- NLI Research Institute >

- Real estate >

- Japanese Property Market Quarterly Review,Second Quarter 2016-While Housing Starts Robust, Office and Retail Rents Peak Out-

Japanese Property Market Quarterly Review,Second Quarter 2016-While Housing Starts Robust, Office and Retail Rents Peak Out-

Kazumasa Takeuchi

Font size

- S

- M

- L

1.Economic Conditions

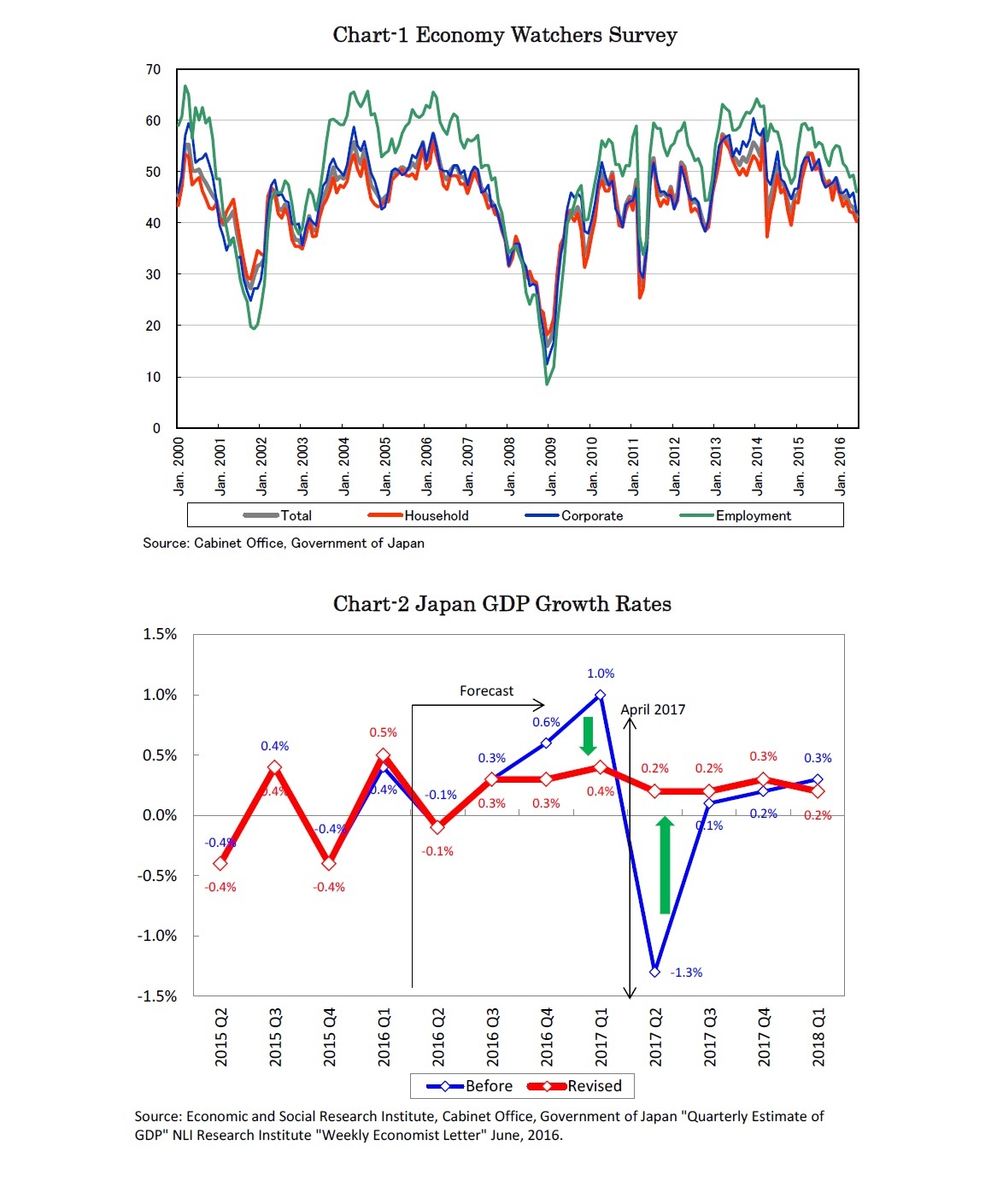

On June 1, the government decided to reschedule the next consumption tax rate hike from 8% to 10% again from April 2017 to October 2019. Considering the disappearance of the anticipated tax hike related rush demand in 2016 and the counteractive slowdown in 2017, NLI Research Institute revised its real GDP growth forecast from +0.9% to +0.6% for 2016 and from 0.0% to +1.1% for 2017 (Chart-2)

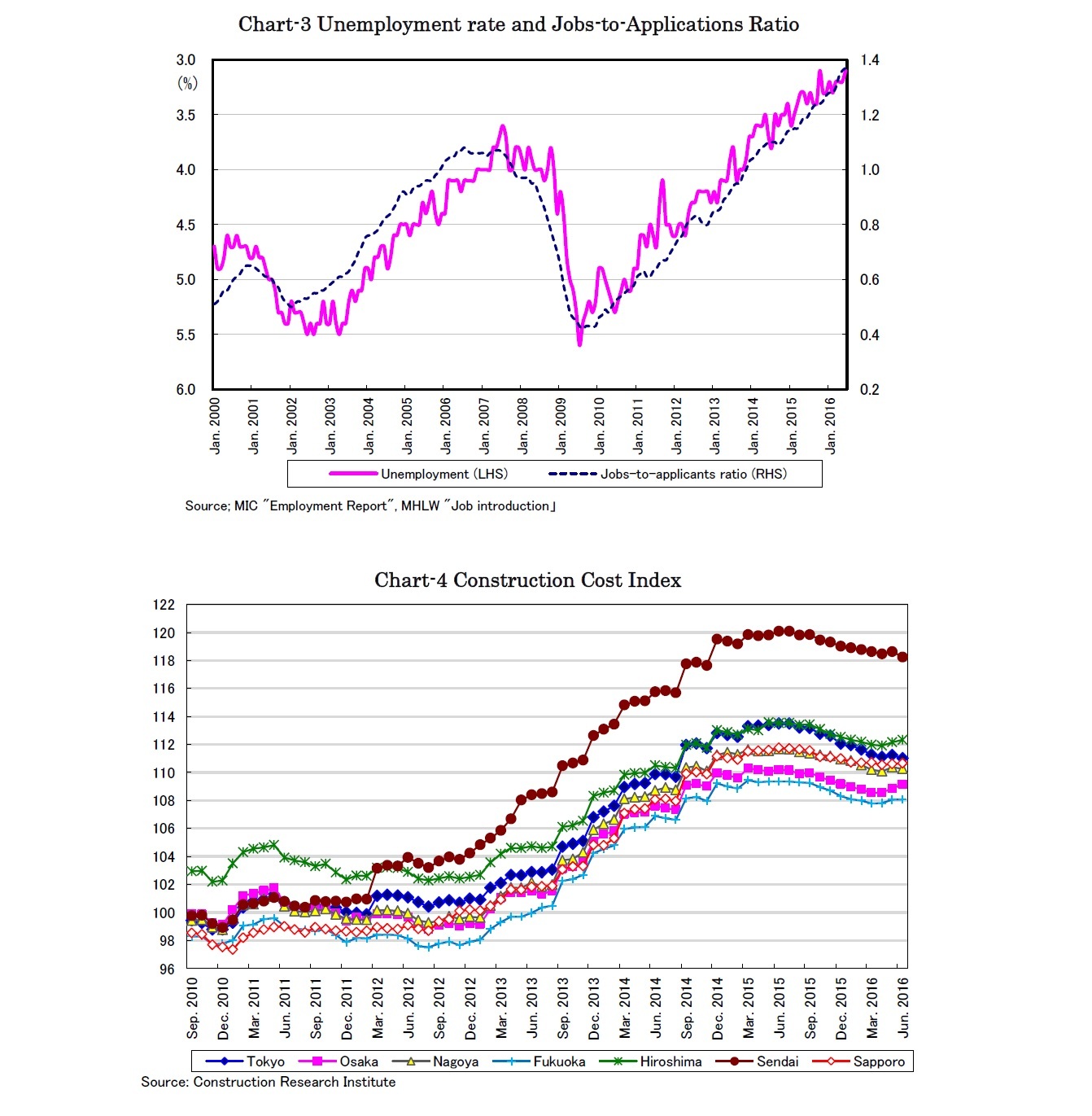

2.Eased Labor Shortage and High Construction Costs

Kazumasa Takeuchi

Research field

Social media account

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング