- NLI Research Institute >

- Life >

- Japanese Property Market Quarterly Review, Third Quarter 2014 -Leasing and Investment Markets Robust while Housing Slows-

Japanese Property Market Quarterly Review, Third Quarter 2014 -Leasing and Investment Markets Robust while Housing Slows-

mamoru masumiya

Font size

- S

- M

- L

■Summary

- Domestic economic sentiment has not noticeably improved after recovering from the temporal depression following the consumption tax rate hike in April. Housing starts, sales and transactions have been suppressed while housing prices continue to rise. Land prices in major metropolitan areas increased for the second consecutive year.

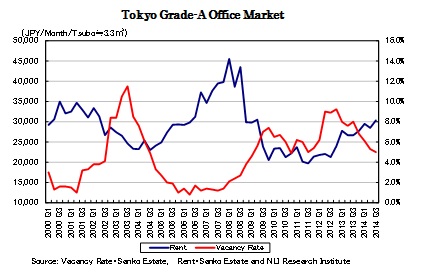

- The Tokyo office market has recently strengthened based on strong demand and modest supply after a standstill following the rapid recovery in the fourth quarter of 2012.

- Tokyo residential rents have been in a recovery phase following rising condominium prices. Retail stores and hotels are benefiting from the increase in foreign visitors. In particular, hotels are enjoying very high occupancy rates and have raised their room rates. The logistics facility market has been facing a tight supply-demand balance.

- The TSE REIT Index rose by 4.5% in the third quarter on the back of the favorable equity market, lower interest rates and recovery in office rents. Transactions in the property investment market have been active and property amounts acquired by foreigners until October have already exceeded full year amounts of 2013.

mamoru masumiya

Research field

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング