks Out Affecting Retail Stores and Hotels-

Japanese Property Market Quarterly Review, Third Quarter 2016-Inbound Demand Peaks Out Affecting Retail Stores and Hotels-

mamoru masumiya

Font size

- S

- M

- L

- Japanese real GDP maintained a positive q-o-q growth for the third consecutive quarter. Housing starts of apartments for lease have grown strongly. The average residential land price in the Tokyo metropolitan area has shown a leveling off.

- Tokyo grade-A office rents have rebounded in a downward trend from the third quarter 2015. Tokyo residential rents have still been on a rising trend, though at a slower pace.

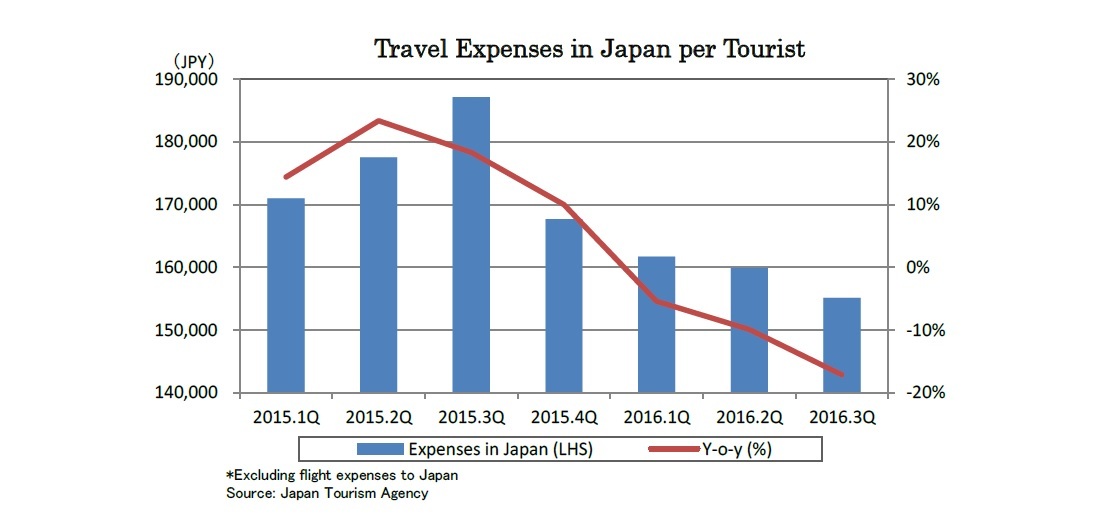

- Foreign visitor arrivals continue to grow at a pace of about +20% y-o-y, however, consumption by foreign visitors in Japan has shrunk significantly. Retail sales have declined, pulled by shrinking duty-free sales in department stores. The increase of foreign visitors has no longer driven hotel demand. The logistics leasing market has faced huge supply both in the Tokyo and Osaka metropolitan areas.

- The TSE REIT Index did not change much while waiting for the comprehensive review of the Bank of Japan's policies. Despite aggressive acquisitions by J-REITs, other investors have reduced their activities drastically.

1.Economy and Housing Market

2.Land Prices

3.Sub-sectors

(1) Office

(2) Residential Rent

(3) Retail, Hotel and Logistics

4.Property Investment and J-REIT Markets

mamoru masumiya

Research field

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング