- NLI Research Institute >

- Real estate >

- Japanese Property Market Quarterly Review, First Quarter 2015 -Office Rents Steady and Transactions Increase-

Japanese Property Market Quarterly Review, First Quarter 2015 -Office Rents Steady and Transactions Increase-

Eriko Kato

Font size

- S

- M

- L

■Summary

- Japan`s real GDP growth is likely to become negative at -1% in fiscal 2014, however, it is expected to strengthen hereafter supported by the fallen oil prices. The housing market has been suppressed by a weak demand following the consumption tax hike and increasing construction costs, but the y-o-y growth of housing starts finally turned positive in March. An increasing number of monitoring sites posted land price appreciations and the average national land price declined at a milder pace by 0.3% y-o-y.

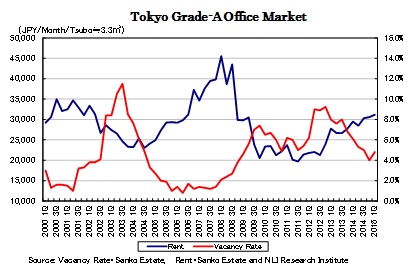

- Office rents in Tokyo have steadily increased though at a slow pace backed by the robust demand. Residential rents in the five major wards in Tokyo have been on a mild ascending trend. The number of foreign visitor arrivals has renewed record highs in each month this year. Hotel occupancy rates have maintained higher levels than last year when the market had already been quite strengthened. The vacancy rates of large logistics facilities remained low backed by the strong demand in both Tokyo and Osaka metropolitan areas.

- The J-REIT market declined by 1.8% in the first quarter affected by the volatile bond market and sizable public offerings. J-REITs acquired as much assets as last year even on difficult low yield conditions.

Eriko Kato

Research field

Social media account

レポート紹介

-

研究領域

-

経済

-

金融・為替

-

資産運用・資産形成

-

年金

-

社会保障制度

-

保険

-

不動産

-

経営・ビジネス

-

暮らし

-

ジェロントロジー(高齢社会総合研究)

-

医療・介護・健康・ヘルスケア

-

政策提言

-

-

注目テーマ・キーワード

-

統計・指標・重要イベント

-

媒体

- アクセスランキング