- NLI Research Institute >

- Real estate >

- Japanese Property Market Quarterly Review, First Quarter 2017-Focus on Coming Large Supply of Offices, Hotels and Logistics Facilities-

Japanese Property Market Quarterly Review, First Quarter 2017-Focus on Coming Large Supply of Offices, Hotels and Logistics Facilities-

Eriko Kato

Font size

- S

- M

- L

- Japan’s real GDP grew for the fifth consecutive quarter and business conditions are expected to remain stable backed by the recovery of corporate earnings and capital expenditure. While housing starts have modestly grown y-o-y, concerns about loans for building apartments for lease and mounting inventories of new condominiums have also increased. While the average national land price appreciated y-o-y for the second consecutive year, the number of sites where land prices appreciated did not increase q-o-q in the first quarter.

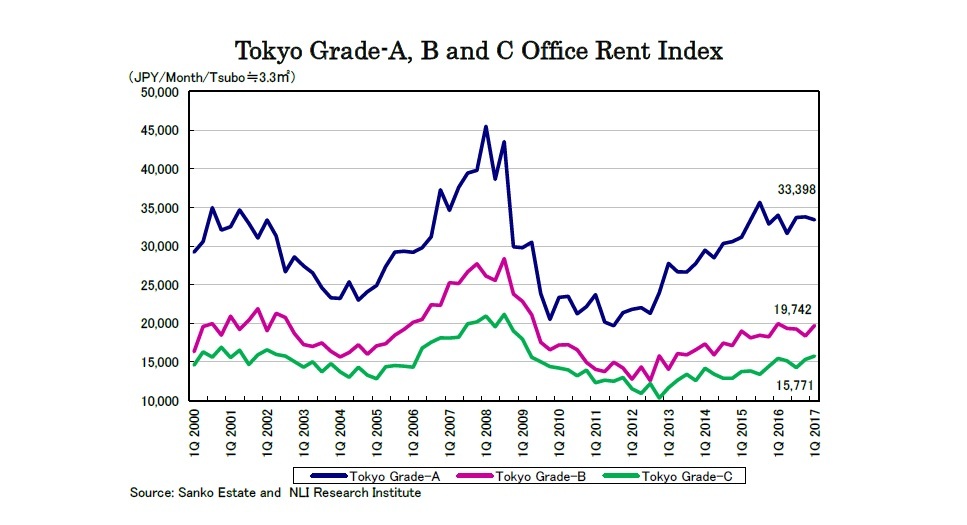

- The rents of Tokyo Grade-A1 offices declined 1.1% q-o-q in advance of large new supply starting from 2018. While hotel demand has been strong due to increasing foreign visitors, coming large new supply worries investors about certain areas and categories. Large new supply of logistics facilities has been considerably absorbed so far by strong demand.

- The TSE REIT Index declined by 4.3% in the first quarter. Despite the interest rate hike in the U.S., 10-year JGB yields have remained around 0% and debt funding conditions have been favorable.

■目次

1. Economy and Housing Market

2. Land Prices

3. Sub-sectors

1) Office

2) Residential Rental

3) Retail設

4) Hotel

5) Logistics Facility

4. J-REIT and Property Investment Markets

1 Sanko Estate Grade-A Office Guidelines: Located in urban area Tokyo five wards, main office areas or other specially integrated areas, with total floor area of more than 33,000 m2, main floor size of more than 990 m2, building age of 15 years or less

Eriko Kato

Research field

Social media account

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング