- NLI Research Institute >

- Social security system >

- The Current Status of the Earned Income Tax Credit in South Korea and the Implication to Japan―Earned Income Tax Credit or Reduced Tax Rate? ―

The Current Status of the Earned Income Tax Credit in South Korea and the Implication to Japan―Earned Income Tax Credit or Reduced Tax Rate? ―

Social Improvement and Life Design Research Department Research fellow Kim Myoungjung

Font size

- S

- M

- L

From 2015, the scope of recipients of the EITC and the CTC has expanded from workers to the self-employed; however, professionals such as lawyers, patent agents, certified public accountants (CPA), physicians, pharmacists and so on but non-registered business operators are excluded. To receive the EITC or the CTC, the self-employed need to fulfill identical application criteria with those of the workers’. In addition, following procedures need to be completed beforehand.

- Registration of entrepreneur: by December 31st every year

- Final return on VAT: by January 26th every year

- Report on current status of business: business exempt from taxation need to report current status of business. By February 10th every year.

- Report on composite income tax: by June 1st every year

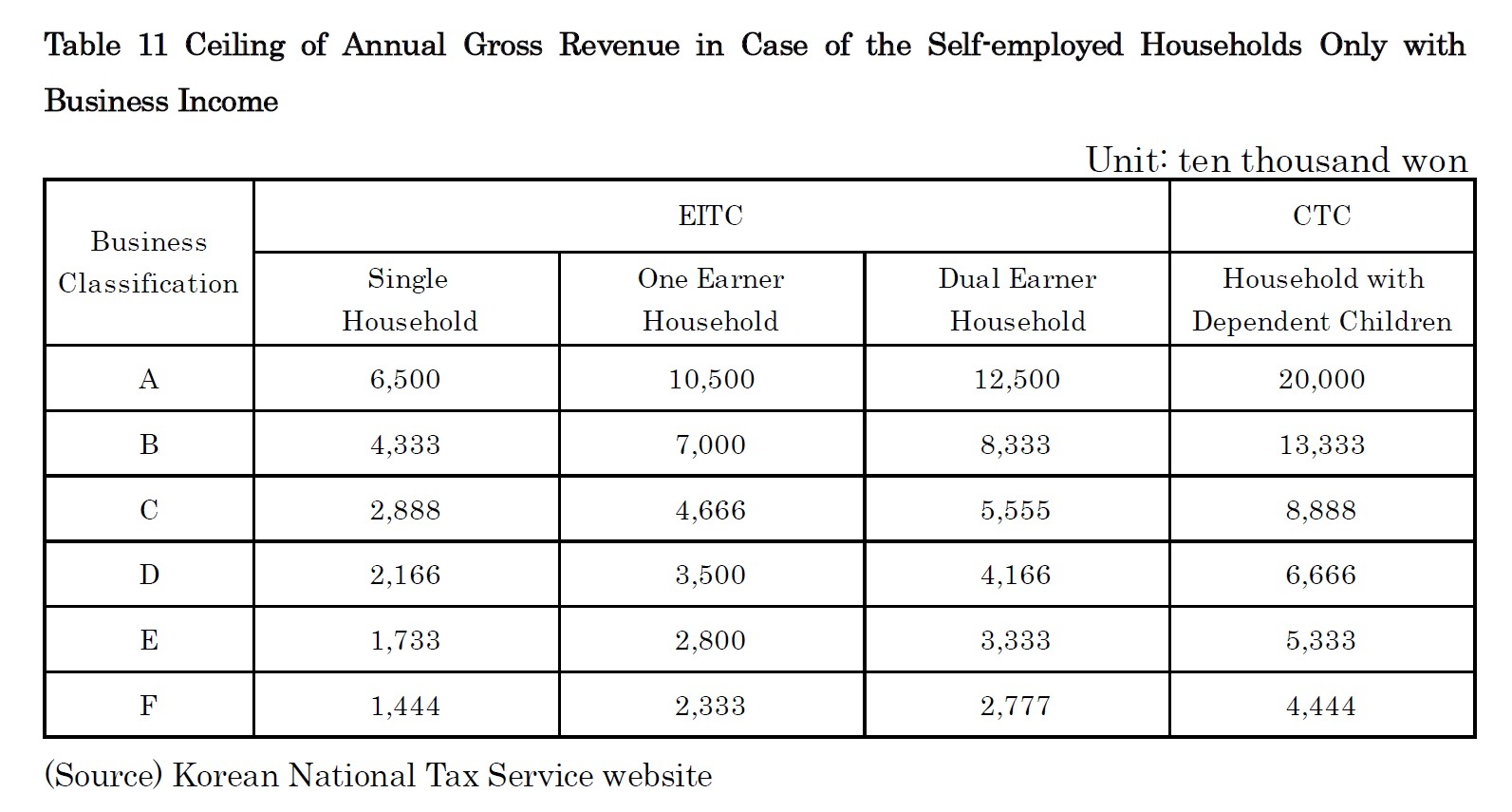

For example, if A manages a restaurant and earns annual gross revenue of 30 million won and his wife earns 10 million won in a year at a job, annual gross salary of A’s household is 23.5 million won (Formula 1)).

Formula 1) Annual gross income of A’s household = (30 million won (A’s annual gross revenue) × 0.45 (adjustment rate for a restaurant) + 10 million won (wife’s total salary)) = 23.5 million

As this satisfies the criteria for base amount of gross income (dual income households) of Table 6, 1,916,250 won is provided as the EITC is based on the calculation of Formula 2.

Formula 2) 2.1 million won – ((23.5 million won (gross income) – 13 million won) × (210/1,200) = 1,916,250 won

However, in case of B who is engaged in leasing of real estate, even though B’s annual revenue and his wife’s salary is the same as the annual gross income of A’s household, adjustment rate is higher and the amount of gross income increases; therefore, the amount of gross income does not satisfy the criteria for the base amount of gross income (dual income households) of Table 6 , the EITC is not provided to B (Formula 3)).

Formula 3) Annual gross income of B’s household = 30 million won (B’s annual gross revenue) × 0.9 (adjustment rate of leasing real estate) + 10 million won (wife’s salary) = 37.5 million won

4――Analysis on Effects and Challenges Ahead

to

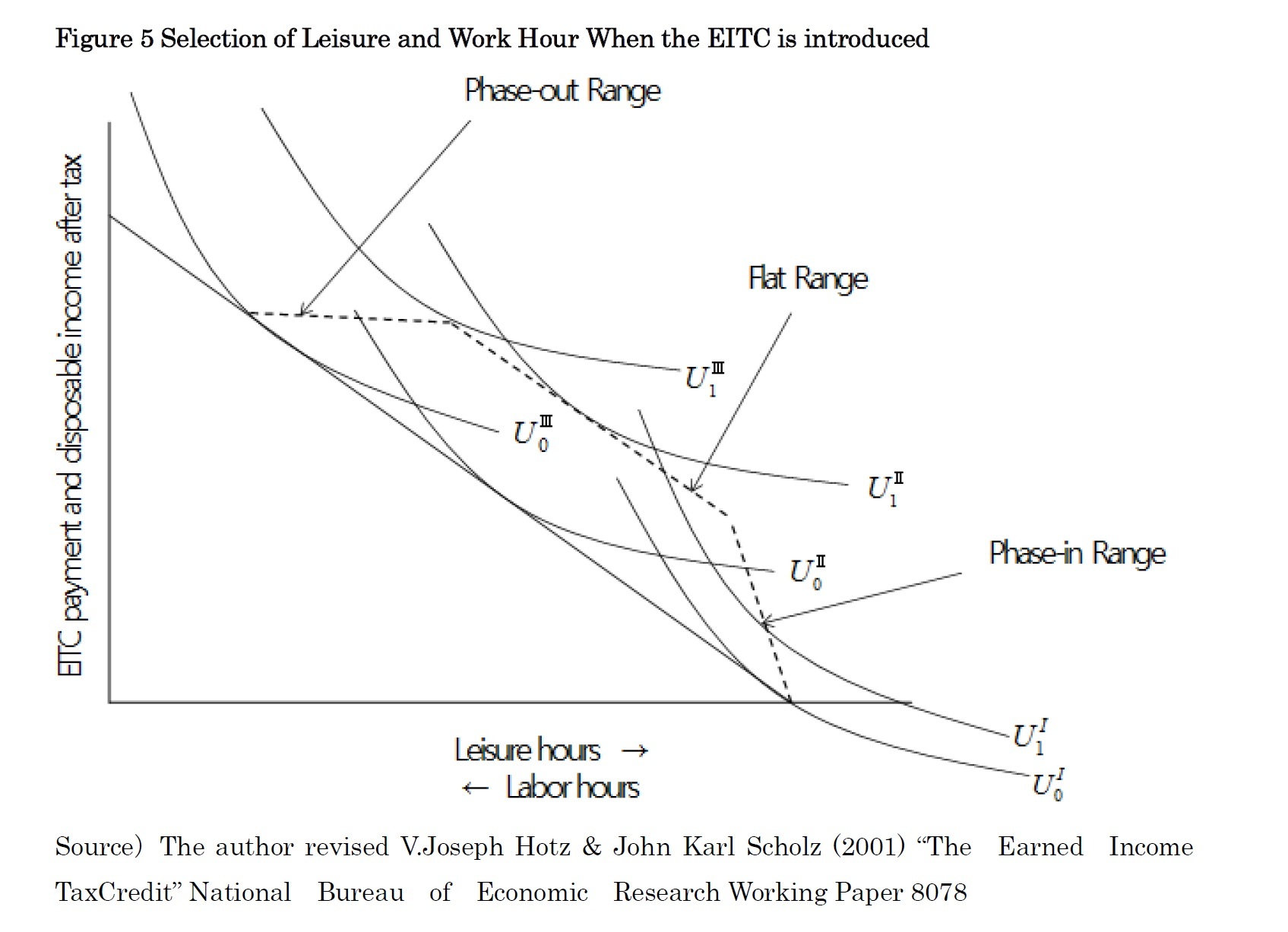

to , and both the rates of participation in labor market and labor hours rise. In case of the people who have already been participated, in a phase-in range(the range in which the work incentives increase at a fixed rate as the earned income rises), as the cost of choosing leisure instead of work increases, the increase of labor hours could be expected; however, both the substitution effect16and the income effect17occur, so its impact on work hour is not clear.

, and both the rates of participation in labor market and labor hours rise. In case of the people who have already been participated, in a phase-in range(the range in which the work incentives increase at a fixed rate as the earned income rises), as the cost of choosing leisure instead of work increases, the increase of labor hours could be expected; however, both the substitution effect16and the income effect17occur, so its impact on work hour is not clear.

to

to  and the substitution effect does not exist, labor hours decrease. Finally, in a phase-out range(the range in which work incentives decrease as the earned income increases), indifference curve moves from

and the substitution effect does not exist, labor hours decrease. Finally, in a phase-out range(the range in which work incentives decrease as the earned income increases), indifference curve moves from  to

to

Precedent studies that analyzed effects of the EITC on labor supply can be largely classified into two groups: influences on participation in the labor market and influences on changes in labor hours. Due to the 8-year and relatively short history of the South Korean EITC, there are not many analysis on the effects. In this section, firstly, precedent studies on the EITC of the US that were implemented earlier than South Korea is introduced, and then results of recent studies on the South Korean EITC are presented.

First, there are various studies on how the EITC of the US has influenced the participation in the labor market. Keane (1995) and Keane and Moffitt (1998) estimated that expansion of the EITC would increase labor force participation rate between 1984 and 1996. Dicket, Houser, and Scholz (1995) also demonstrated the analysis result that participation in the labor market increases as income increases. Eliss and Liebman (1996) drew the conclusion that expansion of the EITC led to increase in single-mother families’ labor participation rates.

Next, studies on influences of the EITC in labor hours are as follows. Contrary to the numerous studies that shows a positive correlation between the EITC and participation in the labor market, studies on the correlation between the EITC and labor hours do not necessarily converge.

Keane (1995), and Keane and Moffitt (1998) states that the EITC have positive effects on labor force participation as well as the labor market. On the other hand, Hoffam and Seidman (1990), and Browsing (1995) conclude that expansion of the EITC reduces worker’s labor hours.

What are the analysis results on introduction of the Korean EITC, which has shorter history than the EITC of the US? Using the NaSTab (National Survey of Tax and Benefit) Panel Data of Korea Institute of Public Finance, Heonjae Song・Hong Kee Bahng (2014) analyzed the influences of the EITC on labor supply. The analyses are carried out for married couple households and single-parent households. The studies show the result that the rates of participation in labor market increases in the phase-in range (the range in which work incentives increases as earnings rise). On the other hand, married couple households reduce labor supply in both flat range (the range in which maximum amounts of incentives are provided regardless of increase and decrease in earnings) and phase-out range (the range in which work incentives decrease as earnings increases); single parent households show different results.

Utilizing ‘Korean Welfare Panel’, Dae-woong Lee・Gi-hun Kwon・Sang-ho Moon(2015) analyzed how the EITC benefits affect the labor market participation of low income class, labor hours and wages with Difference in Difference Analysis (DID Analysis)19. According to analysis results, employment rate of the group that receives the EITC (treatment group) increased from 70.51% before receiving (in 2008) to 78.20% (in 2012) after receiving, it increased by 7.69 percentage point. On the other hand, employment rate of the group that does not receive the EITC (control group) decreased from 71.85% in 2008 to 66.25% in 2012 by 5.62 percentage point decrease. In terms of labor hours, treatment group increased labor hours by 0.75 month while control group reduced labor hours by 0.19 month during the same period.

Young-joon Chun (2010) classified households into 7 equal groups of the same number by their incomes and analyzed how the EITC influenced labor hours. As a result, the study found out that its effects on the increase in labor hours is not so significant.

Chan-mi Jeong・Jae-jin Kim(2015) analyzed the changes in criteria of the EITC payment in 2014, and the redistributive effects of the CTC on one-earner and dual-earner households, by using the household survey data of 2013. As a result, the EITC and the CTC have positive impacts on poverty rate and income redistribution; on the contrary, poverty rates of single-parent and elderly households increase among the one-earner households.

According to the results of studies in the South Korean EITC, some studies show that implementation of the EITC increased the rate of participation in labor market or the labor hours while other studies present decrease in both the rate and the labor hours; results do not necessarily converge. However, there are many study results that the rates of participation in the labor market and labor hours have positive impacts on average. Especially, there are many studies that rated the participation in the labor market increases in phase-in range (the range in which EITC benefits increase as earnings increase); therefore, to some extent, the South Korean EITC has achieved the goal set in the initial phase of the system.

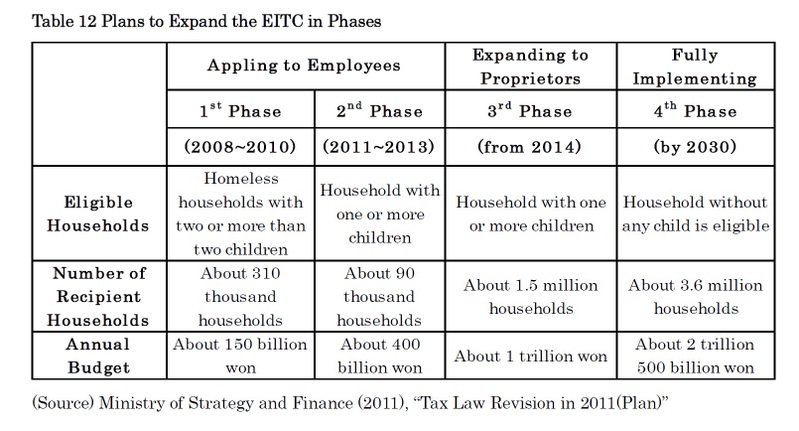

However, there are many problems to be solved. First, securing financial resources needs to be prioritized. The scope of eligibility shows a tendency to expand. Budget for the EITC and the CTC was about 150 billion won in the initial period, and budget amounts increased to 1.7 trillion won in 2015. Although South Korean government plans to increase the range of eligible people (Table 12), the actual tax revenues are smaller than the budget due to recession, and securing financial resources is a difficult task for South Korean government.

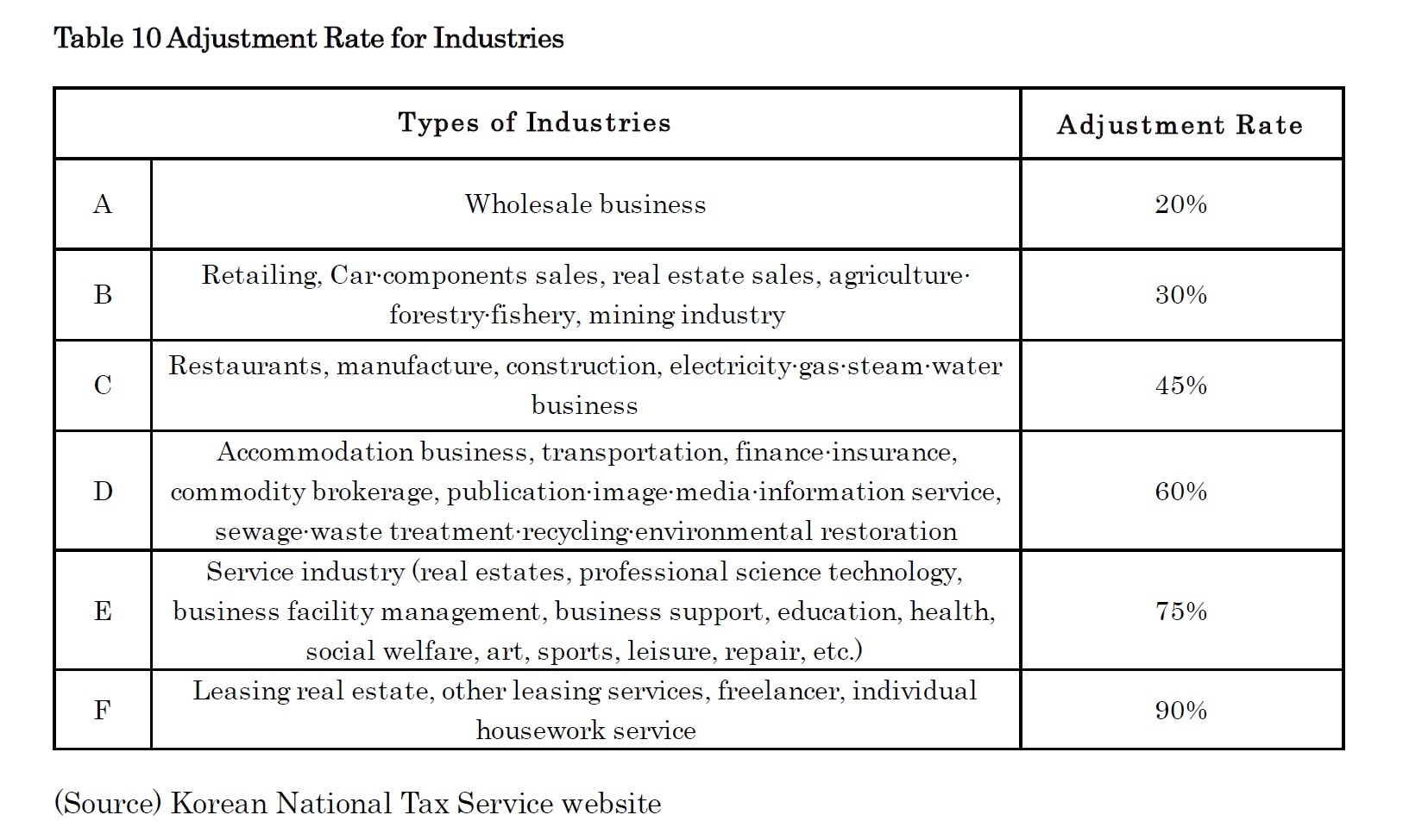

In addition, self-employed households, exempt from professionals from 2015, can receive the EITC. As the self-employed have more difficulties in securing earnings than the employed do, the EITC reflects adjustment rates for industries of Table 10 and decides the recipients. However, adjustment rate for an industry is 90% and adjustment rates are high in general, so it is difficult for the self-employed to receive the EITC.

In order to provide more EITC benefits for the self-employed in financial difficulties, raising the income capture rate of the self-employed needs to be the first priority. As the income capture rate of the self-employed rises and the adjustment rates decrease, more self-employed households can benefit from the EITC.

South Korean government needs to focus on poor women that form the majority of the working poor for an implementation of the EITC. Many working women are engaged in insecure jobs such as part-time work, and they are susceptible to fall into poverty. In addition, once a person falls into poverty, it is difficult to escape from it. Those facts imply that South Korean government has scarcely implemented significant policies for working women to this day. Therefore, South Korean government needs to implement policies thoroughly for working women including the implementation of the ETIC from now on. The policies will promote female participation in the labor market, and it will lead to the establishment of safe environment for them to escape from poverty.

15 Choosing either to work or not is based on utility level (level of satisfaction) of working and leisure. Indifference curve is a device to facilitate the comparison.

16 Effect that increase in wage rate makes labor supply more favorable, and labor supply increases.

17 Effect that increase in wage rate raises real wage, demand of leisure increases, and labor supply increases if leisure is a normal good (the demand for it increases as income increases).

18 Retrieved from V.Joseph Hotz & John Karl Scholz (2001) “The Earned Income TaxCredit” National Bureau of Economic Research Working Paper 8078, and Dae-woong Lee・Gi-hun Kwon・Sang-ho Moon(2015) “Studies on policy effects of the EITC”, The Korean Association for Policy Studies, Vol. 24, No. 2.

19 Estimating effect before and after implementing a policy, an equation like follows can be applied.

In this equation,

is a variable affected by execution of a policy.

is a variable affected by execution of a policy.  is a dummy variable; it becomes 1 if affected by the policy, and it becomes 2 if unaffected.

is a dummy variable; it becomes 1 if affected by the policy, and it becomes 2 if unaffected. is an error term, and

is an error term, and and

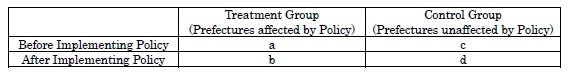

and  are parameters for estimation. With estimation results based on this equation, it is possible to interpret that Y increased by policy implementation. However, it is difficult to judge that the policy is the only factor that increased Y. For instance, by enforcing an industrial policy in some prefectures, per capita GDP in the prefectures can increase, but it is impossible to say that the effect is solely due to the policy. That is, there is a possibility that the effect includes not only policy effect but also exogenous effects occur with time (time effect). DID Analysis divide into two groups: treatment group and control group. Treatment group is affected by policy while control group is not. That is, in order to examine net policy effect, it is necessary to analyze both those affected by policy (treatment group) and those unaffected by policy over time (control group).

are parameters for estimation. With estimation results based on this equation, it is possible to interpret that Y increased by policy implementation. However, it is difficult to judge that the policy is the only factor that increased Y. For instance, by enforcing an industrial policy in some prefectures, per capita GDP in the prefectures can increase, but it is impossible to say that the effect is solely due to the policy. That is, there is a possibility that the effect includes not only policy effect but also exogenous effects occur with time (time effect). DID Analysis divide into two groups: treatment group and control group. Treatment group is affected by policy while control group is not. That is, in order to examine net policy effect, it is necessary to analyze both those affected by policy (treatment group) and those unaffected by policy over time (control group).

As illustrated in the table above, policy effect before and after implementing on treatment group, prefectures affected by policy, (b-a) includes not only policy effect but also exogenous effect which occurs with time. On the other hand, policy effect before and after implementing on control group, prefectures unaffected by policy, (d-c ) solely reflects exogenous effect over time. Therefore, by excluding (d-c ) from (b-a), net policy effect that excludes exogenous effect with time is obtained. However, a point to notice is to assume exogenous effects on treatment group and control group is same. This is the main content of DID analysis.

Social Improvement and Life Design Research Department Research fellow

Kim Myoungjung

Research field

03-3512-1878

Social media account

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング