- NLI Research Institute >

- Real estate >

- Japanese Property Market Quarterly Review, Second Quarter 2017-Tokyo Grade-A Office Rents Rise Again, Investors Increasingly Consider Selling-

Japanese Property Market Quarterly Review, Second Quarter 2017-Tokyo Grade-A Office Rents Rise Again, Investors Increasingly Consider Selling-

Kazumasa Takeuchi

Font size

- S

- M

- L

6. J-REIT and Property Investment Markets

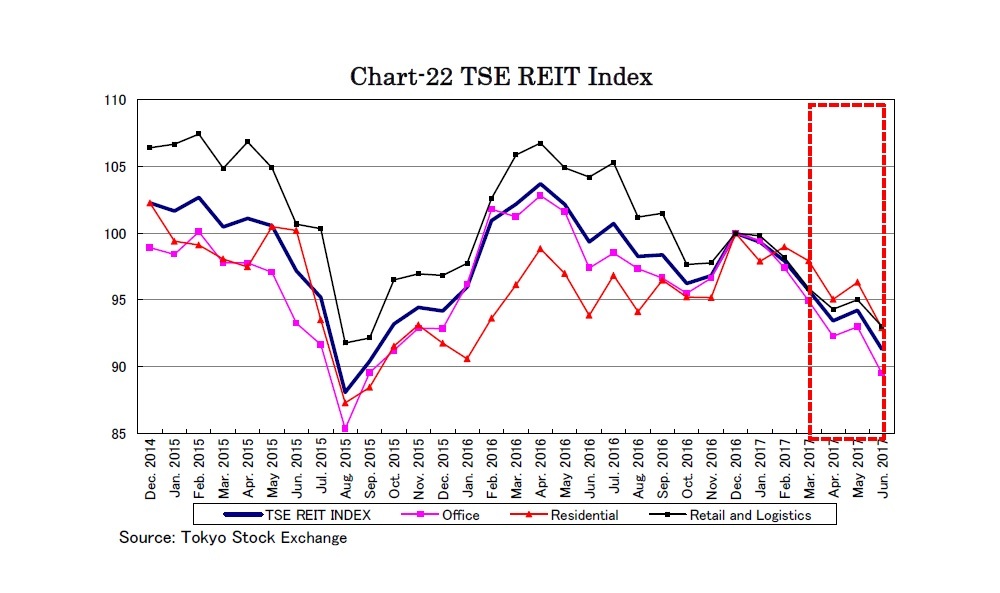

The TSE REIT index declined by 4.6% in the second quarter, falling below 1,700 points for the first time in 16 months (Chart-22). Office, residential and retail-logistics sectors declined by 5.7%, 5.1% and 3.0%, respectively. Affected by successive cash outflows from J-REIT mutual funds, which have been the largest J-REIT investors, the index dropped by 8.7% from the beginning of the year.

At the end of June, the J-REIT market value was 10.6 trillion JPY with 2.0 trillion JPY of unrealized capital gain. The weighted average price to NAV ratio was 1.1 times and the dividend yield was 4.0% with a 3.9% yield spread on 10-year JGBs.

J-REIT unit prices rose significantly since the inception of Abenomics at the end of 2012. However, the index has currently fallen to the level of October 2014 when the BOJ tripled the acquisition volume of J-REITs as well as January 2016 when the BOJ announced the negative interest rate policy. It looks as if only J-REITs have lost the benefit from Abenomics, while the equity market has risen considerably as the Nikkei 225 index hovers around 20,000 JPY and 10-year JGB yields have fallen to around 0%.

On the other hand, DPU of J-REITs has grown by 27% since the inception of Abenomics, benefiting from rent recovery and debt cost deduction. In addition, NAV per unit has also grown by 49%. Thus, the valuation of J-REITs has increasingly become attractive, as the weighted average dividend yield increased to 4.0% and price to NAV ratio shrank to 1.1 times.

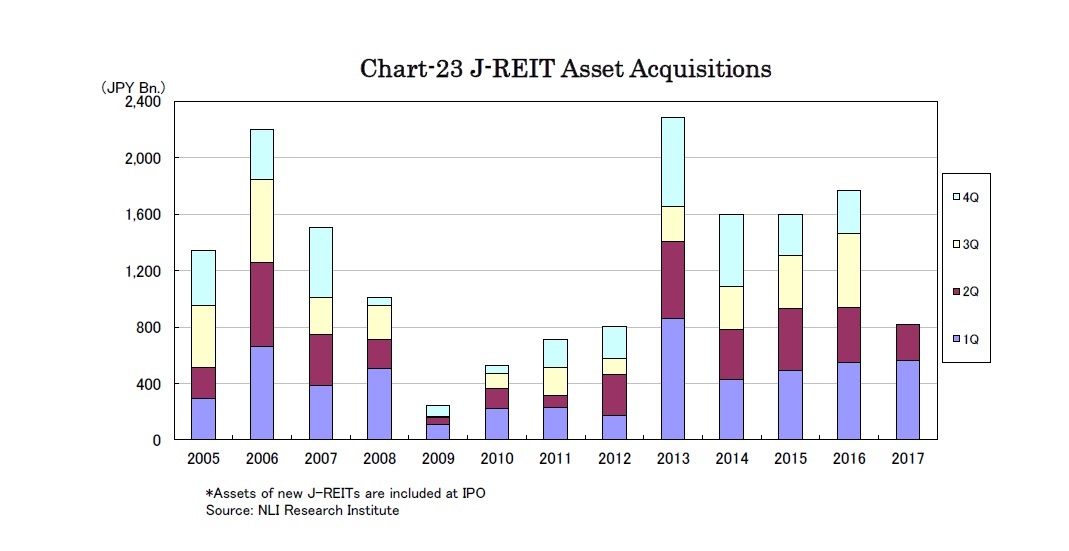

The property transaction volume increased by 29% to 822.7 billion JPY in the second quarter, according to Nikkei Real Estate Market Report. Avoiding very low yields in the center of Tokyo, investors have increasingly transacted properties in the suburbs of Tokyo and local cities such as Yokohama Minato Mirai, Tennozu Isle, Shinagawa Seaside and Osaka. And not only large office buildings but also hotels, logistics facilities and bulk of residential portfolios have been transacted.

Two-thirds of respondents replied that the Japanese property investment market had peaked in an April investor survey by the Japan Real Estate Institute. On the other hand, foreign investors have relatively become active in property acquisitions, previously facing difficulty in 2016 with competition from aggressive Japanese investors.

* This report includes data from various sources and NLI Research Institute does not guarantee the accuracy and reliability. In addition, this report is intended only for providing information, and the opinions and forecasts are not intended to make or break any contracts.

Kazumasa Takeuchi

Research field

Social media account

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング