- NLI Research Institute >

- Real estate >

- Interest Rate Concerns Emerge, Property Prices Forecasted to Decline after Going Sideways~The Thirteenth Japanese Property Market Survey~

Interest Rate Concerns Emerge, Property Prices Forecasted to Decline after Going Sideways~The Thirteenth Japanese Property Market Survey~

mamoru masumiya

Font size

- S

- M

- L

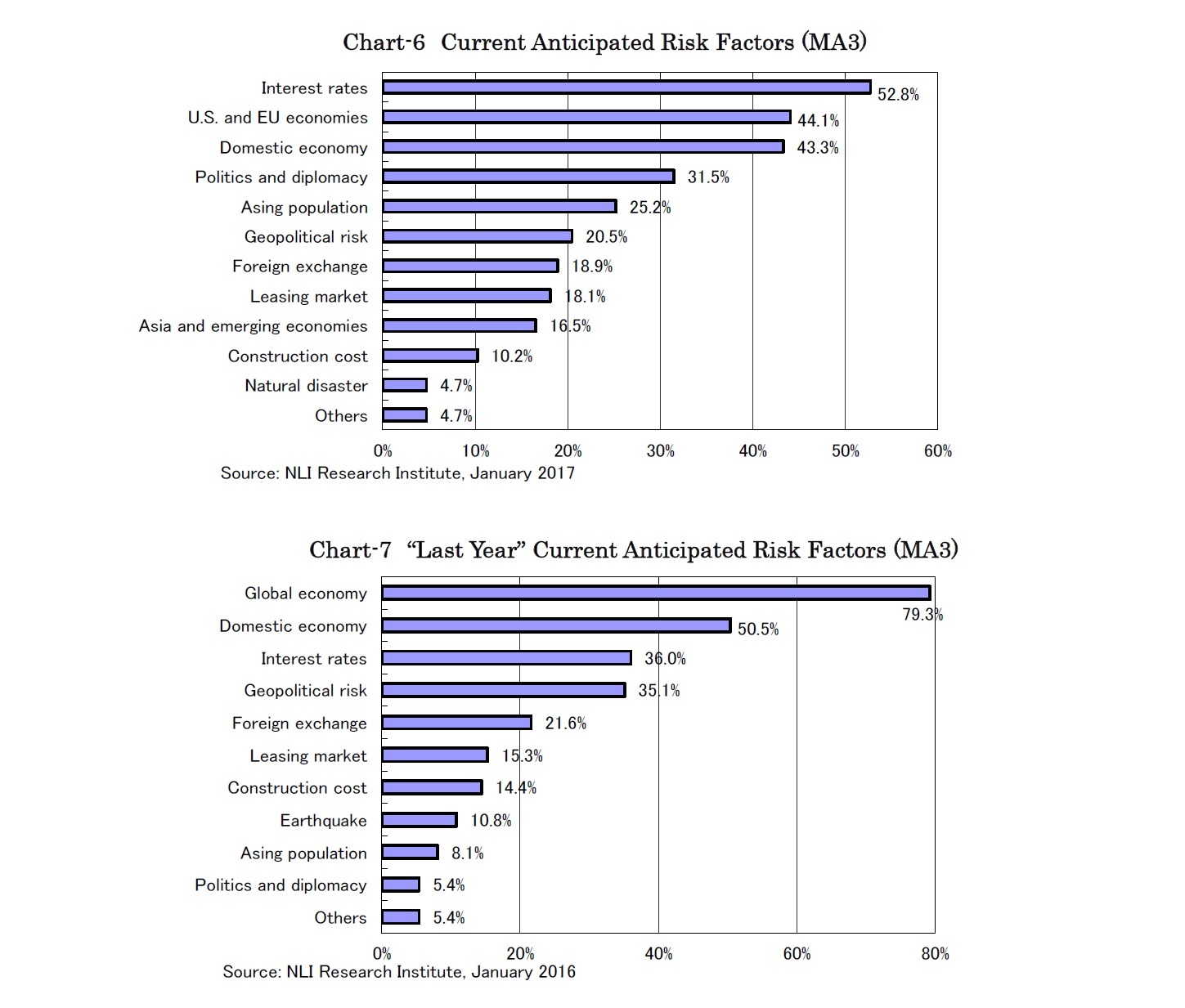

The next question was about which risk factors were the top three influential concerns for the property investment market.

This time, “Interest rates” ranked first for the first time, selected by 52.8% of respondents (Chart-6). Despite the BOJ attempting to adjust 10-year-bond yields to around 0%, the boost of U.S. bond yields have brought concerns that Japanese bond yields will also rise sooner than previously expected.

“The U.S. and EU economies” ranked second, selected by 44.1% of respondents. While “Global economy” ranked first, selected by 79.3% last year (Chart-7), the main concern at that time focused on the Chinese economy. This time, with “Asia and emerging economies” moderating to 16.5%, attention on the market has focused on whether the new administration of the U.S. government can meet the high market expectations. Of course, the economy of the EU has also been a sizable concern with the progressing U.K. withdrawal.

Similarly, “Politics and diplomacy” drew attention, selected by 31.5% of respondents. Japanese exporters are heavily concerned about rising protectionism, with the U.S. dropping out of the TPP and seeking renegotiation on NAFTA. In Europe, important elections scheduled in 2017 could bring another country to follow the U.K. and withdraw from the EU. In Asia, it is possible that new U.S. diplomatic measures may impact tensions surrounding the South China Sea and the South Korean president-to-be could damage the fragile relationship with Japan.

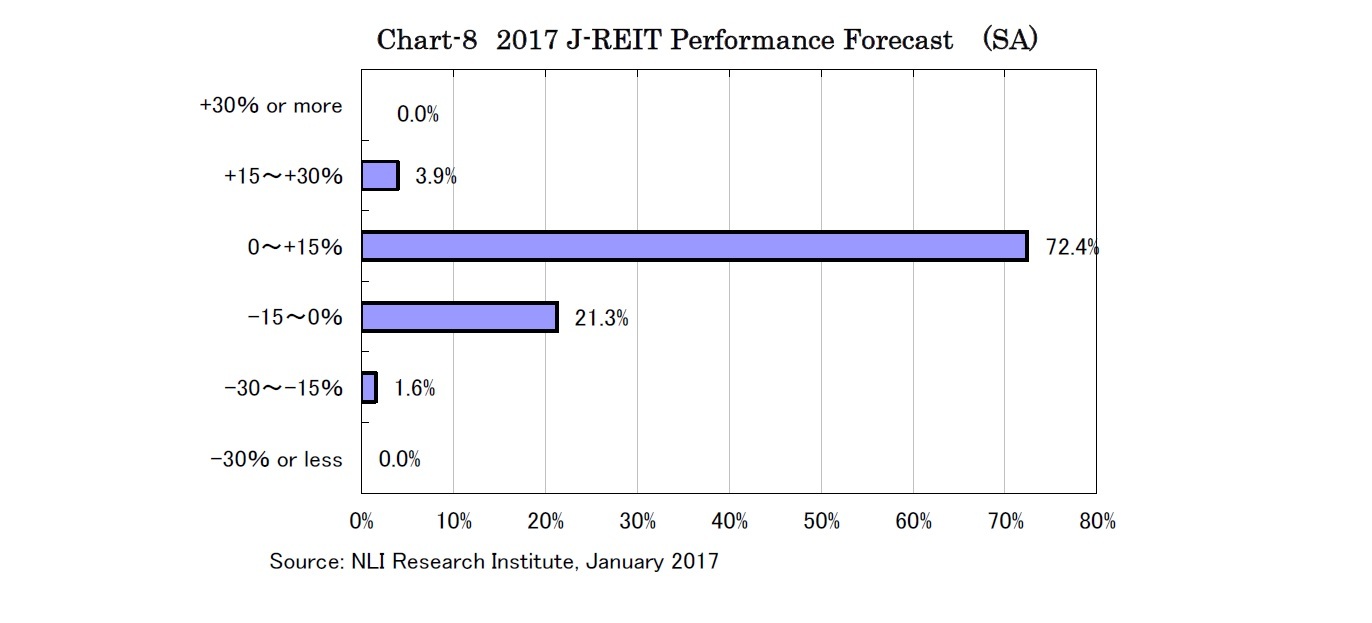

Regarding the J-REIT market forecast, 72.4% of respondents selected “0~+15%” of performance for TSE REIT index in 2017 (Chart-8). More than 90% of the respondents forecasted that the J-REIT prices will stay within a range of ±15% at the end of 2017.

Underperforming against equities after the U.S. presidential election, J-REIT prices apparently have some room to appreciate. However, few forecasted a high performance as market attentions shifted from the benefits of interest rate decline to the effects of interest rate hike. Thus, property rents are required to rise for J-REIT prices to appreciate as equities, while the America first policy will not directly impact the Japanese domestic economy nor boost property rents in Japan.

On the contrary, J-REIT prices will show relative resilience in case of a market correction disappointed under the Trump administration, as easing concerns about interest rate hike or investors who prefer yields of J-REITs will support J-REIT prices.

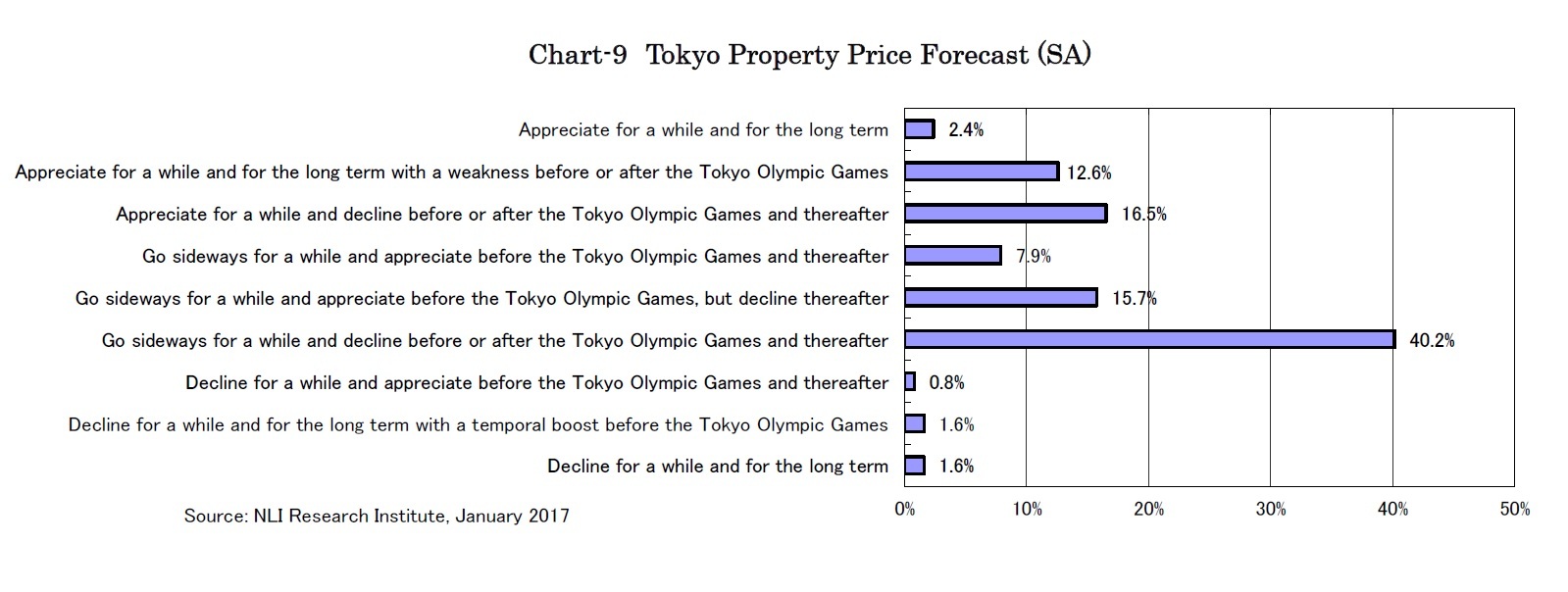

Finally, when asked to select a likely pathway of property prices in Tokyo, “Go sideways for a while and decline before or after the 2020 Tokyo Olympic Games and thereafter” ranked first, selected by 40.2% of respondents (Chart-9).

For a while, considering the recent equity market recovery and the BOJ attempting to adjust 10-year-bond yields to around 0%, the concern about property price decline is quite limited with “Go sideways” and “Appreciate for a while” selected by about two-thirds and one-third of respondents, respectively.

However, regarding property prices before or after the 2020 Tokyo Olympic Games, the responses anticipating a property price decline accounted for more than 70% of responses. Glut of office supply is scheduled in 2018, 2019 and 2020, and the consumption tax rate hike to 10% is scheduled in October 2019. Around that time, exit measures of the monetary easing policy should be discussed. Besides these, not a few investors who bought properties expecting price appreciation until the 2020 Tokyo Olympic Games should consider selling out.

Regarding property prices for the long term, “decline thereafter” accounted for nearly 80% of responses. It seems few players expect the Olympic event to make Tokyo more competitive as an international city or future inflation to support property prices for the long term. As the Tokyo metropolitan government forecasts the population of Tokyo will begin to decline after 2020, it seems structurally difficult to expect property prices to appreciate for the long term.

mamoru masumiya

Research field

Social media account

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング