- NLI Research Institute >

- Real estate >

- Cross Border Capital Flows into Japanese Properties in 2015-Risk-Off Sentiment Restrains Property Transactions-

Cross Border Capital Flows into Japanese Properties in 2015-Risk-Off Sentiment Restrains Property Transactions-

mamoru masumiya

Font size

- S

- M

- L

1.Transaction Volume of Japanese Properties

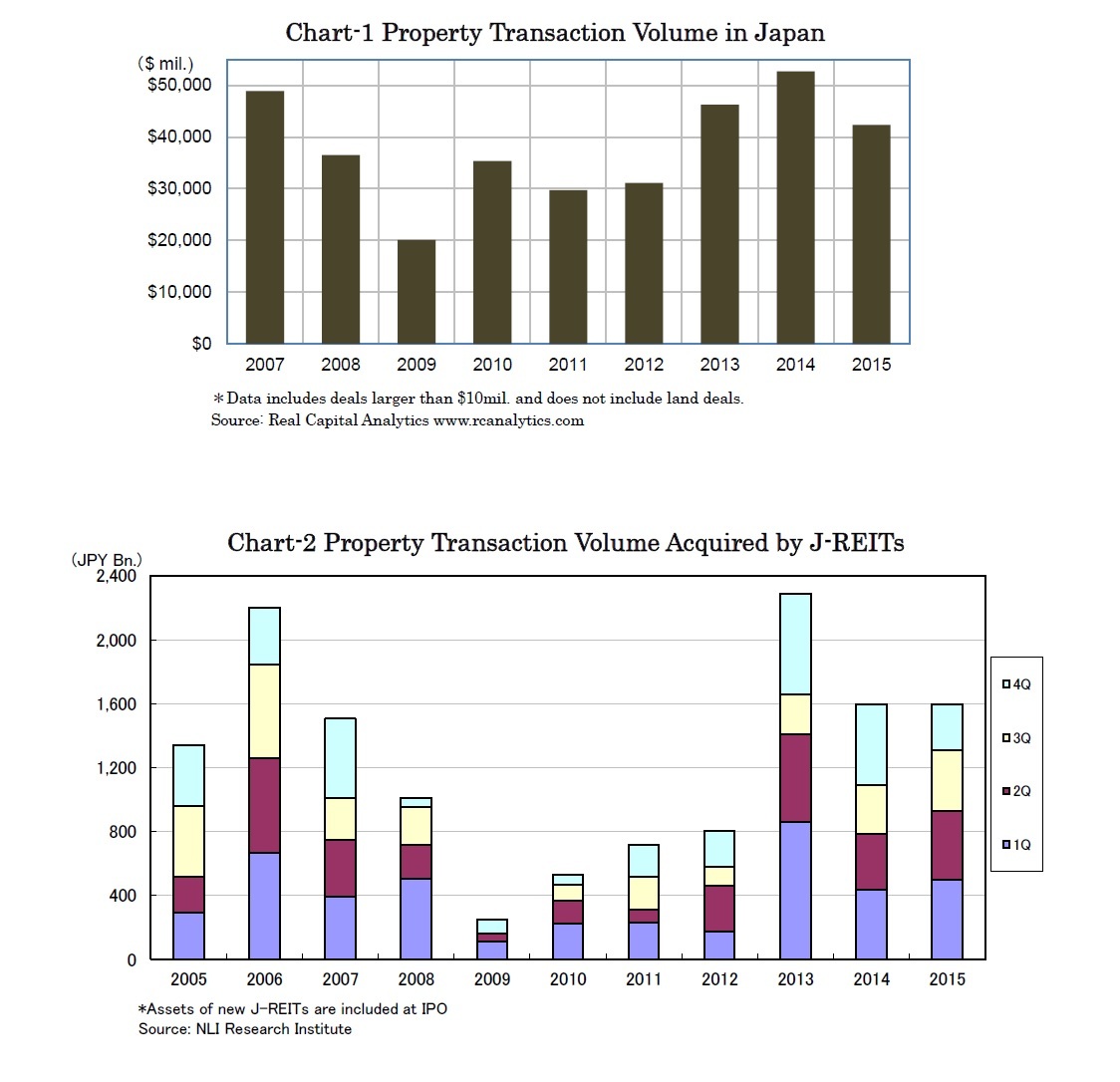

The transaction volume of Japanese properties shrank for the first time in four years in 2015. According to Real Capital Analytics, the transaction volume of Japanese properties shrank by about 20% to 42.4 billion USD in 2015 (Chart-1). Though the transaction volume remained above the ten year average, the recent increase trend ended in 2015. Considering that J-REITs, which mainly acquire properties internally from their sponsors, acquired no less in 2015 than in 2014, open transactions such as those in auctions apparently shrank by a significant amount.

It seems the transaction volume declined because few purchasers accepted offered-prices immediately in the risk-off sentiment while owners did not hurry to sell their properties with no other alternative measures to secure certain income yields.

2.Volume of Acquisitions by Cross Border Capital

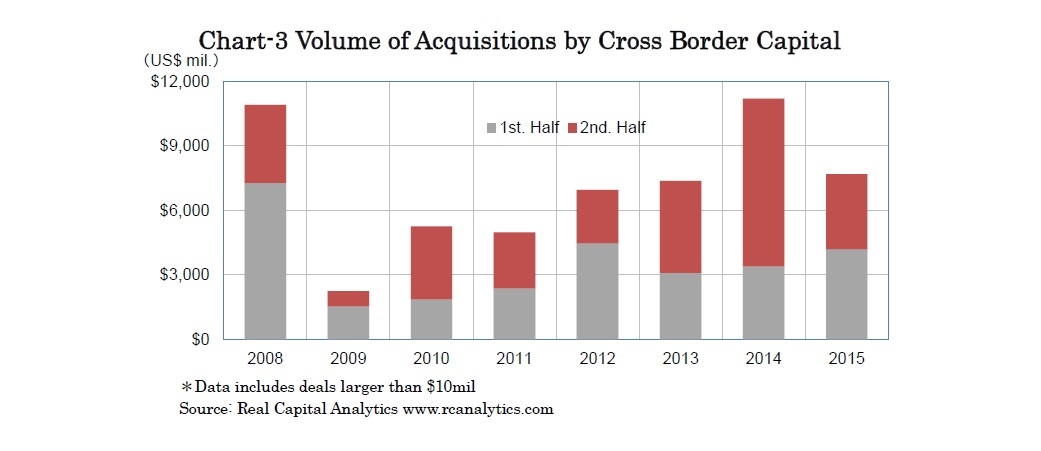

Cross border capital acquired USD 7,700 million of Japanese properties in 2015, declining by nearly 30% y-o-y (Chart-3).

The risk-off sentiment overshadowed cross border capital particularly in the second half of 2015. The volume of acquisitions exceeded that of the same period one year ago in the first half; however the volume fell short of even half of that of the same period one year ago in the second half of 2015.

Moreover, it should be noted that some large individual deals have had significant impacts on the volume number. For example, the largest deal in 2014, Government of Singapore Investment Corporation (GIC) acquiring Pacific Century Place, posted USD 1,700 million, while the largest deal in 2015, China Investment Corporation (CIC) acquiring Meguro Gajoen, posted USD 1,170 million. Just the gap of these two deals explains a volume decline of about USD 570 million.

3.Sector Preference

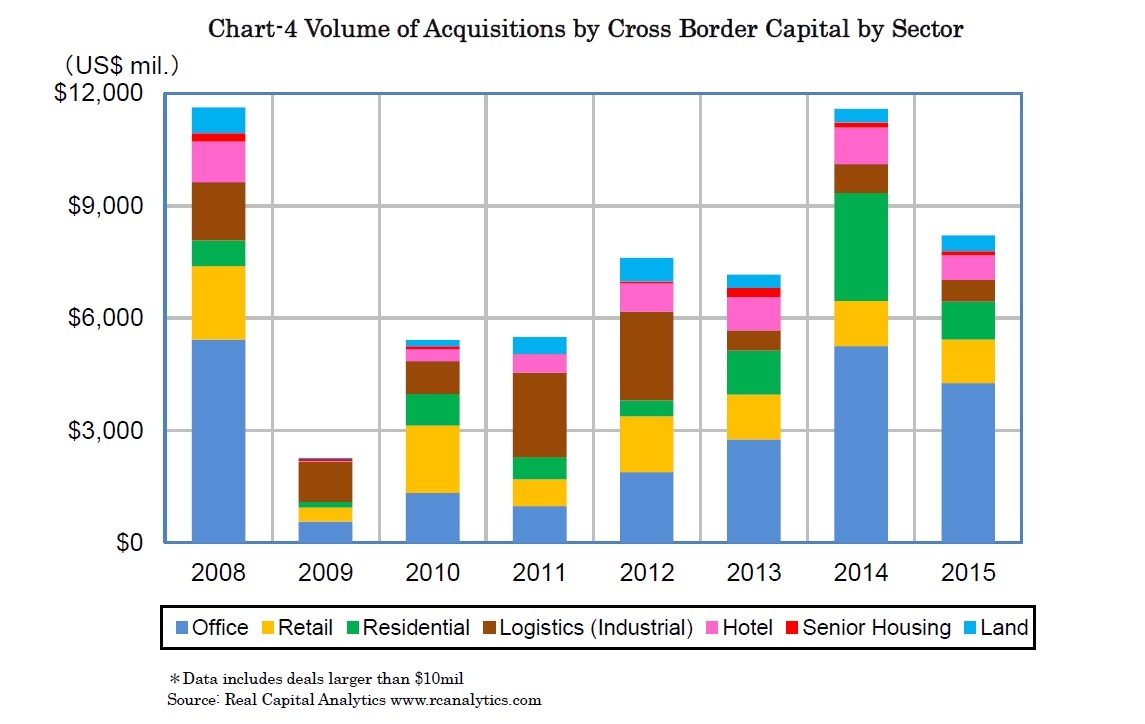

For instance, cross border capital acquired USD 660 million of Japanese hotels in 2015, declining by about 30% y-o-y. Though Japanese hotels recorded the highest occupancy rates through 2015 with nearly 20 million foreign visitor arrivals to Japan, cross border capital did not rush to acquire Japanese hotels.

The risk-off sentiment was particularly noticeable in the office sector which was mainly invested in by institutional investors. Cross border capital acquired USD 4,300 million of Japanese offices in 2015, declining by about 20% y-o-y. Cross border capital had become stagnant since the equity market plunge, and the volume of acquisitions stood at only USD 600 million over the four months through the end of 2015.

Moreover, cross border capital acquired USD 1,020 million of Japanese residential properties, declining by more than 60% y-o-y. The volume of acquisitions shrank significantly because Blackstone had acquired a huge residential portfolio totaling USD 1,440 million in 2014. However the volume of acquisitions in 2015 fell short of even that of 2013.

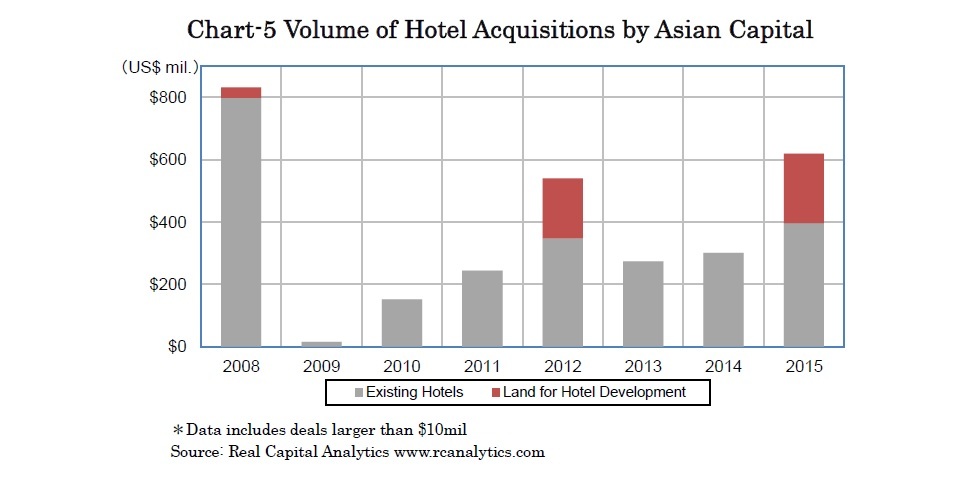

What is more noticeable is that Asian capital acquired Japanese land for hotel development (Chart-5). Asian capital has been diversifying in hotel businesses in Japan, as Hong Kong based Great Eagle acquired land in Roppongi for developing a hotel under its own brand, Langham.

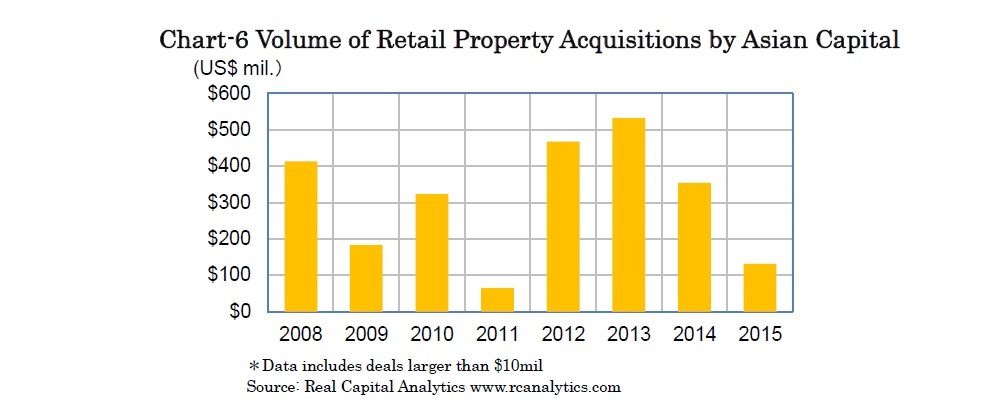

In the matured and competitive Japanese consumer market, managing retail properties requires sophisticated skills. Well-experienced property funds in the U.S. sometimes acquire Japanese retail properties and western retail chains and luxury brands do so for their own stores. On the other hand, Asian capital rarely acquire Japanese retail properties, though Singapore or Hong Kong companies who have developed retail malls all over Asia are noticed occasionally.

mamoru masumiya

Research field

Social media account

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング