- NLI Research Institute >

- Real estate >

- Japanese Property Market Quarterly Review,Second Quarter 2016-While Housing Starts Robust, Office and Retail Rents Peak Out-

Japanese Property Market Quarterly Review,Second Quarter 2016-While Housing Starts Robust, Office and Retail Rents Peak Out-

Kazumasa Takeuchi

Font size

- S

- M

- L

5. Sub-sectors

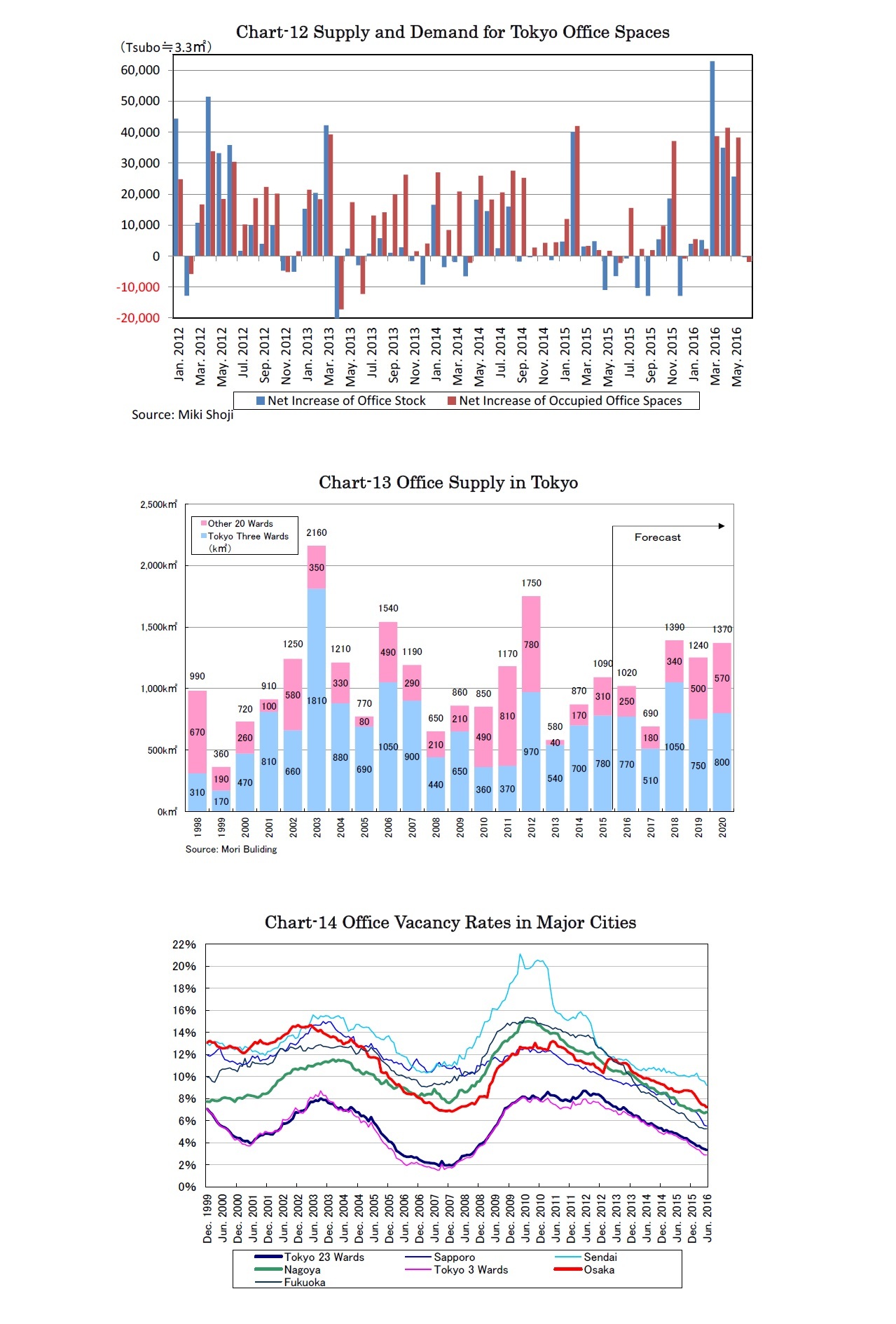

Large buildings in the Tokyo CBD such as JR Shinjuku Miraina Tower, Sumitomo Fudosan Shinjuku Garden Tower, Otemachi Financial City Grand Cube and Tokyo Garden Terrace were completed in the first half of 2016 with occupancy rates of each exceeding 80%.

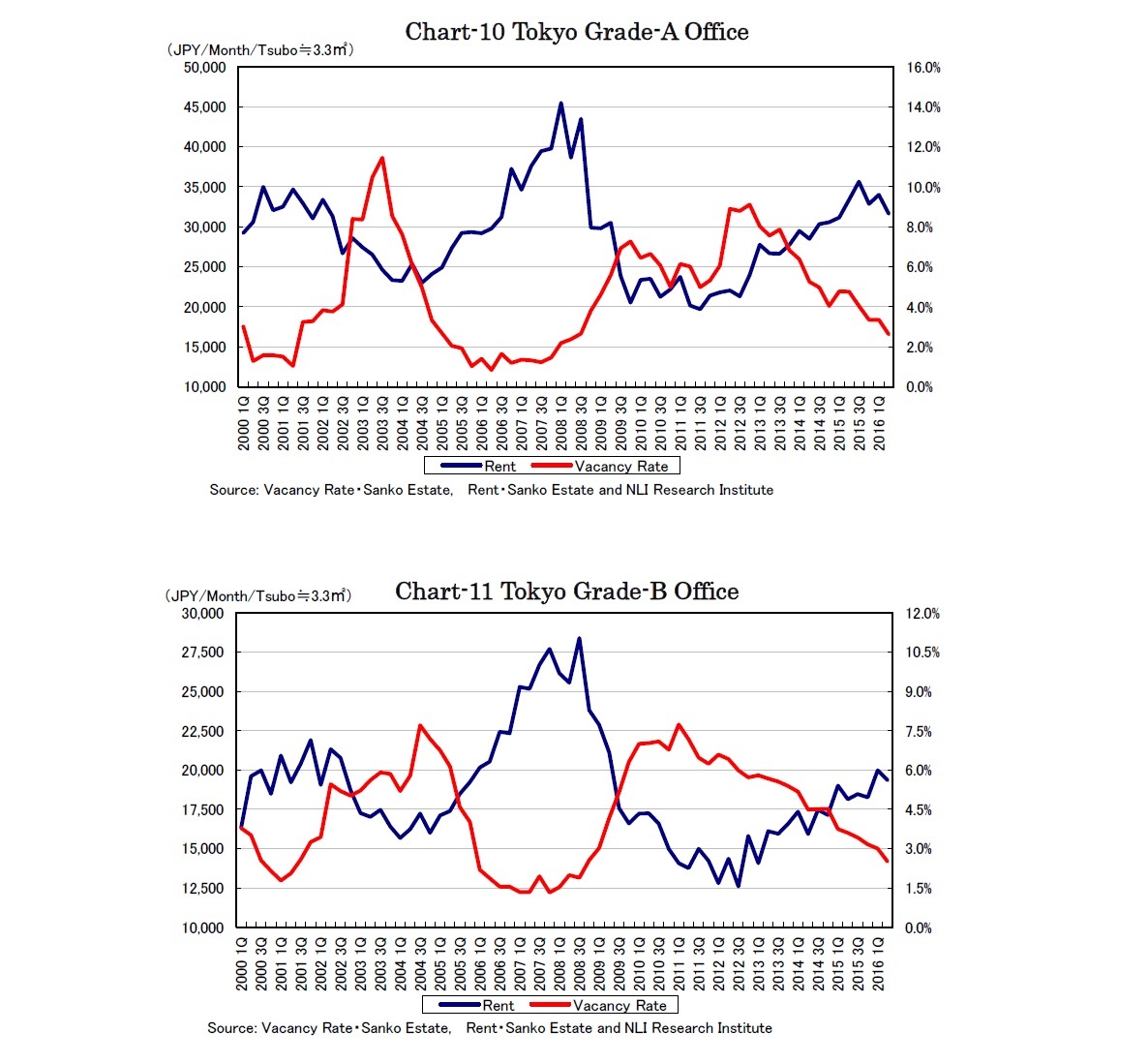

The vacancy rates of Tokyo grade-A1 and grade-B offices improved to 2.6% and 2.5% respectively in the second quarter (Chart-10, 11). Moreover, not only high grade buildings but also small buildings have seen occupancy rate improvements.

On the contrary to occupancy improvement, the rents of Tokyo grade-A and grade-B offices declined by 6.9% and 3.1% q-o-q respectively (Chart-10, 11). Several negative factors such as the earthquake in Kumamoto, the appreciation of the yen, the equity market decline, stagnant consumption and the scarce office demand following the large supply in the first quarter have apparently affected office rents.

According to Mori Building, office supply in Tokyo will be nearly as small in 2017 as that in 2013. Thus, it looks like office occupancy rates will continue to improve until 2018, when large new supply is anticipated. However, it should be noted with caution that most large affluent tenants have already settled and office space per person has been shrinking.

Other than Tokyo, office vacancy rates in major cities have been improving (Chart-14) and moderate new office supply is scheduled in coming years.

1 Sanko Estate chooses high grade buildings individually on its guidelines such as gfa of more than 33,000m2, main floor sizes of more than 990 m2, building age of 15 years or less and so on.

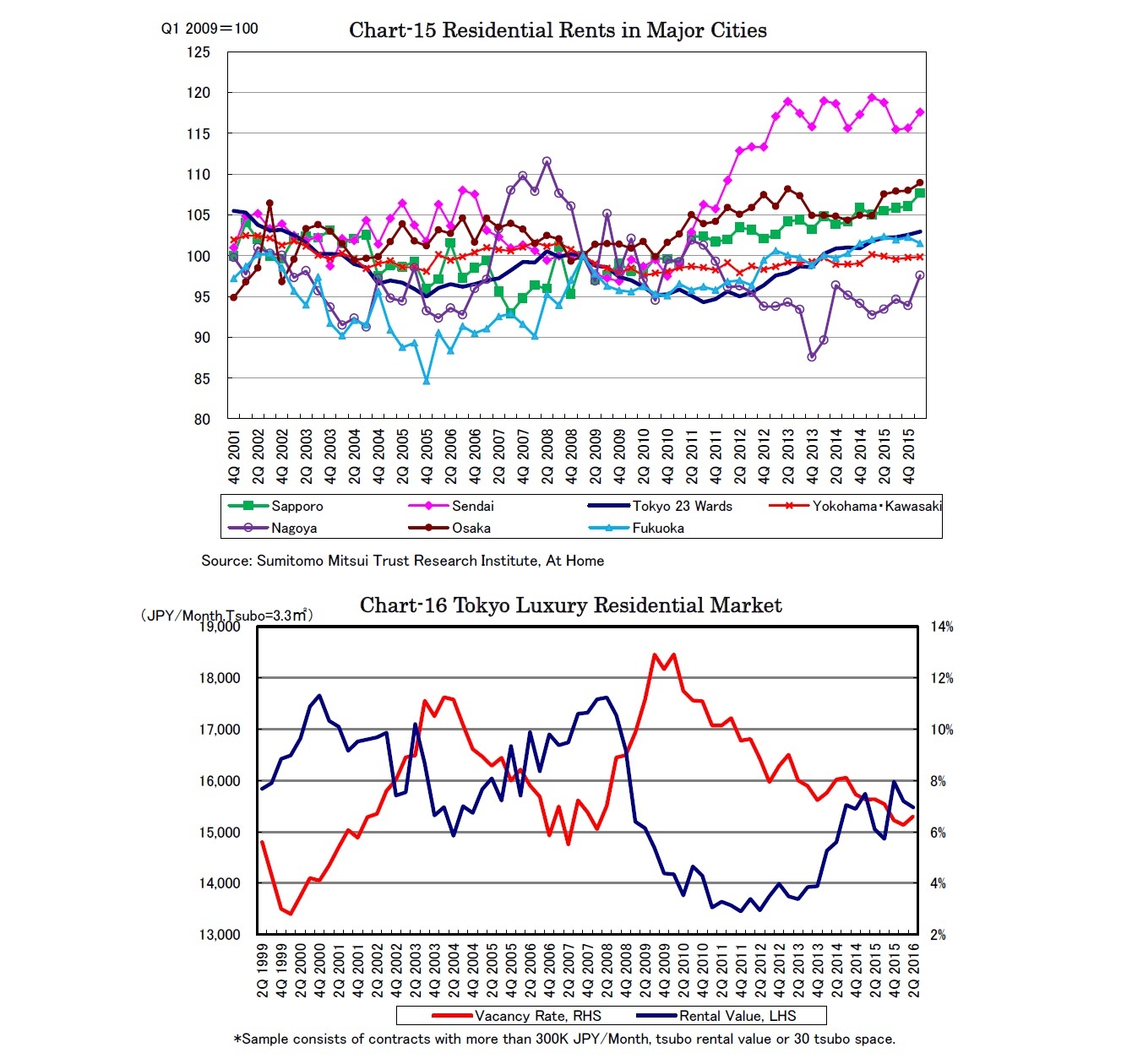

Residential rents in Tokyo and other major cities have been rising (Chart-15). However, vacancy rates of flats for lease in the Tokyo metropolitan area deteriorated to more than 30% as land owners have accelerated building flats to save on inheritance taxes.

The vacancy rates of Tokyo luxury apartments have improved to as low as those in 2007, with luxury residential rent prices rising by nearly 15% from the bottom in 2011.

Kazumasa Takeuchi

Research field