- NLI Research Institute >

- Real estate >

- Property Investments by Asian Insurers -Potentially Active Investors into Japan-

Property Investments by Asian Insurers -Potentially Active Investors into Japan-

mamoru masumiya

Font size

- S

- M

- L

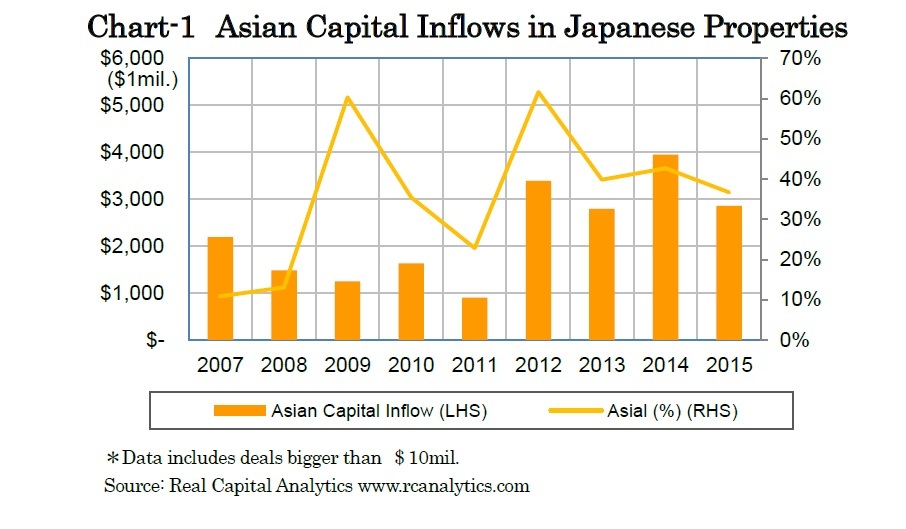

Foreign capital inflows to the Japanese property investment market have recently increased, years after the Global Financial Crisis. In particular, capital inflows from Asian countries have grown significantly.

Among the Asian capital that recently acquired sizable Japanese properties, sovereign wealth funds have particularly been noticeable. However, Asian insurers have never been noticeable on the list of acquirers, though theoretically they are said to be a good fit with long term property investment for stable income. It would be interesting to check how actively Asian insurers invest in property assets outside Japan.

■Contents

1|Increasing Capital Inflows From Asia

2|Property Investments by Asian Insurers

3|Prospects

1|Increasing Capital Inflows From Asia

Among the Asian capital that recently acquired sizable Japanese properties, sovereign wealth funds have particularly been noticeable such as China Investment Corporation (CIC) acquiring Meguro Gajoen, and Government of Singapore Investment Corporation (GIC), the manager of the Singapore foreign reserve, acquiring Pacific Century Place, both of which are valued at more than 1 billion US dollars.

However, Asian insurers have never been noticeable on the list of acquirers, though theoretically they are said to be a good fit with long term property investment for stable income. It would be interesting to check how actively Asian insurers invest in property assets outside Japan.

2|Property Investments by Asian Insurers

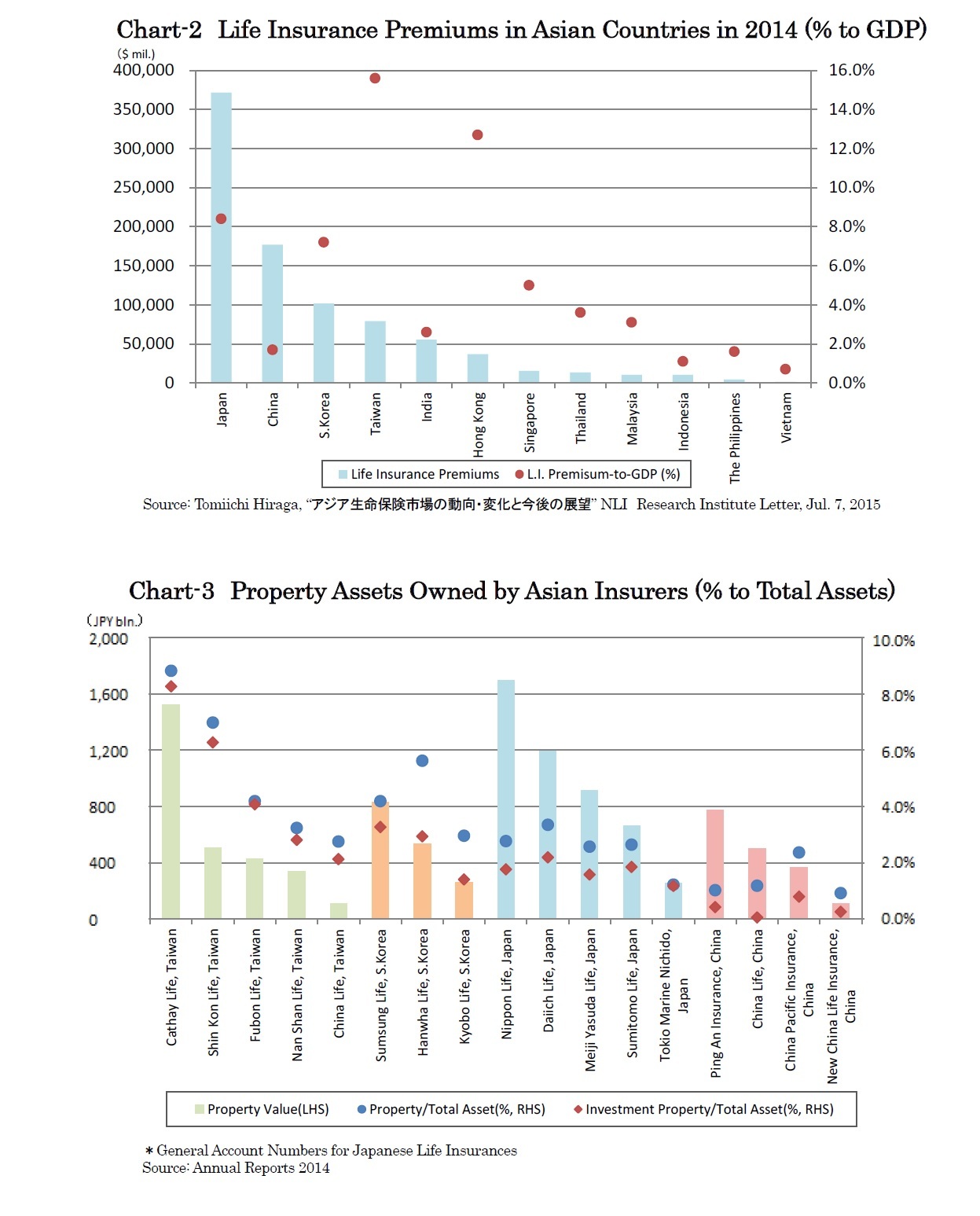

Therefore, sizable insurers that are influential on the property investment markets tend to be found in relatively large markets such as Japan, China, South Korea and Taiwan. Compared with each other, insurers in these four countries have clearly different characteristics in terms of property investments (Chart-3).

Other than Taiwanese, South Korean insurers have also invested in properties proactively, both domestically and overseas, with twice the investment property-to-total asset ratios as those of Japanese insurers. As the National Pension Fund has been engaged in property investment, property assets have been regarded as one of the main investment objectives for institutional investors. While some conglomerates dominate the South Korean property investment market, life insurers are one of the largest property investors at the heart of the conglomerates groups such as Samsung Life Insurance.

On the other hand, Chinese insurers have recently been allowed to invest in properties since 2010 and still have very low investment property-to-total asset ratios.

However, Chinese insurers already own a great portion of properties due to their sizable total assets. Furthermore, some Chinese insurers have already become active property investors, such as China Pacific Insurance with more than 2% of its total assets invested in properties.

3|Prospects

On the other hand, insurers in relatively matured markets such as Taiwan and South Korea have long been active in property investment, both domestically and overseas.

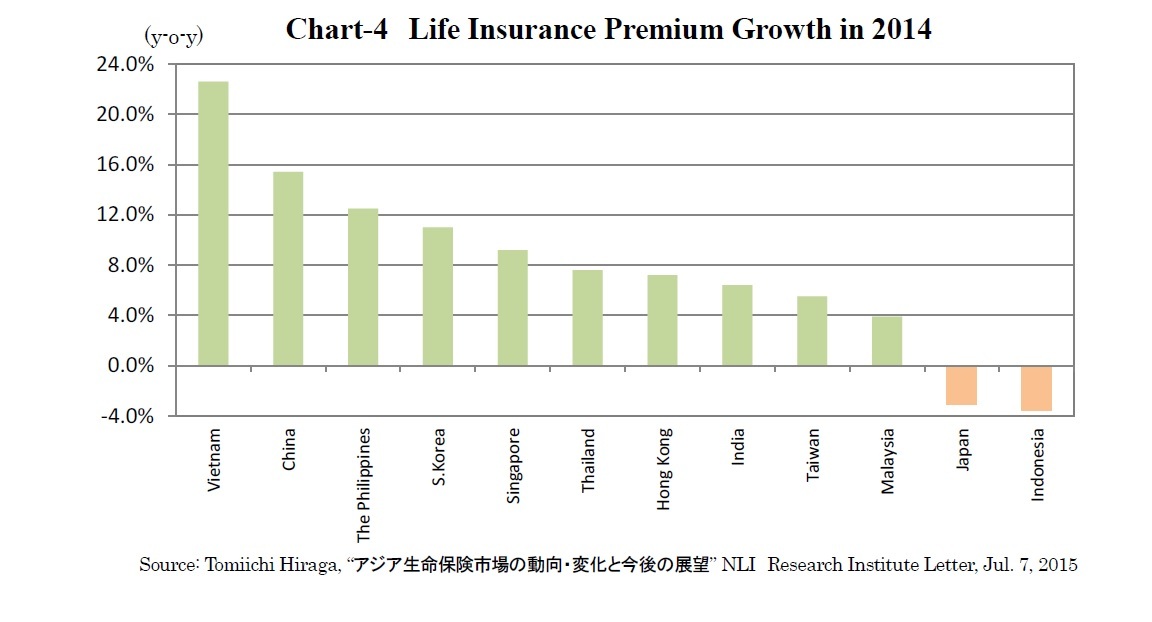

Though insurance markets in most Asian countries are still small in size (Chart-2), they are growing rapidly, which is far different from the conditions in Japan (Chart-4).

Asian insurers have never been noted to acquire Japanese property assets, however, quite a few of them have already been proactive in property investment and have intentions to expand their overseas property portfolios. It is highly likely that Asian insurers will actively invest in Japanese properties in the near future on the back of their increasing assets under management boosted by the growing insurance markets.

mamoru masumiya

Research field

Social media account

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング