- NLI Research Institute >

- Economics >

- Japan’s Economic Outlook for FY 2020–2022

16/02/2021

Japan’s Economic Outlook for FY 2020–2022

Economic Research Department Executive Research Fellow Taro Saito

Font size

- S

- M

- L

1. In the October–December quarter of 2020, the economy grew at an annualized rate of 12.7%.

In the October–December quarter of 2020, real GDP grew 3.0% (12.7% per annum) from the previous quarter, marking the second consecutive quarter of double-digit annual growth.

Because of a recovery in global economic activity, exports grew at a high rate of 11.1% from the previous quarter, and external demand contributed to the growth rate by 1.0% (4.3%). Private consumption rose 2.2% from the previous quarter for the second consecutive quarter, supported by the Go To campaign as economic constraints were eased, and capital investment, which had fallen sharply due to the coronavirus pandemic, increased by 4.5% for the first time in three quarters. Government spending, boosted by the Go To Travel campaign, rose 2.0% quarter-over-quarter, and also boosted growth.

In 2020 , real GDP declined by 4.8% (in 2019, 0.3%) and the nominal GDP declined by 3.9% (in 2019, 0.9%), marking the first significant negative growth since 2009 (real GDP −5.7%, nominal GDP −6.2%) after the global financial crisis.

Real GDP in the October–December quarter of 2020 grew at an annual rate of 12.7%, a rapid growth rate following the highest growth rate of the July–September quarter, recapturing more than 90% of the decline in the April–June second quarter, when the economy posted record negative growth. The Japanese economy, however, had been affected by the consumption tax hike before the impact of the new coronavirus infection became apparent. Compared with the most recent peak in the July–September quarter of 2019, real GDP in the October–December quarter of 2020 was down 2.9% and private consumption was down 5.3%, indicating that there is still a long way to go before economic activity normalizes.

In addition, although the economy grew rapidly in the October–December quarter, there was a pause in the recovery toward the end of the year on a monthly basis.The hiatus in recovery came from responses to an increase in the number of people who had tested positive for the novel coronavirus, such as shortening the business hours of restaurants and other restrictions.

Because of a recovery in global economic activity, exports grew at a high rate of 11.1% from the previous quarter, and external demand contributed to the growth rate by 1.0% (4.3%). Private consumption rose 2.2% from the previous quarter for the second consecutive quarter, supported by the Go To campaign as economic constraints were eased, and capital investment, which had fallen sharply due to the coronavirus pandemic, increased by 4.5% for the first time in three quarters. Government spending, boosted by the Go To Travel campaign, rose 2.0% quarter-over-quarter, and also boosted growth.

In 2020 , real GDP declined by 4.8% (in 2019, 0.3%) and the nominal GDP declined by 3.9% (in 2019, 0.9%), marking the first significant negative growth since 2009 (real GDP −5.7%, nominal GDP −6.2%) after the global financial crisis.

Real GDP in the October–December quarter of 2020 grew at an annual rate of 12.7%, a rapid growth rate following the highest growth rate of the July–September quarter, recapturing more than 90% of the decline in the April–June second quarter, when the economy posted record negative growth. The Japanese economy, however, had been affected by the consumption tax hike before the impact of the new coronavirus infection became apparent. Compared with the most recent peak in the July–September quarter of 2019, real GDP in the October–December quarter of 2020 was down 2.9% and private consumption was down 5.3%, indicating that there is still a long way to go before economic activity normalizes.

In addition, although the economy grew rapidly in the October–December quarter, there was a pause in the recovery toward the end of the year on a monthly basis.The hiatus in recovery came from responses to an increase in the number of people who had tested positive for the novel coronavirus, such as shortening the business hours of restaurants and other restrictions.

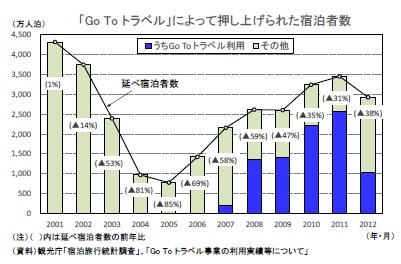

Falling consumption of face-to-face services

Falling consumption of face-to-face servicesPersonal consumption, which recorded an extremely sharp decline under the declaration of a state of emergency in April 2020, recovered after bottoming out in May, but weakened again toward the end of the year. Examining real consumer spending by type in the "Family Income and Expenditure Survey" (Statistics Bureau, Ministry of Internal Affairs) reveals that spending on goods has already exceeded the pre-coronavirus average in 2019 due to the expansion of stay-at-home consumption and the effects of special fixed benefits. Since the declaration of a state of emergency, however, spending on services has fallen significantly with a subsequent weak recovery. In particular, the consumption of face-to-face services (general dining out, transportation, accommodation, package tours, entertainment, and sports) dropped to about 20% of pre-coronavirus levels in April and May 2020. Supported by the Go To Travel campaign, face-to-face services recovered to about 60% in October but then fell again and returned to a little less than half of pre-coronavirus levels in December. The number of people who tested positive for the new coronavirus increased, prompting the Go To Travel campaign to suspend operations and restaurant operators to shorten business hours.

Started in July 2020, the Go To Travel campaign provided about 87.81 million nights of accommodation, and the amount of discount support reached about 539.9 billion yen. According to the "Accommodation Travel Statistics" issued by the Japan Tourism Agency, the total number of visitors decreased by 80% from the previous year in April and May 2020 under the declaration of a state of emergency, but domestic tourism has been recovering with the support of the Go To Travel campaign. Go To Travel's share of total guests increased from about 10% in July to 74% in November (the average from July to December was 52%). However, as the number of people who tested positive for the new coronavirus increased again, the use of the Go To Travel campaign was halted in some areas from late November to mid-December, and on December 28 the campaign was halted nationwide. As a result, the use of Go To Travel decreased by about 60% from November to December, and the year-over-year decrease in the percentage of visitors increased again from 31% in November to 38% in December.

Started in July 2020, the Go To Travel campaign provided about 87.81 million nights of accommodation, and the amount of discount support reached about 539.9 billion yen. According to the "Accommodation Travel Statistics" issued by the Japan Tourism Agency, the total number of visitors decreased by 80% from the previous year in April and May 2020 under the declaration of a state of emergency, but domestic tourism has been recovering with the support of the Go To Travel campaign. Go To Travel's share of total guests increased from about 10% in July to 74% in November (the average from July to December was 52%). However, as the number of people who tested positive for the new coronavirus increased again, the use of the Go To Travel campaign was halted in some areas from late November to mid-December, and on December 28 the campaign was halted nationwide. As a result, the use of Go To Travel decreased by about 60% from November to December, and the year-over-year decrease in the percentage of visitors increased again from 31% in November to 38% in December.

With a state of emergency re-declared, consumer spending is expected to fall further in 2021. Sales at major department stores fell sharply across the board due to the impact of shorter business hours, although much consumer-related data for January has yet to be released.

Meanwhile, the number of people visiting retail and entertainment facilities (restaurants, cafes, shopping centers, theme parks, movie theaters, etc.), which is highly correlated with face-to-face service consumption, has fallen sharply following the re-declaration of the state of emergency. The state of emergency, which had been in effect for one month until February 7, was extended to March 7 in 10 prefectures, excluding Tochigi Prefecture. As a result, the drop in consumption of face-to-face services is likely to continue through early March.

Meanwhile, the number of people visiting retail and entertainment facilities (restaurants, cafes, shopping centers, theme parks, movie theaters, etc.), which is highly correlated with face-to-face service consumption, has fallen sharply following the re-declaration of the state of emergency. The state of emergency, which had been in effect for one month until February 7, was extended to March 7 in 10 prefectures, excluding Tochigi Prefecture. As a result, the drop in consumption of face-to-face services is likely to continue through early March.

Employment situation remains severe despite positive signs

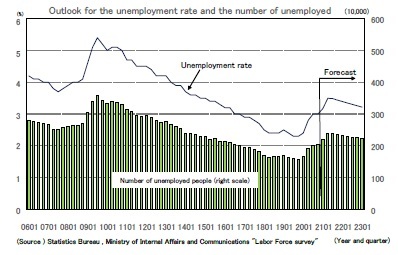

With economic activity picking up in the second half of 2020, the worsening employment situation is coming to an end. The ratio of job openings to job seekers, which reflects the supply–demand balance in the labor market, fell from 1.63 in April 2019 to 1.03 in September 2020, and then rose to 1.06 in December. The unemployment rate rose from 2.2% in December 2019 to 3.1% in October 2020, but slightly improved to 2.9% in November and December.

With economic activity picking up in the second half of 2020, the worsening employment situation is coming to an end. The ratio of job openings to job seekers, which reflects the supply–demand balance in the labor market, fell from 1.63 in April 2019 to 1.03 in September 2020, and then rose to 1.06 in December. The unemployment rate rose from 2.2% in December 2019 to 3.1% in October 2020, but slightly improved to 2.9% in November and December.

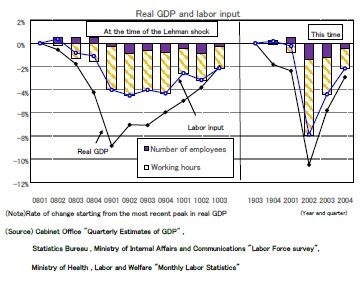

The unemployment rate remained modest despite the sharp decline in economic activity partly due to employment adjustment subsidies and companies implementing deep cuts in working hours while retaining as many employees as possible (including time off). The relationship between real GDP and labor input shows that the adjustment of labor input is achieved mainly by reducing working hours, as was the case with the global financial crisis, but this time the reduction in working hours is particularly large.

The unemployment rate remained modest despite the sharp decline in economic activity partly due to employment adjustment subsidies and companies implementing deep cuts in working hours while retaining as many employees as possible (including time off). The relationship between real GDP and labor input shows that the adjustment of labor input is achieved mainly by reducing working hours, as was the case with the global financial crisis, but this time the reduction in working hours is particularly large.Note, however, that the reduction in labor input is smaller than the decline in real GDP, and labor productivity is waning. Since this situation continued for a long time after the global financial crisis, it took time for the employment situation to improve even after the economic downturn. The economic trough after the global financial crisis occurred in March 2009, yet the unemployment rate peaked in July 2009 at 5.5% and did not fall to below 5% until December 2010, more than a year and a half after the economy bottomed out. As economic activity picked up in the second half of 2020, labor input was trending down. Moreover, economic activity is once again expected to decline following the re-declaration of a state of emergency in the first half of 2021. It is highly likely that labor input adjustments will again be necessary.

In addition, maintaining employment without returning to the original level of economic activity may lead to a reduction in the number of new employees, especially new graduates. In fact, according to the Bank of Japan's Tankan survey of December 2020, the number of new graduate recruitment plans, which had been on the rise since fiscal 2011, declined by 2.6% in fiscal 2020 from the previous year (the first decline in 10 years) and 6.1% in fiscal 2021.

Although the economy has already bottomed out, the unemployment rate is a lagging indicator. An improvement in the employment situation might be delayed by the retention of employees in companies backed by the expansion of employment adjustment subsidies, which will hinder future job creation. The unemployment numbers increased from the last low of 2019 (October–December) of 1.56 million to 2.05 million in 2020 (October–December), but are expected rise to 2.39 million in 2021 (April–June). The unemployment rate rise to 3.5% after the beginning of fiscal 2021 due to the economic slump caused by the re-declaration of a state of emergency. In the latter half of fiscal 2021, the unemployment rate should gradually decline, but it is expected to remain moderate, at 3.2% by the end of fiscal 2022.

Although the economy has already bottomed out, the unemployment rate is a lagging indicator. An improvement in the employment situation might be delayed by the retention of employees in companies backed by the expansion of employment adjustment subsidies, which will hinder future job creation. The unemployment numbers increased from the last low of 2019 (October–December) of 1.56 million to 2.05 million in 2020 (October–December), but are expected rise to 2.39 million in 2021 (April–June). The unemployment rate rise to 3.5% after the beginning of fiscal 2021 due to the economic slump caused by the re-declaration of a state of emergency. In the latter half of fiscal 2021, the unemployment rate should gradually decline, but it is expected to remain moderate, at 3.2% by the end of fiscal 2022.

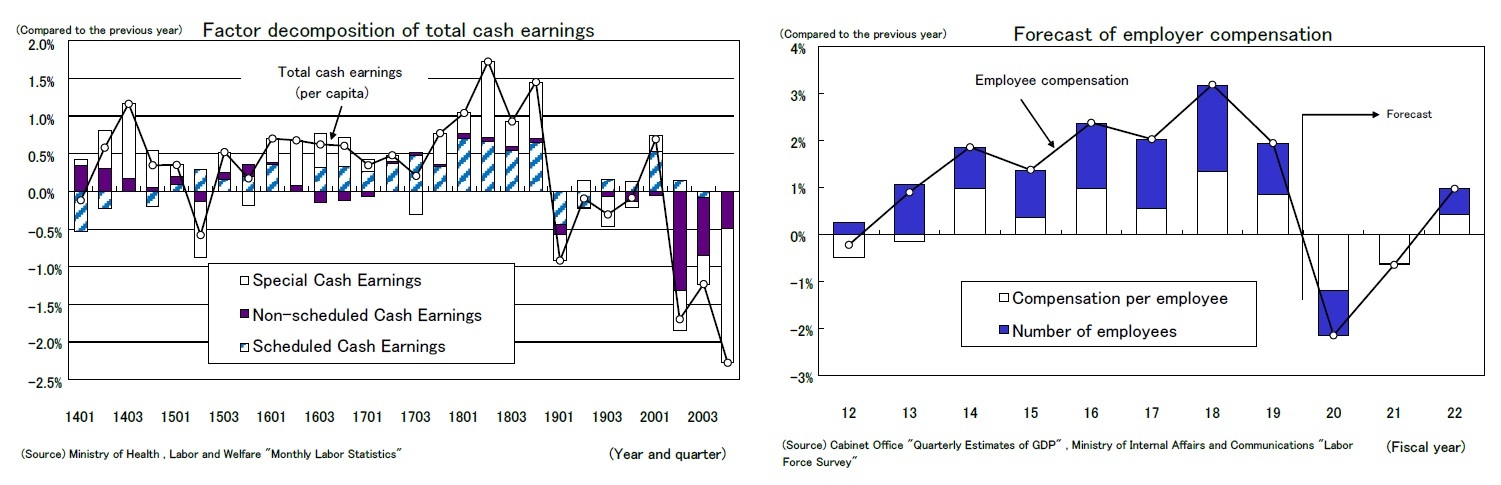

Employee pay will be down for second consecutive year

The decline in employment is coming to an end, but wage decreases have begun in earnest recently. According to the "Monthly Labor Statistics" published by the Ministry of Health, Labor and Welfare, total cash earnings (per capita) decreased from −1.2% in the July–September quarter of 2020 to −2.3% in the October–December quarter of 2020. In the spring of 2020, the main cause of the decline in wages was the fall in non-scheduled wages due to a significant reduction in overtime hours. Recently, however, a significant decrease in special wages (bonuses) has significantly reduced wages overall. Bonuses are likely to fall again in 2021 as the effects of poor business performance are reflected later.

Although scheduled wages, which account for about three quarters of total wages, have remained flat from the previous year, the growth rate is likely to decline further from April, when the results of the 2021 shunto negotiations are reflected.

The decline in employment is coming to an end, but wage decreases have begun in earnest recently. According to the "Monthly Labor Statistics" published by the Ministry of Health, Labor and Welfare, total cash earnings (per capita) decreased from −1.2% in the July–September quarter of 2020 to −2.3% in the October–December quarter of 2020. In the spring of 2020, the main cause of the decline in wages was the fall in non-scheduled wages due to a significant reduction in overtime hours. Recently, however, a significant decrease in special wages (bonuses) has significantly reduced wages overall. Bonuses are likely to fall again in 2021 as the effects of poor business performance are reflected later.

Although scheduled wages, which account for about three quarters of total wages, have remained flat from the previous year, the growth rate is likely to decline further from April, when the results of the 2021 shunto negotiations are reflected.

A February 3 Institute of Labor Administration "Survey on Wage Increases" covered about 500 labor and management officials as well as labor and economic experts. The average wage increase forecast for 2021 was 1.73%—down 0.32% from the previous year. The wage increase rate (major private-sector companies' demands for wage increases in the spring) calculated by the Ministry of Health, Labor and Welfare in the spring labor offensive reached the 2% level in 2014 for the first time in 13 years after the start of Abenomics. Although the rate of wage increases kept steady at 2% until 2020, it is certain that it will fall below 2% in 2021 for the first time in 8 years. The Institute expects wage increases in 2021 to be 1.75%. This means that there will be almost no wage increase except for a regular pay raise, which is said to be about 1.7–1.8%.

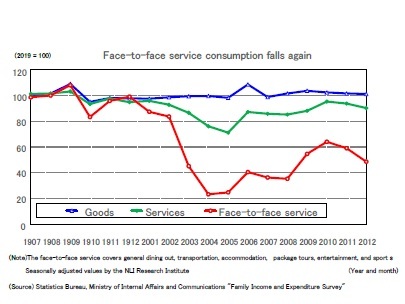

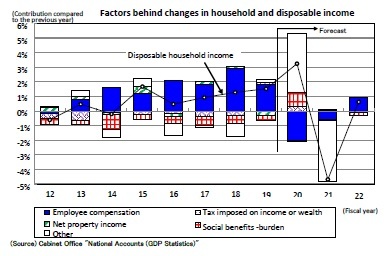

Employers' remuneration has been growing steadily mainly due to an increase in the number of employees because of companies' labor shortages. However, due to the decrease in both the number of employees and wages per employee, it is expected that in FY 2020 it will decrease by 2.1% from the previous year, the first decrease in 8 years. Although the decline in the number of employees will be halted in fiscal 2022, due to the continued decline in per capita wages, the figure is forecast to decline 0.6% from the previous year for the second consecutive year, and to increase 1.0% in fiscal 2022 from the previous year for the first time in 3 years.

Employers' remuneration has been growing steadily mainly due to an increase in the number of employees because of companies' labor shortages. However, due to the decrease in both the number of employees and wages per employee, it is expected that in FY 2020 it will decrease by 2.1% from the previous year, the first decrease in 8 years. Although the decline in the number of employees will be halted in fiscal 2022, due to the continued decline in per capita wages, the figure is forecast to decline 0.6% from the previous year for the second consecutive year, and to increase 1.0% in fiscal 2022 from the previous year for the first time in 3 years.

The 100,000 yen per person special fixed benefits had pushed up disposable household income, but the impact has already passed. According to the "Quarterly Estimates of Household Disposable Income and Household Savings Ratio (reference series)" by the Cabinet Office, household disposable income in the April–June quarter of 2020 was +11.6% of the previous year's level, and in the July–September quarter it was +2.9% of the previous year's level. However, the payment of the special fixed benefit was almost completed in September, and in the October–December quarter, the decrease in employee compensation seems to be directly related to the decrease in disposable income.

On a macroeconomic basis, the amount of special fixed benefits paid was 12.7 trillion yen, far exceeding the decrease of 6.2 trillion yen in employee remuneration in fiscal 2020. Therefore, households' disposable income in fiscal 2020 will increase by 3.2% from the previous year, and this plays a role in easing the decline in consumption. However, the rise in the amount of special fixed benefits is only temporary, so disposable income in fiscal 2021 is expected to decline sharply in reaction to this. In the long run, the deterioration of the employment income environment is likely to delay the recovery of consumption.

On a macroeconomic basis, the amount of special fixed benefits paid was 12.7 trillion yen, far exceeding the decrease of 6.2 trillion yen in employee remuneration in fiscal 2020. Therefore, households' disposable income in fiscal 2020 will increase by 3.2% from the previous year, and this plays a role in easing the decline in consumption. However, the rise in the amount of special fixed benefits is only temporary, so disposable income in fiscal 2021 is expected to decline sharply in reaction to this. In the long run, the deterioration of the employment income environment is likely to delay the recovery of consumption.

03-3512-1836

Social media account

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング