- NLI Research Institute >

- Real estate >

- Japanese Property Market Quarterly Review, First Quarter 2016 -Office Rents Rise Again, Foreign Visitor Arrivals Boost Hotels and Land Prices-

Japanese Property Market Quarterly Review, First Quarter 2016 -Office Rents Rise Again, Foreign Visitor Arrivals Boost Hotels and Land Prices-

Eriko Kato

Font size

- S

- M

- L

3.Sub-sectors

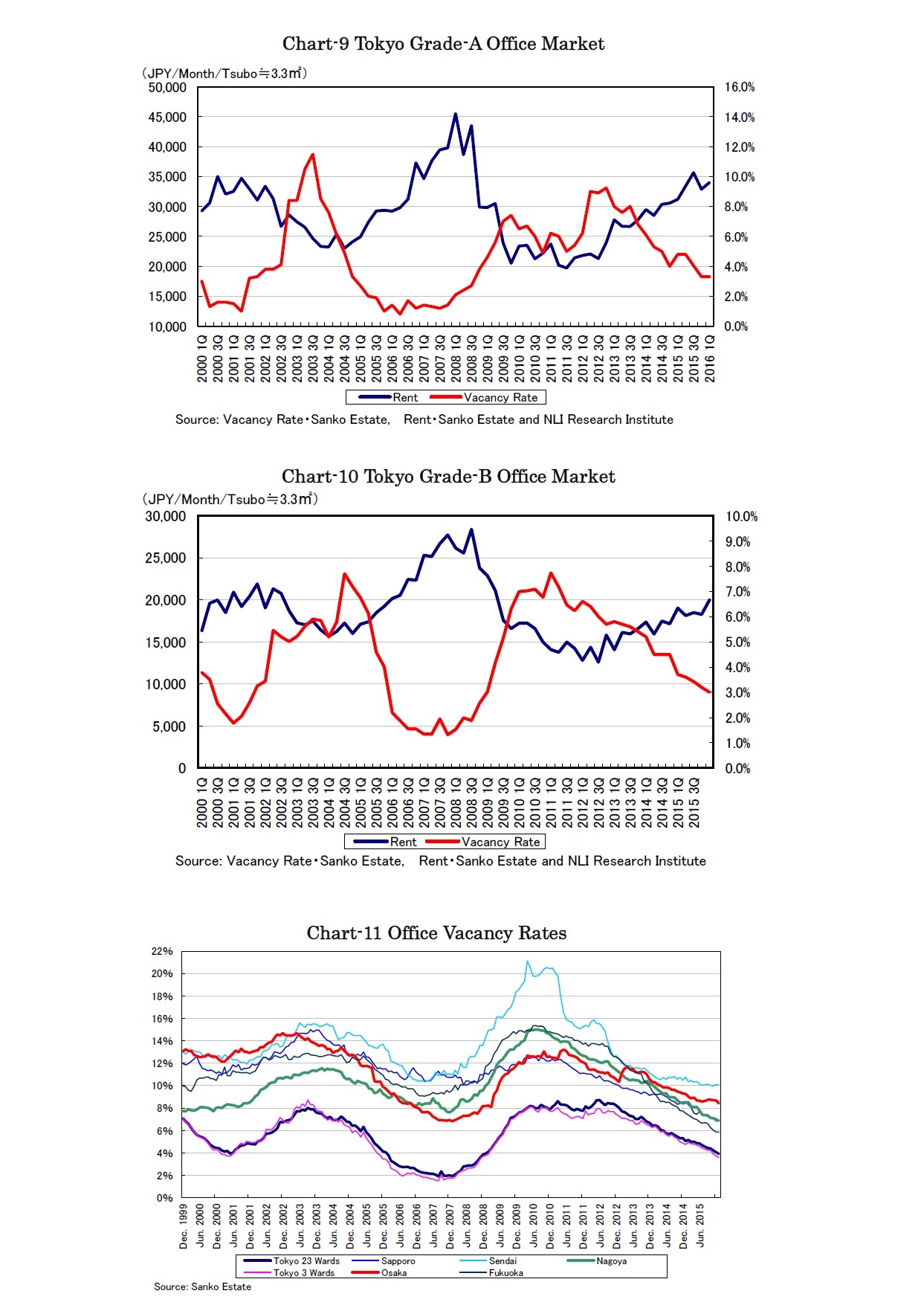

The rent index of Tokyo grade-A1 offices rose by 3.4% q-o-q and 9.1% y-o-y to 33,995 JPY per month per tsubo in the first quarter (Chart-9). Though constrained by large new supply in the fourth quarter, the increasing trend of office rents in Tokyo since 2012 still looks alive.

The vacancy rates of Tokyo grade-A offices remained unchanged at 3.3% in the first quarter, however, finding a tenant seems to have become time-consuming at the current high rents.

The rent index of Tokyo grade-B2 offices also rose by 9.4% q-o-q to 19,971 JPY per month per tsubo and the vacancy rates improved to 3.0% for the fifth consecutive quarter (Chart-10). Office markets have been improving nationwide as vacancy rates in major local cities excluding Sendai continued to decrease (Chart-11).

1 Higher-spec buildings within the very large sized category of the Sanko Estate Grade-A-Office Guidelines, urban area five wards of Tokyo, main office areas and other specially integrated areas, with total floor areas of more than 33,000 m2, main floor sizes of more than 990 m2, building age of 15 years or less (including some well-refurbished older buildings), facilities with ceiling heights of 2.7m or more, individual air-conditioning, earthquake resistance and environmental friendliness.

2 Buildings with main floor sizes of more than 660 m2 excluding Grade-A.

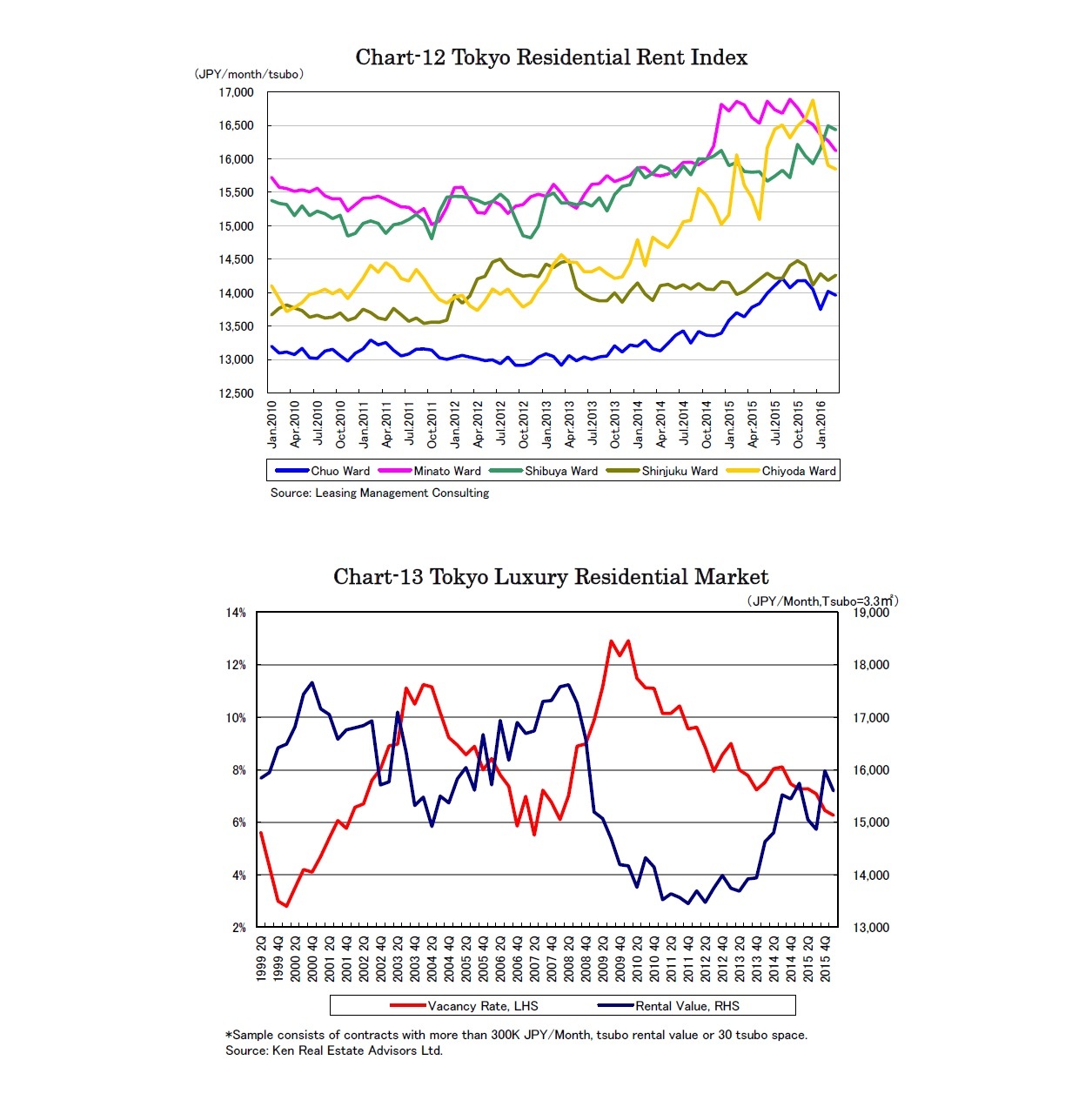

Residential rents in the five major wards of Tokyo have apparently stopped rising excluding Shibuya ward in 2016, terminating the rising trend since 2012 (Chart-12).

Vacancy rates of Tokyo luxury apartments decreased to 6.27% in the first quarter (Chart-13). The current rents at 15,601 JPY per tsubo per month is lower than those at 17,850 JPY in the first quarter 2008 when vacancy rates were at the same level. The current lower rents should be attributed to the smaller number of high-salaried expats.

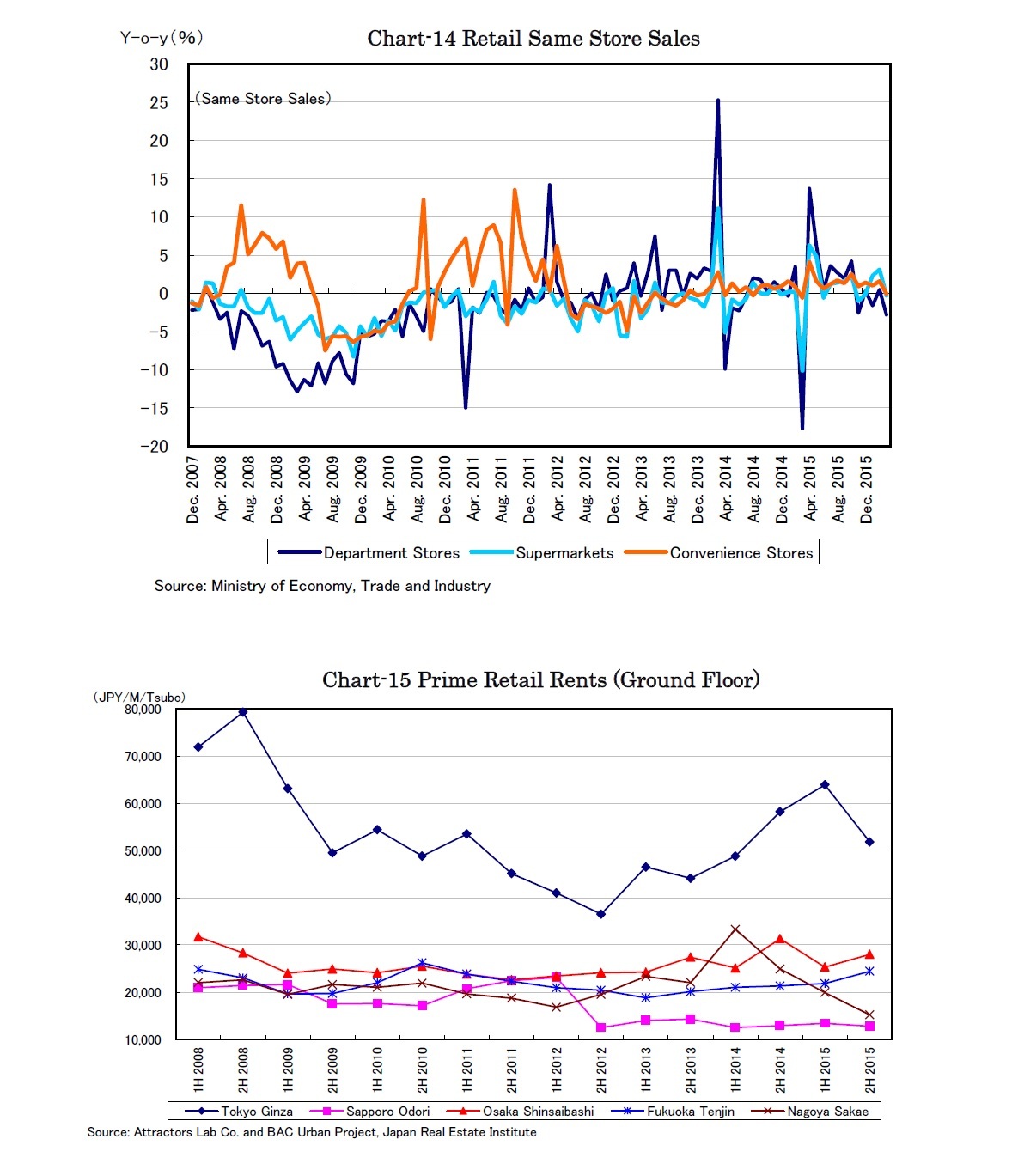

Same store sales of department stores, supermarkets and convenience stores remained stable shrinking somewhat y-o-y in March (Chart-14).

Prime retail rents in Tokyo Ginza dropped in the second half of 2015 though the rents still remained much lower than those of the previous peak in 2008.

Prime retail rents in other major local cities such as Shinsaibashi, Osaka and Tenjin, Fukuoka have been rising.

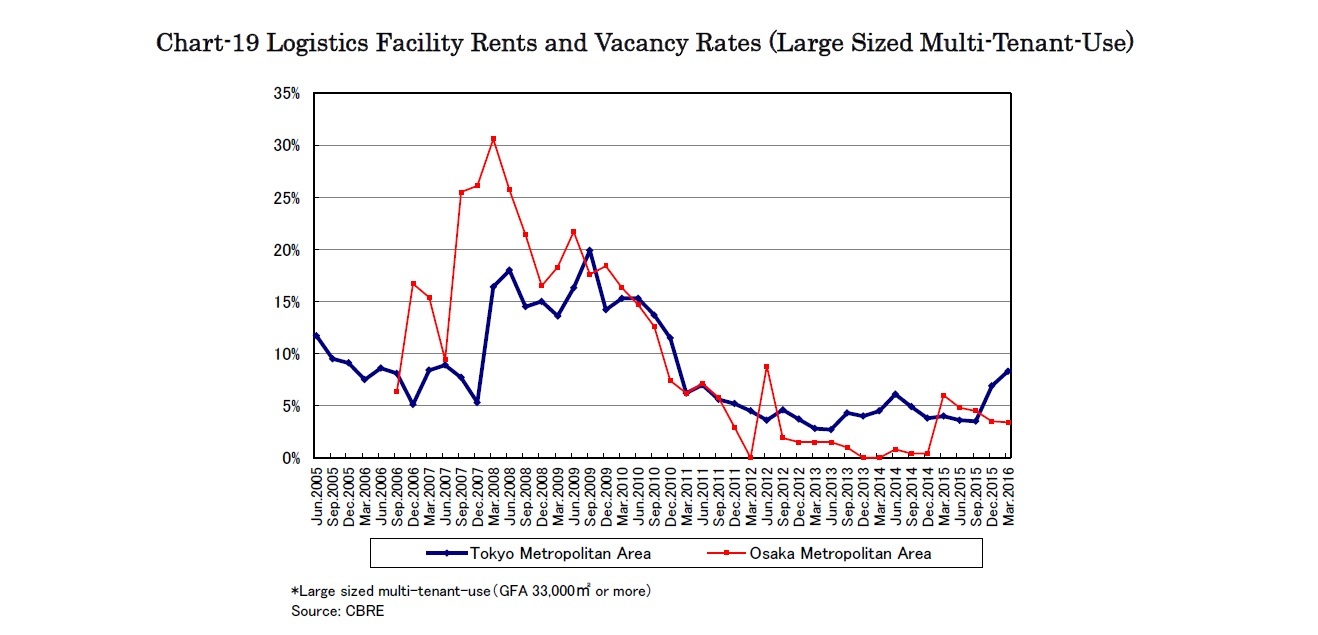

The vacancy rates of large logistics facilities designed for multiple tenants in the Osaka metropolitan area decreased by 0.1% q-o-q to 3.4%. The vacancy rates will certainly increase in the second half, pressed by the largest ever 80 thousand tsubo of new supply expected in the third quarter.

Constrained by the massive supply, the average logistics rent should be lower in both the Tokyo and Osaka metropolitan areas. However, logistics rents have been rising and are expected to remain stable in specific areas where new facilities are rare and multiple consumer markets are accessible such as in areas along the Outer Ring Road and Kyoto.

Eriko Kato

Research field

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング