- NLI Research Institute >

- Real estate >

- Japanese Property Market Quarterly Review, Third Quarter 2016-Inbound Demand Peaks Out Affecting Retail Stores and Hotels-

Japanese Property Market Quarterly Review, Third Quarter 2016-Inbound Demand Peaks Out Affecting Retail Stores and Hotels-

mamoru masumiya

Font size

- S

- M

- L

2.Land Prices

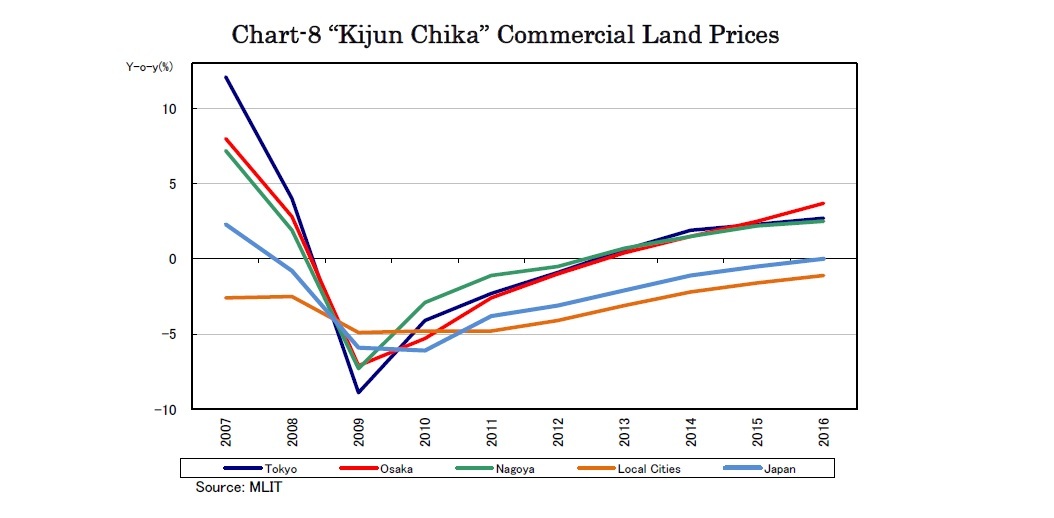

However, regarding residential and industrial land, land price appreciations in the three metropolitan areas could not compensate for decline in local cities. Thus, decline continued in the average national land price for all usage at 0.6% y-o-y.

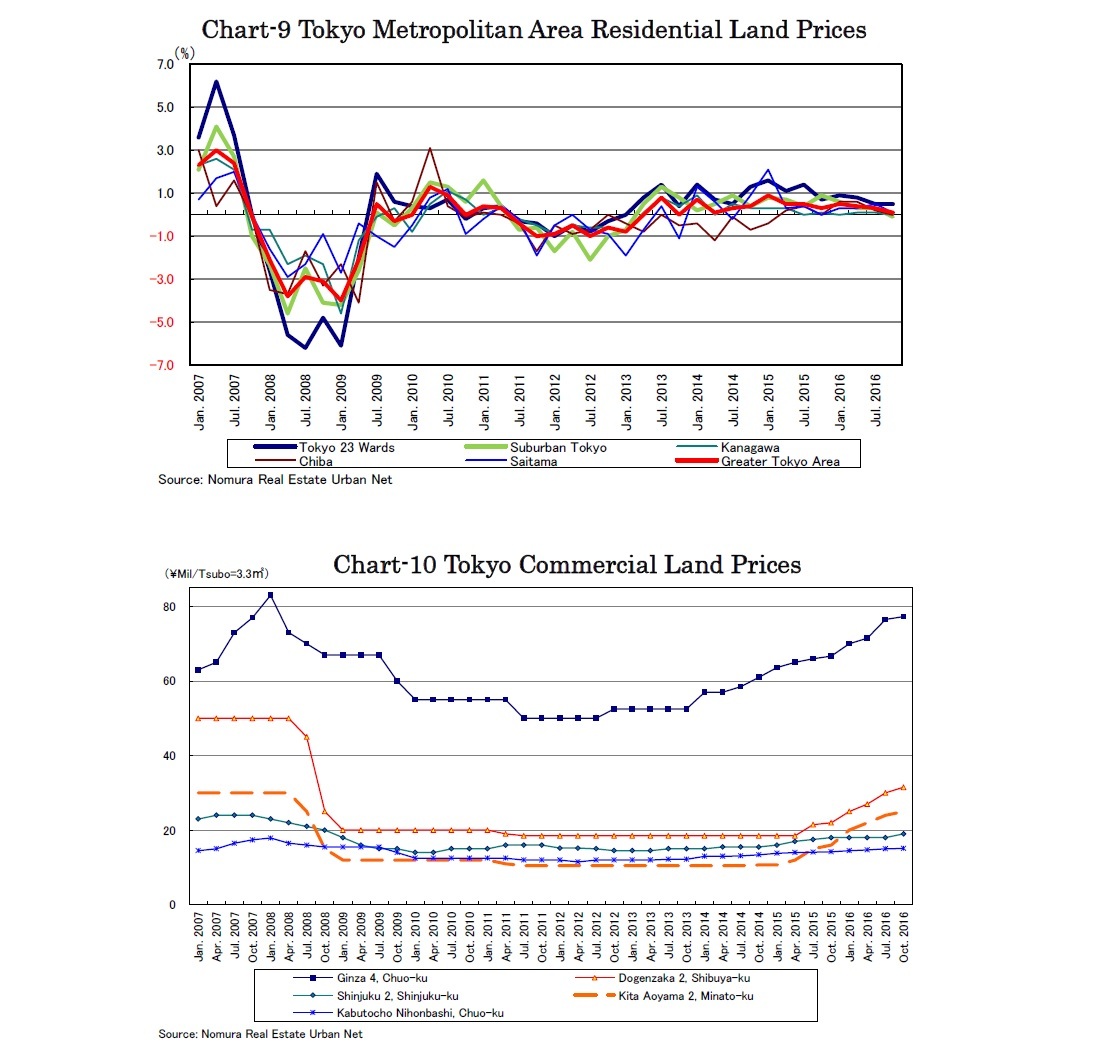

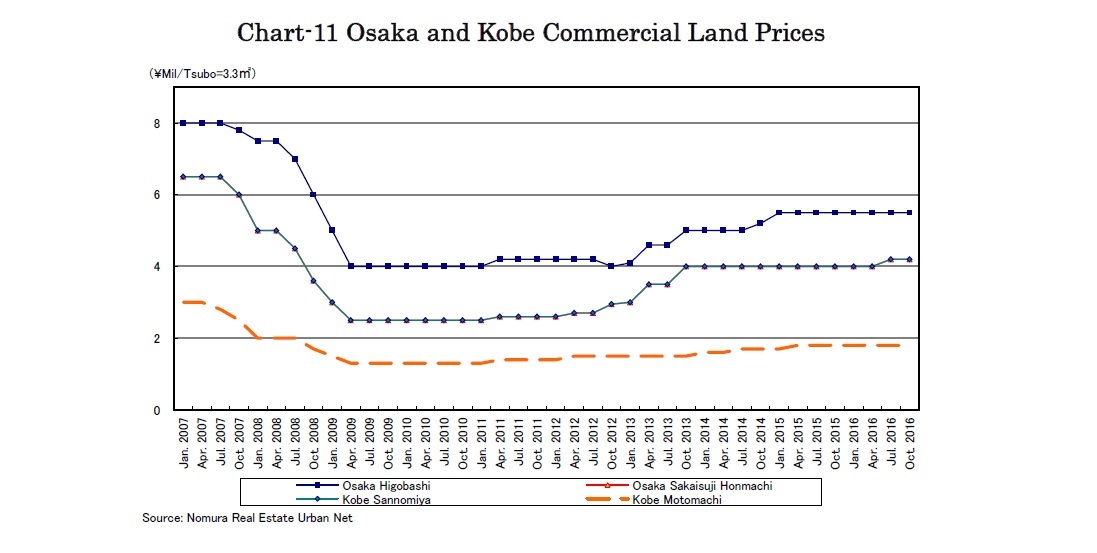

Among commercial land prices in the center of Tokyo, those in Ginza have noticeably appreciated, recovering to the level seen in 2008 (Chart-10). However, those in Osaka have remained far from the peak in 2007 (Chart-11).

mamoru masumiya

Research field

Social media account

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング