- NLI Research Institute >

- Real estate >

- Japanese Property Market Quarterly Review, Fourth Quarter 2016-J-REITs Appreciate by 6% and Record Third Largest Yearly Acquisition Amount in 2016-

06/02/2017

Japanese Property Market Quarterly Review, Fourth Quarter 2016-J-REITs Appreciate by 6% and Record Third Largest Yearly Acquisition Amount in 2016-

Financial Research Department Economic Research Department Researcher Hiroto Iwasa

Font size

- S

- M

- L

3) Retail, Hotel and Logistics

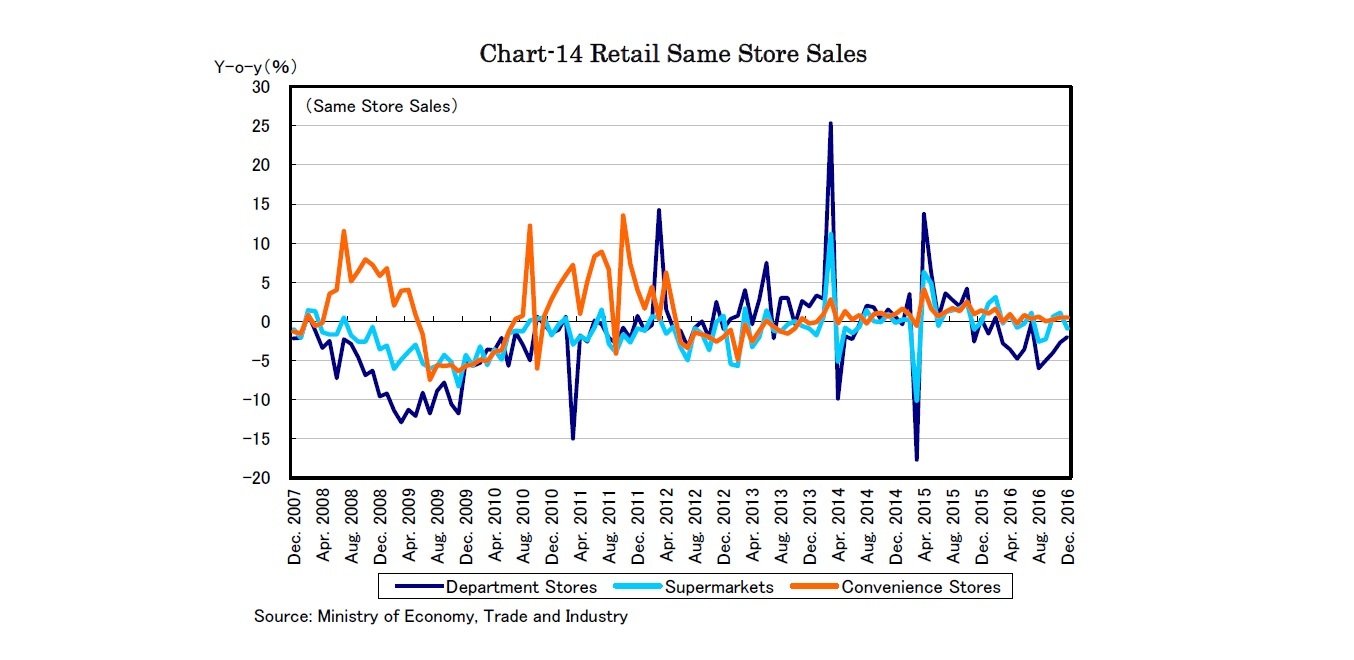

Same store sales of department stores shrank by 2.8% y-o-y, however, those of supermarkets and convenience stores increased by 0.2% and 0.4% y-o-y in the fourth quarter (Chart-14). For the whole year 2016, same store sales of department stores shrank by 2.9% y-o-y and those of supermarkets and convenience stores increased by 0.1% and 0.5% y-o-y, respectively. Stagnant apparel sales and normalizing inbound demand have impacted department stores, while supermarket stores and convenience stores have remained stable.

Same store sales of department stores shrank by 2.8% y-o-y, however, those of supermarkets and convenience stores increased by 0.2% and 0.4% y-o-y in the fourth quarter (Chart-14). For the whole year 2016, same store sales of department stores shrank by 2.9% y-o-y and those of supermarkets and convenience stores increased by 0.1% and 0.5% y-o-y, respectively. Stagnant apparel sales and normalizing inbound demand have impacted department stores, while supermarket stores and convenience stores have remained stable.

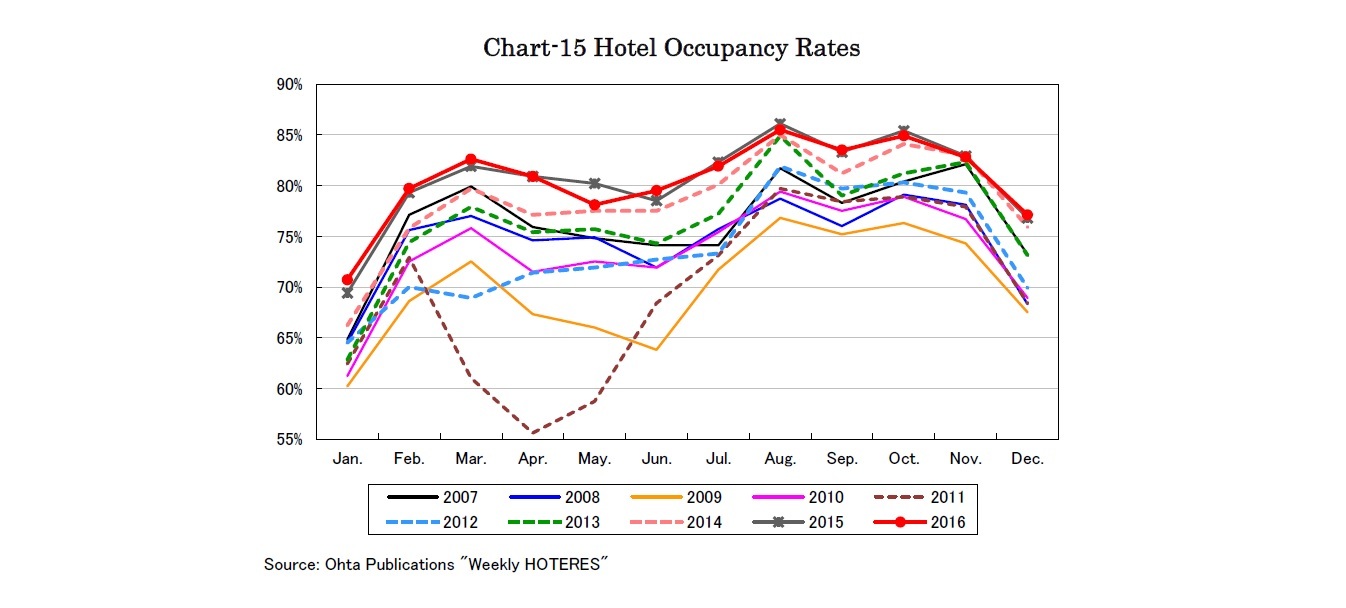

Occupancy rates of hotels in 61 cities across the nation increased by 0.3% y-o-y to 77.0% in December. Though remaining at high levels, occupancy rates posted negative y-o-y changes in several months during 2016 (Chart-15).

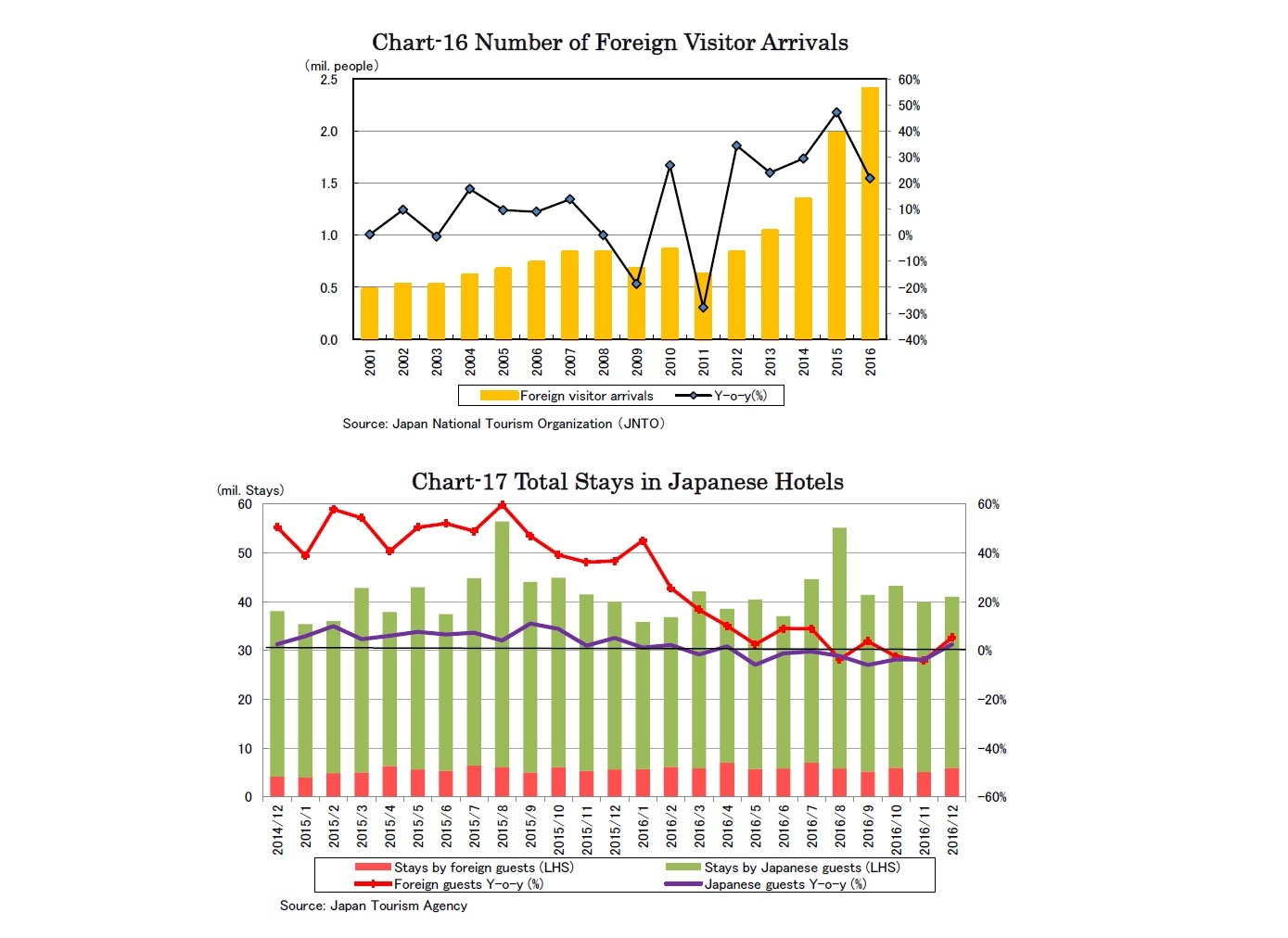

Foreign visitor arrivals increased by 22% to 24.03 million in 2016 for the fourth consecutive record-setting year (Chart-16). Visitor arrivals from 20 major countries excluding Russia posted record highs supported by several factors such as increased cruise services, active promotions to Japan and loosened visa issuance conditions. However, total stays by foreign visitors increased by only 8.5% (Chart-17) and consumption in Japan increased by 8.0% to 3.7 trillion JPY, with consumption per foreign visitor declining by 11% y-o-y to 156k JPY, particularly consumption per Chinese visitor shrinking by 18% y-o-y.

The recent JPY depreciation apparently supports the hotel demand. However, the development of legislation on private accommodations operated through Airbnb and other services and the increasing number of hotel developments will have a considerable impact on the hotel market.

Foreign visitor arrivals increased by 22% to 24.03 million in 2016 for the fourth consecutive record-setting year (Chart-16). Visitor arrivals from 20 major countries excluding Russia posted record highs supported by several factors such as increased cruise services, active promotions to Japan and loosened visa issuance conditions. However, total stays by foreign visitors increased by only 8.5% (Chart-17) and consumption in Japan increased by 8.0% to 3.7 trillion JPY, with consumption per foreign visitor declining by 11% y-o-y to 156k JPY, particularly consumption per Chinese visitor shrinking by 18% y-o-y.

The recent JPY depreciation apparently supports the hotel demand. However, the development of legislation on private accommodations operated through Airbnb and other services and the increasing number of hotel developments will have a considerable impact on the hotel market.

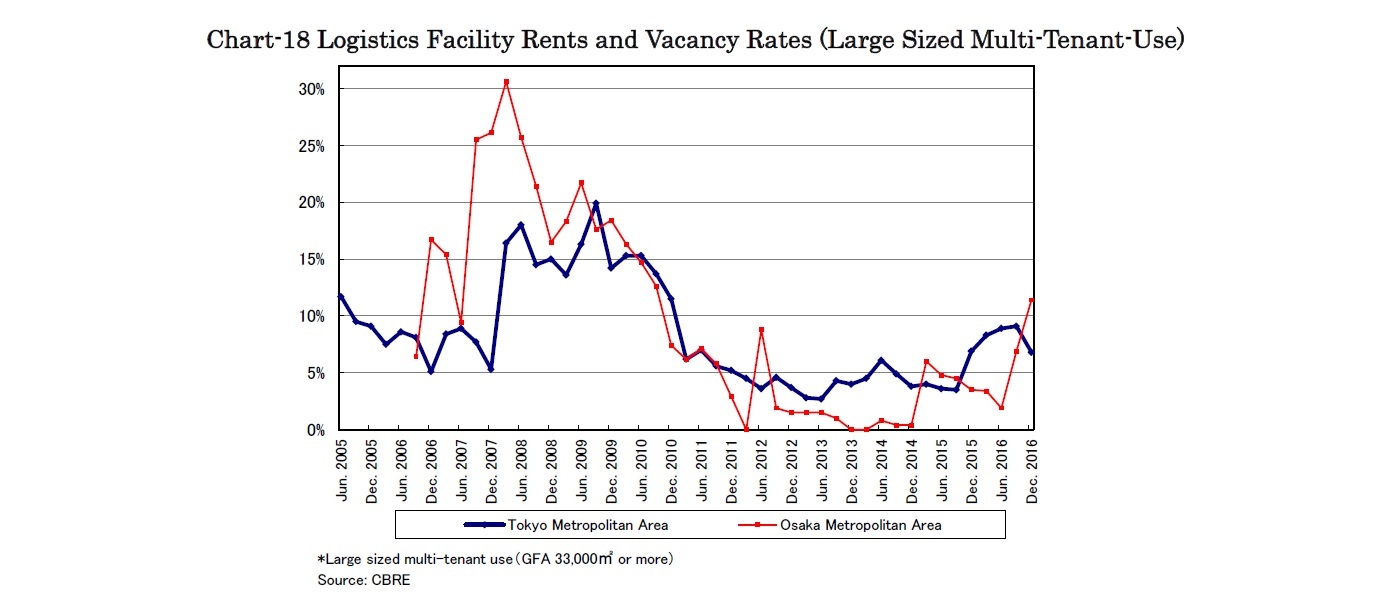

According to CBRE, vacancy rates of large logistics facilities for multi-tenants in the Tokyo metropolitan area improved by 2.3% q-o-q to 6.8%, while those in the Osaka metropolitan area deteriorated by 4.5% q-o-q to 11.4% (Chart-18).

The vacancy rates will remain high in areas where glut of new supply appear such as Ken-O-Do in the Tokyo metropolitan area and the bay-area in the Osaka metropolitan area, despite strong demand for advanced logistics facilities.

According to Ichigo Real Estate Service, logistics rents in the Tokyo metropolitan areas rose by 3.5% q-o-q to 4,140 JPY per month per tsubo in October.

The vacancy rates will remain high in areas where glut of new supply appear such as Ken-O-Do in the Tokyo metropolitan area and the bay-area in the Osaka metropolitan area, despite strong demand for advanced logistics facilities.

According to Ichigo Real Estate Service, logistics rents in the Tokyo metropolitan areas rose by 3.5% q-o-q to 4,140 JPY per month per tsubo in October.

03-3512-1858

Social media account

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング