- NLI Research Institute >

- Real estate >

- Japanese Property Market Quarterly Review, Third Quarter 2016-Inbound Demand Peaks Out Affecting Retail Stores and Hotels-

Japanese Property Market Quarterly Review, Third Quarter 2016-Inbound Demand Peaks Out Affecting Retail Stores and Hotels-

mamoru masumiya

Font size

- S

- M

- L

3.Sub-sectors

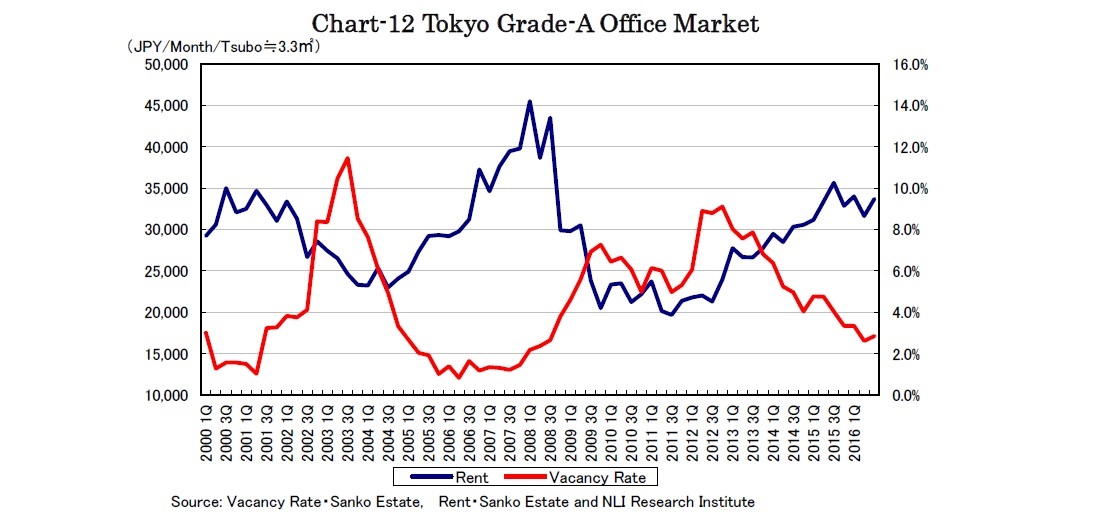

Vacancy rates of Tokyo grade-A1 offices and very large-sized offices in the Tokyo major three wards deteriorated by 0.3% and 0.5% q-o-q to 2.9% and 2.6% respectively in the third quarter, (Chart-12) affected by the completion of Sumitomo Fudosan Roppongi Grand Tower with about a 60% occupancy rate. The office rent index of Tokyo grade-A offices grew by 6.5% q-o-q to 33,703 JPY, however, and appears to be rebounding in a downward trend from the third quarter 2015.

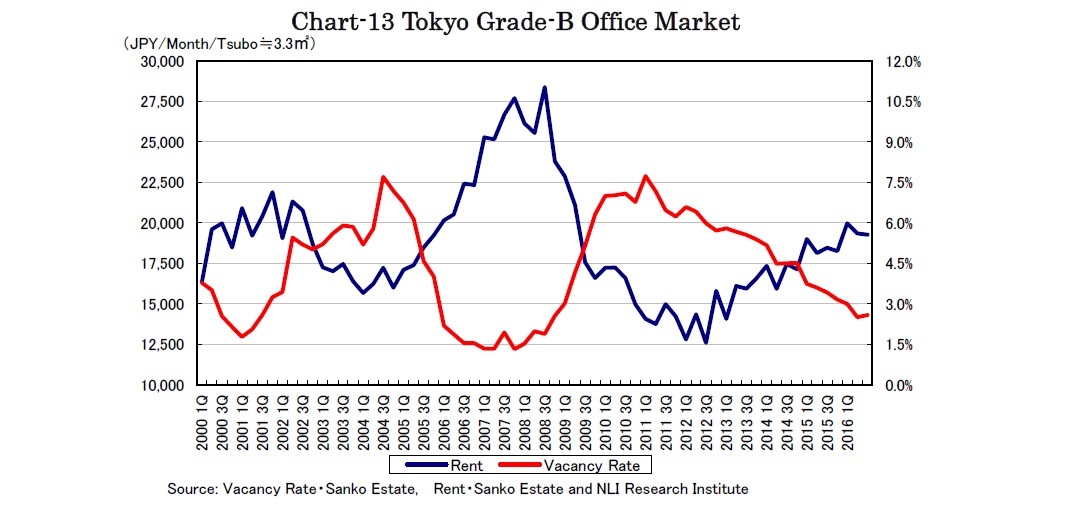

The new grade A office supply affected the grade B office market as well, deteriorating vacancy rates by 0.1% q-o-q to 2.65% and pushing the rent index to decline by 0.4% q-o-q to 19,273 JPY (Chart-13).

The current grade-A office demand mainly relies on moves relating to group consolidations. Companies considering group consolidation do not have to move immediately and tend to wait for the next supply swelling from 2018. Thus, even at very low vacancy rates, office rents have declined in advance of vacancy rate increase.

1 Higher-spec buildings within the very large sized category by Sanko Estate Grade-A-Office Guidelines, urban area Tokyo five wards, main office areas and other specially integrated areas, with total floor areas of more than 33,000 m2, main floor sizes of more than 990 m2, building age of 15 years or less (including some well-refurbished older buildings), facilities with ceiling heights of 2.7m or more, individual air-conditioning, earthquake resistance and environmental friendliness.

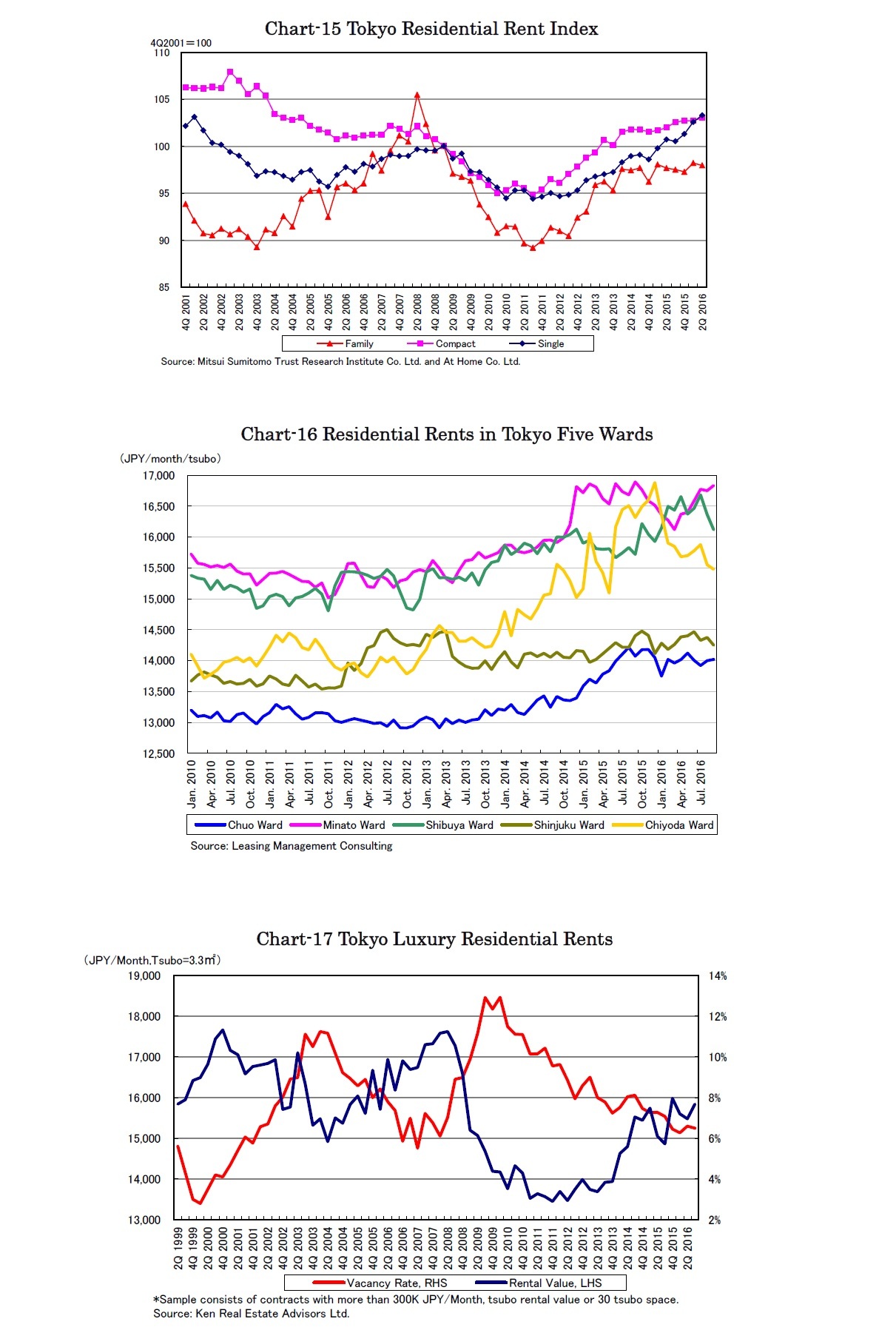

Tokyo residential rents have still been on a rising trend, though at a slower pace, since 2014. Contrary to family and compact type residential rents rising at a milder pace, single type rents which had underperformed before have recently accelerated and risen (Chart-15).

In the center of Tokyo, residential rents in Chiyoda ward where rents had increased overwhelmingly for years have shown a noticeable decline (Chart-16).

Regarding the Tokyo luxury residential market, rents have fluctuated and vacancy rates stopped improving (Chart-17). The number of foreign residents in Tokyo increased for the third consecutive year in 2015, however, the number in Minato ward increased by only 1.6% y-o-y compared with 8.6% overall for Tokyo in July.

mamoru masumiya

Research field

Social media account

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング