- NLI Research Institute >

- Real estate >

- Japanese Property Market Quarterly Review, First Quarter 2016 -Office Rents Rise Again, Foreign Visitor Arrivals Boost Hotels and Land Prices-

Japanese Property Market Quarterly Review, First Quarter 2016 -Office Rents Rise Again, Foreign Visitor Arrivals Boost Hotels and Land Prices-

Eriko Kato

Font size

- S

- M

- L

- Japan’s real GDP grew only 0.7% with a lack of vigor in private consumption in 2015. While housing starts have recovered, the number of new condominium units sold are decreasing and the average price has been rising in the Tokyo metropolitan area. In “Kouji Chika” the average national land price appreciated y-o-y for the first time in eight years and the ratio of appreciating monitoring sites continuously increased.

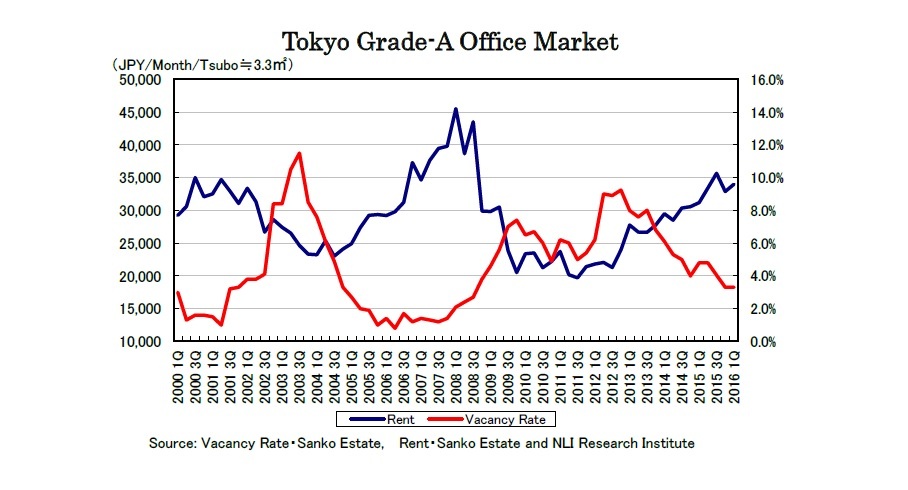

- The rents of Tokyo Grade-A offices rose again in the first quarter after a dip affected by the large supply in the fourth quarter. Office vacancy rates remained low at 3.3%, however, finding a tenant seems time-consuming at the current high rent levels. Residential rents in Tokyo except Shibuya ward have apparently stopped rising. Foreign visitor arrivals in the past twelve months have reached 20 million since January and hotels have maintained high occupancy rates. Logistics vacancy rates rose on the large supply in the Tokyo metropolitan area despite healthy demand for large logistics facilities.

- The TSE REIT Index rose by 8.5% in the first quarter, affected by the decline of bond yields following the announcement of the negative interest rate policy by the Bank of Japan. The pace of property acquisition by J-REITs accelerated again after the significant slowdown in the fourth quarter.

1.Economy and Housing Market

2.Land Prices

3.Sub-sectors

1)Office

2)Residential Rental

3)Retail, Hotel and Logistics

4.J-REIT and Property Investment Markets

Eriko Kato

Research field

Social media account

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング