- NLI Research Institute >

- Real estate >

- Japanese Property Market Quarterly Review, First Quarter 2016 -Office Rents Rise Again, Foreign Visitor Arrivals Boost Hotels and Land Prices-

Japanese Property Market Quarterly Review, First Quarter 2016 -Office Rents Rise Again, Foreign Visitor Arrivals Boost Hotels and Land Prices-

Eriko Kato

Font size

- S

- M

- L

4.J-REIT and Property Investment Markets

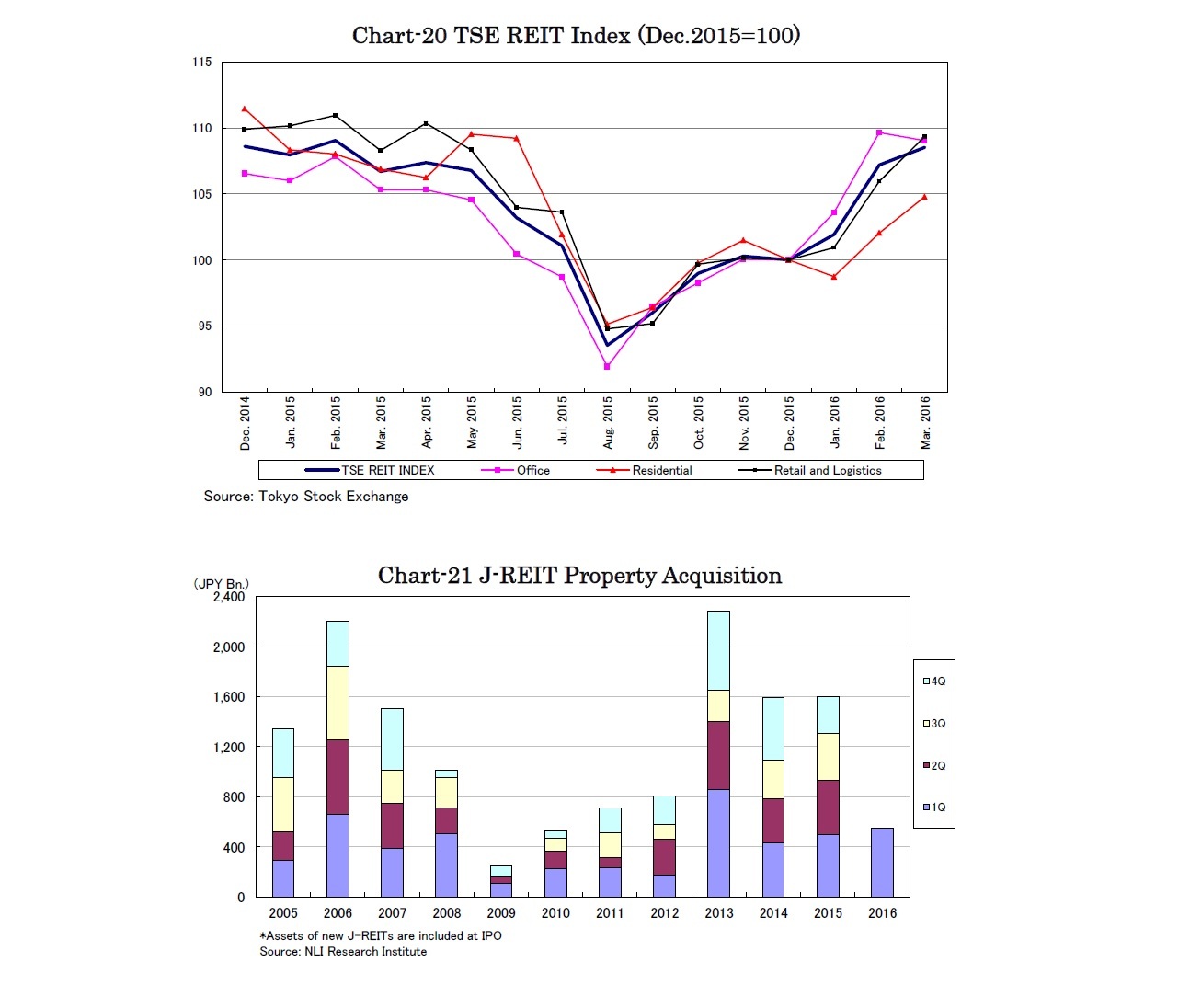

J-REITs acquired properties amounting to 550 billion JPY in the first quarter increasing by 11% y-o-y (Chart-21). The pace of acquisition by J-REITs slowed down significantly in the fourth quarter, however, it has accelerated again. Lasalle Logiport REIT was listed with 8 assets valued at 161 billion JPY, and the number of J-REITs increased to 53.

The negative interest rates can lead to incremental dividends of J-REITs. The average interest rate on existing debts of J-REITs is 1.2% and the current interest rate on a new debt for J-REITs is 0.7%. Considering that refinancing can reduce the average interest rate on debts of J-REITs by 0.5%, J-REITs can increase their dividends by 9%.

Under the negative interest rate policy, property investment yields can be even lower, however, prime properties are held tight and are seldom seen for sale. In order to secure certain investment yields, investors have to consider properties in suburban locations or non-core sectors.

Eriko Kato

Research field

Related Reports

- Japanese Property Market Quarterly Review, Fourth Quarter 2015-J-REITs Decline for First Time in Four Years, Foreign Visitor Arrivals Increase 47%-

- Japanese Property Market Quarterly Review, Third Quarter 2015-Markets Steady but Some Weaknesses Creeping In-

- Japanese Property Market Quarterly Review,Second Quarter 2015-Housing Starts Recover, Foreign Visitors Boost Hotel and Retail-

- Japanese Property Market Quarterly Review, First Quarter 2015 -Office Rents Steady and Transactions Increase-

Social media account

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング