- NLI Research Institute >

- Asset management・Asset building >

- Investors Trading Trends in Japanese Stock Market:An Analysis for September 2025

Column

07/10/2025

Investors Trading Trends in Japanese Stock Market:An Analysis for September 2025

Financial Research Department Chizuru Morishita

Font size

- S

- M

- L

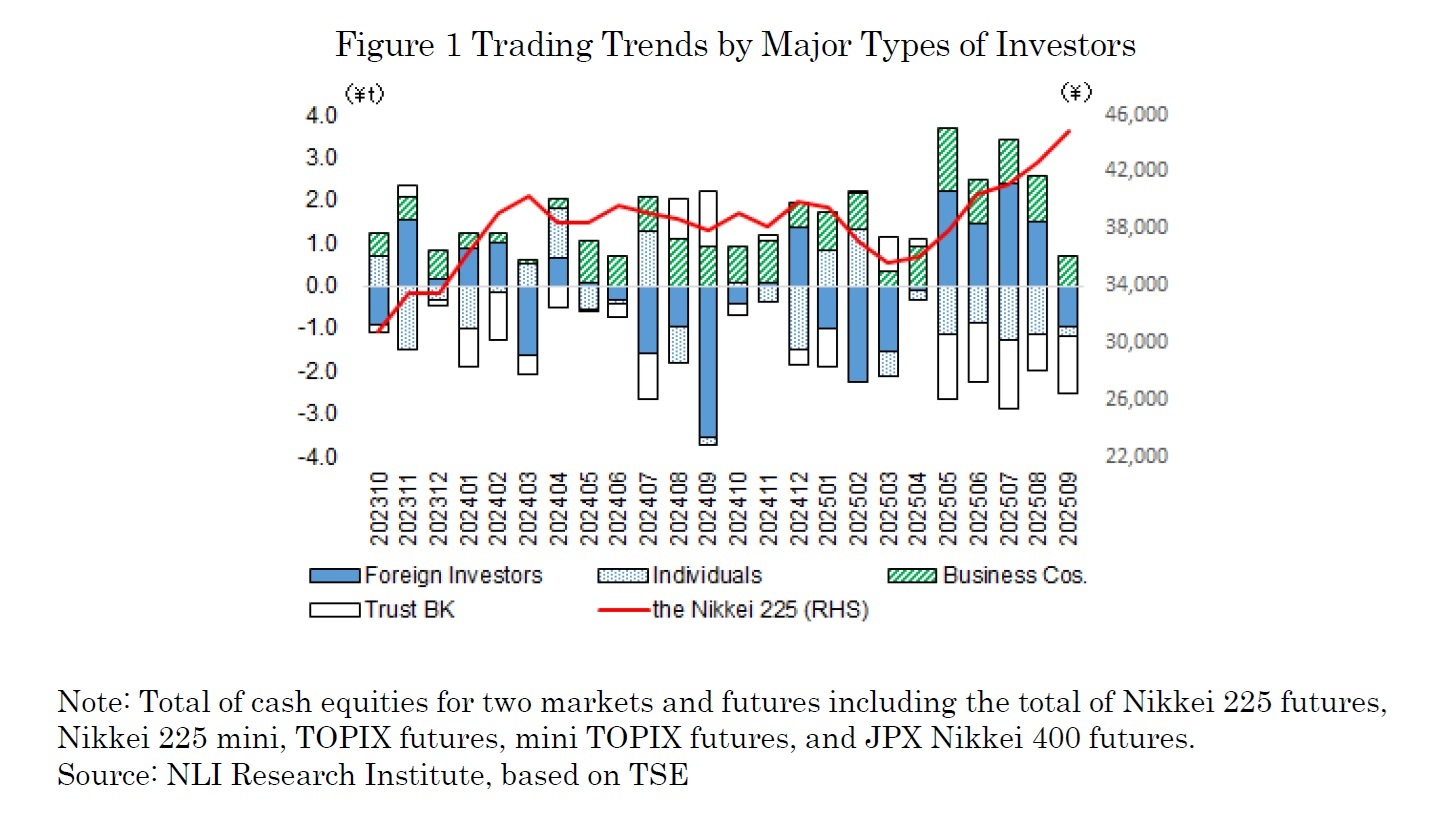

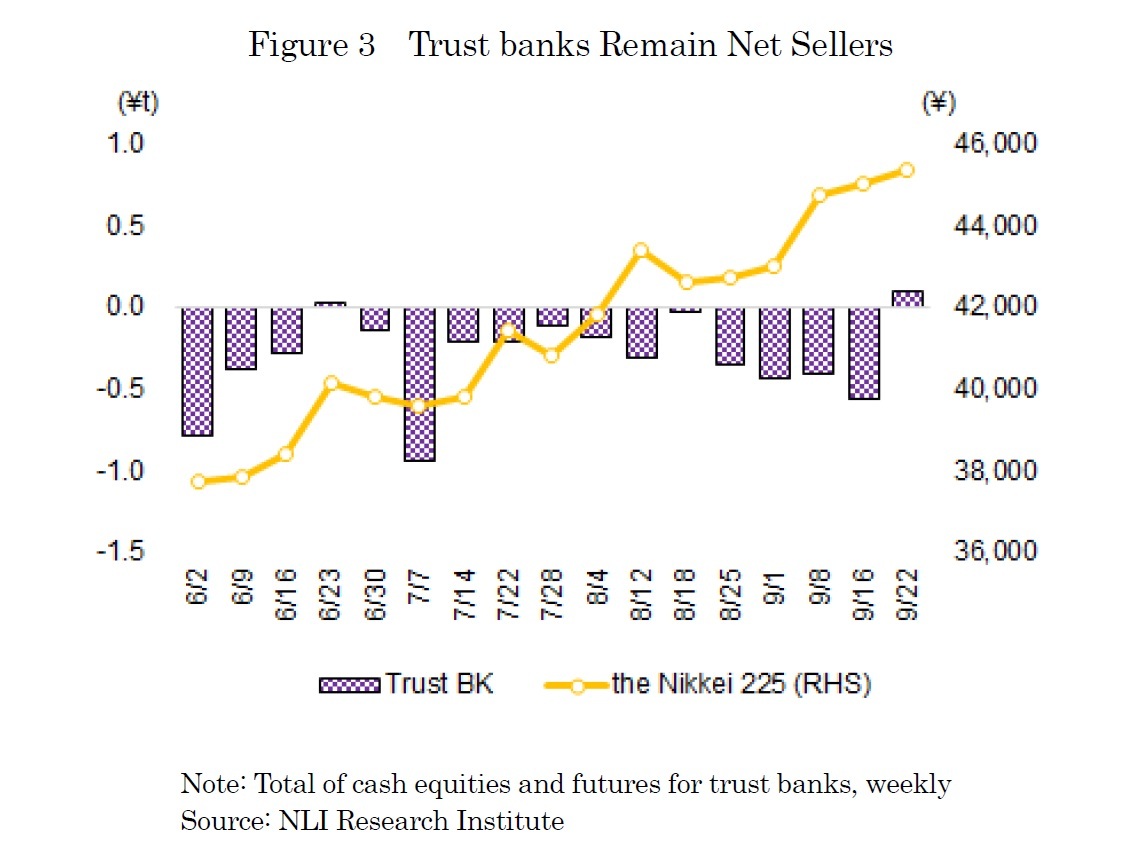

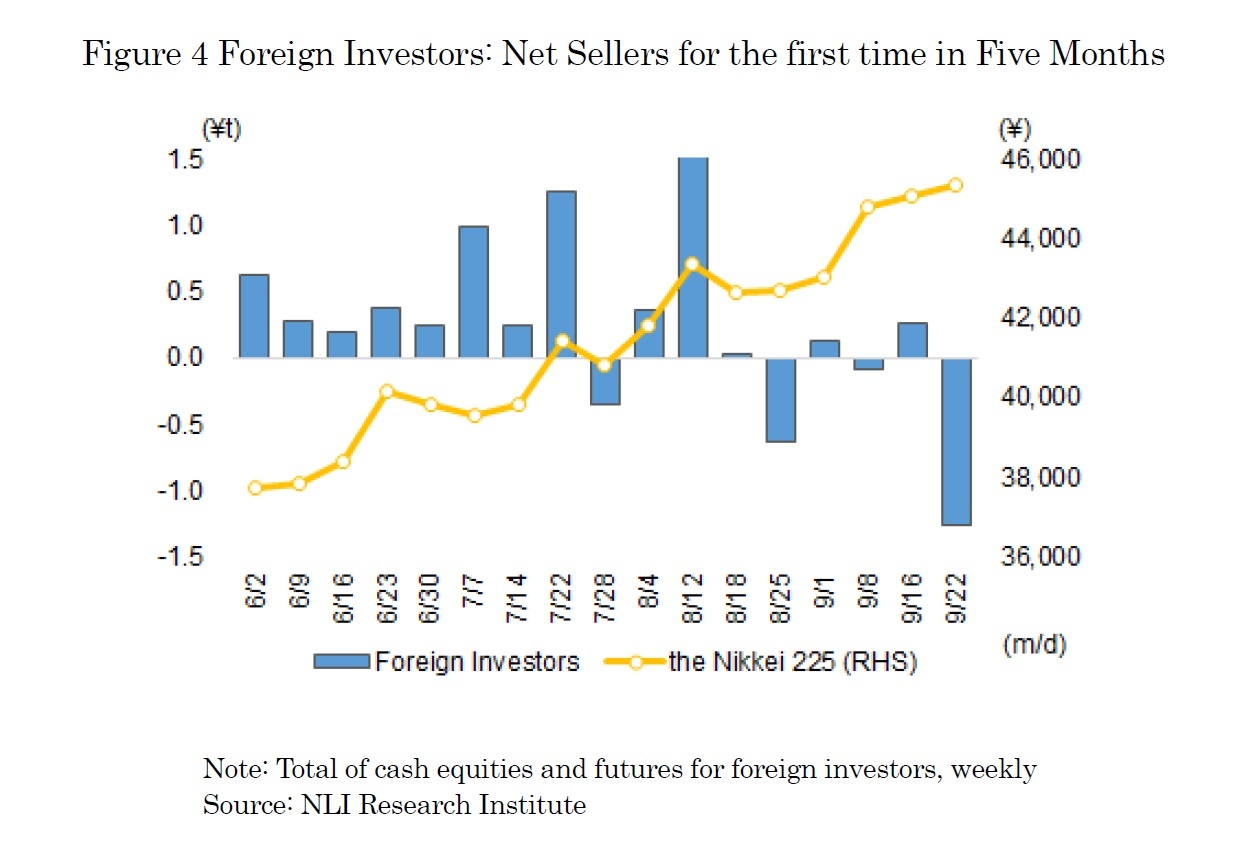

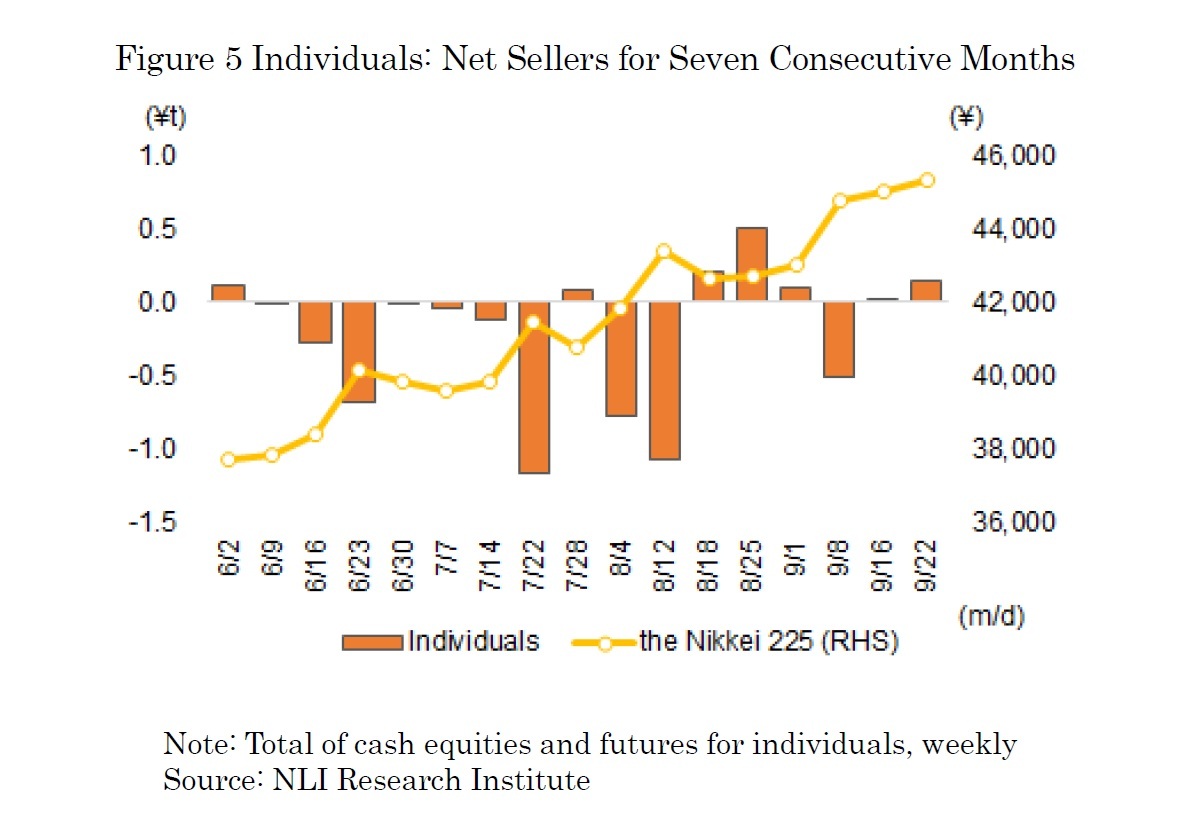

In September 2025, the Nikkei 225 rose for the sixth consecutive month, reaching a new all-time high. In early September, the market gained momentum, supported by the rise in U.S. equities led by high-tech stocks and growing expectations for expansionary fiscal policies under the next administration following Prime Minister Ishiba’s resignation. The Nikkei surpassed 44,000 on the 11th and exceeded 45,000 on the 18th. Although the index temporarily declined on the 19th after the Bank of Japan announced plans to sell ETFs and J-REITs, reassurance that the pace of sales would be gradual helped the market recover quickly. Toward the end of the month, while the rapid pace of gains and a pause in yen depreciation led to some consolidation, the Nikkei maintained high levels and ended the month at 44,933. By investor type, business corporations were net buyers, while trust banks, foreign investors, and individuals were net sellers (as shown in Figure 1).

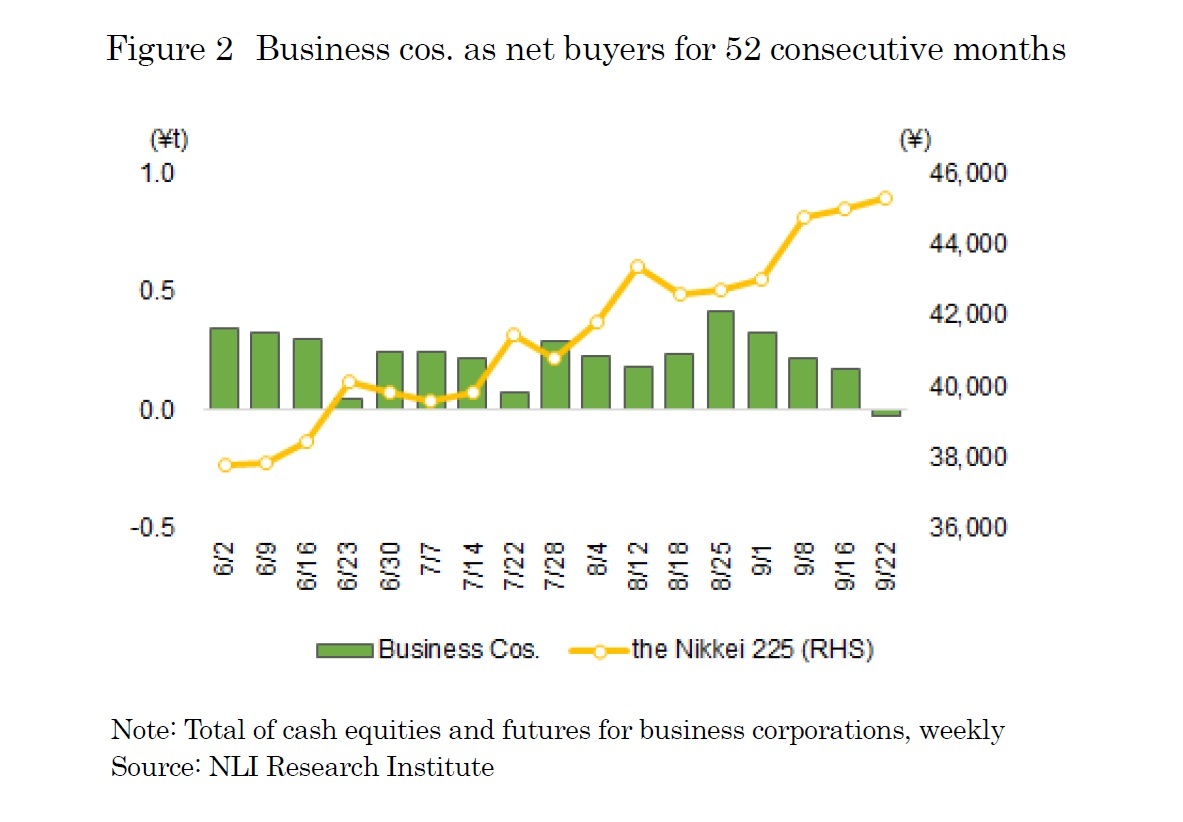

The trading by type of investors in September 2025 (September 1 to 26) shows that business corporations were the largest net buyers, with a total net purchase of 693.5 billion yen in cash equities and futures (as shown in Figure 2). Stable buying, mainly through share buybacks, continued, marking their 52nd consecutive month of net buying.

This report includes data from various sources and NLI Research Institute does not guarantee the accuracy and reliability. In addition, this report is intended only for providing information, and the opinions and forecasts are not intended to make or break any contracts.

03-3512-1855