- NLI Research Institute >

- Real estate >

- Japanese Property Market Quarterly Review, First Quarter 2017-Focus on Coming Large Supply of Offices, Hotels and Logistics Facilities-

Japanese Property Market Quarterly Review, First Quarter 2017-Focus on Coming Large Supply of Offices, Hotels and Logistics Facilities-

Eriko Kato

Font size

- S

- M

- L

3.Sub-sectors

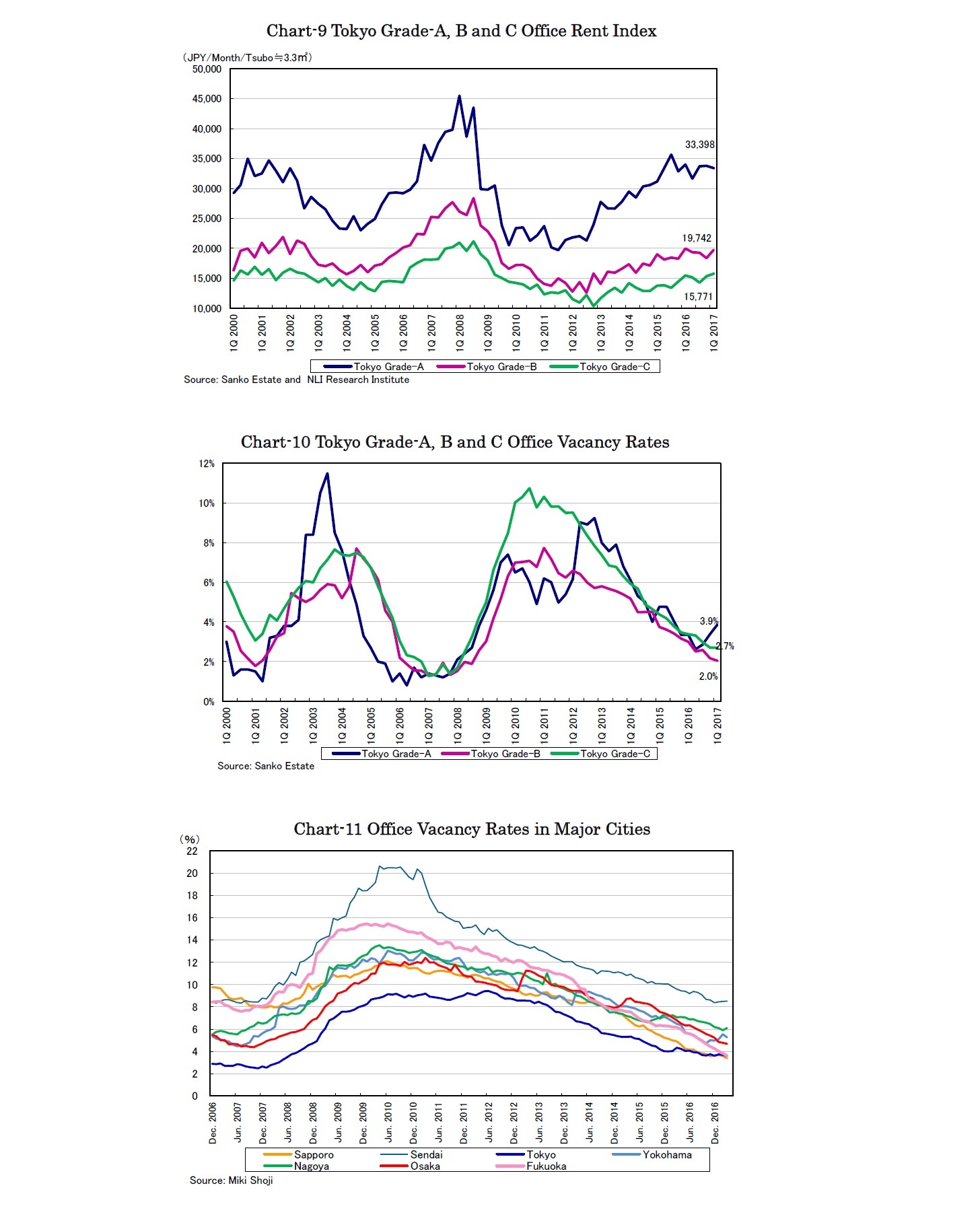

The rent index of Tokyo Grade-A offices declined by 1.1% q-o-q and 1.8% y-o-y to 33,398 JPY per month per tsubo in the first quarter (Chart-9). Grade-A office rents have been on a declining trend since peaking in the third quarter of 2015. Tenants have taken the initiative in leasing negotiations on the back of the 1.4 million square meters of new supply scheduled in 2018, even with current favorable business conditions and corporate earnings.

On the other hand, the rent index of Tokyo Grade-2 offices rose by 1.1% q-o-q and declined by 1.8% y-o-y while that of Tokyo Grade-C3 offices rose by 1.1% q-o-q and 1.8% y-o-y. Grade-C office rents have been strong without direct influence by the glut of coming Grade-A supply. However, office rents of all grades have been much lower than those at the peak in 2008.

Vacancy rates of Grade-A offices deteriorated to 3.9% for the third consecutive quarter (Chart-10). On the contrary, vacancy rates of Grade-B and C have improved and have driven the rent increase.

Office vacancy rates in major cities other than Tokyo have been improving supported by limited new supply excluding Yokohama, where some tenants moved to their own buildings, and Nagoya, where a landmark building was completed next to a JR station (Chart-11).

2 Offices with main floor size of more than 660 m2 excluding Grade-A offices

3 Offices with main floor size of more than 330 m2 excluding Grade-A or B offices

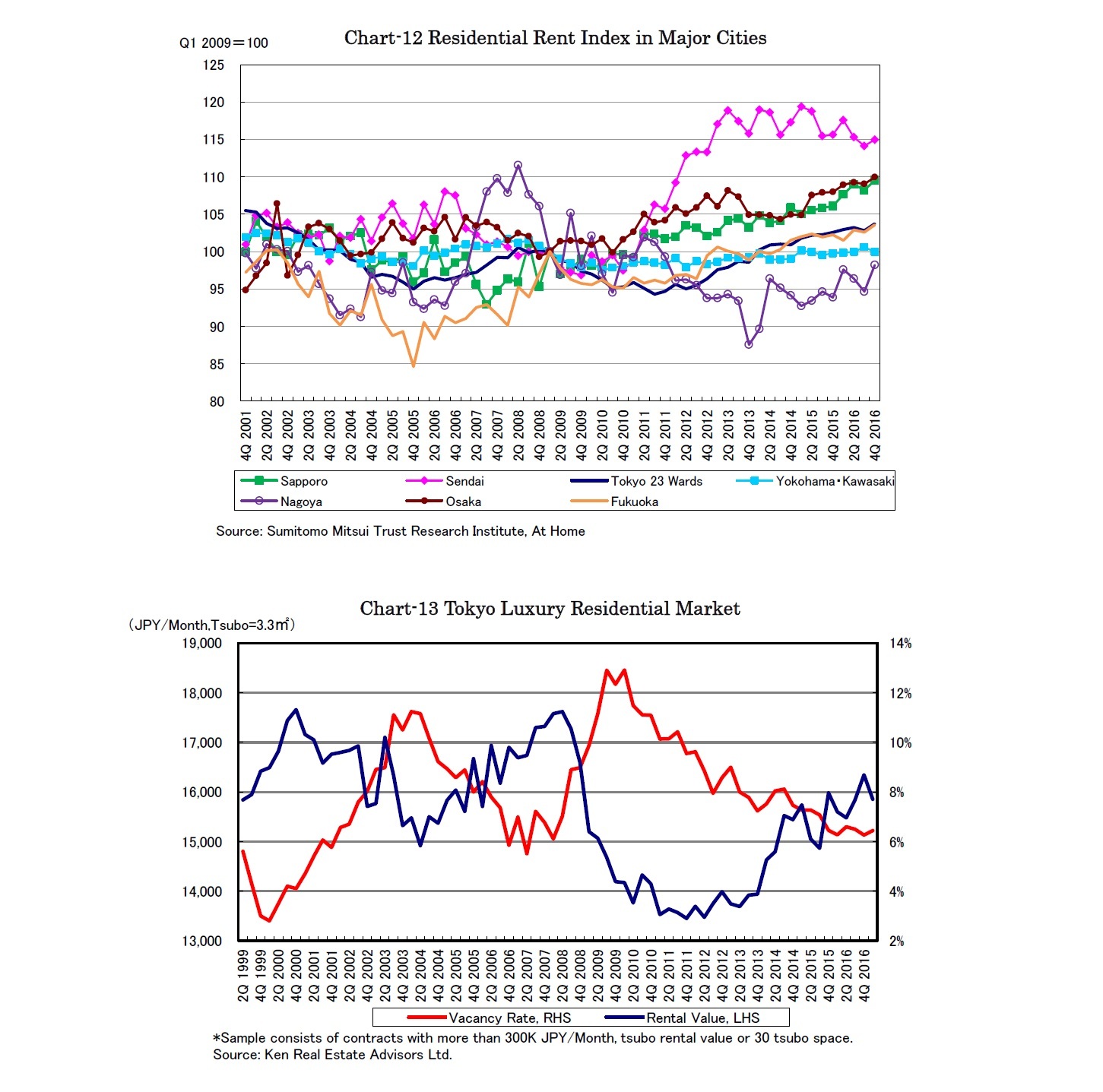

Residential rents in major cities have been on the rise (Chart-12). The residential rents in Tokyo rose again in the fourth quarter after declining once in the third quarter of 2016.

The vacancy rates of Tokyo luxury apartments have leveled off since the beginning of 2016 following several years of improvement (Chart-13). The luxury residential rents which still appear on the ascending trend also declined by 3.0% q-o-q to 15,853 JPY per tsubo per month in the first quarter of 2017. The rents have been much lower than those at the peak above 17,000 JPY per tsubo per month in 2008, suggesting the spending ability of potential tenants has drastically deteriorated.

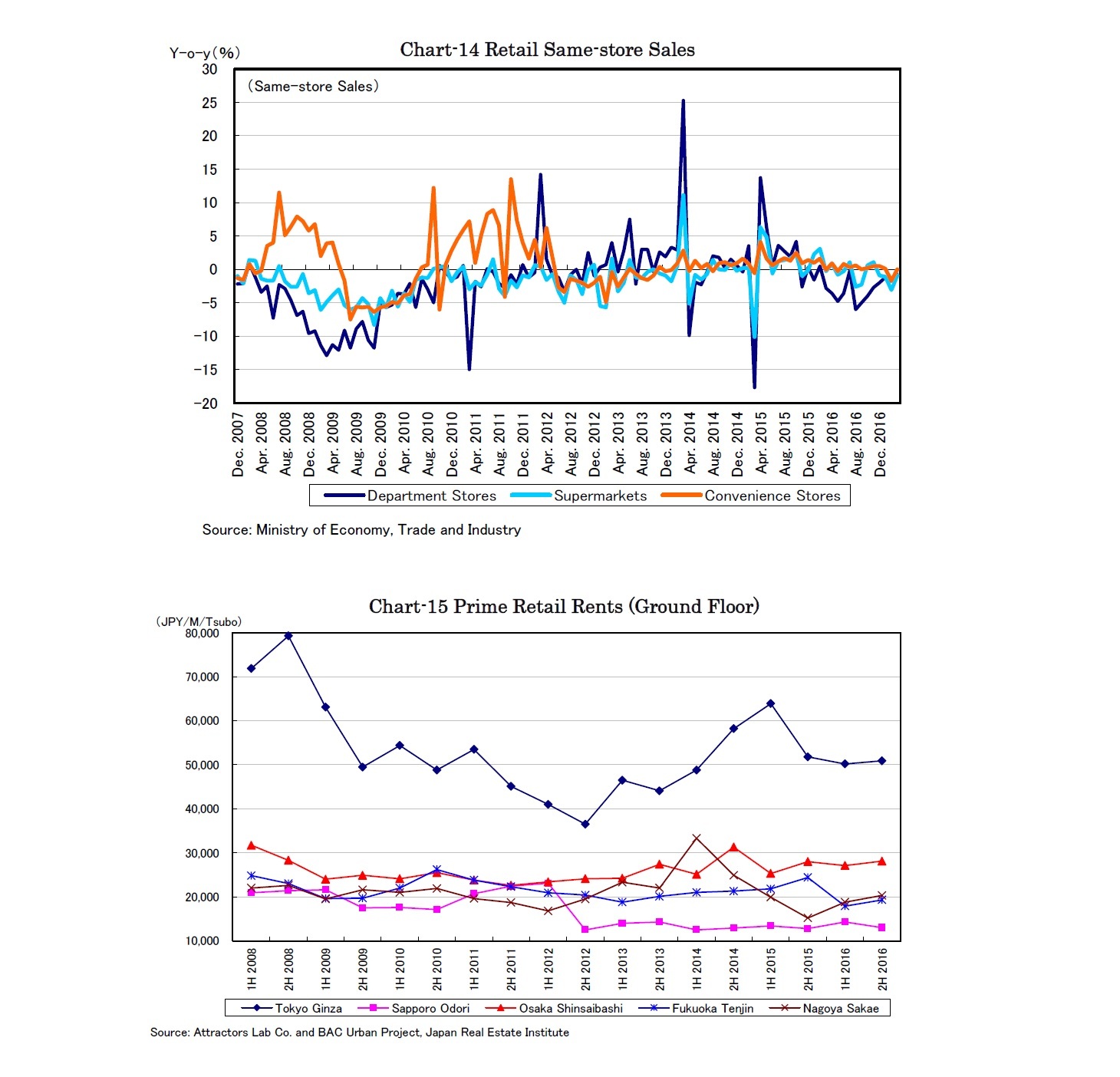

Same-store sales of department stores declined y-o-y for the thirteenth consecutive month, however, the pace of decline moderated in the first quarter (Chart-14). Those of supermarkets and convenience stores remained stable though shrinking somewhat y-o-y.

Prime retail rents in Tokyo Ginza remained mostly unchanged after declining from the peak in 2015 which was lower than that in 2008 (Chart-15). Prime retail rents in other major cities have been stable.

Eriko Kato

Research field

Social media account

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング