- NLI Research Institute >

- Real estate >

- Japanese Property Market Quarterly Review, Third Quarter 2016-Inbound Demand Peaks Out Affecting Retail Stores and Hotels-

Japanese Property Market Quarterly Review, Third Quarter 2016-Inbound Demand Peaks Out Affecting Retail Stores and Hotels-

mamoru masumiya

Font size

- S

- M

- L

1.Economy and Housing Market

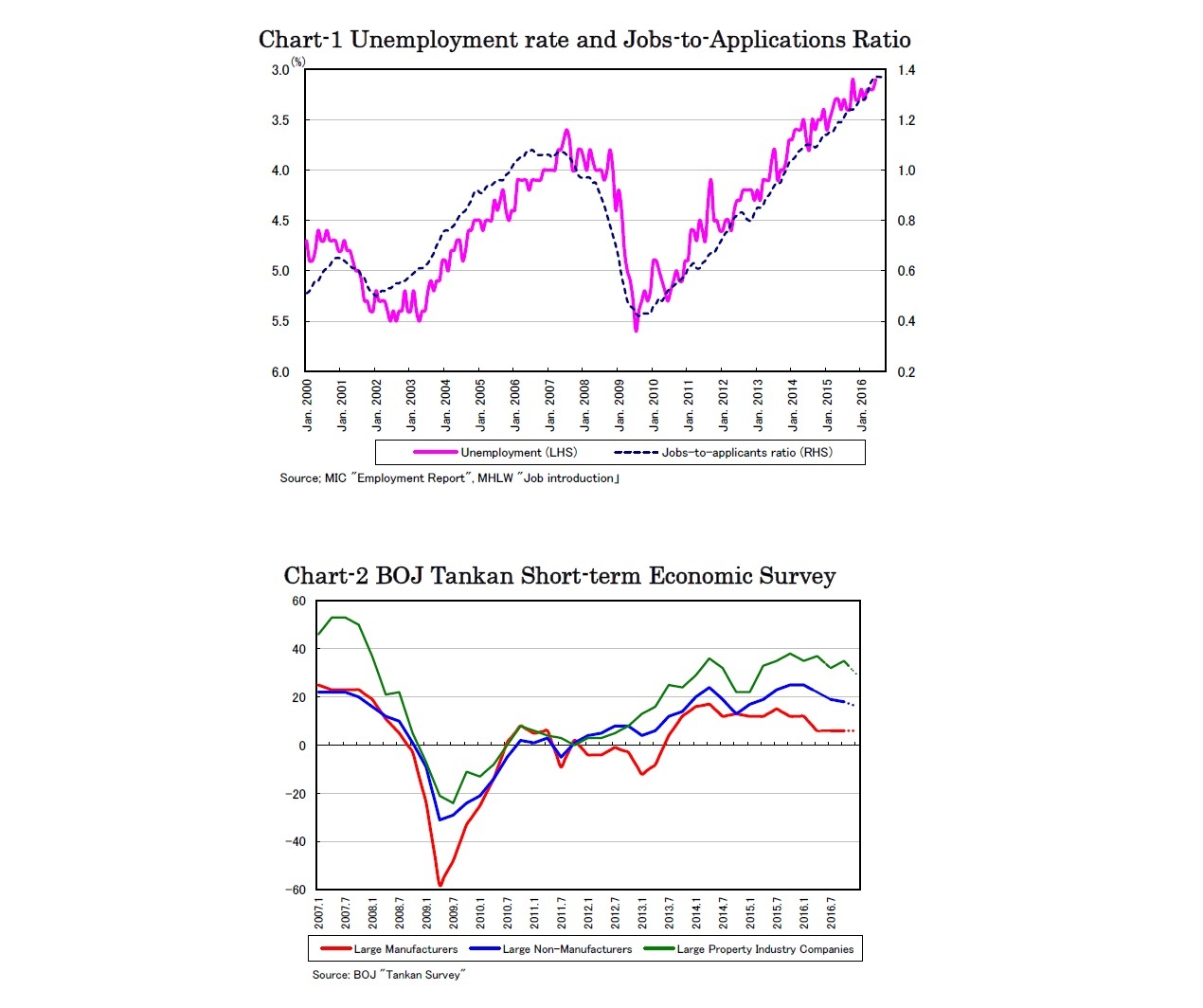

Positive GDP growth is expected to continue for the moment backed by the recovery in private consumption given the good employment environment (Chart-1), though net exports will not be reliable affected by uncertain global economic conditions. In the BOJ Tankan Survey in the third quarter of 2016, the D.I. of all three categories, large manufacturers, large non-manufactures and large property industry companies, are forecasted to maintain certain positive degrees in the fourth quarter (Chart-2).

NLI Research Institute revised its Japanese GDP growth forecast up by 0.2% to +0.9% for the fiscal year 2016 and forecasts +0.7% for 2017, reflecting the latest numbers from the Cabinet Office.

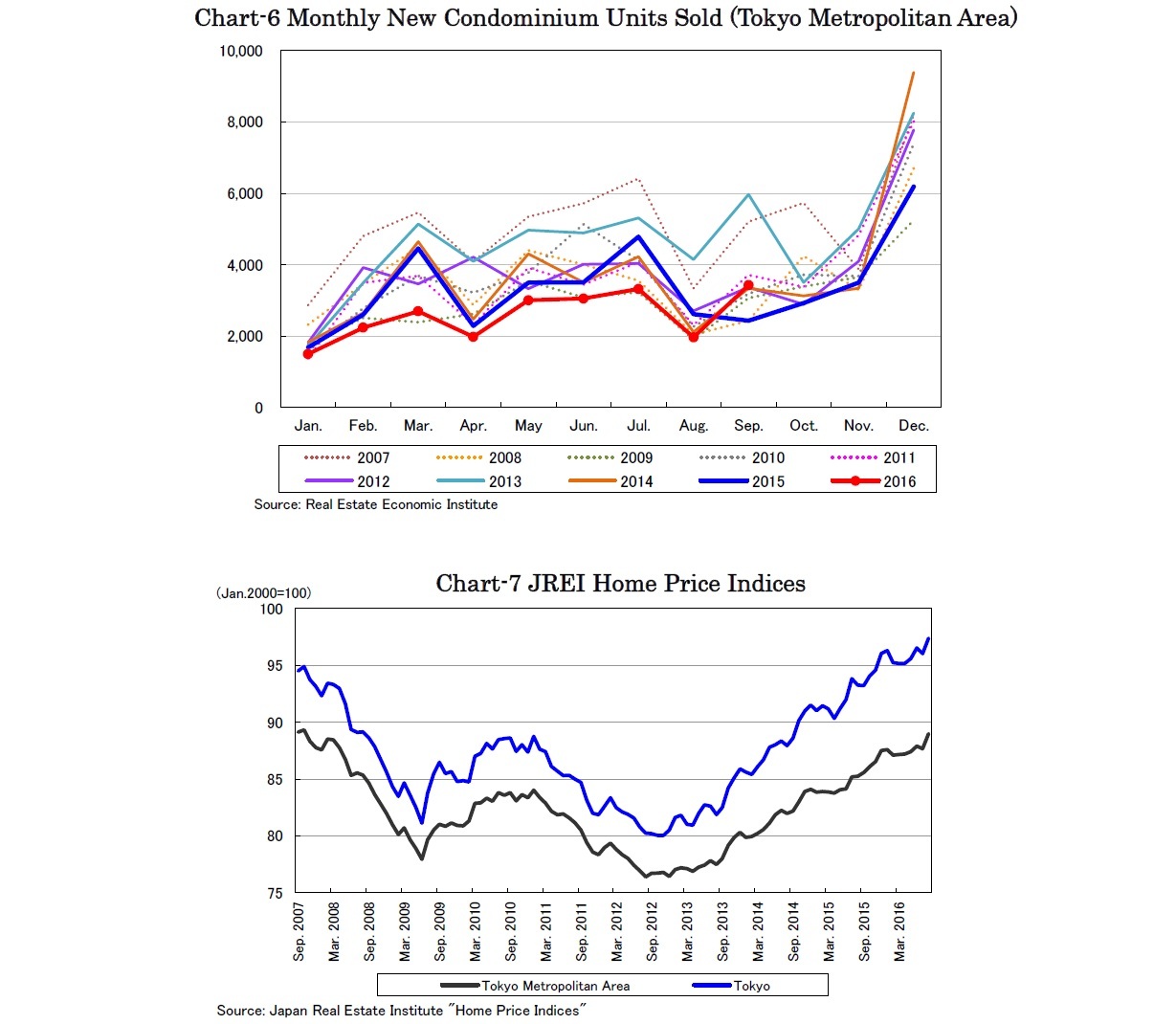

Condominium prices in the secondary market continued to rise as the average unit price in the Tokyo metropolitan area rose by 5.7% y-o-y to 31.3 million JPY in September, according to Real Estate Information Network Systems. Furthermore, Japan Real Estate Institute Home Price Indices, the repeat sales method index, also continued to rise (Chart-7).

mamoru masumiya

Research field

Social media account

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング