- NLI Research Institute >

- Real estate >

- Japanese Property Market Quarterly Review, Third Quarter 2016-Inbound Demand Peaks Out Affecting Retail Stores and Hotels-

Japanese Property Market Quarterly Review, Third Quarter 2016-Inbound Demand Peaks Out Affecting Retail Stores and Hotels-

mamoru masumiya

Font size

- S

- M

- L

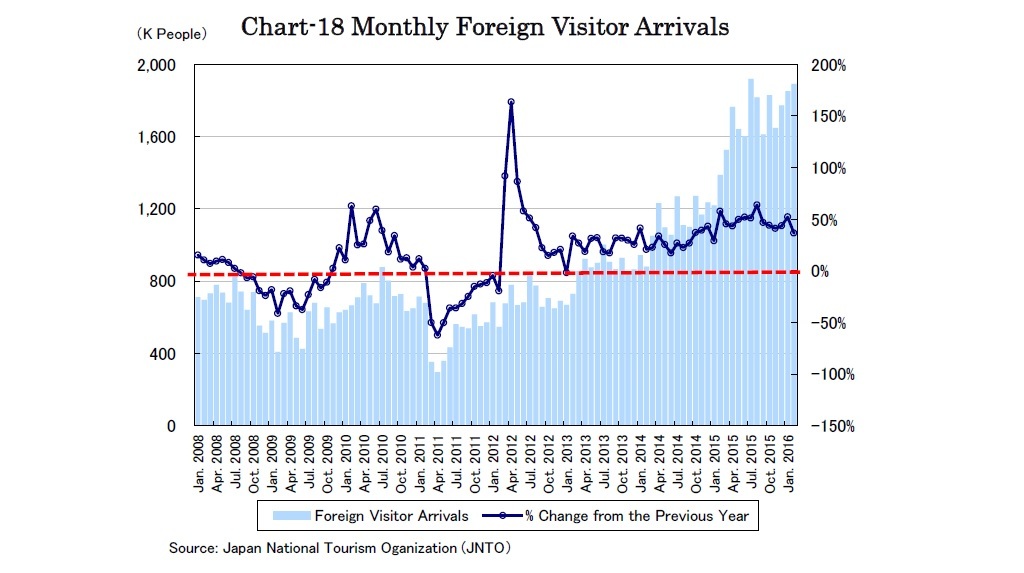

Foreign visitor arrival numbers have still grown at the pace of about +20% y-o-y in 2016 (Chart-18), increasing by 19% to 1.9 million in September, and 18 million for the year in 2016.

Visitor arrivals from South Korea increased the most at 42.8% y-o-y in September as a result of the recent launch of new airline routes. Visitor arrivals from ASEAN nations have also maintained strong growth such as Indonesia by 38.5% y-o-y, the Philippines by 31.3% and Thailand by 30.0%. Visitor arrivals from the U.S. and Canada also increased significantly by 26.9% and 24.8%, pushed by promotions for Japan.

However, visitor arrivals from China in September decelerated noticeably to a mere +6.3% y-o-y, affected by the cancellation of cruise ships due to typhoons, however, visitor arrivals from China in 2016 have increased by 30.5% y-o-y already reaching 5 million in September.

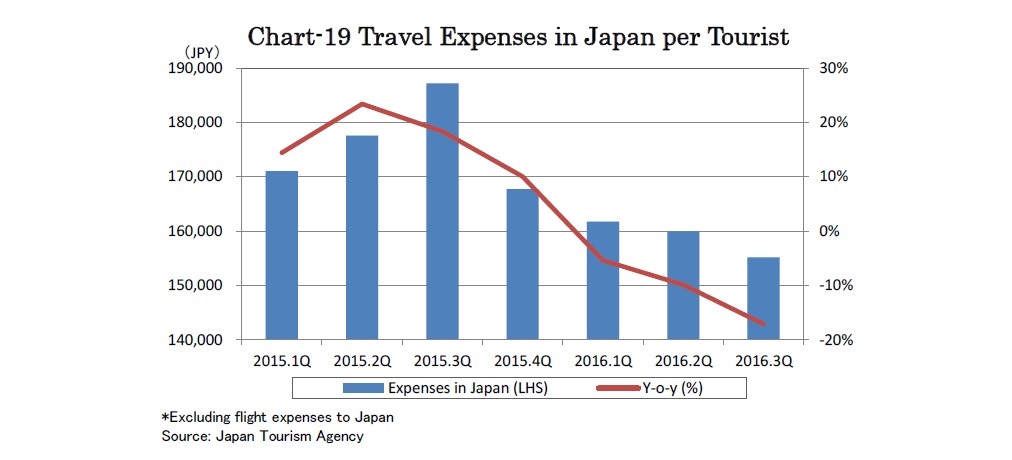

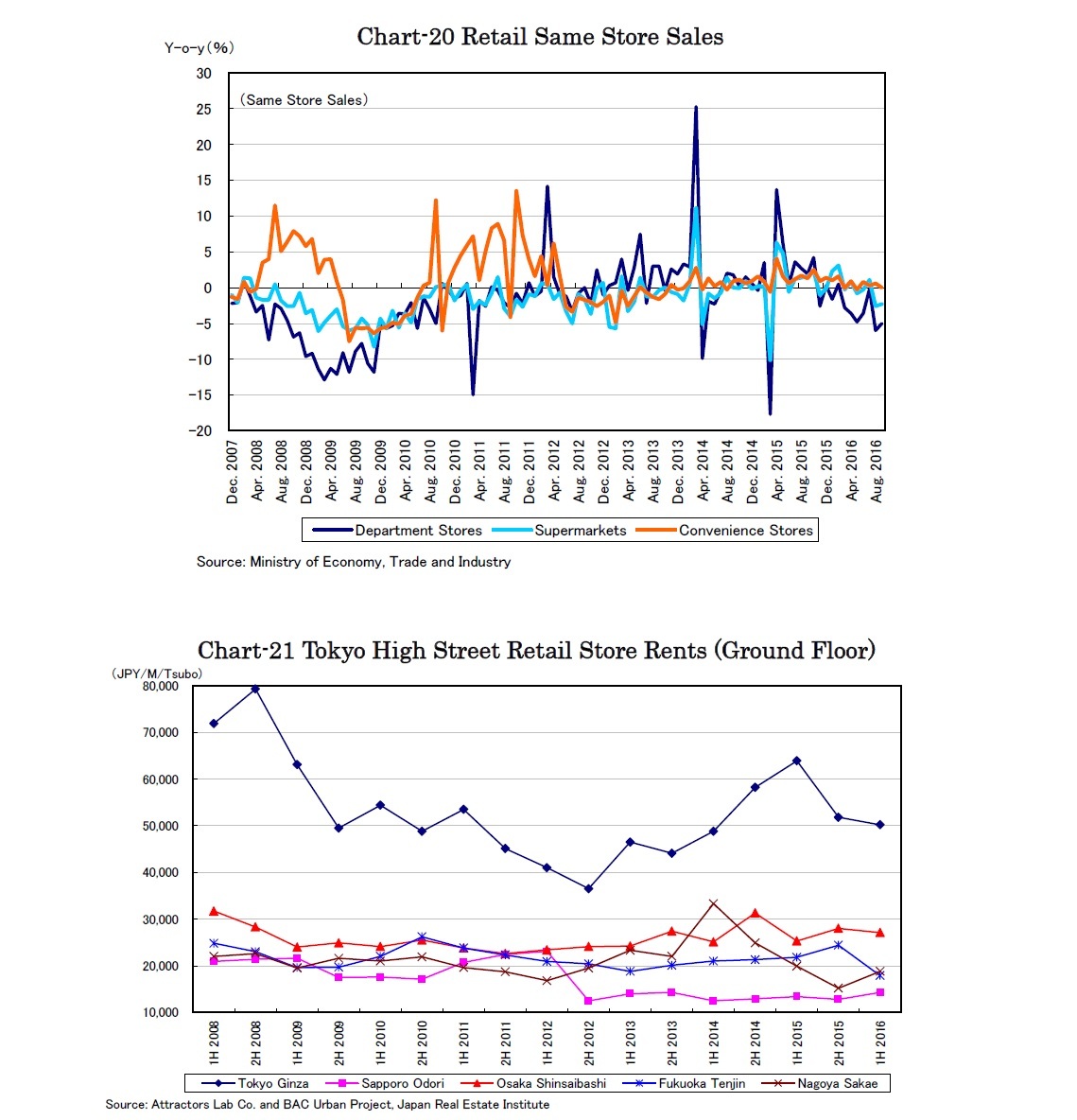

Duty free sales in department stores shrank significantly by 10.1% y-o-y for the sixth consecutive month in September, though the number of foreign customers still increased by 15.9% y-o-y.

Affected by weakening retail sales, retail store rents have also adjusted since the latter half of 2015, in particular in Ginza where many luxury brand stores are located (Chart-21).

mamoru masumiya

Research field

Social media account

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング