- NLI Research Institute >

- Real estate >

- Japanese Property Market Quarterly Review, Fourth Quarter 2016-J-REITs Appreciate by 6% and Record Third Largest Yearly Acquisition Amount in 2016-

06/02/2017

Japanese Property Market Quarterly Review, Fourth Quarter 2016-J-REITs Appreciate by 6% and Record Third Largest Yearly Acquisition Amount in 2016-

Financial Research Department Economic Research Department Researcher Hiroto Iwasa

Font size

- S

- M

- L

2.Land Prices

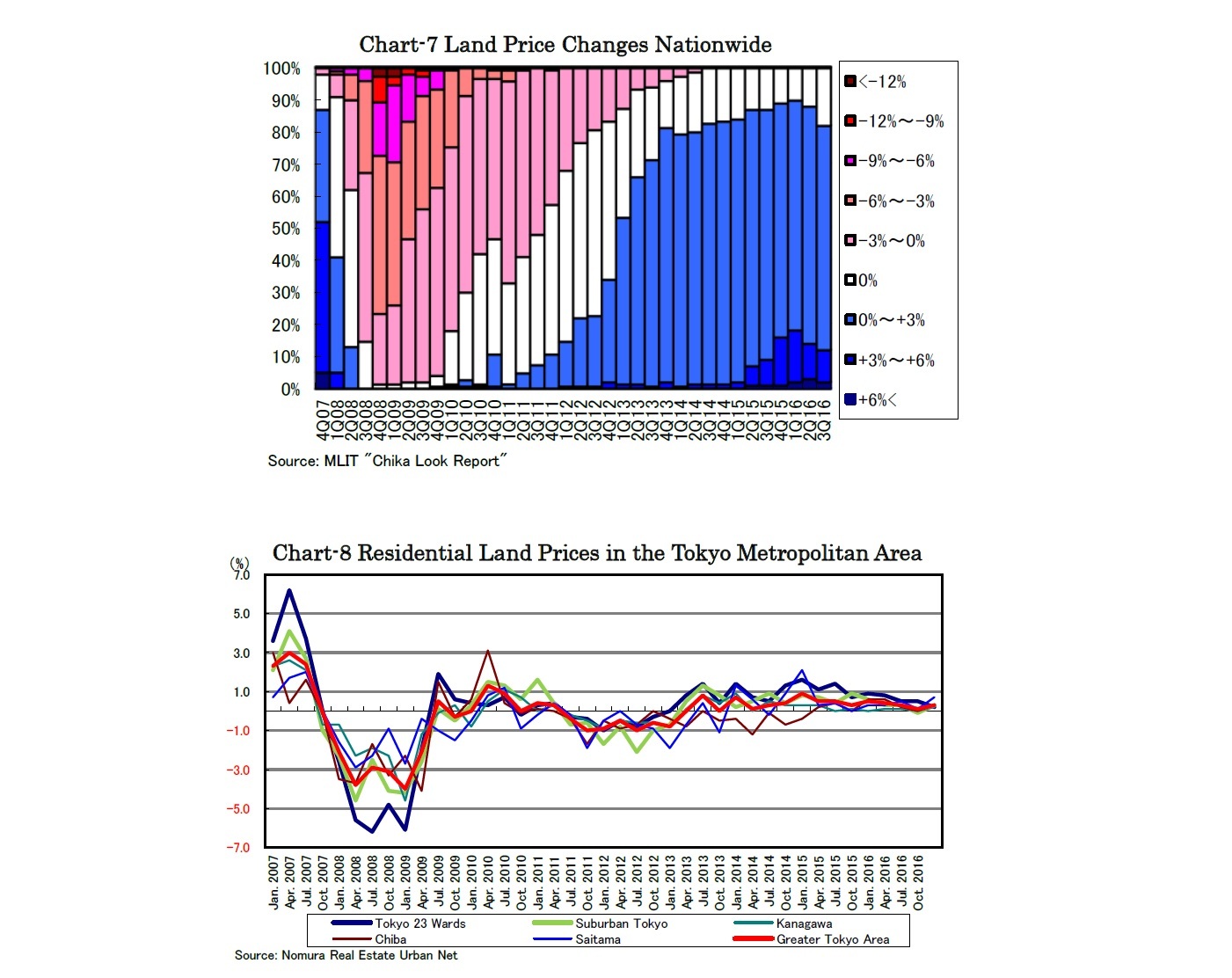

Land price appreciation has continued on the back of excess funds and progressing urban redevelopments. However, the stream has been lost in some areas. As shown in the MLIT’s “Chika look report,” the number of monitoring spots posting land price appreciation declined from 39 to 33 in the Tokyo metropolitan area (Chart-7). Despite this, the number in the Osaka metropolitan area remained high at 24 of all 25 monitoring spots, and all 9 monitoring spots in the Nagoya metropolitan area posted land price appreciation.

According to Nomura Real Estate Urban Net, residential land prices in the Tokyo metropolitan area appreciated by 0.3% q-o-q in the fourth quarter for the tenth consecutive quarter and by 1.2% y-o-y, led by those in Tokyo’s 23 wards appreciating by 2.1% y-o-y (Chart-8).

According to Nomura Real Estate Urban Net, residential land prices in the Tokyo metropolitan area appreciated by 0.3% q-o-q in the fourth quarter for the tenth consecutive quarter and by 1.2% y-o-y, led by those in Tokyo’s 23 wards appreciating by 2.1% y-o-y (Chart-8).

3.Sub-sectors

1) Office

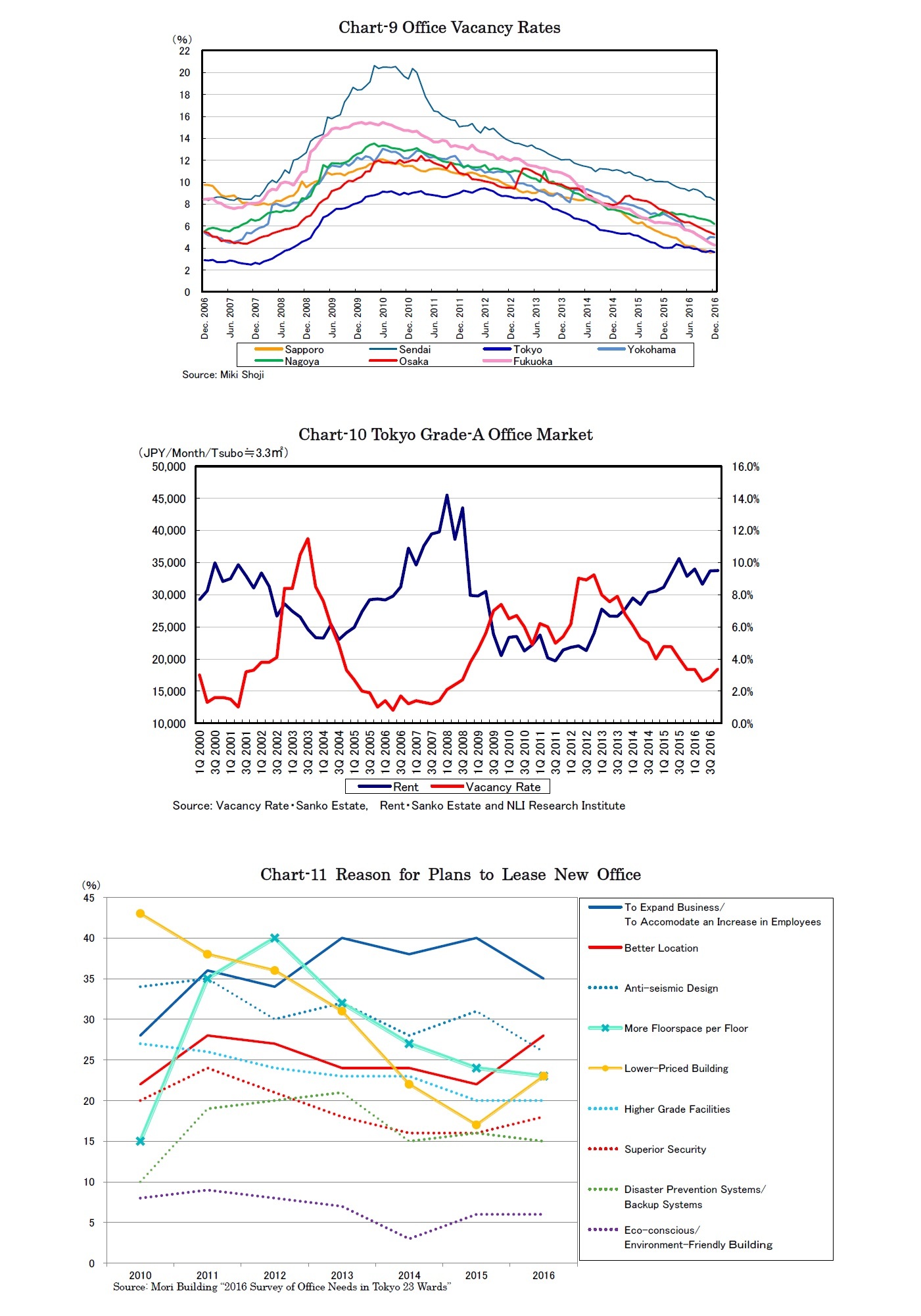

According to Miki Shoji, office vacancy rates in the five central wards of Tokyo improved by 0.14% to 3.61% and the average office rent rose by 4.8% y-o-y in December. While the office rents in Tokyo have risen at the pace of 4 or 5% y-o-y supported by low vacancy rates, office rents in local cities have risen at higher paces than in Tokyo with limited new supply (Chart-9).

The rent index of Tokyo grade-A1 offices slightly rose by 0.2% q-o-q to 33,785 JPY per month per tsubo in the fourth quarter (Chart-10). As the rents apparently peaked out in the third quarter of 2015, finding new tenants for grade-A offices has recently become increasingly time-consuming. In the Mori Building’s “2016 Survey of Office Needs in Tokyo 23 Wards,” when asked of the reasons for plans to lease new office space, “Lower Rent” responses increased for the first time since 2010, following “To expand Business/ To Accommodate an Increase in Employees” responses ranking first.

According to Miki Shoji, office vacancy rates in the five central wards of Tokyo improved by 0.14% to 3.61% and the average office rent rose by 4.8% y-o-y in December. While the office rents in Tokyo have risen at the pace of 4 or 5% y-o-y supported by low vacancy rates, office rents in local cities have risen at higher paces than in Tokyo with limited new supply (Chart-9).

The rent index of Tokyo grade-A1 offices slightly rose by 0.2% q-o-q to 33,785 JPY per month per tsubo in the fourth quarter (Chart-10). As the rents apparently peaked out in the third quarter of 2015, finding new tenants for grade-A offices has recently become increasingly time-consuming. In the Mori Building’s “2016 Survey of Office Needs in Tokyo 23 Wards,” when asked of the reasons for plans to lease new office space, “Lower Rent” responses increased for the first time since 2010, following “To expand Business/ To Accommodate an Increase in Employees” responses ranking first.

1 Higher-spec buildings within the very large sized category by Sanko Estate Grade-A-Office Guidelines, urban area Tokyo five wards, main office areas and other specially integrated areas, with total floor areas of more than 33,000 m2, main floor sizes of more than 990 m2, building age of 15 years or less (including some well-refurbished older buildings), facilities with ceiling heights of 2.7m or more, individual air-conditioning, earthquake resistance and environmental friendliness.

2) Residential Rental

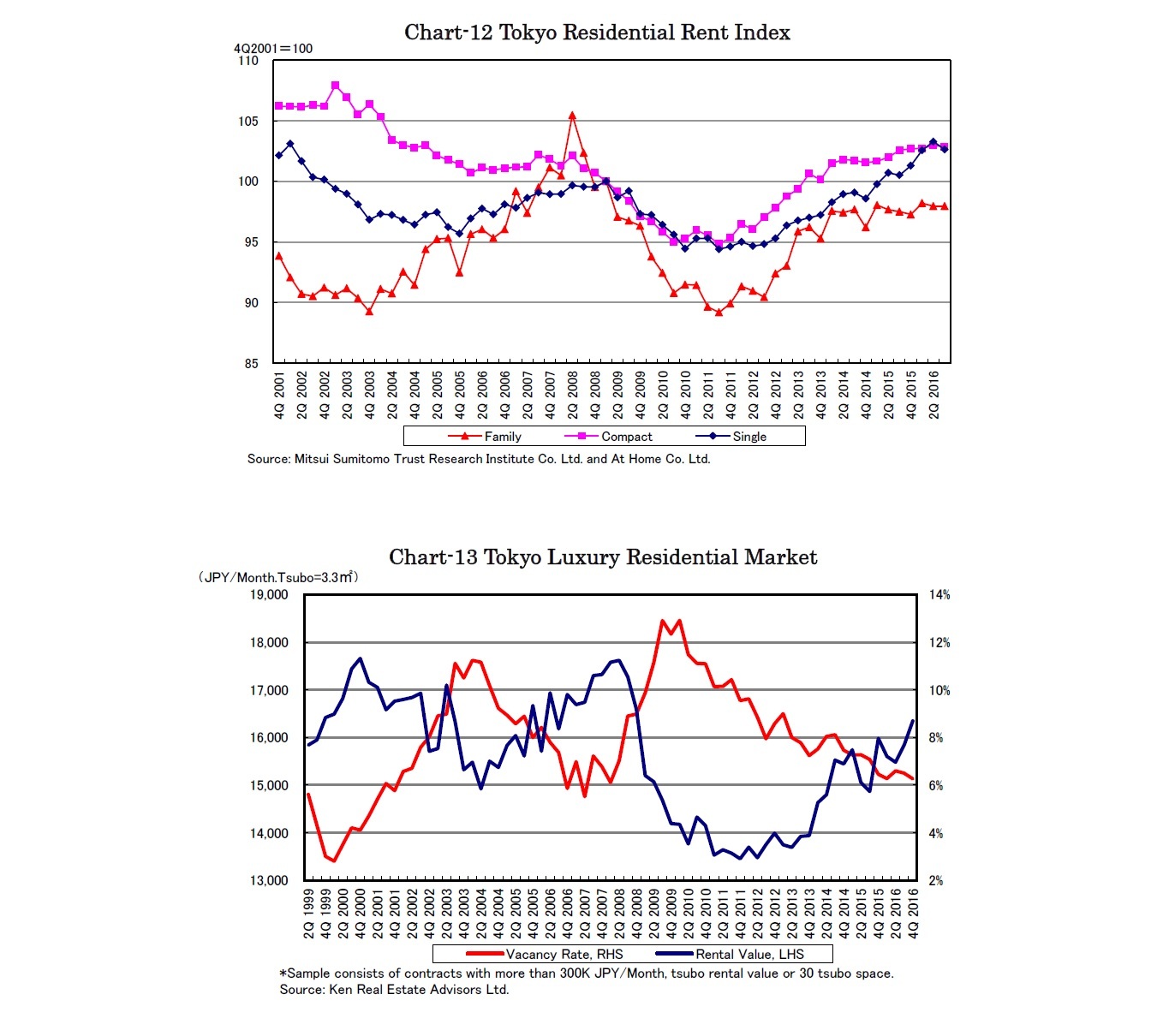

Though declining somewhat q-o-q in the third quarter, it appears residential rents in Tokyo’s 23 wards have still been on the ascending trend, as single-type, compact type and family type rose by 2.1%, 0.3% and 0.5% y-o-y, respectively (Chart-12).

On the other hand, Tokyo luxury residential rents rose strongly by 2.3% y-o-y to 16,346 JPY per month per tsubo on the back of improving vacancy rates in December (Chart-13).

Though declining somewhat q-o-q in the third quarter, it appears residential rents in Tokyo’s 23 wards have still been on the ascending trend, as single-type, compact type and family type rose by 2.1%, 0.3% and 0.5% y-o-y, respectively (Chart-12).

On the other hand, Tokyo luxury residential rents rose strongly by 2.3% y-o-y to 16,346 JPY per month per tsubo on the back of improving vacancy rates in December (Chart-13).

03-3512-1858

Social media account

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング